Internet payment systems

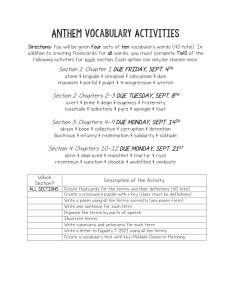

advertisement

Varna Free University

E-BUSINESS

Internet payment systems

Prof. Teodora Bakardjieva

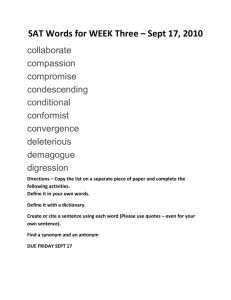

Outline

•

•

•

•

•

•

•

Introduction

Issues related

Security

Outstanding protocols

Mechanisms

Advantages and disadvantages

Conclusion

27 Sept. 99

2

Introduction

• In the past year, the number of users

reachable through Internet has

increased dramatically

• Potential to establish a new kind of

open marketplace for goods and

services

27 Sept. 99

3

Introduction (cont)

• Online shops in Internet

– Bookshop (Amazon.com)

– Flight Resevation and Hotel Reservation

shopping place, etc.

• An effective payment mechanism is

needed

27 Sept. 99

4

Issues related

•

•

•

•

•

Security Performance

Reliability

Efficiency

Bandwidth

Anonymity (mainly in electronic coins)

27 Sept. 99

5

Security

• Internet is not a secure place

• There are attacks from:

– eavesdropping

– masquerading

– message tampering

– replay

27 Sept. 99

6

How to solve?

• RSA public key cryptography is widely

used for authentication and encryption

in the computer industry

• Using public/private (asymmetric) key

pair or symmetric session key to

prevent eavesdropping

27 Sept. 99

7

How to solve? (cont)

• Using message digest to prevent

message tampering

• Using nonce to prevent replay

• Using digital certificate to prevent

masquerading

27 Sept. 99

8

Outstanding protocols

• Credit card based

– Secure Electronic Transaction (SET)

– Secure Socket Layer (SSL)

• Electronic coins

– DigiCash

– NetCash

27 Sept. 99

12

Credit-card based systems

• Parties involved: cardholder, merchant,

issuer, acquirer and payment gateway

• Transfer user's credit-card number to

merchant via insecure network

• A trusted third party to authenticate the

public key

27 Sept. 99

13

Secure Electronic Transaction

(SET)

• Developed by VISA and MasterCard

• To facilitate secure payment card

transactions over the Internet

• Digital Certificates create a trust chain

throughout the transaction, verifying

cardholder and merchant validity

• It is the most secure payment protocol

27 Sept. 99

14

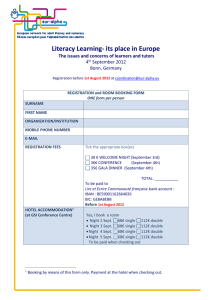

Framework

Non-SET

Financial

Network

Card

Issuer

Non-SET

Payment

Gateway

SET

Card

Holder

SET

27 Sept. 99

Merchant

15

Payment processes

• The messages needed to perform a

complete purchase transaction usually

include:

– Initialization (PInitReq/PInitRes)

– Purchase order (PReq/PRes)

– Authorization (AuthReq/AuthRes)

– Capture of payment (CapReq/CapRes)

27 Sept. 99

16

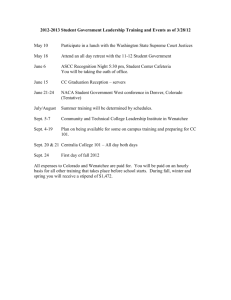

Typical SET Purchase Trans.

CardHolder

Merchant

Payment Gateway

PInitReq

PInitRes

PReq

AuthReq

AuthRes

PRes

CapReq

CapRes

Initialization

PInitReq: {BrandID, LID_C, Chall_C}

Cardholder

Merchant

PInitRes: {TransID, Date, Chall_C, Chall_M}SigM,

CA, CM

27 Sept. 99

18

Purchase order

PReq: {OI, PI}

Cardholder

Merchant

Pres: {TransID, [Results], Chall_C}SigM

27 Sept. 99

19

Authorization

{{AuthReq}SigM}PKA

Merchant

Acquirer

{{AuthRes}SigA}PKM

27 Sept. 99

Issuer

Existing

Financial

Network

20

Capture of payment

CapReq

CapToken

CapToken

Clearing

Merchant

Acquirer

{{CapRes}SigA}PKM

27 Sept. 99

Issuer

Existing

Financial

Network

21

Advantages

• It is secure enough to protect user's

credit-card numbers and personal

information from attacks

• hardware independent

• world-wide usage

27 Sept. 99

22

Disadvantages

• User must have credit card

• No transfer of funds between users

• It is not cost-effective when the payment

is small

• None of anonymity and it is traceable

27 Sept. 99

23

Electronic cash/coins

• Parties involved: client, merchant and

bank

• Client must have an account in the bank

• Less security and encryption

• Suitable for small payment, but not for

large payment

27 Sept. 99

24

DigiCash (E-cash)

• A fully anonymous electronic cash

system

• Using blind signature technique

• Parties involved: bank, buyer and

merchant

• Using RSA public-key cryptography

• Special client and merchant software

are needed

27 Sept. 99

25

Withdrawing Ecash coins

• User's cyberwallet software calculates

how many digital coins are needed to

withdraw the requested amount

• software then generates random serial

numbers for those coins

• the serial numbers are blinded by

multiplying it by a random factor

27 Sept. 99

26

Withdrawing Ecash coins

(cont)

• Blinded coins are packaged into a

message, digitally signed with user's

private key, encrypted with the bank's

public key, then sent to the bank

• When the bank receives the message, it

checks the signature

• After signing the blind coins, the bank

returns them to the user

27 Sept. 99

27

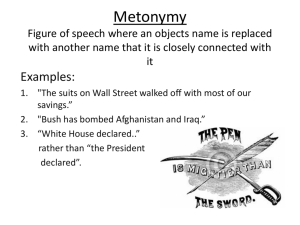

Spending Ecash

27 Sept. 99

28

Advantages

• Cost-effective for small payment

• User can transfer his electronic coins to

other user

• No need to apply credit card

• Anonymous feature

• Hardware independent

27 Sept. 99

29

Disadvantages

• It is not suitable for large payment

because of lower security

• Client must use wallet software in order

to store the withdrawn coins from the

bank

• A large database to store used serial

numbers to prevent double spending

27 Sept. 99

30

Comparisons

• SET

• Ecash

– use credit card

– 5 parties involved

– no anonymous

– large and small

payment

27 Sept. 99

– use e-coins

– 3 parties involved

– anonymous nature

– a large database is

needed to log used

serial numbers

– small payment

31

Conclusions

• An effective, secure and reliable

Internet payment system is needed

• Depending on the payment amount,

different level of security is used

• SET protocol is an outstanding payment

protocol for secure electronic commerce

27 Sept. 99

32