MBA - Marketing Management Alessi

advertisement

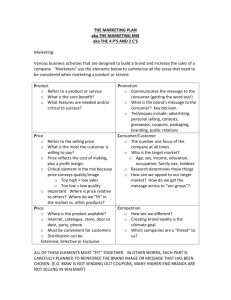

ALESSI Evolution of an Italian Design Factory Marketing Management Team C EMBA ’06 How to control and expand distribution without compromising the brand image? Distribution Structure Distribution and the Brand Image Challenges Next Step Why Controlling Distribution? Control Brand Image Problem of heterogeneity in retailer strategies over product display Diversity in distribution channels Recovering from price and brand confusion of past ten years Increase turnover Distribution Structure Use distribution as A channel of distribution • Diversified channels: retail outlets, museum stores, gift shops, … A place to increase brand equity • Luxury retail shops in Italy Offering: between shopping and specialty Design-oriented table and kitchen products Shopping goods (not convenience goods!): about 50% purchases as gifts, wedding presents, Christmas: overall 25-30% of annual sales. Specialty goods: best sellers like M.Suicide, Magic Bunny, etc… Consumer side distribution structure ~1983: Change into streamlined distribution system Distribution Structure 1983: streamlined distribution system Manufacturer Manufacturer orders - deliveries orders Single Country Independent Distributors Independent agents or subsidiaries orders - deliveries orders Retailers Retailers Hybrid channel administration deliveries Indirect for orders and direct for deliveries Agents: independent or company-owned subsidiaries Benefits: increase of control in distribution, reduction of functional discrepancies, reduction of delivery costs, economies of scale in order management, better mapping in assortment of goods and better services by company-owned subsidiaries Distribution Structure streamlined distribution system Manufacturer orders Single Country Agent deliveries orders Retailers PUSH strategy Shift in market coverage strategy Induce cooperation with retailers, keep inventory low, display products, and visibility on shelf spaces to win voluntary cooperation. From intensive distribution to selective distribution: Agents as independent entities in exclusive geographical areas From 9000 retailers in 1989 to 5000 in 2000. Management of Power in Distribution Channels Avoidance Strategy Differentiation: design oriented and product naming Focus: Table and kitchen, high-quality Reduction in costs: Reduction in delivery costs by streamlined distribution system. Lately: Resistance and confrontation strategy Diversification of channels: selected retailers, own stores, licensing Controlled distribution system Management of Power in Distribution Channels Power Management increased by streamlined distribution system Better control over products and shorter delivery channels thus reduction of costs of opportunity. Services: support in merchandising, inventory risk, training service offering Threat of revocation Retailer churn=5% in ‘03 basic offering Trainings Merchandising Reference value Identification Coercive sources Power Non-coercive sources Distribution and the Brand Distribution on Brand Image Consistent retail experience to strengthen the brand Benefits: Customer Loyalty, more inelastic consumer response, greater trace cooperation and support, possible licensing opportunity Shop-in-shop for control over product display, demanding retailer commitment: ask for minimal surfaces Mono-brand stores: show rooms and flagship stores ’03: 3 moves to expand distribution while increasing customer-based brand equity value: Consistent retail experience Increasing retail penetration in key markets Licensing the Brand for newer types of products like watches and cars Distribution Challenges on Brand Image ~80s: Too intensive distribution system Price discrepancy between luxury retailers and others confusing brand image Luxury Other retailers Constant control challenge over product display, merchandising and pricing Though selective approach, Licensing still putting at risk the brand image by partners controlling manufacturing and distribution. Next Step: Multiple Trademarks