[1934] 2 K.B. 394 [DIVISIONAL COURT] L'ESTRANGE v. F

advertisement

![[1934] 2 K.B. 394 [DIVISIONAL COURT] L'ESTRANGE v. F](http://s3.studylib.net/store/data/009420841_1-c15fc369ca88e930128425cd46d4b756-768x994.png)

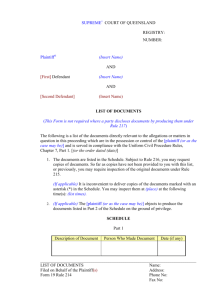

[1934] 2 K.B. 394

[DIVISIONAL COURT]

L'ESTRANGE v. F. GRAUCOB, LIMITED.

1934 Feb. 16, 19, 20.

SCRUTTON, and MAUGHAM L.JJ.

Sale of Goods - Contract in writing signed by Parties for sale of Automatic Slot

Machine - Clause in small print excluding "any express or implied condition,

statement, or warranty, statutory or otherwise" - No misrepresentation by Seller as

to terms of Contract - Machine out of order - Action by Buyer against Seller for

Breach of Implied Warranty of Fitness - Competence of Action.

The buyer of an automatic slot machine signed and handed to the sellers an order

form containing in ordinary print and writing the essential terms of the contract,

and in small print certain special terms one of which was "any express or implied

condition, statement, or warranty, statutory or otherwise not stated herein is

hereby excluded." The sellers thereupon signed and handed to the buyer a printed

order confirmation assenting to the terms in the order form. The machine was

delivered by the sellers to the buyer, who paid to the sellers an instalment of the

price. The machine did not work satisfactorily, and the buyer brought an action

against the sellers in the county court claiming (inter alia) damages for breach of

an implied warranty that

[1934] 2 K.B. 394 Page 395

the machine was fit for the purpose for which it was sold. The sellers pleaded (inter

alia) that the contract expressly provided for the exclusion of all implied warranties.

The buyer replied that at the time when she signed the order form she had not read

it and knew nothing of its contents, and that the clause excluding warranties could

not easily be read owing to the smallness of the print. There was no evidence of

any misrepresentation by the sellers to the buyer as to the terms of the contract:Held, by the Divisional Court (Scrutton and Maugham L.JJ.), reversing on this point

the judgment of the county court judge, that as the buyer had signed the written

contract, and had not been induced to do so by any misrepresentation, she was

bound by the terms of the contract, and it was wholly immaterial that she had not

read it and did not know its contents; and that the action failed and the sellers were

entitled to judgment.

Parker v. South Eastern Ry. Co. (1877) 2 C. P. D. 416, 421, observations approved

and applied.

Wallis, Son & Wells v. Pratt & Haynes [1911] A. C. 394 and Andrews Brothers

(Bournemouth), Ld. v. Singer & Co.[1934] 1 K. B. 17 referred to.

Richardson, Spence & Co. v. Rowntree [1894] A. C. 217, and the other railway

ticket cases, distinguished.

APPEAL from the Carnarvonshire County Court held at Llandudno.

The plaintiff, Miss Harriet Mary L'Estrange, was the owner of premises in

Great Ormes Road, Llandudno, where she resided and carried on the

business of a caf‚. The defendants, Messrs. F. Graucob, Ld., of City Road,

London, E.C., were manufacturers and sellers of automatic slot machines.

On February 7, 1933, two of the defendants' representatives, a Mr. Page,

their sales supervisor, and a Mr. Berse, one of their travellers, called upon

the plaintiff and asked her to buy an automatic slot machine for cigarettes.

A meeting was arranged at the house of the plaintiff's stepmother between

these representatives of the defendants on the one part, and the plaintiff,

her stepmother, and a Mr. Pratt who assisted the plaintiff in her business on

the other part. The plaintiff decided to buy from the defendants an

automatic cigarette machine of the description mentioned below. Mr. Page

then produced a form printed on brown paper, headed "Sales Agreement,"

in which there were blanks for the particulars of any given transaction. The

[1934] 2 K.B. 394 Page 396

blanks on the form were then filled up with the particulars of the plaintiff's

purchase and the form was signed by the plaintiff.

The document when completed was, so far as material, in the following

terms: "Sales Agreement. Date Feb. 7, 1933. To

F. Graucob, Ltd., .... Please forward me as soon as possible: One Six

Column Junior Ilam Automatic Machine .... which I agree to purchase from

you on the terms stated below .... and to pay for the same in the following

manner: Instalments 8l. 15s. 0d. down. 18 payments of 3l. 19s. 11d." Then

after some other formal matter came certain clauses in small print which, so

far as material, were as follows: "I agree to take delivery of the machine

upon receiving notice that it is ready for delivery, and to make the first

monthly payment 30 days after the date following that of the posting of

such notice and all subsequent payments on the corresponding date of each

succeeding month. .... If any payment shall not have been received by you

within a fortnight after it has become due, all the remaining payments shall

fall due for immediate payment, and I agree to pay interest on these

remaining payments at the rate of ten per cent. per annum as from the date

of their so falling due. In consideration of your undertaking to put in hand at

once work on this machine I agree not to countermand this order. .... This

agreement contains all the terms and conditions under which I agree to

purchase the machine specified above, and any express or implied

condition, statement, or warranty, statutory or otherwise not stated herein

is hereby excluded..... (sgd.) H. M. L'Estrange." Then followed printed

questions relating to the purchaser and her business and premises with

blank spaces for the answers which were filled in in manuscript

appropriately to this case.

On the same date the plaintiff handed to Mr. Page her cheque for 4l. on

account of the price of the machine.

On February 9, 1933, the defendants, having received the above mentioned

document, sent to the plaintiff an "order confirmation" of that date signed

by them; a "guarantee"

[1934] 2 K.B. 394 Page 397

for eighteen months for the free fixing, maintenance, and insurance of the

machine; and an invoice.

On March 28, 1933, the machine was delivered at the plaintiff's premises,

and on March 29 a mechanic of the defendants came and installed it there,

the plaintiff handing to him on behalf of the defendants a further sum of

4l. 15s. in respect of the price, and 6s. for packing, making together 5l. 1s.

The machine did not work satisfactorily, and after a few days it became

jammed and unworkable. On April 7, 1933, the plaintiff wrote to the

defendants that it had failed and was still out of order, and a mechanic was

sent to put it right. On April 27, she again wrote that it was far from

reliable; and on April 28 a mechanic again attended to it, and the plaintiff

then signed a form that it was working to her satisfaction. On May 4, she

wrote that the machine had been of no use for a month, and asked for

another month in which to pay her first instalment, but added that since the

last overhaul the machine had worked satisfactorily. On May 8, her patience

being exhausted, she wrote that she had decided to forfeit her deposit, and

requested the defendants to remove the machine; and on May 11 she

ceased to make use of the machine. The defendants, however, declined to

terminate the transaction.

On May 25, 1933, the plaintiff brought the present action against the

defendants in the county court, her claim being for 9l. 1s., made up of the

above sums of 4l. and 5l. 1s., as money received by the defendants to the

use of the plaintiff, having been paid by the plaintiff to the defendants as

part of the consideration for the delivery of the machine pursuant to a

contract in the terms of the above documents, which consideration wholly

failed by reason that the machine was unfit for the purpose for which it was

intended to be used.

On June 9, 1933, the defendants delivered their defence by which they

denied that the machine was delivered in a condition unfit for the purpose

for which it was intended; and further denied that the sum claimed by the

plaintiff

[1934] 2 K.B. 394 Page 398

was payable to her: and by way of counterclaim the defendants sought to

recover from the plaintiff 71l.18s. 6d. as the balance of the price of the

machine.

On June 19, 1933, the plaintiff delivered an amended claim which added a

count for breach of an implied warranty on the sale of the machine that it

was reasonably fit for the purpose for which it was sold; but which still

claimed only 9l. 1s.

When the action came on for trial the plaintiff applied for and obtained leave

to put her claim for 9l. 1s. in three alternative ways: (1.) repayment as on a

total failure of consideration; (2.) return of money for breach of implied

conditions going to the root of the contract that the machine was reasonably

fit for the purposes for which it was required; and (3.) damages for breach

of an implied warranty that the machine was reasonably fit for those

purposes.

To these alternative claims the defendants at the trial set up the following

respective defences: (1.) no total failure of consideration; (2.) no implied

conditions, as the property in the machine had passed to the plaintiff, the

defendants relying, as to this point, upon the Sale of Goods Act, 1893 (56 &

57 Vict. c. 71), s. 11 (c); (3.) no action on implied warranty, as the

agreement signed by the plaintiff expressly provided for the exclusion of all

implied warranties.

In reply to the last of these defences the plaintiff contended: (1.) that she

was induced to sign the document under the impression that it was an order

form; and (2.) that at the time when she signed it she knew nothing of the

conditions on which the defendants relied.

Evidence was given on behalf of the plaintiff by herself and by Mr. Pratt. The

plaintiff said that she did not read the brown document and that the

defendants did not read it to her or tell her to read it, that she never read

the words in small type and did not remember that the agents had ever

called her attention to them, that she signed the document and did so

intentionally, that though she signed the document she had no clear idea of

what she was signing, that she thought that the document was an order

form or

[1934] 2 K.B. 394 Page 399

a form by which she was giving her consent to the purchase of a machine,

that two days after the arrival of the machine it ceased to work and that it

could not afterwards be made to work continuously, and that on May 11 she

ceased to use the machine and decided to ask the defendants to take it back

and to forfeit her deposit. Mr. Pratt gave evidence corroborating that of the

plaintiff.

Evidence was given on behalf of the defendants by Mr. Page and Mr. Berse.

Mr. Page said that the interview on February 7, 1933, lasted for over two

hours, that he sat near the plaintiff and read to her the whole of the brown

paper document including the small print, that the plaintiff asked no

question about the small print, that he pointed out to her that the total price

was not stated in figures in the document, that the plaintiff signed the

document at a desk while he was sitting by her, and that he also read to her

the guarantee. Mr. Berse gave evidence substantially to the same effect,

and stated further that the blanks in the brown document were filled up in

accordance with the answers given by the plaintiff.

On August 17, 1933, the county court judge gave judgment. After stating

the pleas and contentions of the parties and the substance of the evidence

on both sides he went on to say that he found as a fact that when the

defendants' two canvassers left the plaintiff after the interview of February

7, 1933, she had no knowledge of the contents of the document which she

had signed except the amount of the purchase price and the monthly

instalment and the arrangement about putting up the machine. He also

found as a fact that there must have been some defect in the mechanism of

the machine which rendered it so frequently unworkable that it was not

reasonably fit for the purpose for which it was required. In his view there

was an implied warranty that the machine should be reasonably fit for that

purpose, and he found as a fact that that warranty was broken. On behalf of

the defendants it was contended that that warranty was excluded by the

conditions printed in small type in the conditions of sale, and reliance was

placed upon the rule

[1934] 2 K.B. 394 Page 400

laid down in Parker v. South Eastern Ry. Co. (1) That rule, however, was

subject to certain exceptions, and the question was whether this case came

within it. The conditions here were printed in very small type, and when the

issue was whether the person signing the document knew of the conditions

it became material to ask whether the type was of a reasonable size. In all

such cases three questions must be answered according to the directions of

Lord Herschell L.C. in Richardson, Spence & Co. v. Rowntree (2) - namely:

(1.) Did the plaintiff know that there was writing or printing on the

document? (2.) Did she know that the writing or printing contained

conditions relating to the terms of the contract? (3.) Did the defendants do

what was reasonably sufficient to give the plaintiff notice of the conditions?

In the present case he (the judge) found as facts that the answer to the first

of these questions was in the affirmative, and the answers to the second

and third of them in the negative. On these grounds, therefore, he held that

the defendants were not entitled to rely upon the clause which excluded

implied warranties from the contract. He estimated the damages to which

the plaintiff was entitled for breach of the implied warranty at 70l. He gave

judgment for the plaintiff on the claim for 70l.; and for the defendants on

the counterclaim for 71l. 18s. 6d., the balance of the price.

The defendants gave notice of appeal dated September 14, 1933, from so

much of the judgment of the county court judge as adjudged that the

plaintiff should recover from the defendants the sum of 70l.damages.

A. T. Denning and D. E. Evans for the defendants, appellants.

Gordon Alchin for the plaintiff, respondent.

SCRUTTON L.J. In this case the plaintiff commenced proceedings against the

defendants in the county court,

(1)

2 C. P. D. 416, 421.

(2)

[1894] A. C. 217, 219.

[1934] 2 K.B. 394 Page 401

her claim being for 9l. 1s. as money received by the defendants to the use of the

plaintiff as part of the consideration for the delivery of an automatic slot machine

pursuant to a contract in writing dated February 7, 1933, which consideration was

alleged to have wholly failed by reason of the fact that the machine was delivered

in a condition unfit for the purpose for which it was intended. The only document

which corresponds to the contract there mentioned is a long document on brown

paper headed "Sales Agreement." By their defence the defendants denied that the

machine was delivered in a condition unfit, for the purpose intended, and denied

that the sum claimed was payable to the plaintiff; and they counterclaimed for the

balance of the price of the machine. Just before the trial the plaintiff amended her

claim by adding a count for breach of an implied warranty that the machine was

reasonably fit for the purpose for which it was sold; though she still claimed only

9l. 1s.There the pleadings stopped. At the trial, as the judge has stated in his

judgment, the plaintiff's claim was put in three different ways: total failure of

consideration; breach of implied conditions going to the root of the contract; and

breach of warranty. The defendants pleaded: no total failure of consideration; no

implied conditions: and that no action would lie for breach of implied warranty, as

the agreement expressly provided for the exclusion of all implied warranties. To this

last defence the plaintiff contended that she was induced to sign the contract by the

misrepresentation that it was an order form, and that at the time when she signed

she knew nothing of the conditions.

The county court judge has given judgment for the plaintiff for 70l., though there is

no claim by the plaintiff for that sum; and he has given judgment for the

defendants on the counterclaim for 71l. 18s. 6d., the balance of the price.

As to the defence that no action would lie for breach of implied warranty, the

defendants relied upon the following clause in the contract: "This agreement

contains all the terms and conditions under which I agree to purchase the machine

specified above and any express or implied condition,

[1934] 2 K.B. 394 Page 402

statement, or warranty, statutory or otherwise not stated herein is hereby

excluded." A clause of that sort has been before the Courts for some time. The first

reported case in which it made its appearance seems to be Wallis, Son & Wells v.

Pratt & Haynes (1), where the exclusion clause mentioned only "warranty" and it

was held that it did not exclude conditions. In the more recent case of Andrews

Brothers (Bournemouth), Ld. v. Singer & Co. (2), where the draftsman had put into

the contract of sale a clause which excluded only implied conditions, warranties and

liabilities, it was held that the clause did not apply to an express term describing

the article, and did not exempt the seller from liability where he delivered an article

of a different description. The clause here in question would seem to have been

intended to go further than any of the previous clauses and to include all terms

denoting collateral stipulations, in order to avoid the result of these decisions.

The main question raised in the present case is whether that clause formed part of

the contract. If it did, it clearly excluded any condition or warranty.

In the course of the argument in the county court reference was made to the

railway passenger and cloak-room ticket cases, such as Richardson, Spence & Co.

v. Rowntree. (3) In that case Lord Herschell L.C. laid down the law applicable to

these cases and stated the three questions which should there be left to the jury. In

the present case the learned judge asked himself the three questions appropriate to

these cases, and in answering them has found as facts: (i.) that the plaintiff knew

that there was printed material on the document which she signed, (ii.) that she did

not know that the document contained conditions relating to the contract, and (iii.)

that the defendants did not do what was reasonably sufficient to bring these

conditions to the notice of the plaintiff.

The present case is not a ticket case, and it is distinguishable from the ticket cases.

In Parker v. South Eastern Ry. Co. (4) Mellish L.J. laid down in a few sentences the

law which is

(1)

[1911] A. C. 394.

(2)

[1934] 1 K. B. 17.

(3)

[1894] A. C. 217.

(4)

2 C. P. D. 416.

[1934] 2 K.B. 394 Page 403

applicable to this case. He there said (1): "In an ordinary case, where an action is

brought on a written agreement which is signed by the defendant, the agreement is

proved by proving his signature, and, in the absence of fraud, it is wholly

immaterial that he has not read the agreement and does not know its contents."

Having said that, he goes on to deal with the ticket cases, where there is no

signature to the contractual document, the document being simply handed by the

one party to the other (1): "The parties may, however, reduce their agreement into

writing, so that the writing constitutes the sole evidence of the agreement, without

signing it; but in that case there must be evidence independently of the agreement

itself to prove that the defendant has assented to it. In that case, also, if it is

proved that the defendant has assented to the writing constituting the agreement

between the parties, it is, in the absence of fraud, immaterial that the defendant

had not read the agreement and did not know its contents." In cases in which the

contract is contained in a railway ticket or other unsigned document, it is necessary

to prove that an alleged party was aware, or ought to have been aware, of its

terms and conditions. These cases have no application when the document has

been signed. When a document containing contractual terms is signed, then, in the

absence of fraud, or, I will add, misrepresentation, the party signing it is bound,

and it is wholly immaterial whether he has read the document or not.

The plaintiff contended at the trial that she was induced by misrepresentation to

sign the contract without knowing its terms, and that on that ground they are not

binding upon her. The learned judge in his judgment makes no mention of that

contention of the plaintiff, and he pronounces no finding as to the alleged

misrepresentation. There is a further difficulty. Fraud is not mentioned in the

pleadings, and I strongly object to deal with allegations of fraud where fraud is not

expressly pleaded. I have read the evidence with care, and it contains no material

upon which fraud

(1)

2 C. P. D. 421.

[1934] 2 K.B. 394 Page 404

could be found. The plaintiff no doubt alleged that the defendants' agent

represented to her that the document which was given her to be signed was an

order form, but according to the defendants' evidence no such statement was made

to her by the agent. Moreover, whether the plaintiff was or was not told that the

document was an order form, it was in fact an order form, and an order form is a

contractual document. It may be either an acceptance or a proposal which may be

accepted, but it always contains some contractual terms. There is no evidence that

the plaintiff was induced to sign the contract by misrepresentation.

In this case the plaintiff has signed a document headed "Sales Agreement," which

she admits had to do with an intended purchase, and which contained a clause

excluding all conditions and warranties. That being so, the plaintiff, having put her

signature to the document and not having been induced to do so by any fraud or

misrepresentation, cannot be heard to say that she is not bound by the terms of

the document because she has not read them.

The county court judge has given judgment for the defendants on the counterclaim

for the balance of the price, 71l. 18s. 6d. I do not see how he could have clone that

unless he found that the contract included the clause in small print providing that, if

any instalment of the price should not be duly paid, all the remaining instalments

should fall due for immediate payment. That judgment on the counterclaim must

stand. As to the claim, judgment was given for the plaintiff for 70l. for breach of an

implied warranty, though only 9l. 1s. was claimed. Such a judgment could not have

been given even in the High Court without an amendment of the claim. But even if

there had been an amendment, the further difficulty would have remained that the

signed document contained a clause excluding any implied condition or warranty. If

the view which I have expressed as to the effect of a signed document is correct,

the plaintiff has no ground of claim, and the judgment in her favour cannot stand.

In my opinion, the judgment for

[1934] 2 K.B. 394 Page 405

the plaintiff on the claim should be set aside and judgment entered for the

defendants on the claim; and the judgment for the defendants on the counterclaim

should stand.

MAUGHAM L.J. I regret the decision to which I have come, but I am bound by legal

rules and cannot decide the case on other considerations.

The material question is whether or not there was a contract in writing between the

plaintiff and the defendants in the terms contained in the brown paper document.

In the case of a formal contract between seller and buyer, such as a deed, there is

a presumption which puts it beyond doubt that the parties intended that the

document should contain the terms of their contract. The brown paper document is

not a formal instrument of that character, yet, in my opinion, having been signed it

may well constitute a contract in writing. A reference to any of the text-books

dealing with the law of contract will provide many cases of the verbal acceptance of

a written offer, in which the Courts have held that the written offer and the

acceptance, even though only verbal, together constituted a contract in writing,

which could not be altered by extraneous evidence. The rule may not operate

equitably in all cases, but it is unquestionably binding in law.

In the present case on February 7, 1933, an order form, for such I consider the

brown paper document to be, was signed by the plaintiff. It was an elaborate form

containing a number of clauses, and among them certain terms and conditions in

regrettably small print but quite legible. The plaintiff having signed that document

gave it to a canvasser of the defendants, who took it away. It had been filled up in

ink by the canvasser before she signed it. Another document called an order

confirmation dated February 9, 1933, was sent to her by the defendants. In my

opinion the contract was concluded not when the brown order form was signed by

the plaintiff but when the order confirmation was signed by the defendants. If the

document signed by the plaintiff was a part of a contract in writing, it is impossible

[1934] 2 K.B. 394 Page 406

to pick out certain clauses from it and ignore them as not binding on the plaintiff.

In a case of this nature it is possible that the document signed by a contracting

party may not be the contract, but merely a memorandum in writing of a preceding

verbal contract between the parties, and if in this case it appeared that the

document in question was only a memorandum of a previous contract which had

not contained the clause excluding all conditions and warranties, the plaintiff might

have relied upon the case of Roe v. Naylor (No. 2) (1) and contended successfully

that, as the clause was not a part of the contract, she was not bound by it. In my

judgment, however, such a view as that is excluded here, because on the facts

there was no preceding verbal agreement between the parties.

I deal with this case on the footing that when the order confirmation was signed by

the defendants confirming the order form which had been signed by the plaintiff,

there was then a signed contract in writing between the parties. If that is so, then,

subject to certain contingencies, there is no doubt that it was wholly immaterial

whether the plaintiff read the small print or not. There can be no dispute as to the

soundness in law of the statement of Mellish L.J. in Parker v. South Eastern Ry. Co.

(2), which has been read by my learned brother, to the effect that where a party

has signed a written agreement it is immaterial to the question of his liability under

it that he has not read it and does not know its contents. That is true in any case in

which the agreement is held to be an agreement in writing.

There are, however, two possibilities to be kept in view. The first is that it might be

proved that the document, though signed by the plaintiff, was signed in

circumstances which made it not her act. That is known as the case of Non est

factum. I do not think it is necessary to add anything to what Scrutton L.J. has

already said about that, The written document admittedly related to the purchase of

the machine by the plaintiff. Even if she was told that

(1)

(1919) 87 L. J. (K. B.) 958.

(2)

2 C. P. D. 416, 421.

[1934] 2 K.B. 394 Page 407

it was an order form, she could not be heard to say that it did not affect her

because she did not know its contents.

Another possibility is that the plaintiff might have been induced to sign the

document by misrepresentation. She contended that she was so induced to sign the

document inasmuch as (i.) she was assured that it was an order form, (ii.) that at

the time when she signed it she knew nothing of the conditions which it contained.

The second of these contentions is unavailing by reason of the fact that the

document was in writing signed by the plaintiff. As to the first contention it is true

that the document was an order form. But further, if the statement that it was an

order form could be treated as a representation that it contained no clause

expressly excluding all conditions and warranties. the answer would be that there is

no evidence to prove that that statement was made by or on behalf of the

defendants.

In this case it is, in my view, an irrelevant circumstance that the plaintiff did not

read, or hear of, the parts of the sales document which are in small print, and that

document should have effect according to its terms. I may add, however, that I

could wish that the contract had been in a simpler and more usual form. It is

unfortunate that the important clause excluding conditions and warranties is in such

small print. I also think that the order confirmation form should have contained an

express statement to the effect that it was exclusive of all conditions and

warranties.

I agree that the appeal should be allowed.

Appeal allowed. Judgment entered for defendants on claim as well as on

counterclaim.

BAILMENT - BAILMENT FOR VALUABLE CONSIDERATION - HIRE OF WORK AND LABOUR - NATURE OF

THE CONTRACT; OWNER’S OBLIGATIONS - IN GENERAL - SPECIAL CONTRACT — WITH DYER AND

CLEANER — MISREPRESENTATION

When plaintiff took a white satin dress to defendants’ shop to be cleaned she was given a paper headed ‘Receipt’

and was asked by a shop assistant to sign it. Plaintiff inquired why her signature was required and the assistant

replied, in effect, that defendants would not accept liability for certain specific risks, including the risk of damage

by or to the beads and sequins with which the dress was trimmed. In fact the ‘receipt’ contained a condition that

the cleaners accepted no liability for any damage however arising. When the dress was returned to plaintiff it was

found to be stained, and she was awarded damages by the county court judge, who held that defendants had been

guilty of negligence and were not protected by their exemption clause by reason of misrepresentation as to its

character. On appeal by defendants: Held defendants could not rely on the exemption clause because their

assistant by an innocent misrepresentation had created a false impression in the mind of plaintiff as to the extent

of the exemption and thereby induced her to sign the receipt.

Per Denning, LJ: any behaviour, by word or conduct, was sufficient to be a misrepresentation if such as to mislead

the other party about the existence or extent of the exemption. If it conveyed a false impression that was enough.

Such an impression might even be conveyed by simply handing the document to the customer as if it were a

receipt, or by asking her to sign it without drawing attention to the condition.

ROAD TRAFFIC - PUBLIC SERVICE VEHICLES - CONTROL BY LICENSING - ROAD SERVICE LICENCES OFFENCES IN RESPECT OF ROAD SERVICE LICENCES - SIGNIFICANT OMISSION MAY RENDER TRUE

STATEMENT FALSE

Any behaviour, by word or conduct, was sufficient to be a misrepresentation if such as to mislead the other party

about the existence or extent of the exemption. If it conveyed a false impression that was enough. Such an

impression might even be conveyed by simply handing the document to the customer as if it were a receipt, or by

asking her to sign it without drawing attention to the condition.

2 pages

[1982] 1 MLJ 344

HENG YEOW HUA v TAN YEW LAI & SONS SDN BHD

ACJ KUALA LUMPUR

HASHIM YEOP A SANI J

CIVIL APPEAL NO 60 OF 1980

16 October 1981

Contract — Sale and purchase agreement relating to land — Dispute over interest

overdue — Claim by appellant for vacant possession — Relief granted by President

of Sessions Court — Whether order amounted to rescission

Jurisdiction — Sessions Court — Immovable property — Whether Sessions Court

can hear suit for recovery of immovable property

The plaintiff claimed against the defendant for vacant possession and mesne profits

as from the date of the purported termination of the agreement. The plaintiff was a

housing developer and the agreement between the parties was admittedly a sale

agreement in respect of a house and described as such in the agreement itself. The

said agreement was entered into in February 1975. Purchase price of the house was

$39,500. It was completed in March 1976 and possession was given to the

appellant also in March 1976. The sessions court found that 35 instalments were

made for the period between May 29, 1976 to September 22, 1978. There was

protracted correspondence between the parties over the disputed interest overdue.

When finally no payment was made on the sums overdue, the plaintiff sent a letter

terminating the agreement to the defendant, giving him notice to quit on or before

February 28, 1979.

The defendant appealed against the learned President's decision. The Memorandum

of Appeal raised the following questions of law for the appellate court: —

(1)

Did the Order of the learned President amount to a rescission order?

(2)

Was the respondent duplicating his claims in that having elected to charge

interest for late payments according to the agreement and having received

and taken interest over the years could he then ask for an alternative

remedy contradictory to his election?

(3)

Was there an infringement of any provisions of the National Land Code and

the Moneylenders' Ordinance 1951?

(4)

Did the Sessions Court have jurisdiction to hear the suit as the appellant

alleged that an issue of title was involved?

Held, dismissing the appeal:

(1)

as regards question (1), the relief granted by the President was the main

relief asked for in the Statement of Claim. It was not an order for rescission

and could not be construed as such;

(2)

as regards question (2) the principle that a party may not approbate and

reprobate has no application on the facts of the case;

(3)

as regards question (3) nowhere was this argument raised during the hearing

before the learned President nor was it stated anywhere in the pleadings; the

court would therefore not consider this point at all;

(4)

as regards question (4), a Sessions Court can hear and determine any action

or suit for recovery of immovable property so long as the title to the property

is not in issue;

(5)

there was no reason to interfere with the order of the learned President;

Cases referred to

Hiew Kim Swee v GC Gomez [1955] MLJ 170 172

Ali Mat bin Khamis v Jamaliah binti Kassim [1974] 1 MLJ 18

CIVIL APPEAL

JG Bernatt for the applicant.

Jennifer Chong (Miss) for the respondent.

HASHIM YEOP A SANI J

(delivering oral judgment): The plaintiff (respondent now) was claiming for vacant

possession and mesne profits as from the date of the purported termination of the

agreement (P1). The plaintiff was a housing developer and the agreement between

the parties was admittedly a sale agreement in respect of a house and described as

such in the agreement itself. The learned President saw it clearly as an agreement

for the sale of house No. 297, Taman Dato Tan Yew Lai, Kuala Lumpur. In fact from

their pleadings the parties themselves throughout treated the agreement as such

and the terms and conditions of sale of the house was as agreed upon by the

plaintiff and the defendant.

The agreement was entered into in February 1975. Purchase price agreed to was

$39,500. The house was completed in March 1976 and possession given to

appellant presumably also in March 1976. Apparently payments were made for

about 2 years but not as

1982 1 MLJ 344 at 345

regularly as stipulated in the agreement. The last payment was made in July 1978.

Since then no payments were made. Notice (P4) was sent to the appellant to

deliver vacant possession on or before February 28, 1979.

Clause 4.02 of P1 deals with the mode of progress payments amounting to $17,500

of the purchase price. It says that each payment would be due upon furnishing the

requisite notice and architect's certificate stating that so much of the construction

had been completed. The learned President dealt satisfactorily with the issue of the

requisite notices and the certificates raised by the defendant. The balance of

$22,000 of the purchase price was to be paid by regular instalments for 120

months. The learned President found that in all 35 instalments had been made for

the period May 29, 1976 to September 22, 1978. From the facts of the case the

learned President found that the defendant had acquiesced to the non-compliance

of certain requirements of P1.

It would appear from the evidence as well as the grounds of judgment that there

was a protracted and heated correspondence between the parties over the disputed

interest overdue — see P14, P15 and D20. When finally no payment was made on

the sums overdue the letter terminating the agreement was sent to the defendant

and giving him notice to quit on or before February 28, 1979.

The Memorandum of Appeal raises some minor issues of fact but the main

questions of law are:—

(1)

Does the Order of the learned President amount to a rescission order?

(2)

Is respondent duplicating his claims in that having elected to charge interest

for late payments according to the agreement and having received and taken

interest over the years can he now ask for an alternative remedy

contradictory to his election?

(3)

Was there an infringement of any provisions of the National Land Code 1965

and the Moneylenders' Ordinance 1951?

(4)

Did the Sessions Court have jurisdiction to hear the suit as the appellant

alleged that an issue of title was involved?

As regards question (1) it is to be observed that the claim of the respondent

(plaintiff before the learned President) was simply for vacant possession and mesne

profits. It is a remedy provided by the agreement executed between the parties.

Although it does seem odd that the respondent, who admittedly was a housing

developer at the material time and the agreement was executed as a sale

agreement, the agreement also purports to be a loan agreement. No objection on

the nature of the agreement was however raised on behalf of the appellant at any

stage of the proceeding. The relief granted by the President was in any case the

main relief asked for in the statement of claim. It is not an order for rescission and

cannot be construed as such. In any case at the conclusion of hearing of the appeal

counsel for appellant stated that he was waiving this ground.

As regards question (2) the law on election as to the proper remedy by a plaintiff is

settled. The principle that a person may not "approbate and reprobate" is according

to Halsbury'sa type of estoppel intermediate between "estoppel by record" and

"estoppel in pais". The principle is that a party may not "approbrate and reprobate"

and this expresses two propositions namely (1) the person having a choice between

two courses of conduct is to be treated as having made an election from which he

cannot resile and (2) the person will not be regarded, in general at any rate, as

having so elected unless he has taken a benefit under or arising out of the choice of

the course of conduct which he has first pursued and with which his subsequent

conduct is inconsistent. Thus a plaintiff having two inconsistent claims who elects to

abandon one and pursue the other may not, in general, afterwards choose to return

to the former claim and sue on it, but this rule of election does not apply where the

two claims are not inconsistent and the circumstances do not show an intention to

abandon one of them.

Where a plaintiff merely claims alternative reliefs, the general rule is that he can

elect at the trial but where relief is asked on footings which are inconsistent (for

example damages on the basis of a contract having been repudiated and a

declaration on the basis that the contract is subsisting) the plaintiff should be put to

his election at the trial. This principle has no application on the facts of this case.

As regards question (3) it is observed that no where was this argument raised

during the hearing before the learned President nor was it stated anywhere in the

pleadings. The statement of defence merely denies any default (without good

cause) by the appellant. What was disputed was the effectiveness of notices P2 etc.

on the grounds that the proviso to clause 4.02 of P1 had not been complied with.

This was another ground which counsel for appellant stated he was waiving at the

conclusion of the hearing of the appeal. For these reasons I do not wish to consider

this point at all.

The appellant during argument here also raises the question of jurisdiction as it was

contended that there was an issue of title. The rule for the courts to follow on the

question where there is bona fide issue of title involved is well set out in Hiew Kim

Swee v GC Gomez [1955] MLJ 170 172where Thomson J. (as he then was) said: —

"On the other hand, where proceedings were taken for possession under section 122 of the 1846 Act (or

the later corresponding sections) it was held, again from the very commencement, that where a defence

was raised which on the face of it would raise a question of title it was the duty of the judge to inquire into

the facts upon which such a defence was based. That was decided in 1848 in the case of In re Fearon v

Nowall (1848) 17 LJQB 161."

In Ali Mat bin Khamis v Jamaliah binti Kassim [1974] 1 MLJ 18 the question of

ownership of property was raised in the defence thereby bringing out the question

of title which took the matter outside the jurisdiction of the Subordinate Court. This

is not the case here. A Sessions Court can hear and determine any action or suit for

recovery of immovable property so long as the title to the property is not in issue.

1982 1 MLJ 344 at 346

Thus my answers to all the four questions raised are against the appellant. As

regards questions of fact I find nothing to justify interference as the findings of fact

were clearly made by the trial court.

There appears at the end of the judgment of the learned President that counsel for

the plaintiff "undertook to refund to defendant any sum outstanding after judgment

had been satisfied." The respondent sought during argument to remove that part of

the learned President's order on the grounds simply that the relief was never asked

for in the statement of claim.

One of the underlying objectives in rules of procedure is to avoid unnecessary

duplication of suits and/or proceedings. Therefore courts in every cause or matter

pending before them should grant all such remedies as appear to be necessary and

to which the party would appear entitled in respect of any legal or equitable claim

so that the objective is achieved by having the controversy between the parties

completely and finally determined.

True I find some of the provisions of the agreement peculiar. Although it is a sale

agreement the title of the property remained throughout with the developer. Under

clause 6.02 of P1 the plaintiff (respondent now) would not transfer the title to the

appellant until after all payments have been made. Provisions under the

miscellaneous part of P1 deal with late payments, interest charges, defaults and

vacant possession and forfeiture of all moneys paid. But it is settled law that when

a document containing contractual terms is signed, then in the absence of fraud or

misrepresentation, the party signing it is bound by the terms. In this case the

defendant had signed the agreement knowing fully well that it is a contract for

purchase of the house and provisions of the agreement dealt substantially with the

modes of payment. It is always implied that the court has the discretion to add to

the reliefs prayed for any relief which in its opinion is fair and just and warranted by

the circumstances of the case. It is also clear from the notes as well as from the

grounds of decision of the learned President that there was an undertaking by

counsel for the plaintiff then. I do not think I should interfere with an order

consequent upon an undertaking made before another court the terms of which I

am not fully familiar with. Furthermore, there is also no cross appeal against this

part of the order of the learned President.

The appeal is therefore dismissed with costs and the order of the learned President

is affirmed.

Appeal dismissed.

5 pages

[1989] 1 MLJ 278

PETER RALPH GROSSEY v THE CHARTERED BANK

Also Reported in: [1988] SLR 973

HIGH COURT (SINGAPORE)

RAJAH J

SUIT NO 3141 OF 1984

18 November 1988

Banking — Current account — Overdraft against marketable securities — Bearer

securities — Notice of redemption — Whether part of banking business — Wang

bonds — Difference in converted value and face value — Claim by plaintiff

The plaintiff was at all material times a customer of the defendant bank ('the bank')

with which it maintained a current account on which it had advanced to him various

sums of money from time to time by way of overdraft against marketable securities

lodged with it by the plaintiff. The plaintiff said that he discussed with Northrop, an

officer of the bank, in April 1982 the possibility of offering convertible bearer bonds

as security for credit facilities by the bank. At that time as indeed of now, in respect

of Eurobonds, which are internationally traded securities, the major part of

Eurobond clearing and settlement was and is conducted through two centralized

clearing systems, namely, Euro-clear in Brussels and CEDEL in Luxembourg. Each

of the two systems provided an efficient, risk-free settlement system for

internationally traded securities, avoiding the costs and delays caused by physical

delivery of certificates. Participants in both systems had to be institutions. The

plaintiff's evidence is that as a result of the discussions, agreement between the

bank and himself was reached, culminating in a letter dated 12 April 1982 from the

bank to himself (AB4) which, inter alia, reads:

'(1) Further to our recent discussions we are pleased to advise that our London merchant bank,

Standard Chartered Merchant Bank Ltd … are members of the Euro-clear System and can act as

custodian for the various loan stocks to be held as security for your facilities in Singapore …

(3) Please arrange for the securities to be delivered free of payment to Standard Chartered

Merchant Bank Ltd, London … It will be necessary for us to furnish our associates with your full

name and residence status and your interest payment instructions. You should also let us know

by whom the various securities will be delivered. Please advise accordingly.'

The plaintiff's evidence is that on the Saturday following AB4 of 12 April 1982 or the

Saturday after that Northrop asked him to cancel the arrangements as had been set

out in para 3 of AB4, that is to say, to deliver the bond securities to the Standard

Chartered Merchant Bank in London, and told him to have the said bearer bonds

physically transferred to the bank in Singapore. As a result of this the plaintiff

countermanded the order to his agent in England to have the bearer bonds placed

with the Standard Chartered Merchant Bank in London and instead asked his agent

to have the convertible bearer bonds sent on to the bank in Singapore. In the event

some of the bonds came to him, which he handed over to the bank as and when

they arrived, while others went direct to the bank. The plaintiff's view of the bank's

change of mind is that it seemed to him that the bank would and should know what

it was doing and that perhaps Northrop had found out more from London of how

the bank could deal from Singapore with the situation. On this issue the bank's

evidence as deposed to by Northrop (DW1) and supported by Chee Kok Kee (DW2),

the officer in charge of the securities department of the bank, was to the effect that

at no time did Northrop countermand para 3 of AB4 and that it was the plaintiff who

of his own volition had decided that the

1989 1 MLJ 278 at 279

services of the Standard Chartered Merchant Bank in London was not to be used,

perhaps because of income tax reasons.

The question is whether the learned judge should accept the evidence of the

plaintiff or that of Northrop as supported by Chee. The bank submitted that it is not

part of 'banking business' as defined in s 2 of the Banking Act (Cap 19, 1985 Ed) to

inform a customer of the notice of redemption of bearer securities held by them and

consequently its failure to inform the plaintiff of the notice of redemption of the

Wang bonds was not part of banking business. The bank also relied on the following

exemption clause: '… nor is the bank responsible for any loss that may be incurred

by bonds or coupons not being duly presented when drawn or due; all requisite

notices in this connection and in connection with rights, bonuses or entitlements to

convert in respect of any bonds or shares should be given to the bank by customers

…'.

The plaintiff says that had he redeemed the Wang bonds on 27 May 1983, the date

of redemption, by converting them to shares he would have received the sum of

US$84,650 being the value of the converted shares. As it was, he only received

US$56,445, the face value of the convertible Wang bonds. The plaintiff is now

claiming US$28,205 being the difference in value of the converted shares and the

face value of the Wang bonds.

Held, allowing the claim with costs:

(1)

Taking into account the circumstances in which these Wang convertible

bonds were accepted by the bank as collateral for the overdraft account, it

lies ill in the mouth of the bank for it now to say that it is not part of its

business to inform the plaintiff, a customer, of the notice of redemption of

the Wang bonds held by it as security. The bank should not be heard to say

that the relaying of such information to its customers is not part of its

banking business.

(2)

The condition relied upon by the bank as exempting it from liability is

ineffective and unenforceable against the plaintiff by the bank.

(3)

The bank did not exercise due care (a) in not taking the necessary steps to

place itself in a position to ascertain when the notice of redemption was

given by the Wang company, and (b) thus disenabling itself from informing

the plaintiff of such notice which would have made it possible for him to

convert the bearer bonds to registrable shares in the Wang company. The

bank was thus in breach of its duty of care in respect of the deposited Wang

convertible bearer bonds to its customer the plaintiff.

(4)

There will therefore be interlocutory judgment for the plaintiff on his claim

with costs, the question of the assessment of damages suffered by the

plaintiff being referred to the registrar. Damages suffered by the plaintiff

shall be the difference in the value of the converted shares and the face

value of the Wang convertible bonds.

Cases referred to

Curtis v Chemical Cleaning & Dyeing Co [1951] 1 KB 805

Mendelssohn v Normand Ltd [1970] 1 QB 177

HE Cashin for the plaintiff.

Dennis Singham for the defendant.

RAJAH J

The defendant is a company incorporated in England with limited liability under a

Royal Charter of 1853 with a registered branch office in Singapore carrying on,

inter alia, a banking business and related financial services under licence issued by

the competent authorities of Singapore. It was and is a member of the Standard

Chartered Bank Group of which the Standard Chartered Merchant Bank Ltd, London

('SCMB') was also a member and it has been carrying on banking business and

other related financial services in Singapore for well over a century. Section 2 of the

Banking Act (Cap 19, 1985 Ed) defines 'banking business' as 'the business of

receiving money on account or deposit account, paying and collecting cheques

drawn by or paid in by customers, the making of advances to customers, and

includes such other business as the Authority may prescribe for the purposes of this

Act'.

The plaintiff, a citizen of the UK, was at all material times a customer of the

defendant ('the bank') at its main office in Singapore since 1966, when he arrived

in Singapore and where he has been resident since and is now a permanent

resident.

The plaintiff is a businessman of standing in Singapore being involved in the affairs

of a number of foreign international companies, of which he was and is a director.

The plaintiff maintained with the bank a current account on which it has advanced

the plaintiff various sums of money from time to time by way of overdraft against

marketable securities lodged with it by the plaintiff.

On 5 February 1979 the bank wrote to the plaintiff as follows (AB1):

Banking arrangements

We advise that the total value of all your shares held by us to secure your guarantee and overdraft line

amounts to S$591,425. Under the terms of the banking facilities extended to you, our commitments under

both lines of credit should not exceed 65% and 50% respectively of the current market value of the

shares.

Your account is currently overdrawn to the extent of S$65,281.27 and there is thus an overall shortfall in

our security.

Under the circumstances, we shall be pleased if you will arrange to lodge further shares with us, or

alternatively, reduce your overdraft to within the limit of S$40,000.

We await your advice on the matter.

On 6 April 1979 the manager of the defendant wrote to the plaintiff as follows

(AB2):

Banking arrangements

We have reviewed the banking arrangements currently made available to you and are pleased to advise

that we have extended the credit line for a further period on the following terms and conditions, with a

reduction in the level of the overdraft facility to conform with our normal margin requirements.

1989 1 MLJ 278 at 280

£75,000

S$7,700

S$30,000 (reduced from

S$40,000)

For the issue of a guarantee favouring Lloyds. Counter indemnity to be held.

For the issue of a guarantee to M/s Hock Seng Enterprises Pte Ltd. Counter

indemnity to be held.

Overdraft facilities in current account. Interest will be levied at 1ࡩ% above our

prime lending rate which is currently 8% pa. Changes in prime rate are notified to the

press and featured on our counters and in current account statement.

Security

We hold marketable securities supported by blank transfers and a letter of lien. Our commitment under

the guarantee lines should not at any time exceed 65% of the current market value of the shares

deposited and 50% on the overdraft facility.

Subject to review on 30 April 1980.

We trust that the foregoing arrangements are satisfactory to you.

These arrangements, it would appear, continued until late November 1981 when Mr

Northrop, the advances manager of the bank, wrote to the plaintiff on 23 November

1981 to the effect that it was time to review the banking arrangements as the

quantum of his overdraft had increased and the cover for his facilities had eroded.

To this the plaintiff responded on 7 December 1981 as follows:

Dear Mr Northrop,

Many thanks for your letter B467 of 23 November. I was aware that the cover for my facilities had eroded

somewhat, and in fact am in the process of rearranging my assets to provide adequate cover. One of my

difficulties is to determine which shares/bonds etc will be relatively immobile as it is, of course, awkward

for both parties if the collateral is frequently changed. If you can bear with me a little longer I shall

develop a plan which we can then discuss and agree - may I contact you again shortly on this? (AB3)

It is the plaintiff's evidence that in the course of a number of discussions with

Northrop, he discussed with him sometime in April 1982 or thereabouts the

possibility of offering convertible bearer bonds as security for credit facilities by the

bank. The difficulty for the bank here it would appear was two-fold, (1) that as a

holder of convertible bearer bonds the plaintiff's name would not appear in the

register of the issuing company, and (2) that the bank as then organized would not

be able to keep track of the notices of conversion as and when given by the various

issuing companies.

At that time as indeed of now, in respect of Eurobonds, which are internationally

traded securities, the major part of Eurobond clearing and settlement was and is

conducted through two centralized clearing systems, namely, Euro-clear in Brussels

and CEDEL in Luxembourg. Each of the two systems provided an efficient, risk-free

settlement system for internationally traded securities, avoiding the costs and

delays caused by physical delivery of certificates. Participants in both systems had

to be institutions. Euro-clear was established in 1968 and at the end of 1986, Euroclear had over 2,050 participants. (See p 590 of International Finance and

Investment edited by Brian Terry (1987).)

The plaintiff's agent in the UK in respect of his Eurobond holdings was a firm of

stockbrokers by the name of Charlton Seal Dimmock & Co operating in Manchester,

England ('agent'). Member banks of the Euro-clear System would hold the

convertible bearer bonds on behalf of his agent. Interest coupons would be

attached to these bonds and the institution holding the bonds would present these

interest coupons to the Euro-clear System which would then collect the interest on

the coupons and remit it to his agent on whose behalf the member institution would

be holding the bonds. These interest payments collected on behalf of the plaintiff

had always been remitted by his agent to Hongkong where the plaintiff had a bank

account. As and when the companies issuing the convertible bearer bonds gave

notices of redemption the issuing companies would inform the Euro-clear System

who would then inform the custodian institution of such notices. The custodian

institution in turn would inform the agent who would in turn inform the plaintiff of

such notices. The plaintiff would finally instruct his agent as to what was to be done

with the bearer convertible bonds.

It was against this background that the feasibility of placing these convertible

bearer bonds with the bank by way of security for the plaintiff's banking

arrangements with it was discussed. What was discussed and finally agreed upon

by the bank and plaintiff are crucial to this case.

The plaintiff's evidence is that as a result of the discussions, agreement between

the bank and himself was reached culminating in a letter dated 12 April 1982 from

the bank to himself (AB4) which reads:

Banking facilities

(1) Further to our recent discussions we are pleased to advise that our London merchant bank,

Standard Chartered Merchant Bank Ltd, 33–36, Gracechurch Street, London EC3V OAX are

members of the Euro-clear System and can act as custodian for the various loan stocks to be

held as security for your facilities in Singapore. Current charges are: For free delivery within

Euro-clear System - US$1.00 per security

Annual custodian charges

Up to US$500,000

= 0.5 per mile

Next US$1,000,000 = 0.25 per mile

Next US$23,500,000 = 0.2 per mile

Next US$25,000,000 = 0.175 per mile

Above US$50,000,000 = 0.15 per mile

(2) Fees are payable quarterly based on aggregate month end balances unless the amount

involved warrants

1989 1 MLJ 278 at 281

annual billing only. Your current account will be debited with these charges automatically under

advice.

(3) Please arrange for the securities to be delivered free of payment to Standard Chartered

Merchant Bank Ltd, London, clients accounts no 94632, attn: Mr Richard Southward. It will be

necessary for us to furnish our associates with your full name and residence status and your

interest payment instructions. You should also let us know by whom the various securities will be

delivered. Please advise accordingly.

(4) We attach a letter of lien in respect of these securities and would be pleased if you would sign

where indicated.

Up till the writing of this letter the bank's evidence and that of the plaintiff run on

parallel lines but after the last-mentioned letter their evidence diverge and become

conflicting.

The plaintiff's evidence is that on the Saturday following AB4 of 12 April 1982 or the

Saturday after that Northrop asked him to cancel the arrangements as had been set

out in para 3 of AB4, that is to say, to deliver the bond securities to SCMB in

London, and told him to have the said bearer bonds physically transferred to the

bank in Singapore. As a result of this the plaintiff countermanded the order to his

agent in England to have the bearer bonds placed with the Standard Chartered

Merchant Bank in London and instead asked his agent to have the convertible

bearer bonds sent on to the bank in Singapore. In the event some of the bonds

came to him, which he handed over to the bank as and when they arrived, and

others went direct to the bank. The plaintiff's view on the bank's change of mind is

that it seemed to him that the bank would and should know what it was doing and

that perhaps Northrop had found out more from London of how the bank could deal

from Singapore with the situation. On this issue the bank's evidence as deposed to

by Northrop (DW1) and supported by Chee Kok Kee (DW2), the officer in charge of

the securities department of the bank, was to the effect that at no time did

Northrop countermand para 3 of his letter of 12 April 1982 (AB4) and that it was

the plaintiff who of his own volition had decided that the services of SCMB in

London were not to be used, perhaps because of income tax reasons. On the tax

question the factual position was that the plaintiff's agent had been previously

remitting to Hongkong the interest derived from the bearer bonds and the plaintiff

had always been paying Singapore income tax as a Singapore resident.

The question for me here is do I accept the evidence of the plaintiff or that of

Northrop as supported by Chee Kok Kee. It is clear to me that the plaintiff had kept

his convertible bearer bonds in the UK for the simple reason that he wanted these

kept under conditions where he would come to know when these convertible bearer

bonds would have to be converted to registered shares in the issuing companies.

The point of an investment in convertible bearer bonds is the investor's hope and

expectation that at the notified date of conversion he would be in a situation

whereby by converting to registered shares in the issuing company he would make

a profit on his investment in the convertible bonds. The discussions between the

bank and the plaintiff must have centred round the problem of how the then

existing safe position of the plaintiff in regard to the conversion of the convertible

bearer bonds could be accommodated to the bank's desire to have adequate

physical control over its security. The bank's letter of 12 April 1982 (AB4) to my

mind ideally solved the problem; the plaintiff would maintain his safe position

regarding notification of conversion of the convertible bearer bonds and the bank

for its part would maintain sufficient control and ability to liquidate the convertible

bearer bonds should the need arise. In these circumstances it seems to me that it

would have been sheer madness on the plaintiff's part for him of his own volition to

cancel the agreed safe arrangements for him and have the convertible bearer bonds

transferred to Singapore particularly in the light of the bank's continued assertion

throughout the trial that it was organizationally not geared to meeting the notice of

conversion requirement. I accept the plaintiff's statement that the reason for his

going along with the bank's change of mind was his belief that the bank would have

come to some arrangement with SCMB whereby the bank would have solved the

difficulty of the notice of redemption. On reflection it was not such an intractable

problem as to defeat the ingenuity of a respectable old established banking

institution with connections in the city of London such as the defendants. All it had

to do in my view was to identify the convertible bearer bonds to SCMB in London

and the latter as members of the Euro-clear System could then have easily notified

the bank of any notice of redemption affecting any of the bonds deposited with the

bank by way of security whereupon the bank could have notified the plaintiff who

could then have acted as suited him best. I have a feeling that the bank was fully

alive to this possibility and that it was why it called for the physical transfer of the

bearer convertible bonds to be placed with them in Singapore. This would have

been a perfectly safe position for both parties had someone in the bank

remembered to send SCMB in London the identifying information on the convertible

bonds and had instructed them to notify the bank of any notice of conversion. This

it would appear the bank failed to do thus enabling the situation, of which the

plaintiff is now complaining, to arise. Yet again we know from the evidence before

the court that one of the three newspapers which carried notices of redemption by

arrangement with the Euro-clear System was and is The Financial Timesof London

of which the bank is an acknowledged subscriber. The bank had here yet another

last opportunity of preventing loss on the conversion of the bonds. A daily perusal

of The Financial Times would

1989 1 MLJ 278 at 282

have revealed the notice of redemption on Wang convertible bonds and thus led to

appropriate action being taken thereafter both by the bank and the plaintiff. For

these reasons I prefer the evidence of the plaintiff to that of Northrop and Chee Kok

Kee and find that it was Northrop who countermanded para 3 of the bank's letter of

12 April 1982 (AB4) and asked the plaintiff to have the convertible bearer bonds

sent on to the bank in Singapore, where they were to be used by the bank as

security for the plaintiff's banking facilities which had already been made available

to him by the bank.

Arising out of the banking arrangements made on 12 May 1982 (AB9) a number of

securities reached the bank from time to time and on 20 August 1982 the bank

gave the plaintiff an acknowledgement receipt (AB12 & AB13) worded as follows:

Securities

We acknowledge receipt of the undermentioned enclosures which we are retaining under lien as per list

attached:

US$25,000

US$50,000

US$50,000

US$50,000

US$50,000

Moran Energy International NV 8% convertible subordinated debenture due 1995 (nos M13–M22, M215–M229)

Reading & Bates Energy Corporation NV 8% convertible subordinated debenture due 1995 (nos M1728, M2296–

M2329, M53374–M53388)

Wang Laboratories (NA) NY 9¼% convertible subordinated guaranteed debenture due 1996 (nos 39728–39777)

Swiss Bank Corporation (Overseas) SA 6¼% convertible bonds due 31 December 1990 (nos 020006, 023824,

028539/541)

TNT Overseas Finance NV 8ࡩ% convertible guaranteed subordinated bonds 1990 (nos 02595–02644)

together with interest coupons which we shall send for collection when they are due.

Conditions

The bank, while receiving articles for the convenience of customers, does not take responsibility for their

loss or damage by thieves, fire, explosion, war, riot or otherwise nor is the bank responsible for any loss

that may be incurred by bonds or coupons not being presented when drawn or due, all requisite notices in

this connection and in connection with rights, bonuses or entitlements to convert in respect of any bonds

or shares should be given to the bank by customers. Notice of intention to withdraw items must be lodged

with the bank during business hours on the day preceding that on which delivery is required.

With regard to this acknowledgement receipt the plaintiff deposed as follows:

AB12 (20.8.82) Condition - AB12 posted to me. Checked the list. Found one missing and wrote to them

about it. I did not notice it. This is the standard form for ordinary shares. I would not have accepted the

condition because there could have been a major danger. No one in the bank had drawn my attention to it

specifically. I only read it when the bank drew my attention to it later after the dispute had arisen.

The defendant submitted that it is not part of 'banking business' as defined in s 2 of

the Banking Act (Cap 19, 1985 Ed) to inform a customer of the notice of

redemption of bearer securities held by them and consequently its failure to inform

the plaintiff of the notice of redemption of the Wang bonds was not part of banking

business. I do not see how the bank, having accepted bearer convertible securities

as collateral for securing the plaintiff's overdraft account with it, can now say that

informing customers of such notices is not part of its banking business. If the

lending of money to customers is banking business then surely the acceptance of

security for such lending must also be part of banking business and if the bank

accepts convertible bearer bonds as security for such lending then surely it is the

bank's business to assist its customers in carrying out the terms of the convertible

bonds and thus safeguard the customers' best interests. Taking into account the

circumstances in which these Wang convertible bonds were accepted by the bank

as collateral for the overdraft account, it lies ill in the mouth of the bank for it now

to say that it is not part of its business to inform the plaintiff, a customer, of the

notice of redemption of the Wang bonds held by it as security. If the giving of such

notice is not to be deemed part of its banking business then the bank should never

have accepted these bonds as security. In the circumstances I do not think that the

bank should now be heard to say that the relaying of such information to its

customers is not part of its banking business.

By para 6 of the defence the defendant pleads that further and in the alternative

the defendant will rely on the clause in the acknowledgment receipt given to the

plaintiff on the deposit of the Wang Bonds dated 20 August 1982 which contains a

clause the material words of which are:

… nor is the bank responsible for any loss that may be incurred by bonds or coupons not being duly

presented when drawn or due; all requisite notices in this connection and in connection with rights,

bonuses or entitlements to convert in respect of any bonds or shares should be given to the bank by

customers …

On this plea of the defendant the plaintiff contends (i) that the condition, if at all

valid, was formulated on 20 August 1982 and can therefore form no part of the

contract dated 12 May 1982 relating to the banking arrangements as set out in

AB9, (ii) that the plaintiff only read the condition after the bank drew his attention

to it later after the dispute had arisen; (iii) that the condition is not expressed

clearly and without ambiguity, (iv) that the condition as pleaded denies the whole

purpose of the contract of 12 May 1982 and would have defeated the purpose of

depositing the convertible bearer bonds in the manner arranged.

1989 1 MLJ 278 at 283

The law on exemption clauses is succintly stated in Chitty on Contracts (25th Ed)

Vol 1 at pp 875–876 as follows:

Exemption clauses must be expressed clearly and without ambiguity or they will be ineffective. Mere

general words in an exemption clause do not ordinarily absolve the party seeking to rely on the exemption

from liability for his own negligence or that of his employees. The clause must clearly express what its

intention is. (p 875)

… if a person was under a legal liability and wished to get rid of it he could only do so by using clear

words. (p 876)

On the issue of when the plaintiff first had knowledge of the condition, I accept the

plaintiff's evidence that he only read it later when the bank drew his attention to it

after the dispute had arisen. On the plea of the bank that the exemption clause

frees it of liability it is to be noticed that it relies on only a part of the clause and

that part reads:

… nor is the bank responsible for any loss that may be incurred by bonds or coupons not being duly

presented when drawn or due; all requisite notices in this connection and in connection with rights,

bonuses or entitlements to convert in respect of any bonds or shares should be given to the bank by

customers …

In my view the exemption clause we are concerned with must be read in its entirety

and not in part as has been done by the bank. Reading it in its entirety one could

come to the conclusion that this clause only applies to those instances 'while

receiving articles for the convenience of customers', that is, in cases where the

bank is a bailee pure and simple for their customers. Further the last paragraph of

the acknowledgement receipt which reads:

Notice of intention to withdraw items must be lodged with the bank during business hours on the day

preceding that on which delivery is required

fortifies my view that the condition was not intended to apply to securities

deposited with the bank by way of collateral but to items left by customers for

safekeeping. In the instant case the bearer bonds were deposited by the plaintiff

with the bank by way of collateral in respect of his overdraft account with the bank

and not merely for safekeeping but subject also to withdrawal from time to time on

proper notice. On a reading of the condition as a whole I do not think that the

condition as framed is applicable to the instant case nor is it enforceable against the

plaintiff for the reason that it is not expressed clearly or without ambiguity.

For these reasons I hold that the condition relied upon by the bank as exempting it

from liability is ineffective and unenforceable against the plaintiff by the bank

(see Curtis v Chemical Cleaning & Dyeing Co [1951] 1 KB 805 andMendelssohn v

Normand Ltd [1970] 1 QB 177). In any event I accept the defendant's submission

that the condition, if at all valid, was formulated on 20 August 1982 (AB12) and can

therefore form no part of the contract dated 12 May 1982 relating to the banking