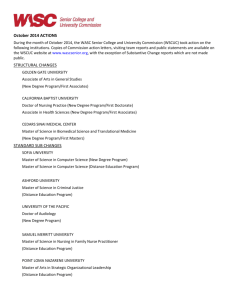

SERVICE TAX * REVERSE CHARGE MECHANISM & INPUT TAX

advertisement

Companies Act 2013 R Sogani & Associates By: CA BHARAT SONKHIYA 1 CA Bharat Sonkhiya| R Sogani & Associates COMPANIES ACT, 2013 COMPANIES ACT, 1956 470 Sections 658 Sections 29 Chapters 2 7 Schedules 18 Chapters 15 Schedules CA Bharat Sonkhiya| R Sogani & Associates Now it has become a proactive law with inclusion and emphasis on more and more stringent clauses. 3 CA Bharat Sonkhiya| R Sogani & Associates Transparency Investor Protection Key HIGHLIGHTS Compliance 4 CSR Corporate Governance CA Bharat Sonkhiya| R Sogani & Associates MAJOR CHANGES P&L STATEMENT OPEN FOR INSPECTION GENERAL PUBLIC BY FILING OF SOME MORE BOARD RESOLUTIONS STIFF PENALTIES RESTRICTION ON INTER CORPORATE LOAN AND GUARANTEE CIN ON OFFICIAL DOCUMENTS RESTRICTIONS ON ACCEPTANCE OF DEPOSITS E-VOTING AND VIDEO CONFERENCING 5 CA Bharat Sonkhiya| R Sogani & Associates LIMIT ON NUMBER OF MEMBERS IN PRIVATE COMPANIES 50 6 200 CA Bharat Sonkhiya| R Sogani & Associates 7 CA Bharat Sonkhiya| R Sogani & Associates TAKING OF LOANS BY PRIVATE COMPANY Loan taken from Upto 31st March, 2014 After 31st March, 2014 Director Director’s relatives Shareholders (Strict procedure) 8 CA Bharat Sonkhiya| R Sogani & Associates DEPOSITS FROM MEMBERS/ SHAREHOLDERS Stringent Provisions 9 CA Bharat Sonkhiya| R Sogani & Associates LOAN FROM DIRECTORS Out of Borrowed Funds Not Allowed Out of Own Funds Allowed Wrong Declaration by Directors- Huge Penalties. 10 CA Bharat Sonkhiya| R Sogani & Associates REPAYMENT OF DEPOSITS By31st March, 2015 FILING OF DOCUMENTS WITH ROC BY :30TH JUNE, 2014 SECTION - 74 For company – Penalty minimum of Rs. One crore and upto Rs. Ten crores 11 Penalty for violation Officer in default – Seven year jail and fine from Rs. 25 Lacs to Rs. Two crores CA Bharat Sonkhiya| R Sogani & Associates Loan from Other Companies 12 ALLOWED CA Bharat Sonkhiya| R Sogani & Associates Business deposits older than 365 days Treated as Deposits. 13 CA Bharat Sonkhiya| R Sogani & Associates Share Application Money Allotment Within 60 days. If not alloted - Treated as Deposits. 14 CA Bharat Sonkhiya| R Sogani & Associates ANY QUERIES ….. 15 CA Bharat Sonkhiya| R Sogani & Associates MANDATORY FILING OF BOARD RESOLUTION To borrow monies To approve quarterly, half yearly financial statement or results To grant loans or give guarantee or provide security 16 To invest the funds of company Board Resolutions Approve the financial statement and board report To take note of disclosure of directors interest and shareholding Section 184 To appoint internal auditor CA Bharat Sonkhiya| R Sogani & Associates BORROWING NEEDS SHAREHOLDER’S APPROVAL SECTION 180(1)(C) Borrowings > Paid up share capital + Free Reserves Special Resolution needs to be passed in the General Meeting Borrowings does not includes CC Limit. 17 CA Bharat Sonkhiya| R Sogani & Associates MENTIONING CIN AND OTHER DETAILS! SECTION 12(3)(C) What to mention? Name Address of its registered office Corporate Identity Number (CIN) Telephone number Fax number E-mail and Website addresses Where to mention? business letters, billheads, letter papers all its notices (including EMail) and other official publications ** Paint or affix its name, and the address of its registered office outside every office or place of its business. 18 CA Bharat Sonkhiya| R Sogani & Associates Consent to act as director Consent within 30 days of appointment 19 Director shall file form DIR-12 with ROC CA Bharat Sonkhiya| R Sogani & Associates APPOINTMENT OF DIRECTOR RS.1,00,000/- SECURITY SECTION 160 20 Requirement of 14 days prior notice and Rs.1,00,000/as security for appointment of Directors in General Meeting. CA Bharat Sonkhiya| R Sogani & Associates RESIGNATION OF DIRECTORSSECTION 168 Stringent provisions. Detailed reasons required to be given by the Directors 21 Intimation by Company to Registrar –within 30 days – Form DIR – 12. Intimation by Director to Registrar –within 30 days – Form DIR – 11. Directors who have resigned shall be liable even after his resignation for the offences occurred during his tenure. CA Bharat Sonkhiya| R Sogani & Associates APPOINTMENT WTD/ MD SECTION- 196 OF WTD 22 •Not more than 5 years. AGE Limit •21 to 70 years If above 70 Years? •Special Resolution •Reasons CA Bharat Sonkhiya| R Sogani & Associates ORIGINAL DOCUMENTS TO BE KEPT TILL DISSOLUTION Address for correspondence till registered office is established Particulars of interest of first directors in other entities Particulars of First Directors 23 MOA and AOA Original documents filed with ROC Particulars of Subscribers of memorandum Declaration by professionals Affidavit from subscribers and first directors that he has not committed any offence CA Bharat Sonkhiya| R Sogani & Associates INSPECTION OF STATEMENT OF PROFIT AND LOSS 24 CA Bharat Sonkhiya| R Sogani & Associates CORPORATE SOCIAL RESPONSIBILITY SECTION 135 Applicability • Net worth>Rs 500 crore. • Turnover > Rs. 1,000 Crores • Net Profit >Rs 5 crore. 25 CSR Committee • Atleast 2 directors CSR Policy • specifie d the schedule VII Expenditure =2% average net profit of immediately preceding 3 F.Y. CA Bharat Sonkhiya| R Sogani & Associates REGISTRATION OF CHARGES All Charges 26 To be registered with ROC CA Bharat Sonkhiya| R Sogani & Associates CFO & CEO also liable for default. 27 CA Bharat Sonkhiya| R Sogani & Associates STRINGENT AND HEFTY PENALTIES Under the Companies Act, 2013 strict penalties have been imposed on the Company and Officer who is in Default, in case of noncompliance of provisions as mentioned in the Act. The amounts of penalties have been increased as compared to the previous provisions. 28 CA Bharat Sonkhiya| R Sogani & Associates Company L. L. P. PRIVATE COMPANY EQUIVALENT TO PUBLIC COMPANY ONLY WAY FORWARD 29 LLP CA Bharat Sonkhiya| R Sogani & Associates Particulars LLP Private Company Structure Law regulated under Minimum Capital requirement Requirement of filing of documents at the time of Incorporation Number of shareholders / directors / partners 30 Companies Act, 2013 LLP Act, 2008 1 Lakh No such requirement Need of filing detailed document No Such Requirements Minimum 2& maximum 200 Shareholders Minimum 2 Directors Minimum 2 partners. CA Bharat Sonkhiya| R Sogani & Associates Particulars LLP Private Company Restrictions Taking Loans More stringent provisions No such restrictions Number of restrictions No such restrictions Advances to others Related party restrictions 31 CA Bharat Sonkhiya| R Sogani & Associates Particulars LLP Private Company Additional Cost Dividend Distribution Tax (on withdrawal of money) 32 Tax @ 16.99% Not applicable Deemed Dividend (advance to shareholders) Taxable in the hands of shareholders Not applicable Corporate Social Responsibility Expenses to be incurred Not applicable Form filing fees Higher filing fees Lower filing fees CA Bharat Sonkhiya| R Sogani & Associates Particulars LLP Private Company Compliances Compliances Substantial level of Compliance Lower Level of Compliance Filing of Resolutions with ROC Most of business decisions required filing with ROC No such mandatory requirement. Meetings to be held Periodic meetings required No such requirements Minutes and statutory records Detailed records No such detail records 33 CA Bharat Sonkhiya| R Sogani & Associates Particulars LLP Private Company Penalties Penalties 34 Heavy penalties Not stiff penalties CA Bharat Sonkhiya| R Sogani & Associates ANY QUESTIONS ….. 32 CA Bharat Sonkhiya| R Sogani & Associates 33 CA Bharat Sonkhiya| R Sogani & Associates