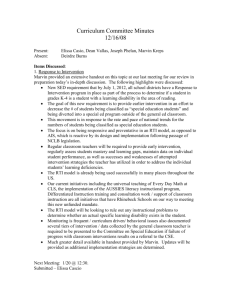

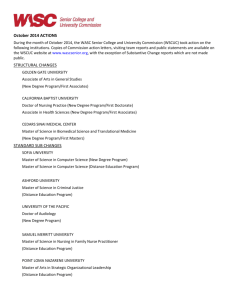

Marvin Zonis + Associates, Inc., International Risk Consultants

advertisement

Getting to the Future: The Principal Drivers of the Global Economy Marvin Zonis, Professor Graduate School of Business The University of Chicago The Principal Drivers of the Global Economy Globalization Withering Away of the State Technology Demography – Human Capital Failed States Economic Growth Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 1 Globalization An increasingly interconnected world: “As a result of very rapid increases in telecommunications and computer-based technologies and products, a dramatic expansion in cross-border financial flows and within countries has emerged. The pace has become truly remarkable. These technology-based developments have so expanded the breadth and depth of markets that governments, even reluctant ones, increasingly have felt they have had little alternative but to deregulate and free up internal credit and financial markets.” Alan Greenspan, keynote address at the Cato Institute's 15th Annual Monetary Conference, October 14, 1997. Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 2 Globalization Globalization is not a new story: “For several major industrialized countries, including the U.S., foreign trade—exports plus imports—has only recently surpassed the levels achieved in the 19th century. Capital flows are even less integrated. Current capital flows are still only about three-quarters of the levels achieved in the 1890s.” Steve H. Hanke, Johns Hopkins University economist Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 3 Globalization Foreign Trade as % of GDP: Source: Forbes, August 24, 1998 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 4 The Withering Away of the State March 24th, 1999: The UK's highest court upholds Chilean ex-President Augusto Pinochet's arrest NATO strikes against Serbian targets in Yugoslavia begin Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 5 The Withering Away of the State Assault on state sovereignty from above – supranational organizations: NATO EU WTO IMF Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 6 The Withering Away of the State Assault on state sovereignty from below – regionalism: Quebec and Canada The Walloon and Flemish separatists and Belgium Kurds and Turkey East Timor and Indonesia Corsica and France Basques and Spain Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 7 Global Inequality Global inequality is widening – I: “Some 3 billion people, half of the world's population live on the margin of subsistence, and the gap between the average incomes of the richest and poorest countries has widened to 70:1.” – Secretary-General Kofi Annan in a message to the International Conference on Development, June 24, 1999 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 8 Global Inequality Global inequality is widening – II: “If we do not have the capacity to deal with social emergencies, if we do not have longer-term plans for solid institutions, if we do not have greater equity and social justice, there will be no political stability. And without political stability, no amount of money will put together packages which will give us financial stability." - James Wolfensohn, President, The World Bank Group, to the IMF-World Bank Meeting in Washington, 1997 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 9 Technology and the Digital Economy Internet users per 1000 people (1998): Iceland 320.3 Finland 305.4 Norway 304.1 Sweden 289.8 US 283 Australia 234.1 Canada 211.5 New Zealand 190.1 178.6 Denmark 140 Singapore Switzerland 138.2 United Kindom 137.3 Netherlands 124.8 Hong Kong 98.7 Israel 95.7 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 10 Technology and the Digital Economy Registered hosts on the Internet: Source: Matrix information and Directory Services Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 11 Human Capital – Changing Demographics Median age by major area, 1950, 1998 and 2050 (in years) 1950 World Total 23.5 More developed regions 28.6 Less developed regions 21.3 Africa 18.7 Asia 21.9 Europe 29.2 Latin America and the Caribbean 20.1 Northern America 29.8 Oceania 27.9 1998 26.1 36.8 23.9 18.3 25.6 37.1 23.9 35.2 30.7 2050 37.8 45.6 36.7 30.7 39.3 47.4 37.8 42.1 39.3 Source: UN Population Division Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 12 Human Capital – Rise in Median Age Median Age 1985, 2000 and 2015 50.0 1985 2000 2015 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 United States China Japan Germany India France United Kingdom Italy Brazil Mexico Source: UN Population Division Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 13 Human Capital – Decline in Fertility Rates Fertility rates 1985, 2000 and 2015 (births per woman) 5.0 1985 2000 2015 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 United States China Japan Germany India France United Kingdom Italy Brazil Mexico Source: World Bank and US Census Bureau Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 14 Human Capital – Aging Population “According to current projections, in 2030 every third person in the member countries of the Organisation for Economic Cooperation and Development will be over age 60.” – UN, Division for Social Policy and Development Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 15 Human Capital – Aging Population “Today, the ratio of working taxpayers to nonworking pensioners in the developed world is around 3 to 1. By 2030, absent reform, this ratio will fall to 1.5 to 1 - and in some of the fastest aging countries, such as Germany and Italy, it will drop all the way to 1 to 1 or even lower. The typical working couple will thus be required to fund the full cash pension and health-care needs of at least one anonymous retiree.” – Former U.S. Commerce Secretary Peter G. Peterson Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 16 Human Capital – Global Aging Consequences of Global Aging: Change in consumption patterns Changes to pension systems Huge infrastructure for young and rapidly growing populations Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 17 What Are the Emerging Markets? High Growth – • AVERAGE GDP GROWTH ABOVE 4 PERCENT PER YEAR, 19871997: 0 China Malaysia Vietnam Singapore Chile Lebanon Lesotho Sudan Indonesia Thailand Uganda Korea, Rep. Ireland Lao PDR Jordan Myanmar Syrian Arab Republic Peru India Oman Israel Papua New Guinea El Salvador Cambodia Argentina 5 10 15 11.6 8.6 8.6 8.5 8.3 8.3 7.8 7.7 7.5 7.4 7.4 7.2 7 6.7 6.3 6.3 6.3 6.2 6 5.9 5.8 5.7 5.6 5.5 5.4 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 0 Hong Kong, China Sri Lanka Eritrea Dominican Nepal Guinea Mauritius Mozambique Panama Bangladesh Chad Benin Botsw ana Colombia Ethiopia Tunisia Ghana Mauritania Pakistan Bolivia Guatemala Nicaragua Poland Turkey Egypt, Arab Rep. Iran, Islamic Rep. Uruguay 5 10 15 5.3 5.3 5.2 5.1 5.1 5 5 4.9 4.8 4.7 4.6 4.5 4.5 4.4 4.3 4.3 4.2 4.2 4.2 4.1 4.1 4.1 4.1 4.1 4 4 4 18 What Are the Emerging Markets? Steady Growth – • AVERAGE GDP GROWTH BETWEEN 1 AND 4 PERCENT PER YEAR, 1987-1997: 0 1 2 3 4 Costa Rica 3.8 Namibia 3.8 0 3 2 1 Gam bia 2.2 Yemen, Rep. 3.7 Mexico 2.2 Malaw i 3.6 Venezuela 2.2 Zimbabw e 3.6 Kenya 2.1 Brazil 3.4 Guinea-Bissau 3.4 Burkina Faso 3.3 Honduras 3.3 Mali 3.3 Philippines 3.3 Gabon 3.2 Ecuador 3.1 Paraguay 3.1 Cote d'Ivoire 3 Nigeria 2.8 Tanzania Senegal Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 2.7 2.5 Morocco 1.9 Togo 1.9 Albania Saudi Arabia Greece 1.8 1.7 1.6 1.5 Niger South Africa Belgium Slovenia Cen. African Zam bia 4 1.5 1.4 1.4 1.2 1 19 What Are the Emerging Markets? Growth?? • AVERAGE GDP GROWTH BELOW 1 PERCENT PER YEAR, 19871997: -5 -4 -3 -2 -1 0 1 -20 2 -15 -10 -5 Madagascar 0.9 Rw anda -5.7 Algeria 0.8 0.7 Congo, Dem. Rep. -6 Belarus -6.1 Congo, Rep. Slovak Republic 0.6 Jamaica Cameroon 0.4 -0.1 -0.2 Czech Republic -0.2 Hungary Romania -0.3 -0.6 Mongolia -0.8 Macedonia, FYR Croatia -1 -1.2 Angola Uzbekistan Haiti Bulgaria Burundi Russian Federation -7.7 Kazakhstan -7.9 Kyrgyz Republic -9.5 Turkmenistan -9.6 Armenia -2.5 Moldova -3.6 Estonia -3.8 -4.4 Sierra Leone Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com -8.5 Latvia Ukraine -3.3 -7.1 Lithuania -2.4 Azerbaijan Georgia 0 -10.3 -13.1 -14.1 -15.1 -16.3 Tajikistan -16.4 20 What are the Emerging Markets? The losers: • Countries whose average annual population growth is above their Average Annual Change in GDP (1987-1997): (20.00) (15.00) (10.00) (5.00) 0.00 Tajikistan Georgia Azerbaijan Moldova Ukraine Turkmenistan Armenia Kyrgyz Republic Congo, Dem. Rep. Latvia Russian Federation Rw anda Lithuania Sierra Leone Belarus Burundi Uzbekistan Haiti Angola Estonia Mongolia Cameroon Bulgaria Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com (20.00) (15.00) (10.00) (5.00) 0.00 Saudi Arabia Congo, Rep. Madagascar Zambia Niger Gambia Algeria Togo Croatia Central African Kenya Macedonia, South Africa Jamaica Tanzania Yemen, Rep. Romania Venezuela Czech Republic Senegal Nigeria Morocco 21 What Are the Emerging Markets? Leading Growth Countries Since 1950: Rank 1 2 3 4 5 6 7 8 9 10 Country Oman Taiwan Botswana Macau Andorra Hong Kong South Korea U. A. E. Singapore Saudi Arabia GDP Growth 1950-90 (%) 3677 3185 3142 3135 2797 2504 2324 2156 1799 1577 Rank 11 12 13 14 15 16 17 18 19 20 Country Thailand Japan Libya Israel Jordan French Polynesia Maldives China Swaziland Malta GDP Grow th 1950-90 (%) 1540 1460 1451 1414 1225 1117 1056 978 975 971 Sources: OECD,UN, Euromonitor Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 22 What Are the Emerging Markets? Failed States: • Symptoms of failed states – low GDP per capita and low economic growth: Real Annual GDP Growth, as GDP Per pe rce ntage Head of Change on Popula tion Previous Country (US$) Ye ar Somalia 100 0 Ethiopia 123 4.5 Congo, Dem. Rep. 161 0 Niger 180 4 Mali 244 5 Madagascar 246 4 Moldova 275 -8 Bangladesh 277 3.4 Tanzania 281 3.3 Kenya 301 1.5 Re al Annua l GDP Growth, as GDP Per percentage Head of Change on Popula tion Previous Country (US$) Year Guinea-Bissau 325 4 Vietnam 338 3.5 Togo 340 4.5 Liberia 344 2 Pakistan 418 -0.1 Ghana 463 2.5 Zimbabwe 481 1.5 Haiti 493 1.5 Indonesia 544 -3.4 Nicaragua 623 2.5 Re al Annual GDP Grow th, as GDP Per percentage Head of Change on Popula tion Previous Country (US$) Year Ukraine 720 -1 Korea, D.P.R. 745 -7 Angola 766 1 Mongolia 858 3 Honduras 888 0.5 Guyana 904 1.8 Bolivia 948 -1.9 Philippines 963 1.8 Nigeria 1242 1 Kazakstan 1314 1 Source: ICRG Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 23 The Major Financial Crises of Our Times: Latin American Debt Crisis of 1982 ERM Crisis of 1992 Mexican Peso Devaluation of 1994 East Asian Crisis of 1997 Russian Crisis of August 1998 Brazil Crisis of 1999 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 24 The Major Financial Crises of Our Times: East Asian Crises, 1997-1998 Japanese Model of Economic Development • State guides economy and growth • State allocates resources • Export led growth Unregulated Banking Systems • • • • • High Levels of Corruption Common Industries Investment Boom Japanese slowdown Chinese Devaluation, 1994 • Currencies Pegged to Dollar • Robert Rubin pushes for strong dollar, March-April, 1995 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 25 Then and Now Then: All emerging markets were treated alike. Emerging markets were considered virtually equal bets. Companies tended to ignore country risk, focusing on the financial and economic aspects of the deal. Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 26 Then and Now Now: A Beauty Pageant Differentiation of Emerging Markets countries on the basis of considerations of political risk. Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 27 The Major Financial Crises of Our Times: The countries that will emerge most successfully from the crises are the ones that will make the most deep seated structural reforms. Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 28 Factors for Country Success Stable Institutions Democratic Politics Policies Human Capital Market Economics Globalization Technology Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 29 Factors for Success: Institutional Strength Long Term Ratings: Australia 97 Canada United States 96 India 80 Netherlands 96 Hong Kong 79 France 95 Thailand 75 United Kingdom 94 Philippines 74 China 73 South Africa 72 Peru 72 Brazil 72 New Zealand 92 Germany 92 Italy 89 Taiwan 88 Japan 87 Mexico 86 Czech Republic 86 South Korea 83 Malaysia 68 Vietnam 66 85 Colombia 66 Chile 84 Venezuela Argentina 84 Russia Panama 83 Indonesia 0 20 40 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 60 80 100 63 54 44 0 20 40 60 80 100 30 Factors for Country Success Stable Institutions Democratic Politics Policies Human Capital Market Economics Globalization Technology Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 31 Factors for Success: Human Capital Women's activity rates for the age group 20-54 years in 1950, 1970, 1990 and 2010 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 32 The East Asian Crises, 1997-1998 Prospects for the Future: • Asia’s Growing Labor Force 55% 25-to-59 age group as % of population Malaysia 50% China Thailand 45% US 40% projected 35% 1990 Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 2025 33 Factors for Success: Human Capital Adult illiteracy rate – 1995: Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 34 Factors for Success: Human Capital Literacy Rates, 1997: Country Literacy Ra te Russian Federation Korea, Rep. Spain 98.00% 98.00% 96.00% Thailand Mexico Indonesia Brazil Turkey China 93.80% 89.60% 83.80% 83.30% 82.30% 81.50% India 52.00% Source: ABC-Clio Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 35 States in Decline Ethnic Distribution In The Former Yugoslavia Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 36 Factors for Success: Human Capital Ethnic Distribution In Russia Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 37 Factors for Success: Corruption 1998 Corruption Perception Index Country Hong Kong Chile Malaysia Taiwan South Africa Czech Republic South Korea Brazil China Turkey Corruption Pe rce ption Inde x Ra nk 16 20 29 29 32 37 43 46 52 54 Country Mexico Philippines Thailand Egypt India Russia Colombia Indonesia Nigeria Corruption Perception Index Rank 55 55 61 66 66 76 79 80 81 Source: Transparency International Marvin Zonis + Associates, Inc. International Risk Consultants www.mza-inc.com 38