Movie tickets, airline prices, discount coupons, financial aid, quantity

advertisement

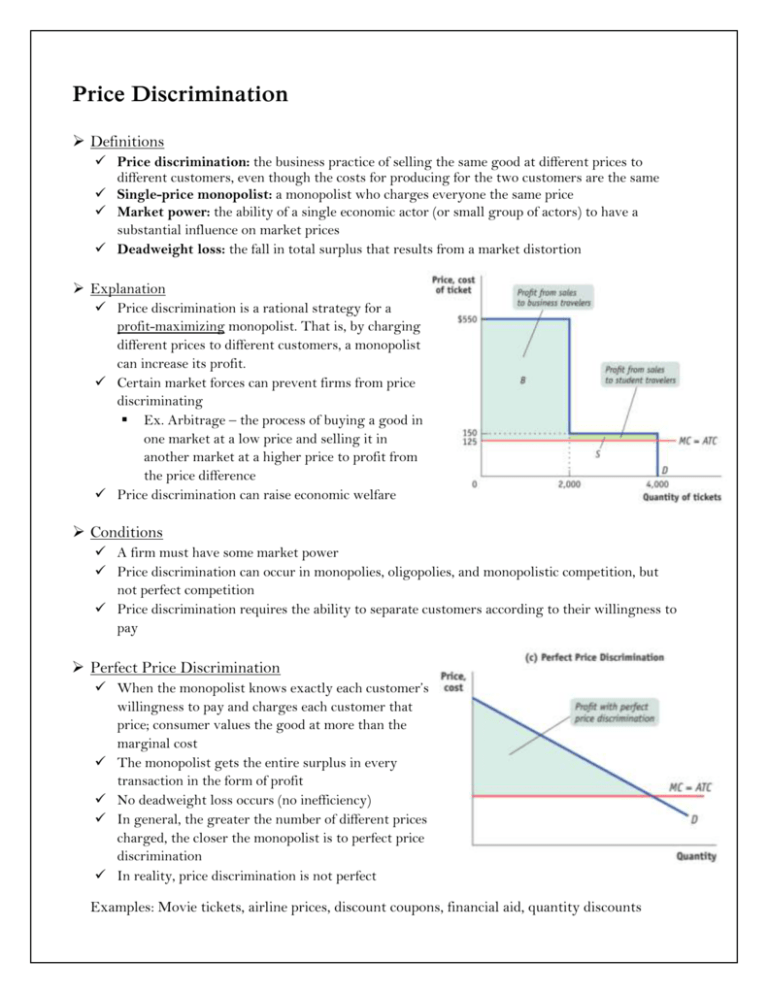

Price Discrimination Definitions Price discrimination: the business practice of selling the same good at different prices to different customers, even though the costs for producing for the two customers are the same Single-price monopolist: a monopolist who charges everyone the same price Market power: the ability of a single economic actor (or small group of actors) to have a substantial influence on market prices Deadweight loss: the fall in total surplus that results from a market distortion Explanation Price discrimination is a rational strategy for a profit-maximizing monopolist. That is, by charging different prices to different customers, a monopolist can increase its profit. Certain market forces can prevent firms from price discriminating Ex. Arbitrage – the process of buying a good in one market at a low price and selling it in another market at a higher price to profit from the price difference Price discrimination can raise economic welfare Conditions A firm must have some market power Price discrimination can occur in monopolies, oligopolies, and monopolistic competition, but not perfect competition Price discrimination requires the ability to separate customers according to their willingness to pay Perfect Price Discrimination When the monopolist knows exactly each customer’s willingness to pay and charges each customer that price; consumer values the good at more than the marginal cost The monopolist gets the entire surplus in every transaction in the form of profit No deadweight loss occurs (no inefficiency) In general, the greater the number of different prices charged, the closer the monopolist is to perfect price discrimination In reality, price discrimination is not perfect Examples: Movie tickets, airline prices, discount coupons, financial aid, quantity discounts Deadweight Loss – The Inefficiency of Monopoly The socially efficient quantity is found where the demand curve and the marginal-cost curve intersect When a monopolist charges a price above marginal cost, some potential consumers value the good more than MC, but less than the monopolist price. They do not buy the good. The result is inefficient. Monopoly pricing prevents some mutually beneficial trades from taking place The socially efficient quantity of output occurs when the marginal cost curve intersects with the demand curve (MC = D) The monopolist produces less than the socially efficient quantity of output The inefficiency of monopoly can be measured with a deadweight loss triangle Monopolistic Competition Characteristics of a monopolistic competition There are large number of sellers in the market Firms sell slightly differentiated products Since they sell slightly differentiated products firms have some price setting power There is a very low entry barrier to market The firms cannot make economic profit in the long run Allocative and productively inefficient Short run In the short run the graph looks similar to a monopoly market Demand is a downward sloping line since the firms have price setting power Marginal revenue is below demand curve, it slopes down twice as steeply as the demand curve Firms make economic profit Long run In the long run demand and marginal revenue decreases and flattens out more. This is caused by the low entry barrier to the market Other firms join into the market when they see economic profit is being made In the long run graph the new demand curve is tangent to the ATC curve This shows the firms are no longer making economic profit They are breaking even If firms start experiencing economic loss, they can easily leave the market, and firms will return to breaking even Efficiency Firms are productively inefficient They are not producing at a quantity where average total cost is lowest Firms are allocatively inefficient The demand curve (marginal benefit) is not equal to marginal cost