Introduction

advertisement

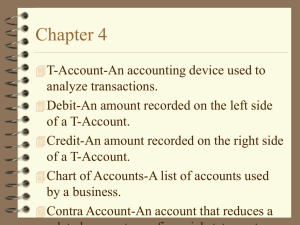

1 Introduction to Double Entry Accounting (複式簿記) Reference: Chapter 1 – 6 (p. 1 – 58) 1 (A) Introduction to Accounting Bookkeeping (簿記) vs. Accounting (會計) – Bookkeeping: records the accounting data in the books. – Accounting: provides important information to the owners and managers of a firm. records data; classifying and summarises data; communicates information. – Users of accounting information: Internal: owners, managers, employees. External: lenders, suppliers, customers, competitors, government, the public. 2 (B) Accounting Equation Assets (資產) Capital (資產) Liabilities (負債) (Resources = (Resources + (Resources in the supplied by supplied by business) the owner) outsiders) e.g. Assets Bank Cash Machinery Fixtures Stock Debtors Motor Vehicles Land Building Capital Capital: Chan Capital: Lee Liabilities Creditors Bank overdraft Bank loan Loan: Cheung 3 Assets = Liabilities + Capital After making profit: Assets = Liabilities + Capital + Profit (Income – Expenses) Examples of Income Sales, Rental income, Commission received, Interest received, Returns outwards Examples of Expenses Purchases, Rent Commission, Interest expenses, Electricity, Wages and salaries, Depreciation, Returns inwards 4 After drawings by the sole proprietor (owner): Assets = Liabilities + Capital + Profit - Drawings Definition of Drawings (提取) The sole proprietor may take cash, stock or other assets from the business for private use. 5 Class work and Homework Accounting equation (p. 14-16) – Class work: Ex. 2.6, 2.8, 2.10, 2.11,2.13 – Homework: Ex. 2.7X, 2.9X, 2.12X,2.15X 6 (C) The Double Entry System Definition – Every transaction are entered into two T-accounts, one in debit (Dr.) side and the other in the credit (Cr.) side. Format of a T-account: Name of the T-account Date Particular Dr $ Date Particular $ Cr 7 5-steps (RC3D) for the double entry system: 1. Recognize the names of accounts 2. Classify the types of accounts (assets, liabilities, capital, income, expenses or drawings) 3. Decide the increase or decrease of the accounts 4. Decide the debit or credit of the accounts 5. Draw up the T-accounts Examples to apply the 5-steps: On January 1, 2008, Chan started the business with $1000 cash. 8 R C D D D Cash Assets Increase Dr. Dr. Cash Capital: Chan Capital Increase Cr. Cr. Capital: Chan Dr. Cr. Assets + - Dr. Liabilities - + 2008 Capital - + Jan 1 Capital: Chan 1000 Incomes - + Expenses + - Drawings - + Dr. 2008 Cash $ Cr. 2008 $ Capital: Chan $ Cr. 2008 $ Jan 1 Cash 1000 9 Class work and Homework Double entry system – Supplementary Exercises (Worksheet) – Assets, liabilities and capital (p.25-27) Class work: Ex. 3.6, 3.8-3.10 Homework: Ex. 3.7X, 3.11X, 3.12X – The treatment of stock (p.37-40) Class work: Ex. 4.5, 4.8-4.10 Homework: Ex. 4.6X, 4,7X, 4.12X, 4.13X – Revenue and expenses (p.48-50) Class work: Ex. 5.6, 5.8, 5.10 Homework: Ex. 10 (D) Balancing the Account Close (balance-off) the accounts at the end of each month. For examination, it may close the accounts at the end of the year. 5 steps to balance-off an accounts: 1. Add the totals of debit and credit. 2. Find the difference between debit and credit. (The difference Balance c/d) 3. Enter the Balance c/d on the side with smaller total. 4. Enter the totals on both sides at the same level. 5. Bring the Balance c/d to the opposite side as Balance b/d on the first day of next month. 11 Class work and Homework Balancing-off – Supplementary Exercises (Worksheet) Double entry system and balancing-off) Class work: Ex. 7.6, 7.7, 7.9 Homework: Ex. 7.8X, 7.10X 12