U.S. Department of Labor's Fair Labor Standards Act (FLSA)

advertisement

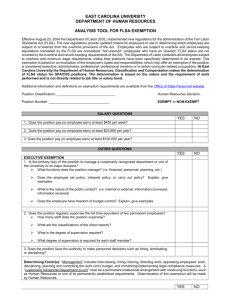

U.S. Department of Labor’s Fair Labor Standards Act (FLSA) Indiana University Board of Trustees September 9, 2004 Fair Labor Standards Act Signed into law in 1938 by President Roosevelt … Basic framework for the treatment of employees: Minimum wage Equal pay Child labor standards Recordkeeping Overtime pay Principles of employee protections that continue today Fair Labor Standards Act Most misunderstood provision governs overtime pay Requires that most employees be paid “overtime” for hours worked in excess of 40 hours in a work week … Overtime = excess of 40 hours in a work week Overtime = one and one-half times “regular rate of pay” Regular rate of pay = includes all remuneration Certain employees may be exempted from overtime pay Fair Labor Standards Act Noncompliance can be costly During FY 2003, the DOL concluded FLSA investigations on over 32,500 cases, covering over 314,000 employees Back wages collected totaled approximately $182 million 27% increase over the $141 million collected in FY 2002 Fair Labor Standards Act Noncompliance can be costly Two to three years’ back pay (doubled for willful violations) Civil penalties = $1,100 per paycheck issued Criminal penalties = $11,000 per violation Attorney’s fees Individual liability for managers responsible for pay classifications and practices DOL investigation is expensive, invasive, and disruptive Fair Labor Standards Act Noncompliance can be costly Example: 30 employees improperly classified as exempt; average unpaid overtime per employee per year = $4,000; willful FLSA violation Penalties and Costs Amount $4,000 x 30 employees x 3 years = $360,000 x 2 (liquidated damages) $ 720,000 $1,100 x 72 pay periods x 30 employees $2,376,000 Attorneys’ fees, admin. costs, plus defense cost $ 200,000 30 x $11,000 per violation $ 330,000 Total cost of noncompliance $3,626,000 Fair Labor Standards Act Noncompliance can be costly UPS: $18 million for employees classified as exempt Pacific Bell: $35 million for engineers Farmers Insurance Exchanges: $90 for claims adjusters University of New Mexico: $2 million for student admin. RehabCare Group: $3 million for nurses, therapists, etc. University of Phoenix: $3 million for admission counselors City of Houston: $96 million for paramedics Fair Labor Standards Act New FLSA regulations were issued by the DOL on April 23, 2004, to become effective on August 23, 2004 Prior regulations considered outdated and confusing Many decades of case law and interpretive guidelines Record-breaking enforcement fines and class actions FLSA lawsuits outnumbered employment discrimination cases New rules are to modernize the “white collar” exemptions Fair Labor Standards Act FLSA overtime exemption, effective August 23, 2004 Based on a position-by-position review All three of the following tests must be satisfied: 1. Salary Basis test --- must be paid a predetermined amount 2. Salary Level test --- must be paid a minimum weekly amount 3. Duties test --- must perform work on an exempt nature Emphasis is on the evaluation of actual duties & responsibilities --- the position’s primary duty(s) Fair Labor Standards Act FLSA overtime exemption --- Salary Basis test Employee must be paid a predetermined, fixed salary that is not subject to reductions due to quality or quantity of work performed New regulations allow for reduction of one or more full days for violations of written workplace conduct rules Fair Labor Standards Act FLSA overtime exemption --- Salary Level test Employee must be paid at least $455 per week Clear obligation to pay overtime to all employees who earn less than $455 per week … annual equivalent of $23,660 Salary level is not prorated for part-time employees The Salary level test does not apply to bona fide lawyers, doctors, or teachers Fair Labor Standards Act FLSA overtime exemption --- Duties test Primary duty(s) must be consistent with one or more of the following FLSA exempt types of work: Executive duties Administrative duties Academic Administrative duties Learned Professional duties Creative Professional duties Teachers at an educational institution Certain Computer duties Outside Sales duties Fair Labor Standards Act FLSA overtime exemption --- Duties test Executive exemption Primary duty of managing the enterprise or a recognized department or subdivision AND Direct the work of two or more full-time employees AND Have authority to hire/fire or make recommendations of significant weight to hire, fire, promote, etc. Fair Labor Standards Act FLSA overtime exemption --- Duties test Administrative exemption Primary duty directly related to the management or general business operations of the employer AND Duties requires the employee to exercise discretion and independent judgment with respect to matters of significance Fair Labor Standards Act FLSA overtime exemption --- Duties test Learned Professional exemption Primary duty must require advance knowledge in a field of science or learning AND Must be customarily acquired by a prolonged course of specialized intellectual instruction Restricted to professions in which specialized academic training is a standard prerequisite Fair Labor Standards Act FLSA overtime exemption --- Salary Level/Duties test Streamlined duties test for employees with total annual compensation of $100,000 or more Who customarily and regularly perform at least one of the exempt duties of an executive, administrative or professional employee Does not apply to computer, craftsmen, construction, etc. employees Fair Labor Standards Act Indiana University considerations New FLSA regulations will reduce the number of positions that qualify for exemption status --- additional positions will be eligible for overtime Salary Level test includes a significantly higher minimum weekly salary Duties test has narrower definitions of exempt work New regulations identify specific types of work that must receive overtime Fair Labor Standards Act Action Plan for Staff positions across Indiana University Review most likely “at risk” positions during fall 2004; affected positions would be changed to nonexempt in early February 2005, with any retroactive overtime pay back to August 2004. Potentially affected positions to maintain work records Managers of potentially affected positions to complete short summary of the positions’ primary duties HR offices to evaluate primary duties for FLSA exemption status Conversion considerations, such as: new category of Staff positions, benefit plan eligibility, and conversion from monthly salaries to hourly rates of pay Fair Labor Standards Act Action Plan for Staff positions Review most likely “at risk” positions during the fall; affected positions would be changed to nonexempt in early February 2005, with any retroactive overtime pay back to August 2004. Approx. number of Staff positions to be reviewed for FLSA exemption Bloomington 800 Indianapolis 590 South Bend 53 Richmond 45 Gary 40 New Albany 30 Kokomo 28 Ft. Wayne 1 Total = 1,587 Fair Labor Standards Act Noncompliance can be costly for Indiana University (DOL investigation is expensive, invasive, and disruptive) May 2000, DOL issued letter to Indiana University very narrow audit, which disclosed that admission counselors, writers, reporters at Bloomington were not in compliance with FLSA --- positions were misclassified as FLSA exempt status Retro overtime payments were processed for 133 employees “If at any time in the future your firm [IU] is found to have violated the monetary provisions of the FLSA, it will be subject to such penalties [civil money penalty for any repeated or willful violations]” Fair Labor Standards Act Action Plan for Staff positions across IU – Objectives Comply with the law Ensure consistency across all Indiana University units Preserve benefit plan coverages for affected employees Preserve total compensation for affected employees, for same work effort Ensure transparency for all decisions Managers are responsible for providing accurate and clear description of the primary duty(s) assigned to positions U.S. Department of Labor’s Fair Labor Standards Act (FLSA) Indiana University Board of Trustees September 9, 2004