How Marx built his Theory of Crisis

advertisement

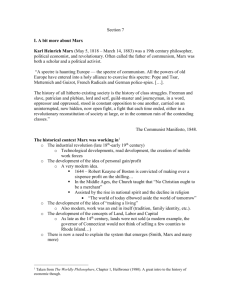

Marx’ Theory or Theories of Crisis Michael R. Krätke Lancaster University The enigma of Marx‘ theory of crisis The conventional (‚Marxist‘)view today: There is one (and only one ‚true‘) theory of crisis in Marx – in chapter 15, of volume III of Capital The opposite view: There is no theory of crisis in Marx at all The traditional view: There are several theories of crisis in Marx‘ Capital, without a clear-cut hierarchy, these might be difficult or even impossible to reconcile The evidence from the MEGA: Marx has worked again and again on a coherent and comprehensive theory of crisis (based upon intensive empirical studies) - for several reasons: - against Say‘s law, against vulgar political economy, against fellow socialists - because of the importance of the relatively new phenomenon of cycles and crises (the crisis cycle being the specific mode of motion and development for modern, that is industrial capitalism) Marx and Sam Moore Exchange between Sam Moore and Marx in the early months of 1873 (letter to Engels, May 31, 1873) Marx‘ ambition: to arrive at the „main laws“ of the crises by analyzing all the data available and putting them into the form of „irregular curves“ (formula‘s) Sam Moore thought it not feasible at that time Marx told Engels that he had given up the idea But he did not give it up entirely! The famous episode shows: 1. Marx was a seasoned empirical researcher, 2. adamant about finding and establishing „general laws“, 3. Marx did not study the calculus just as a pastime activity. Böhm-Bawerk and Marx Böhm – Bawerk 1898: a theory of crisis is only possible at the end of any comprehensive treatise on economic theory (as ist last chapter or book) Marx in 1857/58 (in the various versions of the 6 books plan): the theory of crisis will come at the end, in the last book of his comprehensive critique of political economy Book 5 (or 6) : „ World market and crises“ In spite of all the changes of his plan (starting in the Grundrisse) he never dropped it entirely In Capital (in all three volumes plus manuscripts) anticipations of and direct hints to an analysis and explanation of crisis and cyles abound (which is only to be spelled out at the very end) Marx’ theories of crisis “Anarchy” of the capitalist mode of production Underconsumption theory Profit squeeze theory Disproportionalities Overaccumulation (or the TFRP) Which one is the real one? (Marx’ preferred theory?) – the basic concept: General Glut – Overproduction of commodities (including Overaccumulation of Capital) Can those theories be reconciled and /or integrated into one comprehensive theory? Very few attempts so far (Otto Bauer in 1934/35, Simon Clarke in 1994) If the evidence from Capital is inconclusive … Let us have a look at Marx‘ real research process We cannot possibly know how Marx‘ unfinished, incomplete theory of crisis would have looked like in its final version But we can know and scrutinize what Marx actually did during the years he kept working on his critique of political economy We have (in the MEGA, partly published, partly still unpublished) ample evidence for Marx‘ ongoing research process (from 1843 to 1883) Marx’ main sources Theory: the general glut debate (Say, Ricardo, James Mill, Malthus, Torrens, Sismondi) Empirical, historical research by others: Thomas Tooke (History of Prices), Gilbart, MacLeod and others The parliamentary enquiries of the crises since 1847/48 (several big reports by Select Committees of the House of Commons) The ‘ Economist’, ‘ Money Market Review’ and others Bank of England reports plus reports from other major (central ) banks The ‘crisis literature’ of 1848/49, 1858/59,1866, 1873ff Marx, the empirical researcher dealt with 7 successive cycles 1. 2. 3. 4. 5. 6. 7. 1816 -1825 1826 -1836 1837- 1847 1848 –1857 1858 –1866 1867 –1873 1874 - 1882 10y 11y 11y 10y 9y 7y 9y 1825 1836 1847/48 1857/58 1866 1873 – 79 1882 Round one: the 1840s 1846-47 Studies of Economic History: What is peculiar about modern / capitalist crisis? Statistical notes on the crises of 1825 and 1836 Marx’ thesis: Every modern crisis actually enhances the level of (industrial) production 1848 – 49 Studying the mechanism of crisis: Why does an industrial crisis appear as a financial crisis? Why and how does a crisis originating in Britain shift to France? General laws and specific mechanisms, general long term tendencies and particular ‘laws of motion’ Round 2: the 1850s 3 political – economic reviews of 1850 (dealing with the events of 1847/48 and later) 24 London notebooks of 1850 – 1853 First small pieces of anaysis: ‘ Bullion’ and ‘ Reflection’ of 1851 Marx’ studies and comments upon crisis tendencies and the next crisis to come (1850 – 1857) (in various newspaper articles) Marx’ manuscript ‘ Money, Credit, Crisis’ (1854-55) All demonstrate how empirical study and theoretical reflection (rethinking of concepts and theories) are intertwined in Marx’ research Marx already tries both: Giving historical explanations of the peculiar events occurring in specific crises and establishing “laws” regarding their regularities / commonalities Lessons learned, problems unsolved Money matters a lot, the particular form of the monetary system has an impact – Money and credit (financial) crises could occur separately! But they are also an integral moment of every single crisis in industrial capitalism! Trade and commerce matter a lot, hence ‘commercial credit’ matters and ‘bank credit’ even more (leading to ‘overcredit’ and ‘overspeculation’)! Hence: in order to deal with crisis we have to deal with the different forms / types of capital and the whole hierarchy of markets What is behind ‘aggregate effective demand’ ? The class structure of modern society Disproportionalities arise from competition between industrial capitals – commercial and financial capital can acerbate them decisively Financial markets / monetary transactions are the means to shift the crisis from one part of the capitalist world to another (an industrial crisis originating in England appears as a financial crisis in France) Hence: how to reconcile the explanation of the concrete mechanisms of crisis with the explanation of the possibility and necessity of a general glut (how are overproduction / overaccumulation in some industries generalized)? Crises can be late! Why? (what disturbs the “normal” cycle?) The “Grundrisse” and the First World Economic Crisis Round 3: The world crisis of 1857/58 ‘Grundrisse’ manuscript, the ‘ Books of crisis’ plus journalism Grundrisse: the first systematic discussion of Ricardo and Say and their critics – Marx commenting upon the ‘ general glut’ debate and taking issue with both sides Marx criticizing the ‘ false explanations’ of crisis cherished by the socialists /leftists of his time (Proudhon and his disciples) The first real world economic crisis – the true scale and scope of a world market crisis (different from the previous ones) Marx is studying the events in much empirical / statistical detail, preparing a book (together with Engels) on the crisis of 1857/58 Explaining the course of crisis events in different sectors of the economy, on different markets, in different parts of the world market (prices, interest rates, bank reserves and circulation of money, wages, unemployment, freight rates, bankruptcies) The lessons of 1857/58 The changing importance of industrial, commercial and financial crisis (from 1836/37 to 1847/48 to 1857/58) The wide impacts of a general crisis in the industrial centre of the world market (the centre and the peripheries) The impact of false economic and financial (banking, money market) regulations (in Britain and abroad) How financial market crises turn into a fiscal crisis of the state (public debt crisis) The importance of international speculative capital (railway speculations) Open questions: why are some crises lasting longer than others, why are different parts of the capitalist world affected differently (coexistence, compossibility of crisis and prosperity), how and why do crises rapidly spread out all over the globe, how and why can a crisis be overcome? Why is this long expected crisis over in a few months time? Reinventing the Tableau Économique Round 4: Marx’ research manuscript of 1861 – 63 Marx second and most extensive critique of the ‘ general glut’ debate in the Ms of 1861 – 63 (again taking issue with both sides, and with the socialists) Rethinking crisis research: How to explain the reality and necessity of crises and the regular form of the industrial cycle in terms of a general theory of modern capitalism? In order to do this, Marx proceeds with the sketchy analysis of the circulation process of capital (looking at its different phases in much detail) [unfortunately, some parts of the manuscript are damaged, so we don’t know all the parts of this investigation] In order to do this, Marx reinvents the analysis of the total reproduction / accumulation process – his own “tableau économique” of 1862 (first a graph, like Quesnay’s) In order to do this, Marx investigates capitalist dynamics: the rise of the organic composition of capital (cotton crisis) and the turnover of fixed capital, accelerated accumulation, accelerated turnover, the “value revolutions” (already briefly considered in the 1857/58 ms) and the “price revolutions” A new plan: How to integrate building blocs of a theory of crisis into the theory of capital? Bits and pieces of it are presented from the very beginning until the end, from the most abstract and simple forms to the most complex and complicated (concrete) forms of capitalist competition and credit Marx discussing Ricardo, Say, Mill The core of the general glut debate: General crisis (not partial crises in particular industries / markets) are not only possible, but inevitable (necessary) Overproduction of commodities (not simple, but the modern kind of commodities) and overaccumulation of capital (in different forms) are the basic phenomena of every general crisis in capitalism What is the common foundation /general condition for all modern crises of overproduction / overaccumulation: the The meaning of crisis in capitalism: Crises are the moments in the course of capitalist development when all the ‘contradictions’ of capitalism come all together to an eruption – hence, the why and when and how of the moment of ‘eruption’ has to be explained Crises are the moments when the basic unity between the disconnected and formally independent, but intrinsically connected actions in the marketplace and processes of production, reproduction and consumption is restored – in a ‘violent’, destructive way Hence: crises in capitalism are moments of intense tensions and conflicts, but also necessary for the very existence and continued reproduction of modern capitalism - they are the constitutive phase of the cycle (of boom and bust) as the specific ‘mode of motion’ of modern industrial capitalism Crises in capitalism are moments of necessary destruction (destruction of use values, depreciation / destruction of values, depreciation / destruction of capitals, depreciation / destruction of land / nature, depreciation / destruction of human labour power) Because of that process of depreciation / devaluation / destruction of values and capital, crises provide (potentially) a veritable rejuvenation cure for capitalism and/or they serve as turning points in the course of capitalist development Marx‘ outline of a plan Forms / possibilities of crisis versus actual crises From the most‚abstract‘ forms of crisis to more ‚concrete‘ forms of crisis Analysing ever more „new forms of crisis“ with different meanings – advance both in the analysis of specific ‚forms‘ and of the ‚contents‘ of crisis (some of them, like the form of a monetary crisis / credit crisis, are both general and specific forms of crisis) Analysing both the dynamics of capitalist accumulation /extended reproduction and the dynamics of market extensions When, how and why do the many „potential crises“ turn (inevitably) into an actual crisis? Where do we find the „conditions“ of crisis – in the different phases of the circulation and reproduction process of capital A new idea / plan for the end (final chapter) of Capital: back to the analysis of „total circulation“ – only through the analysis of the „Gesamtprozess“ (total process of capital reproduction) The „tendency of the rate of profit to fall“ does not matter at all! On the contrary, Marx is explicitly criticizing the view, as he find it in Adam Smith, that a fall in the general rate of profit would lead to crises (hence, the often quoted statement: „There are no permanent crises.“) Round 5: the crisis of 1866 This time (again) it is and it looks like a ‘financial crisis’, as it assumes a ‘predominantly financial character’ Marx expands his thoughts on monetary and credit crises (already in the ms of 1861-63) regarding the causes of financial market crises (overcredit and overspeculation) Financial crisis as consequence of the financial market reforms since 1862 (collapse of swindling companies) Hence: corporate law, financial regulations do matter Crisis phenomenon: money market crisis, starting with the failure of a giant London bank How the financial crisis affects industrial and commercial capital Behind the crisis: another major shift in the structure of the world economy (after the end of the US civil war) Marx’ studies of money markets and their crises from 1867 onwards Another series of financial market studies after the publication of Capital, volume I Again: world money, currencies and financial market crises (in the centre and in the periphery) Hence: back to the study of the theory of foreign exchange (Göschen) Hence: back to the study of the history and theory of banking (Gilbart) – the role of the Bank of England as lender of last resort Marx starts studying the basics of accountancy (from 1869 onwards) and banking techniques – why? Round 6: Marx’ study of the first half of the Long Depression Again a series of notebooks (excerpts and few comments, collections of statistical material) on financial markets and banking, on public credit in Britain, USA, Russia, Germany Marx understands the very peculiar character of the crisis (as the first phase of the first Great Depression of 1873 -1895) Hence new problems: Explain the ‘great’ crises and why and how they are different from ‘normal’ crises in previous cycles! Again: Major shifts in the capitalist world economy (rise of industrial agriculture in the USA, the rise of New York ) Alternatives: long term stagnation or another huge world crisis! Again: the tendency of the general rate of profit to fall does not matter Crisis in ‘Capital’ – Evidence and Interpretation Marx uses his notebooks and excerpts from 1846 onwards extensively for the first drafts of Capital, volume I, II and III (of 1864-65) In Capital, Volume I (1867, 1872, 1872-75) Marx comments upon the crises from 1815 to 1866 Marx uses his later notebooks (from 1868 onwards) in his later manuscripts for Capital, volume II Hence: various references to the crises of 1957/58, 1866 and 1873 – 79 in the 8 later ms for Capital, volume II Marx hesitates to finish Capital, volume II because of the events of the great crisis of 1873 – 79 In Capital, volume III (ms of 1864/65) no reference to the events of 1866, 1873 -79 Marx’ accumulated material for core sections of Capital, volume III (in particular section V) goes far beyond the ms of 1864/65 To use this, Marx would have to reorganize the chapter! The mechanisms of crisis and its laws 1870s exchanges with Engels, Danielson and Sam Moore (and others) about the explanation of the (changing) nature and the (changing) mechanisms of crisis and cycles Marx in 1879/80: taking stock of the first phase of the first Great Depression (a transformation of capitalism / the world market still in the making / the end of British industrial supremacy / another industrial revolution in the making?) Marx realizes that this crisis is quite different, he anticipates the possibility of a long depression Consequences for the critique of political economy: How did Marx plan to change Capital (again)? ( Money, credit and banking, Central banks and international financial markets, Agricultural crisis, commodity speculation, resource wars, Sterling replacing gold as world money) The USA as a new model for advanced capitalism Taking Marx seriously – the state of the art in 1882 A book on ‘ worldmarket and crisis’ was still the culmination of Capital Marx was not yet clear about the peculiar character and the fundamental causes (the necessity) of crisis in modern capitalism – except for a between the Marx was clear about core mechanisms of many particular crises (money market crisis, credit crisis, banking crisis, financial crisis, commercial crisis, industrial crisis) Marx was not (completely) clear about the mechanism of the generalization of crisis (as he had not completed his analysis of the basics of the macroeconomic dynamics of capitalism) Marx was not clear about (all) the links between crisis and transformations of capitalism (although he clearly saw a link: Marx never ever made any reference to the ‘falling general rate of profit’ as the ultimate or the immediate or intermediate cause of crisis (how could he? Could Marx‘ theory of crisis be (re)constructed? Several debates in the era of ‚classical Marxism‘ (Kautsky was the first to open the debate already early in the 1890s) Tugan – Baranowsky and his critics (Kautsky, Bauer, Hilferding, Pannekoek and others) Main contributions by the Austro-Marxists (Bauer 1904, Hilferding 1910) Luxemburg debate (from 1913 to the 1940s) – the beginning of a serious Marxian macroeconomics (starting with the critique of Luxemburg‘s Accumulation of Capital and her critique of Marx) The challenge of the Great Crisis of the 1930s (Moszkowska, Bauer, Braunthal, Leichter, Sternberg, Preobrashensky, Dobb, Corey, Sartre, Varga, Boudin, Kuruma, Uno and some others) Grossmann‘s exceptionalism (his view was not accepted by any of the serious Marxist economists of the 1920s and 1930s) Otto Bauers effort to put together what can be combined (unpublished study of the world economic crisis, written in 1933 – 35) Can Marx‘ theory of crisis be reconstructed ? Yes, but … The real heritage of Marx are the many unsettled questions of his critique of political economy (I don‘t give the full – and very long – list here) Accordingly: Marx‘ theory of crisis can be put together from the elements he left us, under one condition … … that the many unsettled questions of Marx‘theory of political economy are dealt with and maybe settled