Who is a Sub

advertisement

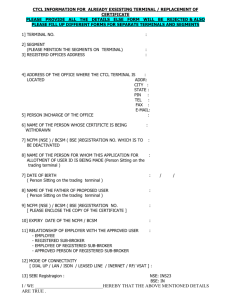

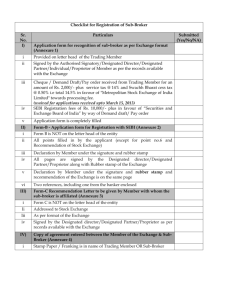

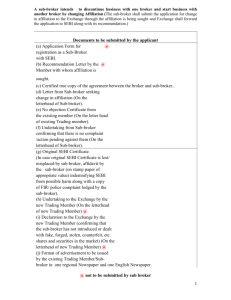

Who is a Sub-Broker A “Sub-Broker” is any person or entity not being a Dealing Member that is registered by the Securities and Exchange Commission (“Commission”) as a Sub-Broker; and acts on behalf of a Dealing Member as its agent for assisting investors in buying and/or selling securities through such Dealing Member. 2 General Requirements for a Sub-Broker 1. Any Broker/Dealer intending to be a Sub-Broker shall file a duly completed Form SEC 2C together with the following documents: (i) A letter from sponsoring Broker/Dealer. The letter should contain an undertaking that the sponsoring Broker/Dealer would be held responsible for losses or liabilities arising from the action (or in action) of the Sub-Broker. (i) A copy of the agreement with sponsoring Broker/Dealer specifying the rights and obligations of the Sub-Broker and the Broker/Dealer. (i) Evidence of minimum paid-up capital of N5million. 2. Approval of the application by the Commission should be within five (5) working days contingent upon filing of complete documentation. 3 General Requirements for a Sub-Broker cont…. 3. The NSE will consider applications from Dealing Members that wish to enter into relationships with Sub-Brokers approved by the Commission and issue letters of approval for applications that comply with the applicable rules and regulations within five (5) working days of filing complete documentation. 4. The CSCS would set up and migrate the Sub-Broker to its sponsoring BrokerDealer after receiving a copy of the NSE’s letter of approval to the relationship between the Sub-broker and its sponsoring Broker-Dealer. 5. Upon the migration, CSCS is to notify the SEC and the NSE. 4 CSCS Requirement for a Sub-Broker 1. Inventory account remains at Sub-Broker level except for individual Sub-Broker. 2. No transfer can occur between Sub-Brokers to Sub-Brokers. 3. No transfer can occur between Sub-Broker and any Broker-Dealer without approval from the sponsor Broker-Dealer. 4. Cash settlement account on the Sub-Broker will be controlled by the BrokerDealer. 5. Inventory account of the Sub-Broker will be under the control of the BrokerDealer but for reconciliation purpose the account will be domiciled under SubBroker. 6. Transaction will be done by the Broker-Dealer 5 Steps for Conversion to Sub-Broker 1. Broker-Dealer sends notification and application to CSCS. 2. Approval by Securities and Exchange Commission (SEC) within 5 working days. 3. Obtain letter of approval from Nigerian Stock Exchange (NSE) 4. Write to CSCS attaching SEC and NSE letter of approvals. 5. CSCS sets up the Sub-Broker accounts under the management of the Broker-Dealer. The Joint Agreement document must be submitted. 6. CSCS confirms the account set up to SEC, NSE, Broker-Dealer and Sub-Broker. 7. Broker-Dealer to notifies CSCS of the Cash Settlement account with the Settlement Bank. 8. Commencement by the Sub-Broker 6 Settlement Bank Arrangement for Sub-Broker Sub-Broker to close his earlier Settlement Bank Account Broker-Dealer to open a second Settlement Bank Account B where all the cash proceeds and purchase funds of the Sub-Broker shall be credited/debited Normal account type: Trading, clients and current account shall be created accordingly for the Sub-Broker Broker-Dealer to advice CSCS on the Account Name, Account Number and Name of the Bank to be domiciled with Broker-Dealer’s Settlement Bank Broker-Dealer shall be signatory A and Sub-Broker shall be signatory B to the Sub-Broker’s account. Mandate signatory with CSCS shall follow suit Broker-Dealer to ensure that all funds for Sub-Brokers’s share purchases are paid into the clients account of the Sub-Broker Broker-Dealer to ensure that proceeds of sales for Sub-Broker’s clients shall be drawn from the clients account Broker-Dealer shall be responsible for the management of the Sub-Broker’s accounts 7 Steps for Conversion from Broker-Dealer to Broker 1. Broker writes SEC and NSE indicating intention to step down from Broker-Dealer to Broker. 2. Broker notifies CSCS of his current status attaching SEC and NSE approvals 3. CSCS blocks the proprietary account of the Broker. 4. Broker requests for Proprietary account transfer to any Broker-Dealer. 5. The normal Cash Settlement Account types would be observed Steps for Conversion from Broker-Dealer to Dealer 1. Dealer writes SEC and NSE indicating intention to step down from Broker-Dealer to Dealer. 2. Only proprietary security account is to be maintained by the Dealer. 3. Dealer to choose a Broker-Dealer to migrate his clients’ accounts and notify his former clients of such migration. Also any client who wants to migrate to another firm can do so through Inter-member transfer window. 4. The normal Cash Settlement Account types will be observed 8 Additional Note For those who do not fall into any of the above categories/classifications, their clients’ shares are quarantined until SEC directs otherwise. However, clients on their own volition can move their shares to BrokerDealer of choice. 9