Folie 1

advertisement

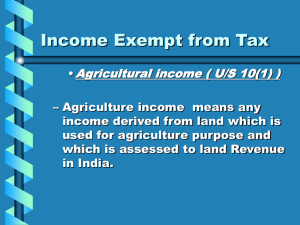

Negative List of Services and Exempted Services - Udayan D. Choksi Charging Section Old charging provision New charging provision (Section 66) (Section 66B) “There shall be levied a tax (hereinafter referred to as the service tax) at the rate of twelve per cent. of the value of taxable services referred to in sub-clauses [ ] of clause (105) of section 65 and collected in such manner as may be prescribed.” “There shall be levied a tax (hereinafter referred to as the service tax) at the rate of twelve per cent. on the value of all services, other than those services specified in the negative list, provided or agreed to be provided in the taxable territory by one person to another and collected in such manner as may be prescribed.” Applicable up to: 30th June, 2012. Notification No. 22/2012-ST, dated 05.06.2012 Applicable from: 1st July, 2012. Notification No. 19/2012-ST, dated 05.06.2012 © 2012 VoxLaw 2 Taxability under Negative List Is the activity a “service”? ‘Service’ Means - Any activity - Carried out by a person for another - For consideration Includes But shall not include - Includes a declared service - Any activity that constitutes merely a transfer in title of goods or immovable property by way of sale, gift or in any other manner; - Such transfer, delivery or supply of any goods which is deemed to be a sale within the meaning of clause (29A) of Article 366 of the Constitution; - A transaction in money or actionable claim; - Any service provided by an employee to an employer in the course of or in relation to his employment; - Fees taken in any Court or a tribunal established under any law for the time being in force - 9 Declared categories / species of services © 2012 VoxLaw 3 Taxability under Negative List Is the activity a “service”? NO No service tax YES Is the service included in the “negative list”? YES No service tax NO No service tax YES No service tax NO Is the service provided in the “taxable territory”? YES Is the service included in the list of exemptions? NO Service tax © 2012 VoxLaw 4 Negative List of Services vs. Exempted Services Aspect Negative List of Service Mega Exemption and Other exemptions Chargeability Outside the scope of charging section of Service Tax Fundamentally taxable Whether exemption can be surrendered? Mandatory exclusion – Service Tax cannot be levied at all Voluntary exemption – Service provider may not claim the exemption and charge Service Tax Whether an exempted service? Yes May not be an exempted service CENVAT Credit Taxes and duties paid on inputs, input services and capital goods cannot be availed Taxes and duties paid on inputs, input services and capital goods can be availed if the exemption is foregone. © 2012 VoxLaw 5 Negative List of Services ... Clause under Section 66D Description of services which are not liable to Service Tax (a) Services by Government or a local authority excluding the following services to the extent they are not covered elsewhere – i. services by the Department of Posts by way of speed post, express parcel post, life insurance and agency services provided to a person other than Government; ii. services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; iii. transport of goods or passengers; or iv. support services, other than services covered under clauses (i) to (iii) above, provided to business entities; (b) Services by the Reserve Bank of India (c) Services by a foreign diplomatic mission located in India (d) Services relating to agriculture or agricultural produce by way of – i. agricultural operations directly related to production of any agricultural produce including cultivation, harvesting, threshing, plant protection or seed testing; ii. supply of farm labour; iii. processes carried out at an agricultural farm including tending, pruning, cutting, harvesting, drying, cleaning, trimming, sun drying, fumigating, curing, sorting, grading, cooling or bulk packaging and such like operations which do not alter the essential characteristics of agricultural produce but make it only marketable for the primary market; iv. renting or leasing of agro machinery or vacant land with or without a structure incidental to its use; v. loading, unloading, packing, storage or warehousing of agricultural produce; … Negative List of Services Description of services which are not liable to Service Tax Clause under Section 66D vi. vii. agricultural extension services; services by any Agricultural Produce Marketing Committee or Board or services provided by a commission agent for sale or purchase of agricultural produce; (e) Trading of goods (f) Any process amounting to manufacture or production of goods (g) Selling of space or time slots for advertisements other than advertisements broadcast by radio or television (h) Service by way of access to a road or a bridge on payment of toll charges (i) Betting, gambling or lottery (j) Admission to entertainment events or access to amusement facilities (k) Transmission or distribution of electricity by an electricity transmission or distribution utility (l) Services by way ofi. pre-school education and education up to higher secondary school or equivalent; ii. education as a part of a curriculum for obtaining a qualification recognised by any law for the time being in force; iii. education as a part of an approved vocational education course; (m) Services by way of renting of residential dwelling for use as residence © 2012 VoxLaw 7 … Negative List of Services Clause under Section 66D Description of services which are not liable to Service Tax (n) Services by way of – i. extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount ii. inter se sale or purchase of foreign currency amongst banks or authorised dealers of foreign exchange or amongst banks and such dealers (o) Service of transportation of passengers, with or without accompanied belongings by – i. a stage carriage; ii. railways in a class other than(A) first class; or (B) an airconditioned coach; iii. metro, monorail or tramway; iv. inland waterways; v. public transport, other than predominantly for tourism purpose, in a vessel between places located in India; and vi. metered cabs, radio taxis or auto rickshaws; (p) Services by way of transportation of goods – i. by road except the services of(A) a goods transportation agency; or (B) a courier agency; ii. by an aircraft or a vessel from a place outside India up to the customs station of clearance in India; or iii. by inland waterways; (q) Funeral, burial, crematorium or mortuary services including transportation of the deceased Negative List of Services– Section 66D Clause Relevant definition Comments (a) Services by Government or a local authority excluding the following services to the extent they are not covered elsewhere i. services by the Department of Posts by way of speed post, express parcel post, life insurance and agency services provided to a person other than Government; ii. services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; iii. transport of goods or passengers; or iv. support services, other than services covered under clauses (i) to (iii) above, provided to business entities; ‘government’ – General Clauses Act, 1897 read with constitution • Government does not include statutory bodies, corporations. • Support Services provided by government liable under reverse charge. E.g. police and security services • TRU Circular clarifies that services provided by government in terms of their sovereign right (e.g. grant of mining or licensing rights) to business entities, and which are not substitutable in any manner by any private entity, are not support services. ‘local authority’ – Panchayat, Municipality, District Boards, Cantonment Boards, regional councils and district councils. ‘support services’ infrastructural, operational, administrative, logistic marketing or any other support of any kind comprising functions that entities carry out in ordinary course of operations themselves but may outsource – specifically includes advertisement and promotion, construction or works contract, renting of movable or immovable property, security, testing and analysis. © 2012 VoxLaw 9 Negative List of Services– Section 66D Clause Negative list of services (b) Services by the RBI (c) Comments All services provided by the RBI are part of the negative list. RBI now liable to service tax under reverse charge. Services by a foreign • This entry does not cover services if any provided by any diplomatic mission located office or establishment of an international organisation. in India • Services provided to foreign diplomatic mission for official use covered under separate exemption notification. © 2012 VoxLaw 10 Negative List of Services– Section 66D Clause Negative list of services (d) Services relating to agriculture or agricultural produce by way of – • Agricultural operations • Supply of farm labour • Processes carried out at an agricultural farm • Renting of agro machinery or vacant land • Loading, unloading, packing, storage and warehousing of agricultural produce • Agricultural extension services • Services provided by any agricultural produce market committee or board or services provided by commission agent for sale or purchase of agricultural produce Comments • Agriculture defined - cultivation of plants and rearing or breeding of animals and other species of life forms for food, fibre, fuel raw materials or other similar products but does not include the rearing of horses • Activities like pisciculture, sericulture, floriculture and horticulture are included in the definition of agriculture. Plantation crops like rubber, tea or coffee are also covered under agriculture. • Agricultural produce defined - any produce of agriculture on which either no further processing is done or such processing is done as is usually done by a cultivator or producer which does not alter its essential characteristics but makes it marketable for primary market; • Leasing of vacant land with a greenhouse or a storage shed meant for agricultural produce covered. • Agricultural extension defined - application of scientific research and knowledge to agricultural practices through former education or training. • More complex value added services are liable to service tax. • Taxing income from agriculture falls to the states (Entry 46 of List II). While Parliament is competent under Entry 97 of List I to charge service tax. These services appear to have been kept in the negative list in view of the special status of agriculture in India. • Services relating to transportation and storage in relation to agriculture operations and produce are currently exempt. Negative List of Services– Section 66D Clause Negative list of services (e) Trading of goods Comments • Activities of a commission agent or a clearing and forwarding agent who sell goods on behalf of another for a commission will not be included in trading of goods. • Futures contracts would be covered under trading of goods as these contracts involve transfer of title and goods on a future date at a predetermined price. • Trading of commodity futures will also be covered under trading of goods. • Services provided by commodity exchanges clearing houses or agents would not be covered in the negative list entry. • Treatment of investments. • Valuation formula for reversal of credit in respect of trading retained • Trading of goods included in negative list. • Transfer of title of goods is excluded from the definition of ‘service’. • “The Negative List shall comprise of the following services …” • Exempted service definition covers “service, on which no service tax is leviable under section 66B of the Finance Act”. © 2012 VoxLaw 12 Negative List of Services– Section 66D Clause Negative list of services Comments (f) Any process amounting to • Defined as a process on which duties of excise are leviable manufacture or production under section 3 of the Central Excise Act or any process of goods amounting to manufacture of alcoholic liquors for human consumption on which duties of excise are leviable under any State Act. • Service tax would be leviable on processes which do not amount to manufacture or production of goods. However, some services relating to processes not amounting to manufacture have been exempted under the exemption list e.g. job work in relation to cut and polished diamonds and gemstones, processes of electroplating, zinc plating, anodising etc. • Service tax not be leviable even if there is a central excise duty exemption for such process. © 2012 VoxLaw 13 Negative List of Services– Section 66D Clause Negative list of services Comments (g) Sale of space or time slots • Under Entry 55 of List II, the State Legislatures have the for advertisements other exclusive taxing power in relation to taxes on advertisements than advertisements other than advertisements published in the newspapers and broadcast by radio or TV advertisements broadcast by radio or television. • Services provided by advertisement agencies relating to preparation of advertisements would not be covered in this negative list entry. • If a person provides a composite service of providing space for advertisement and that is covered in the negative list entry coupled with a taxable service relating to design and preparation of advertisement, the taxability of such a bundled service will be determined in terms of the principles laid down in section 66F of the Act. • The term “any other means” under the definition of advertisement has to be read ejusdem generis, which means advertisement has to be through some medium. • Whether advertisement by display of product itself constitutes medium. (e.g. car displayed at a mall) (h) Providing access to a road • Under Entry 59 of List II of the Seventh Schedule to the or a bridge on payment of Constitution of India, the State Legislatures have been toll charges bestowed with the exclusive taxing power in relation to tolls. © 2012 VoxLaw 14 Negative List of Services– Section 66D Clause Negative list of services (i) Betting, gambling or lottery (j) Admission to entertainment events or amusement facilities Comments • Under Entry 62 of List II of the Seventh Schedule to the Constitution of India, the State Legislatures have been bestowed with the exclusive taxing power in relation to ‘taxes on luxuries, including taxes on entertainments, amusements, betting and gambling.’ • Auxiliary services used for organising or promoting betting or gambling events will not be covered under this entry. • Under Entry 62 of List II of the Seventh Schedule to the Constitution of India, the State Legislatures have been bestowed with the exclusive taxing power in relation to ‘taxes on luxuries, including taxes on entertainments, amusements, betting and gambling.’ • The programme, drama or ballet need not necessarily be held in a theatre to receive the benefit of this entry as the words used in the definition are theatrical performances and not performances in theatres. • Entry to video parlours exhibiting movies played on a DVD player and displayed through a TV screen will also be covered in the definition as an exhibition of cinematographic film. However, a membership of a club does not qualify to avail the benefit under this entry. • Auxiliary service like an event manager for organising entertainment events will also not be covered under this entry © 2012 VoxLaw 15 Negative List of Services– Section 66D Clause Negative list of services Comments (k) Transmission or • Transmission and distribution services were exempted earlier. distribution of electricity by • Electricity transmission or distribution utility has been defined an electricity transmission under the Act to include Central Electricity Authority, State or distribution utility Electricity Board, Central Transmission Utility, State Transmission Utility, Distribution or transmission licensee, Any other entity entrusted with such function by State or Central Government • Charges collected by a developer or a housing society for distribution of electricity within the residential complex is not covered under this entry. • Similarly, services provided by way of installation of gensets or similar equipment by private contractors for distribution of electricity are also not covered under this entry. © 2012 VoxLaw 16 Negative List of Services– Section 66D Clause Negative list of services (l) • Preschool education and education up to higher secondary school or equivalent • Education as a part of a prescribed curriculum for obtaining a qualification recognised by law for the time being in force • Education as part of an approved vocational education course (defined – includes industrial training centres affiliated to the National Council for Vocational Training) Comments • Course recognised by an Indian law are covered. • It has been clarified in the TRU that services provided by international schools giving international certifications are also covered under this entry. • Boarding schools provide service of education coupled with other services like providing dwelling units for residence and food. This may be a case of bundled services if the charges for education and lodging and boarding are inseparable. • Auxiliary educational services and renting of immovable property services provided to or by an educational institution in respect of education exempted from service tax. • Auxiliary educational services defined – includes services relating to imparting any skill, knowledge or education, or development of course content, or any other knowledge enhancement activity, whether for the students or the faculty, or any other services which educational institutions ordinarily carry out themselves but may obtain as outsourced services from any other person. • Private tutors are not covered under this entry. However private tutors can avail the benefit of the threshold exemption. • In case a course in a college leads to a dual qualification only one of which is recognised by law, then it would again be a case of bundled service if the service is inseparable. • Placement services provided to educational institutions for job placements will not be covered under this entry. © 2012 VoxLaw 17 Negative List of Services– Section 66D Clause Negative list of services (m) Renting of residential dwelling for use as residence Comments • Renting has been defined in the Act • Residential dwelling has not been defined and is to be interpreted to mean any residential accommodation not including a hotel, motel, inn, guesthouse, camp-site, lodge, housing board or like places meant for temporary stay. • In case the renting of the residential dwelling is used partly as a residence and partly for non-residential purposes, it would be a case of bundled service and would be taxed appropriately. • If furnished flats are given on the rent for temporary stay, they are in the nature of lodges guest-houses and will not be treated as a residential dwelling. • However, if government department allots houses to its employees and charges a license fee, such service would be covered in the negative list entry relating to services provided by government and would not be taxable © 2012 VoxLaw 18 Negative List of Services– Section 66D Clause Negative list of services (n) Extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount and inter se sale or purchase of foreign currency amongst banks Comments • Transaction must qualify as a service – Transaction in money or actionable claim excluded. • ‘money’ means legal tender, cheque, promissory note, bill of exchange, letter of credit, draft, pay order, traveller cheque, money order, postal or electronic remittance or any such similar instrument but shall not include any currency that is held for its numismatic value. • Fixed deposits or saving deposits or any other such deposit for which return is received by way of interest • Providing a loan or overdraft facility on payment of interest • Mortgages or loans with a collateral security the consideration for which is represented by way of interest • Corporate deposits the consideration for which is represented by way of interest • Any charges or amounts collected over and above the interest or discount would represent taxable consideration • Transactions in repos/ reverse repos excluded from the definition of service itself – in any case it would have been excluded under this negative list entry. • Subscription to or trading in Commercial Papers(CPs) or Certificate of Deposits(CDs) is excluded from the definition of service – CPs and CDs are promissory notes and a transaction in money. • Interest on loans is excluded from the ambit of Rule 6(3) of the CENVAT Credit Rules © 2012 VoxLaw 19 Negative List of Services– Section 66D Clause Negative list of services (o) Service of transportation of passengers, with or without accompanied belongings by – i. a stage carriage; ii. railways in a class other than(A) first class; or (B) an airconditioned coach; iii. metro, monorail or tramway; iv. inland waterways; v. public transport, other than predominantly for tourism purpose, in a vessel between places located in India; and vi. metered cabs, radio taxis or auto rickshaws; Comments Transportation of passengers by following modes shall hence be exigible to Service Tax: • Aircrafts, helicopters, etc. • Railways in first class • Railways in an air-conditioned coach • In a vessel, predominantly for tourism purpose, between places located in India. © 2012 VoxLaw 20 Negative List of Services– Section 66D Clause Negative list of services (p) Services by way of transportation of goods – i. by road except the services of(A) a goods transportation agency; or (B) a courier agency; ii. by an aircraft or a vessel from a place outside India up to the customs station of clearance in India; or iii. by inland waterways; (q) Funeral, burial, crematorium or mortuary services including transportation of the deceased Comments • TRU clarifies transportation of goods by vessel in the coastal waters is not covered under the negative list. • Separate exemption available to GTA services by way of transportation of fruits, vegetables, eggs, milks, food grain or pulses in a goods carriage; goods where gross amount charged on a consignment transported in a single goods carriage does exceed Rs. 1500 and goods where gross amount charged for transportation of all such goods for a single consignee in the goods carriage does exceed Rs. 750 • The words “up to the customs station of clearance in India” were substituted for the words “to the first customs station of landing in India” at the time of assent of the Finance Bill, 2012. • ‘goods transport agency’ means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called. • A seller sells goods to customer on FOR (Free on Road basis) and arranges for transportation and recovers the same from the customer. The seller is providing transportation services to the customer, but is not a GTA • Does it mean there is no liability to Service tax on amounts recovered by seller from the customer. - Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 1. Services provided to the United Nations or a specified international organization 2. Health care services by a clinical establishment, an authorised medical practitioner 3. Services by a veterinary clinic in relation to health care of animals or birds © 2012 VoxLaw 22 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 4. Services by an entity registered under Section 12AA of the Income Tax Act, 1961 by way of charitable activities. “charitable activities” means activities relating to (i) public health by way of (a) care or counseling of (i) terminally ill persons or persons with severe physical or mental disability, (ii) persons afflicted with HIV or AIDS, or (iii) persons addicted to a dependenceforming substance such as narcotics drugs or alcohol; or (b) public awareness of preventive health, family planning or prevention of HIV infection; (ii) advancement of religion or spirituality; (iii) advancement of educational programmes or skill development relating to,(a) abandoned, orphaned or homeless children; (b) physically or mentally abused and traumatized persons; (c) prisoners; or (d) persons over the age of 65 years residing in a rural area; (iv) preservation of environment including watershed, forests and wildlife; or (v) advancement of any other object of general public utility up to a value of,(a) eighteen lakh and seventy five thousand rupees for the year 2012-13 subject to the condition that total value of such activities had not exceeded twenty five lakhs rupees during 2011-12; (b) twenty five lakh rupees in any other financial year subject to the condition that total value of such activities had not exceeded twenty five lakhs rupees during the preceding financial year; © 2012 VoxLaw 23 Exempted Services ... Sr. No. 5. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 Services of(a) renting of precincts of a religious place meant for general public; or (b) conduct of any religious ceremony. © 2012 VoxLaw 24 Exempted Services ... Sr. No. 6. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 Services provided by: (a) an arbitral tribunal to (i) any person other than a business entity; or (ii) any business entity with a turnover up to Rs. 10 lakhs in the preceding FY (b) an individual as an advocate or a partnership firm of advocates by way of legal services to,(i) an advocate or partnership firm of advocates providing legal services ; (ii) any person other than a business entity; or (iii) a business entity with a turnover up to Rs. 10 lakhs in the preceding FY; or (c) a person represented on an arbitral tribunal to an arbitral tribunal; Comments: - ‘business entity’ means any person ordinarily carrying out any activity relating to industry, commerce or any other business or profession - ‘legal service’ means any service provided in relation to advice, consultancy or assistance in any branch of law, in any manner and includes representational services before any court, tribunal or authority; • Legal services covered under the reverse charge mechanism. • Service tax credit not available in view of definition of output service. • Earlier exemption for representational services now applicable only to advocates and not to practicing CA / CS / CWA. © 2012 VoxLaw 25 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 7. Services of technical testing or analysis of newly developed drugs, including vaccines and herbal remedies, on human participants by a clinical research organization approved to conduct clinical trials by the Drug Controller General of India 8. Services by way of training or coaching in recreational activities relating to arts, culture or sports. Comments: • Term ‘recreational activities’ not defined. Lack of definition may create dispute. • TRU has clarified benefit is available to coaching or training relating to all forms of dance, music, painting, sculpture making, theatre and sports etc. 9. Services provided to or by an educational institution in respect of education exempted from service tax, by way of: (a) Auxiliary educational services; or (b) Renting of immovable property © 2012 VoxLaw 26 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 10. Services provided to a recognized sports body by(a) an individual as a player, referee, umpire, coach or manager for participation in a tournament or championship organized by a recognized sports body; (b) another recognised sports body; Comments: • New exemption granted • ‘recognized sports body’ means specified institutions and inter alia includes ‘(vi) a federation or a body which regulates a sport at international level and its affiliated federations or bodies regulating a sport in India’. For e.g. ICC & BCCI 11. Services by way of sponsorship of sporting events organised(a) by a national sports federation, or its affiliated federations, where the participating teams or individuals represent any district, state or zone; (b) by Association of Indian Universities, Inter-University Sports Board, School Games Federation of India, All India Sports Council for the Deaf, Paralympic Committee of India, Special Olympics Bharat; (c) by Central Civil Services Cultural and Sports Board; (d) as part of National Games, by Indian Olympic Association; (e) under Panchayat Yuva Kreeda Aur Khel Abhiyaan (PYKKA) Scheme; © 2012 VoxLaw 27 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 12. Services provided to the Government or local authority by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, restoration or alteration of (a) a civil structure meant predominantly for a non-industrial or non-commercial use; (b) a historical monument, archaeological site or remains of national importance (c) a structure meant predominantly for use as (i) an educational, (ii) a clinical, or (iii) an art or cultural establishment; (d) canal, dam or other irrigation works; (e) pipeline, conduit or plant for (i) drinking water supply (ii) water treatment (iii)sewerage treatment or disposal; or (f) a residential complex predominantly meant for self-use or the use of their employees or other persons specified in the Explanation 1 to clause 44 of section 65 B of the said Finance Act; 13. Services provided by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, restoration or alteration of – (a) road, bridge, tunnel, or terminal for road transportation for use by general public; (b) a civil structure or any other original works pertaining to a scheme under Jawaharlal Nehru National Urban Renewal Mission or Rajiv Awaas Yojana; (c) building owned by an entity registered under section 12AA of the Income tax Act, 1961(43 of 1961) and meant predominantly for religious use by general public; (d) pollution control or effluent treatment plant, except located as a part of a factory; or a structure meant for funeral, burial or cremation of deceased © 2012 VoxLaw 28 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 14. Services by way of construction, erection, commissioning or installation of original works pertaining to,(a) airport, port or railways; (b) single residential unit otherwise as a part of a residential complex; (c) low- cost houses up to a carpet area of 60 square metres per house in a housing project approved by competent authority empowered under the ‘Scheme of Affordable Housing in Partnership’ framed by the Ministry of Housing and Urban Poverty Alleviation, Government of India; (d) post- harvest storage infrastructure for agricultural produce including a cold storages for such purposes; or (e) mechanised food grain handling system, machinery or equipment for units processing agricultural produce as food stuff excluding alcoholic beverages; Comments for 12, 13, 14: • Constructing hospitals and educational institutes for the government, a local authority or a governmental authority is not liable to Service tax. But constructing the same for others is liable to service tax. • Construction of a building owned by an entity registered under section 12 AA of the Income tax Act, 1961 and meant predominantly for religious use by general public is exempt from Service tax. • Repair, maintenance of airports, ports and railways are liable to Service tax and the same will be available as input tax credit to railways, port or airport authority, if other conditions are met. © 2012 VoxLaw 29 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 15. Temporary transfer or permitting the use or enjoyment of a copyright covered under clause (a) or (b) of sub-section (1) of section 13 of the Indian Copyright Act, 1957 (14 of 1957), relating to original literary, dramatic, musical, artistic works or cinematograph films; Comments: • Temporary transfer or permitting use or enjoyment of copyright in cinematographic film and sound recording were earlier liable to service tax. • Now, Temporary transfer or permitting use or enjoyment of copyright in recording cinematographic film is exempted. • ‘software’ is defined as ‘literary work’. 16. Services by a performing artist in folk or classical art forms of (i) music, or (ii) dance, or (iii) theatre, excluding services provided by such artist as a brand ambassador Comment: Activities by an artist in other art forms e.g. western music or dance, modern theatres, performance of actors in films or television serials would be taxable. Similarly activities of artists in still art forms e.g. painting, sculpture making etc. are taxable. 17. Services by way of collecting or providing news by an independent journalist, Press Trust of India or United News of India 18. Services by way of renting of a hotel, inn, guest house, club, campsite or other commercial places meant for residential or lodging purposes, having declared tariff of a room below rupees one thousand per day or equivalent; © 2012 VoxLaw 30 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 19. Services provided in relation to serving of food or beverages by a restaurant, eating joint or a mess, other than those having the facility of air-conditioning or central air-heating in any part of the establishment, at any time during the year and which has a license to serve alcoholic beverages; 20. Services by way of transportation by rail or a vessel from one place in India to another for specified goods like petroleum and petroleum products, defence or military equipment, household effects, railway equipments or materials, agricultural produce, foodstuffs, chemical fertilizers and oilcakes 21. Services provided by a goods transport agency by way of transportation of - fruits, vegetables, eggs, milk, food grains or pulses in a goods carriage, or - goods where gross amount charged on a consignment transported in a single goods carriage does not exceed Rs. 1,500; or - goods, where gross amount charged for transportation of all such goods for a single consignee in the goods carriage does not exceed Rs. 750 22. Services by way of giving on hire (a) to a state transport undertaking, a motor vehicle meant to carry more than twelve passengers; or (b) to a goods transport agency, a means of transportation of goods; 23. Transport of passengers by- air embarking or terminating in an airport located in the state of Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, or Tripura or at Baghdogra located in West Bengal; or a contract carriage for the transportation of passengers, excluding tourism, conducted tour, charter or hire or ropeway, cable car or aerial tramway 24. Services by way of motor vehicle parking to general public excluding leasing of space to an entity for providing such parking facility © 2012 VoxLaw 31 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 25. Services provided to the Government or a local authority by way of (a) Carrying out an activity in relation to any function ordinarily entrusted to a municipality in relation to water supply, public health, sanitation conservancy, solid waste management or slum improvement and upgradation; or (b) repair or maintenance of a vessel or an aircraft 26. Services of general insurance business provided under specified schemes 27. Services provided by an incubatee up to total business turnover of Rs. 50 lakh in an FY, subject to the following conditions: (a) total business turnover had not exceeded Rs. 50 lakh in the preceding FY and (b) A period of 3 years has not lapsed from the date of entering into agreement as an incubatee © 2012 VoxLaw 32 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 28. Service by an unincorporated body or an entity registered as a society to own members by way of reimbursement of charges or share of contribution (a) as a trade union; (b) for the provision of carrying out any activity which is exempt from the levy of service tax; or (c) up to an amount of Rs. 5000 per month per member for sourcing of goods or services from a third person for common use of its members in a housing society or residential complex Comments: • Scope of exemption extended to include contributions from trade unions. • Whether exemption up to Rs. 5,000/- available in respect of contributions received from members is more than Rs. 5,000/-? • Earlier Notification 8/2007-S.T. dated 01.03.2007 imposed a condition that the total consideration received from an individual member by the said association for providing the services does not exceed three thousand rupees per month © 2012 VoxLaw 33 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 29. Services by the following persons in respective capacities a) a sub-broker or an authorised person to a stock broker; b) an authorised person to a member of a commodity exchange; c) a mutual fund agent or distributor to mutual fund or asset management company for distribution or marketing of mutual fund; d) a selling or marketing agent of lottery tickets to a distributer or a selling agent; e) a selling agent or a distributer of SIM cards or recharge coupon vouchers; f) a business facilitator or a business correspondent to a banking company or an insurance company in a rural area; g) business facilitator or a business correspondent to a banking company or an insurance company, in a rural area; h) sub-contractor providing services by way of works contract to another contractor providing exempt works contract service 30. Carrying out an intermediate production process as job work in relation to (a) agriculture, printing or textile processing; (b) cut and polished diamonds and gemstones; or plain and studded jewellery of gold and other precious metals, falling under Chapter 71 of the Central Excise Tariff Act ,1985 (5 of 1986); (c) any goods on which appropriate duty is payable by the principal manufacturer; or (d) processes of electroplating, zinc plating, anodizing, heat treatment, powder coating, painting including spray painting or auto black, during the course of manufacture of parts of cycles or sewing machines upto an aggregate value of taxable service of the specified processes of one hundred and fifty lakh rupees in a financial year subject to the condition that such aggregate value had not exceeded one hundred and fifty lakh rupees during the preceding financial year; © 2012 VoxLaw 34 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 31. Services by an organiser to any person in respect of a business exhibition held outside India 32. Services by way of making telephone calls from: (a) departmentally run public telephones; (b) guaranteed public telephones operating only for local calls; or (c) free telephone at airport and hospitals where no bills are being issued 33. Services by way of slaughtering of animals 34. Services received from a service provider located in a non-taxable territory by: (a) the Government, a local authority or an individual in relation to any purpose other than industry, business or commerce; or (b) an entity registered under section 12AA of the Income tax Act, 1961 (43 of 1961) for the purposes of providing charitable activities. (c ) a person located in a non-taxable territory Comments: • Services provided in taxable territory from a service provider located in a non- taxable territory are covered under reverse charge. • Exemption granted to Government or local authorities or individuals, if services are obtained for non-commercial purposes. • Exemption granted where both service provider and receiver are located in non-taxable territory but place of provision might be in the taxable territory. © 2012 VoxLaw 35 Exempted Services ... Sr. No. Description of Exempted Services - Notification No. 25/2012-ST dated June 20, 2012 effective July 1, 2012 35. Services of public libraries by way of lending of books, publications or any other knowledge enhancing content or material 36. Services by Employee’s State Insurance Corporation to persons governed under the Employees’ Insurance Act, 1948 37. Services by way of transfer of a going concern, as a whole or an independent part thereof Comments: • Transactions of business restructuring, amalgamation, demergers etc. • Reversal of CENVAT Credit under Rule 6 of CENVAT Credit Rules, 2004. 38. Services by way of public conveniences such as bathroom, washrooms, lavatories, urinal or toilets 39. Services by a governmental authority by way of an activity in relation to any function entrusted to a municipality under Article 243W of the Constitution © 2012 VoxLaw 36 Other Exemptions Notification Number Notification No. 27/2012-ST dated June 20, 2012 effective July 1, 2012 Notification No. 29/2012-S.T., dated 20.06.2012 Description of Exempted Service Services provided by any person, for the official use of a foreign diplomatic mission or consular post in India, or for personal use or for the use of the family members of diplomatic agents or career consular officers posted therein Service of renting of an immovable property, from so much of the Service Tax leviable thereon under section 66B of the said Finance Act, as is in excess of the service tax calculated on a value which is equivalent to the gross amount charged for renting of such immovable property less taxes on such property, namely property tax levied and collected by local bodies, provided: - Interest / penalty etc on account of delayed payment of property tax or any other reasons shall not be treated as property tax for the purposes of deduction - wherever the period for which property tax paid is different from the period for which service tax is paid/ payable, only property tax proportionate to the relevant period can be excluded © 2012 VoxLaw 37 Other Exemptions Notification Number Notification No. 31/2012-ST dated June 20, 2012 effective July 1, 2012 Description of Exempted Service Service provided to an exporter for transport of goods by goods transport agency in a goods carriage from : - any container freight station or inland container depot to the port or airport, as the case may be, from where the goods are exported; or - directly from their place of removal, to an inland container depot, a container freight station, a port or airport, as the case may be, from where the goods are exported The exporter shall have to produce the consignment note, by whatever name called, issued in his name and other procedural compliances specified Notification No. 32/2012-ST dated June 20, 2012 effective July 1, 2012 Service provided, by a Technology Business Incubator (TBI) or a Science and Technology Entrepreneurship Park (STEP) recognized by the National Science and Technology Entrepreneurship Development Board (NSTEDB) of the Department of Science and Technology, Government of India - Procedural compliances specified © 2012 VoxLaw 38 Other Exemptions Notification Number Notification No. 41/2012S.T. dated June 29, 2012 effective July 1, 2012 Description of Exempted Service Exemption granted to specified services: “specified services” means- in the case of excisable goods, taxable services that have been used beyond the place of removal, for the export of said goods; - in the case of goods other than (i) above, taxable services used for the export of said goods; - but shall not include any service specifically excluded from the definition of ‘input services’. Rebate can be claimed by means of two methods: 1. Specified % of FOB Value of goods exported (% prescribed as per tariff headings) 2. If amount of rebate is more than 0.12% of FOB value of exported goods, Form A-1 shall be submitted along with relevant invoice, bill or challan, or any other document for each specified service, in original, issued in the name of the exporter, evidencing payment for the specified service used for export of the said goods and the service tax paid thereon and other conditions in notification to be fulfilled. © 2012 VoxLaw 39 Charging Section Old charging provision New charging provision (Section 66) (Section 66B) “There shall be levied a tax (hereinafter referred to as the service tax) at the rate of twelve per cent. of the value of taxable services referred to in sub-clauses [ ] of clause (105) of section 65 and collected in such manner as may be prescribed.” “There shall be levied a tax (hereinafter referred to as the service tax) at the rate of twelve per cent. on the value of all services, other than those services specified in the negative list, provided or agreed to be provided in the taxable territory by one person to another and collected in such manner as may be prescribed.” Applicable up to: 30th June, 2012. Notification No. 22/2012-ST, dated 05.06.2012 Applicable from: 1st July, 2012. Notification No. 19/2012-ST, dated 05.06.2012 © 2012 VoxLaw 40 MUMBAI Mafatlal House, 6th Floor Backbay Reclamation Mumbai 400020 DELHI/NCR P-57, South Extension II New Delhi 110049 AHMEDABAD B-902, Safal Pegasus 100 ft. Prahladnagar Road Ahmedabad 380 051 VADODARA 8, Shalin Complex Manjalpur Vadodara 390011