Syndicated Data Sources: Part 1

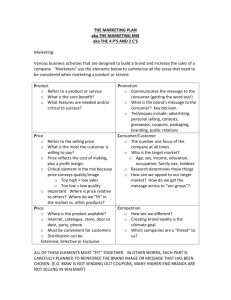

advertisement

Syndicated Data Sources: Part 1 Slide 1 The goal of this lecture on syndicated data sources is to introduce you to the types of customer behavior data that are available on an ongoing basis, which allow marketing managers to track changes in those behaviors that were inspired by changes in the marketing mix. Slide 2 As it states on this slide, syndicated sources are market research suppliers who collect data regularly with standardized procedures. That data is then sold to different clients. The value of syndicated sources is that the data that are being supplied would be cost prohibitive to collect for any one company. If the cost of collecting that data is spread over many companies, then it’s possible for a single supplier to collect that data and then sell profitable subscriptions to companies that require it for making better decisions. In essence, syndication allows data that would otherwise be cost prohibitive to be available to marketing managers. Slide 3 As with everything in marketing research, syndicated data has advantages and disadvantages. One advantage is shared cost, which allows the data to become affordable to companies. Another advantage is its relatively high quality, in the sense that it’s fairly reflective of peoples’ underlying behaviors. As this data is collected on an ongoing basis, it tends to be relatively current. One disadvantage is that the companies that create this data don’t design customized reports for different clients, which would be cost prohibitive. Instead, each subscriber receives a standardized report. A second disadvantage is the buyer must commit to subscribing over an extended period of time. Clearly, it would be great to receive that first report and then cancel the subscription, but that’s not possible. Syndicators understand that as well. Rather than receiving data every month or biweekly, managers might prefer to receive it every quarter or bi-annually. Because the cost commitment is significant and upfront, the subscriber may decide afterwards that the data was not as useful as first thought. Finally, if information is a strategic resource, and syndicated data is available to all competitors, then there’s no strategic advantage to acquiring it. Managers from every company can learn the sales of their competitors’ brands. Slide 4 This slide depicts the basic types of syndicated sources. Memorizing the specific suppliers is unimportant, as they will change over time. Instead, focus on the different types of available data. (1) Diary panels are divided into two types; they can track people’s purchases or media habits—what they watch on television or listen to on the radio—over time. (2) Another type of syndicated source tracks withdrawals, either from warehouses or from retailers. (I’ll discuss those in more detail later when I discuss audit services). (3) A third type of syndicated source is the single-source supplier, and I’ll discuss one source—Behaviorscan—in more detail later. The beauty of single-source data is that it’s possible to run externally valid experiments of the marketing mix for a given product. Page | 1 Slide 5 Again, diary panels allow households to report their buying or media behaviors over time. The two types are purchase panels and media panels. The benefit of a panel: the same respondents complete diaries on an ongoing basis, so it’s possible to track changes in households’ purchase behaviors over time. Slide 6 The next three slides suggest three ways in which diary panel data can be used to solve real marketing problems. Here’s one question that a marketing manager might want answered: How loyal are my brand’s buyers relative to my main competitor’s buyers? Purchase diaries track what people bought over multiple purchase occasions, so it’s possible to determine for each household in the panel the percent of households that bought my brand 0, 1, 2, and 3 times on the last three occasions. The percentages are depicted in the left half of the slide; from them, it appears that the competitor’s customers are more brand loyal, if brand loyalty is defined as repeat purchases rather than as a psychological construct. Recognizing that a major competitor’s customers are relatively more brand loyal has marketing implications; for example, companies with relatively less brand-loyal customers could extend usage among existing buyers to increase their loyalty. Those usage options, listed on the bottom of the slide, include in- or onpack coupons, in-pack contests, and premiums in return for several proof-of-purchase seals. Slide 7 Another question that a marketing manager might want answered: How does my brand’s demographic profile compare to other brands? Am I reaching my target audience? Managers frequently ask those questions. This slide shows an audience divided into three income ranges: less than $10,000, between $10,000 and $20,000, and more than $20,000. Data for the total product category indicate that 21% of buyers have a household income less than $10,000, 31% have an income between $10,000 and $20,000, and 48% have an income more than $20,000. Now consider the distribution of units sold across these three brands. The percent of Brand A sales from the less-than-$10,000-income group is much higher than for competitors Brand B and Brand C; 32% of Brand A sales comes from this group, whereas roughly 15% of Brand B and C sales comes from this group. A reasonable conclusion: relative to both the category and competitors, Brand A is not performing well among higher-income households. How should the producers of Brand A respond? They might re-target or revamp their advertising to reach the proper audience: higher-income households. Slide 8 A third question that a marketing manager might want answered: Should I promote my brand using a coupon or a free sample? Coupons are costly to manufacturers in terms of placement (because newspapers don’t run coupons for free), redemption (because money is returned to consumers), and handling (because retailer and clearinghouses require compensation). Although an expensive proposition, coupons are far less costly than distributing free samples. In the example shown on this slide, the free samples cost three times as much as coupons. Given the relative costs and efficacies, which promotional effort is best? To answer the marketing manager’s question, her company ran an experiment. In each of three different markets, consumers received a coupon, a free sample, or nothing. Then, panel data were used to reveal purchase rates in those three markets over time. Finally, boosts in repeat purchase rates were related to the costs of these three promotion alternatives. Page | 2 Panel data can indicate both trial (buying something a first time)—and repeat (buying something repeatedly) purchases. Although interested in trial—after all, subsequent sales require a first sale—manufacturers are far more interested in repeat purchase rate because little profit is derived from one-time purchasers. People who try something but decide they don’t like it won’t account for many sales over time. In contrast, repeat buyers account for the lion’s share of sales and concomitant profits. In this example, 21% of households redeemed the coupon, 17% of households that received a sample purchased the brand at least once, and 12% of households that received neither a coupon nor a sample purchased the brand at least once. Those percentages are the trial rates. For repeat purchases, the rate was 37% for households receiving a free sample, 34% for households receiving a coupon, and 29% for households receiving nothing (i.e., the control group). However, free samples cost three times more than coupons but yielded only a 3% higher repeat rate. Although the cost information in this example is limited, it appears that the far higher cost but only modest incremental boost in repeat purchase rate for samples versus coupons recommends the use of the latter. Slide 9 (No Audio) Slide 10 This slide shows one page from a diary that people participating in a purchase panel—in this case, an NFO purchase panel—completed. This one page suggests the massive amount of data that panel members provide about the mundane products—like coffee, jams, and laundry detergent—that they purchase. About laundry detergent, for example, NFO panelists indicated the date they bought, if they used a coupon, the product form (was it meant for cold water?), if the product included an enzyme, how many units they bought, how much they paid, the total amount they saved if a special was used, and the type of store in which bought (supermarket?). All that data just for laundry detergent! As panelists would need to provide such data for many other products, their efforts to complete such diaries repeatedly would become tedious. Thus, many people rotate on and off diary panels regularly, which is a problem because tracking a household’s purchases over time requires a household head remain a panelist over time. Slide 11 The next three slides show the types of food-related data that Market Research Corporation of America collect and the kinds of reports that it generates from that data. Slide 12 to Slide 14 (No Audio) Slide 15 This slide shows a single-day page from an Arbitron radio diary. Clearly, this page wouldn’t be easy to complete properly. Remember, many people listen to their radios in their car on the commute to and from work. The diary requires panelists to indicate the time of day they started and stopped listening, the stations to which they listened, and where they were while they listened. Given people’s propensities to flip channels, such recordkeeping might be of suspect accuracy. Also, it’s easy to imagine how panelists would cope with the burden of maintaining a daily listening diary. Rather than record their listening behaviors daily, they’d likely reconstruct during the weekend what they listened to throughout the week. As a result, this data might be less accurate than desired. However, this data is all that’s available on radio listenership. It’s Page | 3 impossible to collect such data without soliciting it from cooperative listeners. Unlike traditional television viewership data, it’s infeasible to attach tracking devices to every radio—which would now include internet radio—to which a person listens throughout the day. Despite its imprecision, Arbitron radio diary data is the best data that’s available for setting radio station ad rates. Slide 16 The next four somewhat detailed slides provide the approach that Arbitron uses to evaluate listener data. Arbitron makes many different calculations to help advertisers identify the most suitable place for their radio ads. Slide 17 to Slide 19 (No Audio) Slide 20 This and the next slide show a sample NAD report for viewership of a single television show. This is clearly an ancient slide; my reason for presenting it is to show the level of detail in which viewership data is provided to advertisers. The data is divided by region, cable status, household size, presence of non-adults, household income, and by other demographics. Although seemingly an excessive amount of detail on viewer demographics for different television shows, it’s what advertisers need to make informed decisions about where to place their ads and how much to spend for those placements. Slide 21 (No Audio) Slide 22 Although useful for making decisions about certain products and ad placements, diary panel data has its limitations. Certain groups, such as minorities and lesser educated folks, are underrepresented in these panels relative to their natural propensity in the general population. In other words, the sample is biased. Although the folks that collect this data weight their samples appropriately, minorities and lesser educated people clearly are underrepresented. Hence, the data may be weak in tracking changes in those groups. Although many people agree to participate as members of a diary panel, they quickly decide, after dealing with the detailed diaries a few times, that it’s not worth the effort. As a result, there’s a high dropout rate, and that’s a problem because it’s impossible to track a household that quickly drops out of the panel. There’s a related flip-side problem: the people who opt to continue to participate in these panels tend to differ from most people. As a result, if the diary panel company isn’t careful, then the panelists will become non-representative of the general population. Thus, it’s necessary occasionally to kick some of the best respondents off the panel. Such rollover is necessary to avoid maturation of the panel population, which would make it non-representative of the general population. Response bias is a problem. People who know that they’re being observed will tend to behave differently. It’s likely that people participating in a media diary will forget that they watched Gilligan’s Island, but they’ll never forget that they watched PBS. There are also Page | 4 going to be general recording errors. It’s a nuisance to make diary entries, so people often wait till the next day or later—when it’s more convenient—to complete their diary entries for the previous days viewing; as a result, they may mis-remember the channel, the times, the programs, and the like. Hence, there’s meaningful response bias associated with diary panel data. Slide 23 Think of syndicated services as tapping into the flow of goods, through the distribution channel, from the producer to the consumer. As a flow, it can be tapped at any point; changes in the flow over time can be accessed from any vantage point. One possible vantage point is wholesaler or warehouse product movement, which audit services use. There are different types of audit services; SAMI is at the warehouse level and the Nielsen Retail Index is at the retailer level. Because there are many more retailers than warehouses, we may get a better sense of flow by catching it further upstream. Slide 24 Here’s a graphic that summarizes the type of data available from a Nielsen Retail Index. Here, the sales data for muffin mix allows a comparison between the sales of Betty Crocker Blueberry Muffin Mix and Duncan Hines Blueberry Muffin Mix for the previous year. Slide 25 Here are five ways manufacturers would use audit services. (1) To monitor the relative market shares of national and private brands to assess how they vary in different markets. (2) To monitor competitor’s actions. For example, if one competitor noticed that another competitor was suddenly flooding one of the warehouses with additional units of a certain brand that might be a signal that they’ll be a special promotion of that brand shortly. That the second competitor is trying to avoid stock outs by increasing the volume of brand available to consumers once these new or special promotion hits. (3) Another way audit services can be used is to monitor new product sales by region. It may be that one product is doing well in one region, but poorly in another, and audit services would help to identify which regions might need to be beefed up as far as sales force or which regions the promotional efforts might need to be shifted to some other theme. (4) A fourth way in which audit services could be used is to improve advertising and distribution. Since you have this data at the regional level, or to some extent in some markets at the local level, there would be an effort to use this data to track advertising and efficacy over time by looking at changes in sales, inspired after a new ad campaign was run. (5) Finally, number five, audit services could be used to determine sales potential in specific markets. If one was interested in introducing a new brand, to the marketplace, look at the sales of competitors, try to guess from which competitors the new brand might steal the most, (assuming we’re talking in established product category), and then estimate that based on the percentage share taken from each of those competitors, what the Page | 5 likely share would be of the new brand. That way a manufacturer could make a decision whether to introduce the new brand or not. Slide 26 (No Audio) Page | 6