Paper 1 - WordPress.com

advertisement

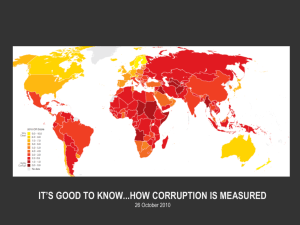

Do State Campaign Finance Reforms Reduce Public Corruption? Adriana Cordis Department of Economics University of South Carolina Upstate Jeff Milyo Department of Economics University of Missouri Meg Patrick Mercatus Center George Mason University July 16, 2012 Abstract: The Supreme Court has long held that campaign finance regulations are permissible for the purpose of preventing corruption or the appearance of corruption. Yet the implied hypothesis that campaign finance reforms are effective tools for combating public corruption has gone essentially untested. We conduct the first systematic evaluation of the treatment effects of state campaign finance laws on actual corruption rates in the states. We examine within-state effects of reforms on both convictions and filings in public corruption cases over the last 25 years; overall, we find no strong or convincing evidence that state campaign finance reforms are in anyway related to public corruption. Earlier research that employs similar methods also finds little support for the contention that state campaign finance regulations increase public trust and confidence in government. Together, these results call into question the legal rationale for campaign finance regulations. 1 Do State Campaign Finance Reforms Reduce Public Corruption? Adriana Cordis, Jeff Milyo and Meg Patrick 1. Introduction In the interest of preserving the basic constitutional freedoms of speech and association, the United States Supreme Court has long held that government restrictions on the financing of political campaigns must be narrowly tailored for the purpose of preventing “the actuality and appearance of corruption.”1 This principle has been the basis for several court decisions that have reigned in the scope of state and federal campaign finance regulations over the last 35 years.2 For this reason, advocates for new and expanded restrictions on campaign financing maintain that such reforms are highly effective tools for addressing political corruption, preserving the integrity of democracy and restoring public confidence in government.3 Yet, despite this continual and intense focus on campaign finance reform as anticorruption policy, there has been very little effort by scholars to evaluate whether campaign finance reforms actually reduce corruption or the appearance of corruption. 1 Buckley v. Valeo, 424 U.S. 1 (1976). 2 Recent examples include: Randall v. Sorrell, 548 U.S. 230 (2006), striking low contribution limits in Vermont; Davis v. FEC (2008), striking differential contribution limits for candidates with self-financing opponents; Citizens United v. FEC, 130 S. Ct. 876 (2010), striking prohibitions on corporate independent expenditures; Arizona Free Enterprise Club’s Freedom Club PAC et al. v. Bennett, 131 S. Ct. 2806 (2011), striking public matching funds for candidates with high-spending opponents; and American Tradition Partnership v. Bullock, 567 U. S. ____ (2012), which reaffirmed Citizens United application to the states. 3 Examples are ubiquitous, but the New York Times editorial page is a reliable source of hyperbole in this regard; in the wake of the Citizens United decision, the Times characterized the majority decision as “radical” and striking “a blow to the heart of democracy” (“The Court’s Blow to Democracy,” 2010). In a subsequent weekly radio address, President Obama called for campaign finance reform, declaring: “what is at stake is no less than the integrity of our democracy” (Obama 2010). For recent high profile calls for campaign finance reform as a means specifically to address political corruption, see the Center for Public Integrity’s “State Integrity Investigation” at: http://www.stateintegrity.org/ (last viewed July 13, 2012). 2 One explanation for the absence of systematic research on the campaign finance reforms and corruption is that it is difficult to disentangle the impact of reforms at the federal level from other factors which may change coincidentally over time. But as demonstrated in Primo and Milyo (2006) and Milyo (2012), there is substantial variation in state campaign finance laws both across states and over time; those authors exploit this state-level variation to identify the treatment effects of campaign finance reforms on public opinion about elections and government. In addition, a growing literature exploits the existence of state-level data on public corruption convictions over time to analyze the causes and consequences of corruption in the states (e.g., Meier and Schlesinger, 2002; Glaeser and Saks, 2006; Cordis, 2009 and Cordis and Warren, 2012). Consequently, the states offer a laboratory well-suited for identifying the treatment effect of campaign finance reforms on public corruption. In this report, we conduct the first systematic within-state analysis of the effects of campaign finance reforms on actual corruption. We measure public corruption in a variety of ways using detailed data on both convictions and prosecutorial filings from the Transactional Records Access Clearinghouse at Syracuse University (TRACfed).4 We also employ multiple strategies for dealing with the fact that state campaign finance reforms may themselves be caused by episodes of political corruption. Overall, we find that state campaign finance reforms are unrelated to state-level convictions or filings in public corruption cases. 2. Literature Review Only a handful of studies even tangentially examine whether state campaign finance laws are associated with political corruption in the states. Of these, only Maxwell and Winters 4 We obtained this data under license from TRACfed (http://tracfed.syr.edu/). 3 (2005) use data on actual corruption convictions; however, the authors analyze just a single cross-section of data, so cannot identify the within state effects of reform. The remaining studies (Alt and Lassen 2003 and 2008; and Rosenson 2009) instead use Boylan and Long’s (2003) survey of statehouse reporters to measure state-level corruption. However, the Boylan and Long survey data is only available for a single year, so these authors are also unable to identify within-state effects of campaign finance reforms.5 Apart from this, the corruption measures employed in these studies are of dubious quality. Maxwell and Winters (2005) employ data on convictions from the Public Integrity Section of the Department of Justice. This is by far the most common source of data on statelevel public corruption employed by social scientists.6 However, Cordis, Milyo and Patrick (in progress) describe several problems with the DOJ data, from a failure to add-up to inconsistent and poorly documented data-collection methods. On the other hand, the survey-based measure of corruption used in other studies is also problematic in that it is based on the subjective opinions of a small number of journalists. Further, as noted in Cordis, Milyo and Patrick (in progress), these measures are not highly correlated with the more detailed and objective corruption data from the TRACfed archive. 5 Stratmannn (2003) examines a single cross-section of 14 democratic countries to analyze the effects of national campaign finance laws on corruption; he finds more restrictive contribution limits are associated with higher levels of public corruption, as measured by the Transparency International Bribe Payers Index and the World bank Corruption Index. This is the only study of which we are aware that investigates the connection between campaign finance laws and corruption across countries. 6 For example, Adser et al. (2003), Alt and Lassen (2008), Cordis (2009), Dincer et al. (2010), Fisman and Gatti (2002), Glaeser and Saks (2006), Goel and Nelson (2011), Hill (2003), Johnson et al. (2011), Leeson and Sobel (2008), Maxwell and Winters (2005), Meier and Holbrook (1992), Meier and Schlesinger (2002), and Nice (1983). 4 It merits mention that neither Maxwell and Winters (2005) nor Alt and Lassen (2003 and 2008) set out to investigate campaign finance regulations as a determinant of reform. In fact, these authors examine only a single indicator for state campaign finance laws and even so only in some of their statistical models. The campaign finance regulation variable used in all three studies describes states with any restrictions on “campaign spending by or on behalf of candidates”; however, mandatory spending restrictions were rendered unenforceable by the landmark 1976 Buckley decision. Consequently, these authors really examine only the crosssectional association between voluntary spending restrictions and corruption, absent controls for other prominent and more relevant features of state campaign finance regulatory regimes, such as contribution limits for different types of contributors.7 In contrast, Rosenson (2009) undertakes specifically to investigate the question of whether state campaign finance laws affect political corruption by examining the crosssectional correlation between an index of major state campaign finance laws and statehouse reporters’ subjective evaluations of corruption in their own state. Rosenson also attempts to address the potential endogeneity of reforms by using an instrumental variables estimation procedure. However, this exercise is problematic for two reasons: 1) the first stage regression does not include all exogenous variables in the structural model, only the excluded instruments; and 2) the proposed instruments (government ideology, membership in Common Cause and population) are themselves unlikely to be truly exogenous. 7 Most states with voluntary spending ceilings for candidates offer public financing for candidates that abide by these limits; however, the indicator used by Maxwell and Winters (2005) and Alt and Lassen (2003 and 2008) also includes states such as Colorado with purely voluntary spending limits. Further, this indicator does not distinguish between states that offer public financing to only gubernatorial candidates versus those that also include state legislative candidates. 5 As a consequence of these shortcomings in both data and methods, the existing literature is uninformative about whether campaign finance reforms affect public corruption in the states. However, even putting aside all such concerns, these studies offer no consistent evidence. Maxwell and Winters observe no significant relationship; Alt and Lassen find a negative association between voluntary spending restrictions and reporters’ perceptions of corruption; and Rosenson finds a positive association between state campaign finance laws and reporters’ perceptions of corruption. However, none of these studies convincingly identifies the treatment effect of state campaign finance laws on state corruption. There have been likewise few serious efforts to estimate the causal effects of state campaign finance laws on the “appearance of corruption,” or similar public-opinion based measures of trust and confidence in government. In fact, only two studies examine the withinstate effects of campaign finance laws on relevant public attitudes. Primo and Milyo (2006) find no strong evidence that reforms increase political efficacy, while Milyo (2012) finds no effect of campaign finance reforms on trust and confidence in government. These studies stand out for their implementation of “best-practice” evaluation methods, such as estimating treatment effects via difference-in-differences and performing multiple checks for the presence of timevarying unobservable factors that might confound identification in these models. We now employ similar empirical methods to the question of whether campaign finance reforms reduce public corruption in the states. 3. Data and Methods We seek to evaluate the treatment effect of state campaign finance reforms on the occurrence of public corruption. An immediate concern is that state campaign finance reforms 6 may themselves be caused by the presence of public corruption. We address this potential endogeneity in three ways. First, we examine the raw data for any long-run relationship between the levels of (or changes in) campaign finance laws and the levels of (or changes in) public corruption in the states. Second, we estimate regressions with state fixed-effects to sweep out time-invariant unobservables and otherwise mitigate endogeneity bias (e.g. Levitt 1994).8 Finally, we look for trends in state corruption in the years leading up to or just after episodes of campaign finance reform. These methods are fairly standard in the evaluation literature; however, our task is complicated by the challenge of measuring public corruption in the states. 2.1 Public Corruption in the States As noted above, most empirical research on public corruption in the U.S. employs convictions data from the DOJ; however, in addition to the problems already mentioned, the Public Integrity Section does not disaggregate state-level conviction data by type of government official, nor do they provide state-level breakdowns for cases filed. For these reasons, we follow Cordis and Warren (2012) and Alt and Lassen (2011) in utilizing the TRACfed data archive compiled by the Transactional Records Access Clearinghouse (TRAC) at Syracuse University. TRAC systematically employs the Freedom of Information Act to make available to the public large quantities of records from various Federal agencies. Information on criminal cases from the DOJ is available beginning in 1986. Under license from TRAC, we collected data on all 8 In principle we could use instrumental variable methods to address potential endogeneity, but we are at a loss for credible instruments. Previous studies that consider the determinants of state campaign finance regulations suggest variables like party control of government (Stratmann and Aparacio-Castillo 2006) or the presence of an initiative process in the state (Witko 2005); however, party control of government is also a likely determinant of corruption, while there is too little variation over time in the number of initiative states. 7 convictions and case filings classified by prosecutors as official corruption. From this data, we created annual series of state level public corruption convictions and filings from 1986-2011. Figure 1 plots corruption convictions for federal, state and local officials over time. From this figure, it is apparent that convictions of state officials are relatively rare. So, while one advantage of TRACfed data is that it allows us to analyze corruption among state officials, the paucity of such convictions produces some challenges for our subsequent regression analyses. Figure 1 also suggests that federal prosecutors focus more on corruption among federal officials than non-federal officials. On the other hand, a recent report from the Corporate Crime Reporter claims the vast majority of state and local official corruption cases (as many as 80%) are handled by U.S. district attorneys.9 Even so, not all corrupt activity is observed or prosecuted, so convictions are at best a proxy for public corruption. We remain agnostic regarding how best to measure state public corruption and therefore utilize both total convictions in a state and convictions of only state government officials in our empirical analysis. Another advantage of the TRACfed data is the availability of prosecutorial filings in corruption cases disaggregated by state. Not all corruption can be demonstrated sufficiently in court to achieve a conviction, so prosecutorial filings give us another proxy for the presence of state corruption. Further, there is less delay from acts of corruption to filings compared to convictions (see below). Consequently, we perform all of our statistical analyses using both convictions and filings. 9 “Public Coruption in the United States,” 2007. Report by the Corporate Crime Reporter to the National Press Club, available at: http://corporatecrimereporter.com/corrupt100807.htm (last viewed June 25, 2012). 8 In order to compare corruption convictions and filings across states, we normalize these by the pool of government officials in the state. For example, we examine total official corruption convictions per 10,000 government full-time equivalent civilian employees (including employment in federal, state and local government); however, when restricting our attention to corruption convictions among state officials only, we examine convictions per 10,000 state government full-time equivalent employment (FTEs). In Figures 2a and 2b, we show how average conviction rates in the states vary from the 1990’s to the 2000’s. For total convictions per government FTE, there is a great deal of persistence in state-level corruption across all states; this underscores the importance of controlling for unobserved state-specific time invariant determinants of corruption. In addition Montana stands out as a particularly corrupt state by this measure (with North Dakota and New Jersey receiving dishonorable mentions). However, when limiting attention to only state officials convicted for public corruption, there are many more transitions from low corruption to high corruption and vice versa across decades. Also, by this measure, it is Illinois, Mississippi, Tennessee and West Virginia that exhibit the highest persistent levels of corruption. The differences observed across these two measures of corruption are the primary reason that we utilize both of these measures of corruption in our empirical investigation. 2.2 Delays in Case Filings and Convictions The TRACfed data archive also allows us to generate information on the median and average time from initial referral of a case to filing or conviction. From 1986-2011, the median time from referral to case filing is 112 days and the average is 260 days; for convictions the median and average times are 386 days and 556 days, respectively. Consequently, measures of 9 corruption based on filings and convictions generally lead the calendar year in which the associated corruption occurred. In addition, these data are reported on a fiscal year cycle, so will lead the calendar year by another 90 days. In order to identify the effect of changes in state campaign finance laws, it is necessary to take account of the delay in observing corruption filings or convictions. We address this complication in several ways. As a first pass, we examine patterns in the raw data over the course of decades in order to observe slow-moving trends. We then pool our annual data into five non-overlapping five-year waves; this permits us to examine the effects of state campaign finance regulations in year t on average corruption convictions and filings for years t through t+4. However, in order to utilize all of our annual data, we also consider two other strategies. We use leading averages to construct “adjusted filings” and “adjusted convictions” as a means to get a better proxy for public corruption occurring in a given state in a particular year. Based on the observed median and average number of days from referral to filing, we define “adjusted filings” in year t as the average of filings in years t and t+1. “Adjusted convictions” in year t are defined as the weighted average of years t through t+3, where the weights are introduced to account for the observed increase in median and average time to conviction of about 15 days per year over the 25-year time period.10 Even so, our subsequent regression results are little changed whether we use this weighted leading average or an unweighted leading average for adjusted convictions. 10 In 2010, “adjusted convictions” = .75(average convictions in years t through t+2) + .25(convictions in year t); for each prior year, the weights shift by .01 away from the second term in the sum. We do not use a similarly weighted average for filings, because we cannot reject the hypothesis of no linear time trend in either the median or average time to filing. 10 Finally, we analyze unadjusted annual convictions and filings and estimate eleven separate indicators for each year before and after the implementation of a particular reform from t-5 to t+5, as well as an indicator for the presence of that same reform for years t+6 and beyond. We then plot the estimated coefficients and 95% confidence interval for these indicators; this allows us to easily observe any delayed impacts of reform, as well as evidence of “reverse causality” from episodes of corruption to reform. Descriptive statistics for each of the measures of state corruption described above are listed in Table 1. The paucity of observed corruption among state officials is demonstrated by the high proportion of “zeroes” for each of our corruption measures (see Panel 2 of Table 1). Consequently, when analyzing corruption among state officials, we employ a Tobit model (see below). 2.3 State Campaign Finance Regulations All data on state campaign finance laws are taken from Milyo (2012), who in turn relied on several sources, including the National Council of State Legislatures, state government websites and the Federal Election Commission. As noted in Milyo (2012) and Primo and Milyo (2006), state campaign finance regulatory regimes fall into five broad and nested types: i) no contribution limits, ii) limits on corporate contributions to candidates, iii) limits on corporate and individual contributions to candidates, iv) contributions limits and public funding of gubernatorial elections, and v) contributions limits and public funding of gubernatorial and state legislative elections. Therefore, we create a campaign finance index (CFR) that ranges from 0 to 4, respectively. In addition to this simple index, we also examine the effects of the 11 component laws by employing separate indicators for limits on corporate contributions, limits on individual contributions and each type of public funding. Table 2 describes the number of states with each type of campaign finance law, as well as the average value of the campaign finance regulation index, by decade. Over the last 30 years, there has been a net increase in the number of states with contribution limits, and a smaller increase in the number of states that employ public funding of campaigns. However, because some states adopt, repeal and adopt campaign finance regulations over time (e.g., California and Missouri), the total number of changes is greater than the net change over time. 2.4 Campaign Finance Reform and Public Corruption: A First Look In Figures 3a and 3b, we consider the long-run association between average annual corruption convictions and the average state campaign finance regulation index over the last twenty years. Since many state campaign finance laws remain unchanged over this time period, any strong equilibrium relationship should be revealed in this diagram. However, there does not appear to be a strong negative (or positive) relationship between corruption and campaign finance regulations, regardless of whether we consider total convictions or only convictions among state officials. Figures 4a and 4b compare the change in the average campaign finance index from the 1990’s to the 2000’s to the change in average annual corruption rates from the same periods. In both figures, it is apparent that among states that did not change their campaign finance laws, the average change in corruption was about zero. The same is also true for the set of states that did change their campaign finance laws. These patterns in the raw data do not suggest that campaign finance reforms reduce public corruption. However, it may be the case 12 that some important determinants of state corruption are spuriously correlated with campaign finance regulations, masking the true causal relationship. Consequently, we now consider multivariate models that include controls for potential confounding variables. 2.5 Multivariate Evaluation Methods We estimate several different versions of linear models of state corruption rates where the independent variables of interest are indicators for each of the four major types of state campaign finance laws. All of these models include controls for year and state fixed effects, as well as controls for state demographics (age, education, ethnicity, income, race, population, poverty, unemployment and union membership), the state political environment (party control of state government, legislative term limits, FOIA laws and state government expenditures) and the number of government FTEs. Definitions and descriptive statistics for all of these control variables are listed in Table 3. In estimating every model, we adjust standard errors for clustering by state (Primo et al. 2007; Bertrand et al. 2004). We use both total corruption rates and rates that include only state officials for our dependent variable in alternative models. As noted above, our corruption measures for state officials contain many zero observations. These may be considered either true zeroes, or instances of censored data. We entertain both possibilities. In the former case, we simply estimate an ordinary least squares model with state fixed effects. By doing so, we follow the advice of Angrist and Pischke (2009), who argue that linear estimation is always useful for estimating marginal effects that have a causal interpretation.11 In the latter case, a Tobit model can be used; however, including state indicators will render the Tobit estimator biased and 11 We do not use count models, as these non-linear models also do not permit estimation with true fixed effects. 13 inconsistent. Instead, we control for unobserved time-invariant heterogeneity by including a “starting value”: the sum of convictions from 1976-1982 per 10,000 government FTEs.12 3. Results In this section we present the results of three different types of multivariate regression analyses; each with its own strengths and weaknesses. The first analysis examines the effects of campaign finance regulations on average corruption over five non-overlapping five-year waves; this is one method of addressing the delay between the occurrence of corrupt activities and the observation of prosecutorial filings or convictions, but we do lose the statistical power associated with more observations. The second analysis uses all of the state-year observations, but employs our measure of adjusted convictions and adjusted filings to address the lag in observed corruption. The third analysis differs from the second in that we use unadjusted measures of corruption, rather than our somewhat ad hoc adjusted measures. We address the time lag in observed corruption by plotting time indicators for several years before and after the implementation of each type of reform; this also permits us to check for the presence of time-varying unobserved trends in corruption that may be associated with adoption of reforms. Other than the number of observations, construction of the dependent variables and the presence of indicators surrounding episodes of reform, the statistical models examined are similar across each analysis. 3.1 Non-Overlapping Five-Year Waves In Table 4 we report the estimated coefficients of interest from the analysis of average state-level public corruption over five-year waves for both conviction rates (Panel 1) and filing 12 Cordis, Milyo and Patrick (in progress) note that this time period precedes several problems exhibited in the DOJ data series. 14 rates (Panel 2). Looking at the results in the first column of Panel 1, state campaign finance laws are neither individually nor jointly significant. 13 This pattern is repeated when we restrict attention to only state officials and\or employ filing rates as our measure of corruption. As noted above, neither the linear model nor the Tobit model is fully satisfactory in (2) and (3), so it is reassuring that these estimates are not dramatically different across the three models. Ignoring statistical significance, the substantive importance of these estimates is likewise modest. Consider the coefficient on corporate convictions in (1); the implied causal impact of limits on corporate contributions to state candidates is a drop in corruption convictions per 10,000 government employees of 0.04, or about 1/5th of a standard deviation in that variable. The implied effect of corporate limits on convictions among state officials is somewhat larger – about 1/3rd of a standard deviation ---, due to the smaller variance in convictions per 10,000 state government FTEs across states. Because this model does not differentiate between reforms that have been just implemented versus those that have been in place for some time, we also estimate the model using the number\log of years that a particular law has been in place (since 1976) as the dependent variable; these specifications also yield no significant effects of reforms. Likewise, we can replace the separate indicators for each type of law with the campaign finance regulation index, the natural log of that index or even the index squared without altering the implications of reform on corruption. 3.2 Annual Observations; Adjusted Corruption Rates 13 Of course, the imprecision in these estimates means that we also cannot reject the null hypothesis of some salutary effect of campaign finance laws on corruption. But neither can we reject the null of a similar perverse effect of reforms on corruption. 15 In Table 5, we present the results of a parallel analysis, except that we now estimate our models using all available state-year observations and employ our measures of adjusted corruption based on four-year leading averages in the role of dependent variable. With only one exception, we observe no statistically significant effects of state campaign finance laws (either individually or jointly) across all the model specifications. The lone exception is that state laws are jointly significant for adjusted filings in column (1) of Panel 2. As before, we also do not see any dramatic differences in coefficient estimates across models (1) – (3), or between convictions and filings. Again ignoring statistical significance, the substantive impact of state reforms is modest in this analysis, as well. For example, limits on corporate contributions to candidates now suggest a reduction in total convictions per 10,000 government employees of 0.10, or less than 1/3rd of the standard deviation in this variable. The implied effect of corporate limits is larger (one standard deviation) when restricting attention to only state officials, again due to smaller variance in this variable. As above, we have also estimated these models using the number\log of years that regulations have been in place, the campaign finance index, the log of that index and its square. These alternative specifications do not yield any significant effects of state campaign finance reforms on public corruption. 3.2 Time Trends Before and After Reform To this point, the only manner in which we have addressed the potential endogeneity of state campaign finance laws and corruption is through the use of state-level fixed effects. As noted above, we are not sanguine about the prospects for instrumental variables in this 16 context; therefore, we let the data for itself regarding the presence of any time-varying trends in corruption before or after episodes of reform. In order to check for the presence of confounding time trends changes in state corruption, we re-estimate our models above with a set of time indicators for five-year leads and lags of a given reform. Each type of state law is examined thusly in a separate regression; for example, when examining time trends around the implementation of corporate limits, we estimate the model in column (1) of Panel 1 in Table 5 using unadjusted conviction rates, but now we include separate indicators for five-years prior to adopting corporate limits, four years prior, and so on up to five years after the adoption of limits. In addition, we estimate a common effect for six years out and beyond. We then repeat this exercise for each of the state laws and for both unadjusted convictions and filings (as well as for state officials only). Figures 5-8 illustrate the estimated time paths for corruption conviction rates before and after the implementation of a specific reform, based on the estimated coefficients of the leads and lags. For example, in Figure 5, we show the time path for convictions for states that implement limits on corporate contributions. The estimated trend in convictions is shown in the solid line and the dotted lines indicate the 95% confidence interval. The fact that the confidence intervals always bound zero indicates that none of the leading or lagging indicators is statistically significant (nor can we cannot reject the null hypothesis that all of the lead or lag indicators are jointly zero). Consequently, we are fairly confident that there are no unobserved trends that confound our estimate of the treatment effect of corporate contribution limits in this case. 17 Figure 6-9 tell a similar story. And not surprisingly, we observe similar time trends when filings are used for the dependent variable. In no case do we observe anything like an inverted V-shape centered on t=0; this alleviates any concern that our fixed-effects models may be confounded by an endogenous relationship between reform and corruption. Nor do we see significant effects of any reform after some delay; this further alleviates concerns about the lag between acts of corruption and convictions (or filings). We don’t even observe significant reductions in corruption leading up to episodes of reform. All in all, state campaign finance reforms appear to be completely unrelated to public corruption. 4. Discussion We conduct the first systematic and comprehensive test of the hypothesis that state campaign finance reforms reduce actual instances of public corruption. We employ several modeling strategies to overcome the time delay between acts of corruption and observations of corruption, as well as addressing the potential endogeneity of reforms and corruption. Overall, we find that state campaign finance reforms implemented in that last 25 years have no significant effect on public corruption; nor do we observe any evidence to suggest that longer standing differences in state campaign finance regulatory regimes yield any reduction in public corruption. These findings are consistent with other research that demonstrates an absence of any treatment effect of state campaign finance regulations on public trust and confidence in state government (Milyo 2012). And while these findings may be unsurprising to scholars of American politics, they are wildly at odds with the popular wisdom espoused by many 18 politicians, reform advocates and media pundits.14 Beyond this, the apparent impotence of campaign finance regulations in ameliorating the “actuality or appearance of corruption” has dramatic implications for the longstanding legal rationale for all existing campaign finance regulations. Heretofore, many judges and legislators have considered it self-evident that restrictive campaign finance regulations are a prophylactic for public corruption; we demonstrate that this presumption is baseless. 14 The disconnect between the views of scholars of American politics and others is nicely demonstrated in a recent New York Times news analysis of the effects of Citizens United (Kirkpatrick 2010). 19 References Adsera, A., C. Boix, and M. Payne. 2003. “Are You Being Served? Political Accountability and Quality of Government,” Journal of Law, Economics and Organization, 19(2): 445-490. Alt, J. and D. Lassen. 2003. “The Political Economy of Institutions and Corruption in American States,” Journal of Theoretical Politics, 15(3): 341-365. Alt, J. and D. Lassen. 2008. “Political and Judicial Checks on Corruption: Evidence from American State Governments,” Economics and Politics, 20: 33-61. Alt, J. and D. Lassen. 2011. “Enforcement and Public Corruption: Evidence from US States,” working paper, Harvard University. Angrist, J. and J. Pischke. 2009. Mostly Harmless Econometrics: An Empiricists Companion. Princeton University Press (Princeton, NJ). Bertrand, M., E. Duflo, and S. Mullainathan. 2004. “How Much Should We Trust Differences-inDifferences Estimates?” Quarterly Journal of Economics, 119(1):249-275. Boylan, R. and C. Long. 2003. “Measuring Public Corruption in the American States: A Survey of State House Reporters,” State Politics and Policy Quarterly, 3(4): 420-438. Cordis, A. 2009. “Judicial Checks on Corruption in the United States,” Economics of Governance, 10: 375-401. Cordis, A. 2012. ”Corruption and the Composition of Public Spending in the United States,” working paper, University of South Carolina Upstate. Cordis, A., J. Milyo and M. Patrick (in progress). “Measuring Public Corruption in the States.” Cordis, A. and P. Warren. 2012. “Sunshine as Disinfectant: The Effects of State Freedom of Information Act Laws on Public Corruption,” working paper, University of South Carolina Upstate. “The Court’s Blow to Democracy,” 2010. New York Times, online edition at: http://www.nytimes.com/2010/01/22/opinion/22fri1.html (last viewed July 13, 2012). Dincer, O., C. Ellis and G. Waddell. 2010. “Corruption, Decentralization and Yardstick Competition,” Economics of Governance, 11: 269-294. Fisman, R. and R. Gatti. 2002. “Decentralization and Corruption: Evidence form U.S. Federal Transfer Programs,” Public Choice, 113: 25-35. 20 Glaeser, E. and R. Saks. 2006. “Corruption in America,” Journal of Public Economics, 90: 10531072. Goel, R. and M. Nelson. 2011. “Measures of Corruption and Determinants of US Corruption,” Economics of Governance, 12: 155-176. Hill, K. 2003. “Democratization and Corruption: Systematic Evidence from the American States,” American Politics Research, 31(6): 613-631. Johnson, N., C. LaFountain and S. Yamark. 2011. “Corruption is Bad for Growth (Even in the United States),” Public Choice, 147: 377-393. Kirkpatrick, D. 2010. “Does Corporate Money Lead to Political Corruption?” New York Times, online edition at: http://www.nytimes.com/2010/01/24/weekinreview/24kirkpatrick.html (last viewed July 13, 2012). Leeson, P. and R. Sobel.. 2008. “Weathering Corruption,” Journal of Law and Economics, 51: 667-681. Levitt, S. 1994. “Using Repeat Challengers to Estimate the Effects of Campaign Spending on Electoral Outcomes in the U.S. House,” Journal of Political Economy, 102 (1994): 777–798. Maxwell, A. and R. Winters. 2005. “Political Corruption in America,” working paper, Dartmouth University. Meier, K. and T. Holbrook. 1992. “I Seen My Opportunities and I Took ‘Em: Political Corruption in the American States,” Journal of Politics, 54(1): 135-155. Meier, K. and T. Schlesinger. 2002. “Variations in Corruption among the American States,” in Heidenheimer and Johnson (ed.). Political Corruption: Concepts and Contexts. Transaction Publishers (New Brunswick, NJ). Milyo, J. 2012. “Do State Campaign Finance Reforms Increase Trust and Confidence in State Government?” working paper, Political Economics Research Lab, University of Missouri. Nice, D. 1983. “Political Corruption in the American States,” American Politics Quarterly, 11: 507-511. Obama, Barack. 2010. “Giving Government Back to the American People,” weekly radio address (transcript available at: http://www.whitehouse.gov/blog/2010/05/01/weeklyaddress-giving-government-back-american-people; last viewed July 13, 2012). Primo, D., J. Milyo, and M. Jacobsmeier. 2007. “Estimating the Impact of State Policies and Institutions with Mixed-Level Data,” State Politics and Policy Quarterly, 7(4): 446-459. 21 Rosenson, B. 2009. “The Effect of Reform measures on Perceptions of Corruption,” Election Law Journal, 8(1): 31-46. Primo, D. and J. Milyo. 2006. “Campaign Finance Laws and Political Efficacy: Evidence from the States,” Election Law Journal, 5(1): 23-39. Stratmann, T. 2003. “Do Strict Electoral Campaign Finance Rules Limit Corruption?” CESifo DICE Report 1/2003, pp 24-27. Stratmann, T. and F. J. Aparicio-Castillo. 2006. “Competition Policy for Elections: Do Campaign Contribution Limits Matter?“ Public Choice, 127: 177-206. Witko, C. 2005. “Measuring the Stringency of State Campaign Finance Regulation.” State Politics and Policy Quarterly 5(3): 295-310. 22 Table 1: Public Corruption per 10,000 Government FTEs, 1986-2010 N Median Mean Standard Deviation Zero Values 1,250 1,250 0.22 0.26 0.29 0.36 0.32 0.40 15.2% 12.8 250 250 0.25 0.30 0.29 0.36 0.22 0.30 0.8% 0.0 1,150 1,250 0.25 0.28 0.30 0.36 0.34 0.34 2.3% 5.3 1,250 1,250 0.00 0.00 0.11 0.14 0.24 0.31 65.0% 64.4 250 250 0.06 0.07 0.11 0.14 0.14 0.19 34.8% 51.5 1,150 1,250 0.05 0.00 0.11 0.14 0.16 0.24 38.4% 50.6 Panel 1: All Public Corruption Reported Convictions Filings 5-Year Waves Convictions Filings Adjusted Convictions Filings Panel 2: State Officials Only Reported Convictions Filings 5-Year Waves Convictions Filings Adjusted Convictions Filings Note: Adjusted convictions are the average for years t to t+3, so are defined only for the period 19862008; adjusted filings are the average for years t to t+1. 23 Table 2: State Campaign Finance Regulations 1990 2000 2010 Changes 1980-2010 Changes 1986-2008 States with Contribution Limits Corporate 35 Individual 25 37 28 44 36 44 36 15 17 14 16 States with Public Funding Gubernatorial 6 Legislative 4 7 3 13 6 13 7 11 7 9 5 1980 Average CFR Index 1.40 1.50 1.98 2.00 50 44 for all 50 states Notes: CFR Index is the sum of the indicators for each type of law present in a state. Changes include instances of repeals as well as the adoption of campaign finance regulations. 24 Table 3: Descriptive Statistics for Control Variables (1986-2010; n=1,250) Mean Standard Deviation 334,341 80,217 360,403 68,175 State Demographic Controls % Black % Other Race % Hispanic % Under Age 18 % Age 65 and Over % High School Degree % College Degree % Union % Poverty % Unemployed Log (Real Per Capita Income) Log (Population) 10.0 6.0 7.3 25.6 12.6 81.8 23.4 13.1 12.9 5.5 10.4 15.0 9.4 9.6 8.7 2.3 2.0 6.5 5.2 6.0 3.7 1.8 0.2 1.0 State Political Characteristics Unified Control of State Government Democrat*Unified Control of State Government Legislative Term Limits FOIA Index Log(Real Per Capita State Expenditures) .42 .24 .26 6.1 8.5 .49 .43 .44 2.5 0.3 Government FTE’s in State Federal, State and Local State Notes: All data on state demographics, government FTE’s and state expenditures are from the U.S Census. Data on legislative term limits are from the National Council of State Legislatures. The FOIA index is taken from Cordis and Warren (2012). Partisan control of state government indicators were obtained from the archive of state data compiled by Carl Klarner at Indiana State University (http://www.indstate.edu/polisci/klarnerpolitics.htm). 25 Table 4: Effects of the Campaign Finance Regulations (Non-Overlapping 5-Year Waves) Total (1) OLS State Officials Only (2) (3) OLS Tobit Panel 1: Average Annual Convictions per 10,000 Government FTEs (N=250) Corporate Contribution Limits -0.04 (0.42) -0.12 (1.32) -0.04 (0.88) Individual Contribution Limits -0.00 (0.01) 0.07 (0.80) 0.04 (1.01) Gubernatorial Public Funding -0.07 (0.71) -0.03 (0.56) -0.05 (1.78) Legislative Public Funding -0.02 (0.17) 0.05 (0.61) 0.07 (1.35) No No No Joint Significance Panel 2: Average Annual Filings per 10,000 Government FTEs (N=250) Corporate Contribution Limits -0.00 (0.03) -0.05 (1.08) 0.03 (0.65) Individual Contribution Limits -0.00 (0.02) -0.00 (0.01) 0.01 (0.25) Gubernatorial Public Funding -0.04 (0.35) 0.03 (0.47) -0.03 (0.88) Legislative Public Funding -0.08 (0.65) 0.02 (0.26) 0.02 (0.34) No No No Joint Significance Notes: The dependent variables are leading averages from year t to t+4; the independent variables are from year t. Estimated coefficients and absolute value of t-statistics reported for each model (standard errors are adjusted for clustering by state). All models include indicators for each 5-year period and controls for state demographics and political characteristics. The OLS model also includes state indicators, while the Tobit model instead controls for convictions per government FTE from 1976-1982. 26 Table 5: Effects of Campaign Finance Regulations (Annual Observations) Total (1) OLS State Officials Only (2) (3) OLS Tobit Panel 1: Adjusted Convictions per 10,000 Government FTEs (N=1,150) Corporate Contribution Limits -0.10 (1.29) -0.11 (1.77) -0.05 (1.03) Individual Contribution Limits 0.06 (0.68) 0.06 (1.09) 0.05 (1.25) Gubernatorial Public Funding -0.07 (0.92) -0.01 (0.32) -0.04 (1.35) Legislative Public Funding -0.00 (0.06) 0.04 (0.71) 0.06 (1.00) No No No Joint Significance Panel 2: Adjusted Filings per 10,000 Government FTEs (N=1,250) Corporate Contribution Limits -0.10 (1.24) -0.05 (1.12) 0.04 (0.52) Individual Contribution Limits 0.10 (1.23) 0.01 (0.22) 0.02 (0.35) Gubernatorial Public Funding -0.09 (1.01) -0.00 (0.04) -0.03 (0.82) Legislative Public Funding -0.04 (0.51) -0.03 (0.58) -0.02 (0.25) Joint Significance p<.05 No No Notes: The dependent variables are adjusted based on leading averages. Estimated coefficients and absolute value of t-statistics reported for each model (standard errors are adjusted for clustering by state). All models include indicators for years and controls for state demographics and political characteristics. The OLS model also includes state indicators, while the Tobit model instead controls for convictions per government FTE from 1976-1982. 27 Figure 1: Public Corruption by Level of Government 0 100 200 300 400 (Source: TRACfed) 1985 1995 2005 Year Federal Local State 28 Figure 2a Public Corruption in the States: 1.5 Avg. Annual Convictions per 10K Gov't FTEs 2001 - 2010 1 MT ND DE NJ .5 LA 0 PA HI VA AL MI AZ ILCT NV OK CA FL MD MO AK OH OR TX AR SD INME GA NE WY NM SC UT CO KS WI NC VT WA MN NH IA ID 0 .2 MS MA TN WV KY NY RI .4 .6 1991 - 2000 Figure 2b: Public Corruption in the States: State Officials Only .4 Avg. Annual Convictions per 10K State Gov't FTEs CT MS RI .3 TN .2 .1 NE OR WI NV VT HI PA VA NC AZ MD TX OH MI WA WV GA NJ KS ID CO IA SD UT 0 IL AR NM MT AK 0 2001 - 2010 AL NY LA KY CA OKDE FL MA IN SC MO ME MN NH ND .1 .2 1991 - 2000 29 WY .3 .4 Figure 3a: Campaign Finance Regulations and Public Corruption 1 Annual Averages from 1991-2010 .8 MT .6 ND NJ MS .4 TN PA CA AL MO TX IN .2 VA IL OH NM OR UT CO ID KY CT WV AR AK GA OK WY SC NV SD NE NC KS WA NH HI RI FL MD AZ MI ME MN WI VT 0 IA LA NY MA DE 0 1 2 3 Campaign Finance Regulation Index 4 Figure 3b: Campaign Finance Regulations and Corruption: State Officials Annual Averages from 1991-2010 IL .3 MS TN NY WV KY .2 LA MA AR GA CT RI PA AL NJ FL SC WY DE OK MO CA TX .1 NM VA MT AK NC OH IN OR ND 0 UT 0 IA 1 ID CO HI ME AZ NE WA NV NH KS SD MD MI 2 3 Campaign Finance Regulation Index 30 WI MN VT 4 Figure 4a: Campaign Finance Reform and Public Corruption Difference in Annual Avg. from 1991-2000 to 2001-2010 .6 DE MT .4 ND -.2 0 .2 OR MI NV PA HI AL OK LA VA UT KS NM NJ TX IL MD SD WI NH IN NC MS IA MA AK AR FL GA WY SC AZ WA MO CT TN OH CO VT ID NE ME CA MN WV RI KY NY 0 .5 1 1.5 Campaign Finance Regulation Index 2 Figure 4b: Campaign Finance Reform and Corruption: State Officials .4 Difference in Annual Avg. from 1991-2000 to 2001-2010 CT .2 RI AL -.2 0 NM MT AK NE AR NJ VA OR MS NC MD NV WI GA TX PA KS MI HI IA SD OK UT IN DE WV FL MN NH ND IL TN WA LA NY SC KY MO OH VT AZ CO CA ID ME WY -.4 MA 0 .5 1 1.5 Campaign Finance Regulation Index 31 2 Figure 5: Effect of Corporate Contribution Limits -.4 -.2 0 .2 .4 (Estimates and 95% CI) -5 -4 -3 -2 -1 0 1 Year 2 3 4 5 6 7 Notes: Based on ordinary least squares regression of unadjusted total convictions per 10,000 government FTEs on indicators campaign finance laws, state demographics, state political characteristics, year and state-fixed effects (standard errors adjusted for clustering within state). The plot shows coefficient estimates and 95% confidence interval for time indicators from t-5 to t+5 (and a common indicator for t+6 and onward), where t coincides with the implementation of corporate contribution limits. 32 Figure 6: Effect of Individual Contribution Limits -.4 -.2 0 .2 .4 (Estimate and 95% CI) -5 -4 -3 -2 -1 0 1 year 2 3 4 5 6 7 Notes: Based on ordinary least squares regression of unadjusted total convictions per 10,000 government FTEs on indicators campaign finance laws, state demographics, state political characteristics, year and state-fixed effects (standard errors adjusted for clustering within state). The plot shows coefficient estimates and 95% confidence interval for time indicators from t-5 to t+5 (and a common indicator for t+6 and onward), where t coincides with the implementation of individual contribution limits. 33 Figure 7: Effect Of Gubernatorial Public Funding -.4 -.2 0 .2 .4 (Estimates and 95% CI) -5 -4 -3 -2 -1 0 1 Year 2 3 4 5 6 7 Notes: Based on ordinary least squares regression of unadjusted total convictions per 10,000 government FTEs on indicators campaign finance laws, state demographics, state political characteristics, year and state-fixed effects (standard errors adjusted for clustering within state). The plot shows coefficient estimates and 95% confidence interval for time indicators from t-5 to t+5 (and a common indicator for t+6 and onward), where t coincides with the implementation of gubernatorial public funding. 34 Figure 8: Effect of Legislative Public Funding -.4 -.2 0 .2 .4 .6 (Estimates and 95% CI) -5 -4 -3 -2 -1 0 1 Year 2 3 4 5 6 7 Notes: Based on ordinary least squares regression of unadjusted total convictions per 10,000 government FTEs on indicators campaign finance laws, state demographics, state political characteristics, year and state-fixed effects (standard errors adjusted for clustering within state). The plot shows coefficient estimates and 95% confidence interval for time indicators from t-5 to t+5 (and a common indicator for t+6 and onward), where t coincides with the implementation of legislative public funding. 35