Nario

advertisement

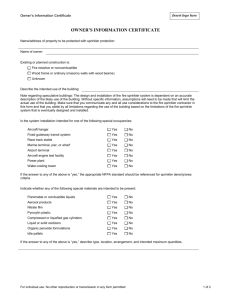

Feasibility Study of Residential Fire Sprinkler Systems in the Matanuska Susitna Borough Olga Narino University of Alaska Anchorage 4/6/2010 Final Draft—April 6, 2010 Feasibility Study of Residential Fire Sprinkler Systems In the Matanuska-Susitna Borough Capstone Project Prepared for: Department of Emergency Services Matanuska-Susitna Borough Prepared by: Olga Narino Graduate Student Master of Public Administration University of Alaska Anchorage April 6, 2010 Table of Contents Acknowledgements ......................................................................................................................... 4 Executive Summary ........................................................................................................................ 5 1. 2. 3. 4. Problem Statement .................................................................................................................. 7 1.1. Research Questions and Purpose of the Study ................................................................. 8 1.2. Background and Significance......................................................................................... 10 1.2.1. The study area ......................................................................................................... 10 1.2.2. Generalities about the Mat-Su Borough Fire Department ...................................... 11 1.2.3. Mat-Su Borough Fire Statistics ............................................................................... 11 1.2.4. Response Time ........................................................................................................ 14 1.2.5. Mat-Su Borough Fire Department Expenses .......................................................... 17 Literature Review.................................................................................................................. 18 2.1. Relevance to Public Administration............................................................................... 18 2.2. Fire Problem at the Residential Level and Approaches from Some Communities ........ 20 2.3. Tax Incentives for Fire Sprinklers .................................................................................. 23 Methodology ......................................................................................................................... 26 3.1. Introduction to Cost-Benefit Analysis............................................................................ 26 3.2. Cost-Benefit Model ........................................................................................................ 26 3.3. Data Analysis ................................................................................................................. 28 3.3.1. Data Sources ........................................................................................................... 28 3.3.2. Estimation Cost-Benefit Model .............................................................................. 29 3.3.3. Findings................................................................................................................... 29 Summary, Conclusions and Recommendations .................................................................... 35 References ..................................................................................................................................... 38 Appendix A. Calculation Worksheet of Tax Credit in Montgomery County ............................... 41 Appendix B. Response Time, Fire Growth and Temperature Curve ............................................ 42 3 Final Draft—April 6, 2010 Acknowledgements 4 Final Draft—April 6, 2010 Executive Summary The incidence of the fire problem in the residential sector has increased in the last years in the state of Alaska. At the state level, fire statistics show the alarming increment of fire events and the negative outcomes (deaths, injuries and millions of property losses) from those fires in one- and two-family homes. This study evaluates the extent of the fire problem at the residential level of one- and two-family homes in the Matanuska Susitna Borough (MSB) and performs a Cost-Benefit Analysis (CBA) in order to know if there are net benefits for homeowners from the installation of fire sprinklers. Through this study, the Department of Emergency Services wants to elucidate the feasibility of a tax incentive by giving a property tax reduction for homeowners who install fire sprinklers in single and two-family homes. The rationale of the tax incentive is to encourage the voluntary installation of built-in fire protection in order to promote a more proactive fire policy and help the fire department to be more cost-effective in the provision of fire services to the community. For the mentioned purpose, this study analyzes the trends of fire statistics compared with the capabilities of the MSB Fire Department to establish the degree of the need of a more proactive fire protection through the promotion of fire sprinklers. The analysis of the fire statistics such fire rates, average losses, response times and fire department expenditures leads to the conclusion that the fire problem is highly significant at the residential level of one- and twofamily homes and that there is a case towards the adoption of a more proactive fire protection policy. The CBA follows the methodology developed by Butry et al (2007), who implement a CBA at the residential level of one- and two-family homes nationally. The results from the CBA do not find evidence to promote the voluntary installation of fire sprinklers. The expected present value of the costs exceeds the expected net present value of the benefits on a 30-year study period. The main reason for this finding is the extremely high up-front and installation costs of the fire sprinklers. This study recommends to direct the attention toward the sprinkler industry in 5 Final Draft—April 6, 2010 the local area to identify the primary reasons behind the high cost of fire sprinklers in the MSB in comparison to the cost in other communities. It is probable that addressing the high cost of the fire sprinklers can lead to a better results in the future because only the present value of the benefits were consistent and close to the national estimates. In addition, a final recommendation is to increment the awareness of the fire problem at the residential level in order to start building partnerships and mobilizing stakeholders toward a more proactive fire protection policy, which embraces new, proven technology and built-in protection like the sprinkler systems. 6 Final Draft—April 6, 2010 1. Problem Statement The incidence of the fire problem in the residential sector has increased in the last years in Alaska. Fire safety is a pressing issue at the level of one- and two-family homes where the statistics show a high occurrence of fires. On average, at the state level, fires in residential properties account for 74% of the total fires in structures, and more than two-thirds of the fires in residential properties occur in one- and two-family homes where the percentage of fire events is increasing (see Figure 1). The critical issue when studying the fire problem is the loss of lives and money. On Figure 2 can be seen that most of the civilian fire deaths occur in one- and two-family homes. According to the 2008 Fire in Alaska Report, these fires caused an estimated direct loss of $18 million, which is the biggest dollar loss among different types of residential occupancy. In consequence, the statistics show that the state suffers many fatalities and millions of dollar loss because of residential structure fires, with the statistics increasing each year. Figure 1. Percentage of Fires in Residential Structures in Alaska Figure 2. Number of Fires Deaths in Residential Structures in Alaska Total civilian fire deaths % Fire in residential properties Total civilian fire deaths in residential structures % Fire in 1 & 2 family homes 73.62 69.45 2005 74.64 70.94 2006 72.40 Fire Deaths in 1 & 2 family homes 75.65 20 17 75.10 12 21 20 20 24 21 21 2006 2007 19 16 13 67.74 2007 2005 2008 Source: State of Alaska fire statistics. 2008 Source: State of Alaska fire statistics. Because of the high incidence of the fire problem in residential structures of one- and two-family homes, the Department of Emergency Services in the Matanuska-Susitna Borough wants to implement a preventive approach. Since the Alaska House Concurrent Resolution No. 1 of the 26th Legislature (2009-2010) encourages the voluntary installation of fire sprinkler 7 Final Draft—April 6, 2010 systems in residences, this study—as requested for the Mat-Su Borough—intends to evaluate if a tax incentive to homeowners for the installation of fire sprinkler systems is viable in newly constructed one- and two-family homes. For that purpose, this study attempts to demonstrate whether or not an individual homeowner may receive net benefits from the installation of a fire sprinkler system. The findings of this study would help to promote a proactive fire protection rather than a reactive fire protection to decrease the incidence of fire problem at the level of one- and two-family homes. Reactive fire protection refers to the traditional fire service where the fire department has to suppress the fire event by beating the clock and arriving soon enough to have a positive impact on the emergency incident. Proactive fire protection is an approach that embraces new, proven technology and built-in protection like the sprinkler systems combined with public education programs (City of Scottsdale Study, 1997). 1.1. Research Questions and Purpose of the Study At the national level, the relevance of a proactive approach has been proved through economic feasibility studies that compare communities with and without fire sprinkler systems and estimate the cost and benefits of such measure (Scottsdale’s 10-year study, 1997; Weatherby, 2009; National Fire Protection Association [NFPA], 2008; Butry et al, 2007). Specifically, this study addresses the following research questions: Would the Mat-Su Borough community be better served with a more proactive fire protection rather than relying in a more reactive fire protection? What are the cost and benefits of fire sprinkler systems at the residential level of one- and two-family homes for an individual homeowner? In order to establish the need of fire sprinkler systems at the level of one- and two-family homes in the Mat-Su Borough, this study, first, will identify the current capabilities of the fire department in comparison with the fire protection needs of the Matsu Borough community. As 8 Final Draft—April 6, 2010 the community grows, fire stations and firefighters must be added to provide this service as the need increases. However, the true outcome of these increases in reactive fire protection has to be analyzed with a review of the fire fatalities, injuries, dollar loss, and the response time to evaluate the performance of the Mat-Su fire department. Second, once the installation cost of a residential fire sprinkler system for new construction is estimated, this study also will estimate the expected savings (benefits) for an individual homeowner with this proactive fire protection policy. For this purpose, the analysis must consider the tax incentives for the homeowner1, amount of reduction of the home insurance with a sprinkler system, the value of the direct and indirect property losses averted, and the monetary value of the deaths and injuries prevented. It is very important to mention that the adoption of a tax incentive to promote sprinkler systems will not change the role or function of the fire department in the Mat-Su Borough community, but it will enhance the department’s ability to effectively and safely perform. In addition to climatic, geographic, and topographic considerations that may support the need for built-in fire protection, the National Fire Sprinkler Association [NFSA] lists some of the positive impacts of a proactive fire safety policy on fire department in a community: Acceptable increases in fire response times Better and safer utilization of staffing and equipment Reduced out-of-service time while on scene at fire calls Reduced worker’s compensation and injury expenses More flexible station locations, based in medical emergency needs According to NFSA’s report, a logical case can be made for property tax incentives for homeowners that install sprinklers. If the homeowner is going to bear some of the burden of fire protection, and thereby reduce demands on community fire protection services, he or she should be given a corresponding reduction in the financial support they are being asked to contribute to the community effort (p. 30). 1 9 Final Draft—April 6, 2010 1.2. Background and Significance 1.2.1. The study area The Mat-Su Borough lies in the heart of south central Alaska, encompassing more than 25,000 square miles of rolling low lands, mountains, lakes, rivers and streams. There are three incorporated cities within the Borough: Houston, Palmer, and Wasilla. Additionally, there are several unincorporated communities and twenty-five recognized community councils (2003 Fact Book). According to Alaska Department of Labor and Workforce Development, Research and Analysis Section (January, 2010), the estimated Mat-Su population for the year 2009 is 84,314. This estimate represents a 3.8% average annual increase in the population growth rate between the years 2000 and 2009. The population growth of 24,992 between 2000 and 2009 is bigger than the population growth of 19,639 between 1990 and 2000. However, the rate at which the population is growing is decreasing steadily since 2005 (see Figure 3). According to Ray (2002) and other studies from NFSA, as population grows fire departments try to maintain their current level of quality response and fire safety, which in turn brings fire protection challenges for the need of additional apparatus, facilities, staffing, and building and fire codes to keep a certain level of quality. Figure 3. Mat-Su Borough Population Growth 2001-2009 Percent Change 6 5 4 5.19 4.95 4.28 4.11 4.21 4.33 3 3.32 3.21 2.29 2 1 Source: Alaska Department of Labor and Workforce Development. 10 Final Draft—April 6, 2010 1.2.2. Generalities about the Mat-Su Borough Fire Department The Mat-Su Borough (MSB) Fire Department provides fire protection services through ten fire service areas: Caswell Lakes, West Lakes, Butte, Sutton, Talkeetna, Big Lake, Meadow Lakes, Willow, Wasilla-Lakes, and Greater Palmer. These fire service areas cover all but the most sparsely populated communities at the northern and eastern fringes of the Borough. The Wasilla-Lakes is the biggest fire service area, which is also known as the Central Mat-Su Fire Department (CMSFD)2 and encompasses 160 square miles of area within the core area of the Mat-Su Borough. The MSB Fire Department operations depend on voluntary personnel to effectively function during emergency and non-emergency situations. Hence, fire protection services are provided by a network of paid-on-call trained responders managed by the Borough’s Department of Emergency Services. Most of the revenue sources come from appropriations of property taxes. The size, population, and taxable mill rate of the fire service areas vary from community to community. Fire apparatus are housed in stations throughout the Borough to enable rapid response to emergencies (2003 Fact Book). 1.2.3. Mat-Su Borough Fire Statistics In 2008, the MSB Fire Department responded to a total of 253 fires, according to the estimates from the National Fire Protection Association (NFPA) report for the Mat-Su Borough (1999-2008). This represents an increase of 0.4% in the total number of fires between 2007 and 2008. Fires in residential structures of one and two family homes represent 27% (68 fires) of all reported fires incidents in the Borough. Figure 4 shows a breakdown of fires by major property class in 2008. In that figure can be seen that fires in residential structures account for almost one third among all fires incidents and that fires in one and two family homes basically explain the significance of the fire problem at the residential level. 2 This department operates from seven fire station/public safety facilities and protects approximately 38,000 full time residents, or approximately 48% of the borough population. This number increases by at least 5000 to 6000 during the summer tourist season (Matanuska Susitna Borough Website, MSB Fire Department History). 11 Final Draft—April 6, 2010 Figure 4. Figure 5. Reported Fire incidents by Major Property Class 2008 Percentage of Fires in Residential Structures in the Mat-Su Borough % Fires in 1 & 2 family homes Fires 1 & 2 family homes 27% % Fires in all residential structures Other residential fires Non-residential structure fires 57% 13% 92.86 98.08 80.39 77.78 2003 2004 91.46 87.04 92.31 88.31 72.22 80.60 73.03 70.64 2005 2006 2007 Non-structure fires 3% Source: NFPA Report for Mat-Su Borough (1999-2008) 2008 Source: NFPA Report for Mat-Su Borough (1999-2008) For the 2003-2008 period, the number of fires in one and two family homes as percentage of fires in all residential structures were at their peak in 2005 (98.08%) (see Figure 5). Overall, at the residential level, the fire problem is concentrated in one and two family homes. Similarly, the number of fires in residential structures dominates the fire problem among different structures. On average, fires in residential structures account for approximately 75% of all structure fires and that percentage has remained approximately at the same level between 2003 and 2008. Fire incident rates per ten thousand population at the level of one and two family homes were examined for the 2003-2008 period (see Figure 6). As the community grows, the rate decreases until 2006 when the increase in the number of fires explains the increase in the rates. Figure 6. Fire Rates in 1 & 2 Family Homes per Ten Thousand Population 2003-2008 Fire Rates 12.00 10.00 8.00 6.00 4.00 2003 2004 2005 2006 2007 Source: NFPA Report for Mat-Su Borough (1999-2008) 12 2008 Final Draft—April 6, 2010 Property losses are significantly high for one and two family homes. Table 1 exhibits fire loss by major property class. Although Figure 4 shows that 27% of all fires occur in one and two family homes, they account for the majority of losses. The last column in Table 1 shows this finding: fires in one and two family homes account for more than two-thirds of the fire losses. Table 2 shows that the average property loss in one and two family homes for the period 2003-2008 is $32,554. When property loss is adjusted to 2005 dollars, the average loss is $32,097. There is no a clear trend in the evolution of the average loss during the period in analysis. According to NFPA, it should be kept in mind that property loss totals can change dramatically from year to year because of the impact of occasional large loss fires. All reported fires in the last decade in one and two family structures caused one fatality in the year 2003 and caused five injuries (three injuries in 2003, one in 2004, and one in 2008). Table 1. Direct Property Loss in Mat-Su Borough (2003-2008) Fire Losses by Major Property Class Year 1&2 Family Homes Other residential structures Nonresidential structures Fire Loss in 1 & 2 Family Homes Nonstructure fire As Percentage of Losses in All Residential Structures 99.74 98.16 100.00 80.64 100.00 98.92 2003 1,716,625 4,500 500 203,275 2004 3,198,900 60,000 274,500 99,500 2005 1,504,900 0 356,250 119,200 2006 1,924,600 462,000 187,700 20,825 2007 2,410,800 0 40,500* 26,000 2008 1,413,376 15,500 1,726,500 151,350 Source: NFPA Report for Mat-Su Borough (1999-2008) * Does not include a fire loss of $13,299,100 from a fire in school and college. As Percentage of Losses in All Type of Structures 99.71 90.53 80.86 74.76 98.35 44.79 As Percentage of Losses in All Fire Incidents Table 2. Average Property Loss in 1 & 2 Family Homes (2003-2008) Year Average Loss Damage in Current Dollars Average Loss Damage in 2005 Constant Dollars 2003 22,888 2004 41,012 2005 29,508 2006 40,949 40,180 2007 2008 20,785 Average for 32,554 the period Source: NFPA Report for Mat-Su Borough (1999-2008) 13 24,198 42,266 29,508 39,679 38,088 18,844 32,097 89.18 88.05 75.99 74.16 97.32 42.74 Final Draft—April 6, 2010 1.2.4. Response Time Response time is an indicator that helps evaluate the performance of fire departments and allows comparison with the accepted standards. In the case of fire departments when facing an emergency situation, prompt response is the most critical factor that determines success or failure in the service delivery. Routley (n.d.) explains the different ways to measure response time and affirms that in the past, most agencies reported average response time as the basic index of performance. More recently, most agencies have adopted fractile response time reporting as a more appropriate performance measurement system. A fractile measure refers to how often a particular objective or benchmark is achieved. The benchmark is set at the upper limit of acceptable performance. “If the benchmark is set, for example, at “7 minutes or less”, any response that takes 420 seconds (7 min:00 sec) or less is classified as a “pass” and any response that takes 421 seconds (7 min:01 sec) or more is classified as a “fail”. The measure is commonly expressed as “X” percent within 7 minutes or less. A system that achieves 80 percent within 7 minutes or less is clearly performing better than a system that achieves 60 percent within 7 minutes or less” (Routley, “Fractile Response Times”, n.d.). All of the nationally accepted performance standards have adopted fractile measurement systems. The national standards have been defined by the NFPA for both career and volunteer fire departments. The staffing systems used by the fire service in the United States principally include career, paid-on-call, and volunteer personnel. Any given fire department may be staffed in one manner or in a combination. The NFPA treats volunteer and career departments differently when it comes to response time standards. For those departments that are substantially (>80%) career there is NFPA 1710. For departments that are substantially (>80) volunteer there is NFPA 1720 (Hensler, 2008). Since the Mat-Su Borough (MSB) Fire Department is a volunteer fire department with about 95.6% of volunteer personnel, the standards that would apply are NFPA 1720: “Standard of Fire Suppression Operations, Emergency Medical Operations, and Special Operations to the 14 Final Draft—April 6, 2010 Public by Volunteer Fire Departments, 2010 Edition. The first edition of this benchmark standard was issued in 2001. It provides an organized approach to defining levels of service, deployment capabilities, and staffing levels for volunteer fire departments. NFPA 1720 strongly emphasizes pre-planning and establishing pre-determined response procedures and standard response assignments for dispatch and response. Some specifics of NFPA 1720 regarding the staffing and response times include: Urban Zones with >1000 people/sq. mi. call for 15 staff to assemble an attack in 9 minutes, 90% of the time. Suburban Zones with 500-1000 people/sq. mi. call for 10 staff to assemble an attack in 10 minutes, 80% of the time. Rural Zones with <500 people/sq. mi. call for 6 staff to assemble an attack in 14 minutes, 80% of the time. Remote Zones with a travel distance ≥ 8 mi. call for 4 staff, once on scene, to assemble an attack in 2 minutes, 90% of the time. As of 2009 (Alaska Dept. of Labor), there were 84,314 people residing in the Mat-Su Borough, which encompasses an area of approximately 25,260 square miles. Thus, the population density is about 3 people per square mile. However, about half of the borough population is located in the “core area” which encompasses approximately 100 square miles between and around the cities of Palmer and Wasilla (2003 Fact Book). This means that the current population density is about 500 people per square mile in the core area, but future development may increase the population density to 500 to 1000 people per square mile in this area. Therefore, the MSB Fire Department falls under the standards defined for suburban and rural zones. Figure 7 shows the average response times and the fractile response time of the MSB Fire Department. The response time data do not discriminate the response time by type of fire incident or type of structure (residential or commercial), so the data reflect the overall response of the department to any fire in the MSB. On average response time has increased throughout the last eight years from 10 minutes to 12 minutes and 30 seconds approximately. This increase 15 Final Draft—April 6, 2010 suggests that response times are getting longer, and hence, the effectiveness in the response to any fire incident has decreased. According to Routley (n.d.), the problem with the average response time is that reduces a range of information to a single number and does not provide an adequate indication of performance for most situations. When using the fractile response time, the overall picture of the response time of the MSB Fire Department gets worse. The response time in 80% of the calls ranges from 13 minutes to 19 minutes throughout the period 2000-2008 (see Figure 7). As in the case of the average response, the rising and increasing trend in the response time in 80% of the cases means that performance is worsen. In 2008, the MSB Fire Department fractile response at 80% was 19 minutes and at 90% was 24 minutes. These results do not meet the national standards presented in NFPA 1720. Note the big gap between current 80% fractile response time and the standard of 10 minutes, 80% of the time. Figure 8 shows that at 10 minutes, less than 60% of the calls are responded. It would be necessary to determine whether this shift has resulted from heavier traffic that is slowing down response speeds or from a rising number of calls in the more remote places of the coverage area. Figure 7. Figure 8. Mat-Su Borough Fire Department Fractile 10 Minutes or Less (2000-2008) Mat-Su Borough Fire Department (MSFD) Response Time (2000-2008) 20.0 Minutes 17.5 MSFD Fractile (10 Minutes or less) 15.0 64.4 56.2 54.6 56.8 51.8 53.3 52.5 12.5 10.0 48.3 48.7 7.5 MSFD at 80% Fractile Response Time MSFD Average Response Time Standard Source: Mast-Su National Fire Incident Reporting System (NFIRS) Response Times. Source: Mast-Su National Fire Incident Reporting System (NFIRS) Response Times. 16 Final Draft—April 6, 2010 In conclusion, time is a critical element when analyzing the performance of fire departments. Fire growth can expand at a rate of many times its volume per minute (see Appendix B for the illustration of fire growth over time and the sequence of events that may occur from ignition to suppression). Time is the critical factor for the rescue of occupants and the application of extinguishing agents to minimize loss. The time segment between fire ignition and the start of fire suppression has a direct relationship to fire loss. 1.2.5. Mat-Su Borough Fire Department Expenses Historical administrative information of the MSB Fire Department allows the development of a picture of financial performance of the department. Usually the budgeted revenue covers the department expenditures. Thus, indicators of the expenditure side will help assess the level of resources consumed for service provision. Although the department expenditures cannot be specified by sector served (residential or commercial), the trend of the Figure 9. Figure 10. MSB Fire Department Expenditure (2005 Constant Dollars) MSB Fire Department Expenditures Per Capita (2005 Constant Dollars) $8 $7 $6 $5 $4 $3 $2 $1 $0 $60 $50 Dollars Millions Dollars expenditures is an indicator for monitoring the department’s capabilities in service provision. $40 $30 $20 $10 $0 Operating Expenses Source: MSB Fire Dept, Administrative Information. Capital Expenses Source: MSB Fire Dept, Administrative Information. Figure 9 shows the evolution of the department expenditures in 2005 constant dollars. Note that during almost the first half of the current decade, the total expenditures remain more or less constant or stable at a level of $3.5 million on average. However, after 2004, the total expenditure has a constant increase until 2007, when the expenditure changes its trend. Although 17 Final Draft—April 6, 2010 it is very difficult to establish the causality of this trend or to know what sector served is demanding more fire service, this indicator shows that there has been an extraordinary increase in the allocation of resources to provide fire services. As population grows, it is expected to have more expenses for fire protection, but Figure 3 shows that Mat-Su population is growing at a slower pace in the last years. Hence, the increase in the expenditures must be associated with the increasing number of fires in the last years. Figure 10 shows the fire department expenses by function on per capita basis. This figure shows that operating expenditures (personnel plus non-capital expenses) remain constant until 2004 when there is an abrupt increase from $35 to $50 approximately. Since 2005, the operating expenses have remained more or less constant at a higher level of $50 per individual resident. The capital expenditures per capita have also increased in the last years. From the fire statistics in previous sections and the trends found in this section, it is possible to conclude that the MatSu Fire Department expenditures is increasing but the outcome from the services is not improving. For example, there has been an increase in the response time, which implies that the department is taking more time to arrive to the fire scene. At 10 minutes or less, the number of fire calls responded out of the total calls is decreasing in the last years from 56.8% to 48.7% (see Figure 8). 2. Literature Review 2.1. Relevance to Public Administration The advance of a fire safety policy such as the promotion of a built-in protection through fire sprinkler systems is an issue that falls within the field of public policymaking in which there is a constant debate about the lines between public and private issues. Different interests demand that government “get in” or “stay out” of an issue, depending upon the values of the competing groups or interests and the extent to which they benefit or suffer from such action. The majority of fire deaths in the country and millions of dollars in loss attributed to the direct and indirect costs associated with residential fires make the case for state and local governments to seek the solutions to this national tragedy. However, since public policies often 18 Final Draft—April 6, 2010 change the status quo by given benefits to some or taking away benefits from others, public policymaking reflects the commitments of public assets. As stated by Gerston (2002), when a policy is put into motion, some people will be happy about the decision, while others may attempt to get the policymakers to change their minds (and decisions). For that reason, implementing a proactive fire safety policy involves both building partnerships and mobilizing stakeholders in the process. Taking these actions will help to ensure the outcome focuses on the citizen and the quality of life of the community. According to the National Fire Sprinkler Association [NFSA]’s report Residential Fire Sprinklers: A step-by-step approach for communities, it is important to involve as many stakeholders in the process as possible and to ensure they engage in dialogue. The report recommends examining each stakeholder and evaluating the role that each plays in the process. Fire department, public policy leaders, building officials, home builders, fire sprinkler contractors, insurance agents, and citizens will have to work together from beginning to end to be successful. Bringing together as many stakeholders as possible is one consideration of Gerston (2002), who affirms that to advocate a public policy is necessary not only to survey and size up a political landscape but also to figure out who the key policy-change agents are and identify potential allies and opponents. Advocacy starts trying to persuade others to take a course of action: “selling that policy in the political arena”. However, in other instances, policymaking is done through taking advantage of what is called policy windows in the public administration jargon. Kingdon (2003) defines this concept as the opportunities for action on given initiatives that stay open for only short periods. One example of the policy window concept that concerns to the proactive fire safety policy is offered by Rubin (2010), who mentions that “in South Carolina in 2008, not long after a fire in a Sofa Superstore that killed nine firefighters, the legislature proposed a generous tax break for businesses and homeowners who put in sprinkler systems. State and local tax breaks would pay for up to 50 percent of the cost. The governor vetoed the measure, arguing that if 50 percent of the cost was paid by the public, the costs would be inflated, but the legislature overrode his objection and passed the tax break” (p. 56). In consequence, an open window 19 Final Draft—April 6, 2010 affects the types of governmental agenda, that is, the list of subjects to which people in and around government are paying serious attention at any given point in time. Despite policy windows rarity, the major changes in public policy result from appearance of these opportunities. In the case of South Carolina’s tax break for fire sprinkler systems, the catastrophic fire in the Sofa Superstore opened a window for advocates of greater measures over fire safety policy. That fire event provided legislature with a wonderful excuse to expand the fire safety measures. In conclusion, taking a preventive approach as a fire safety policy requires either advocacy or opportunities that open policy windows. Currently, the alarming fire statistics in the residential sector may be considered a strategy for winning others to the cause for fire sprinklers. Many times, some of the most effective advocates are those who have been directly affected by fire. In addition, it is also important to mention the policy values that underline this fire safety policy. As mentioned by NFSA, with a proactive approach, growth can actually provide the opportunity for community leaders to enhance quality of life and build fire safe communities. As community growth occurs, fire protection must be accepted as one of the essential services of government. The most important thing is to make sure that stakeholders understand what happens if no action is taken. 2.2. Fire Problem at the Residential Level and Approaches from Some Communities Several studies highlight the incidence of the fire problem in the country as well as the advantages of having a proactive instead of a reactive approach to the problem. Hall (2009) estimates $317 billion as the total cost of fire in the United States for the year 2006. Economic loss (property damage) represents $13.6 billion of this total. The author’s definition of the cost includes: i) a combination of losses caused by fire (direct loss such as property damage and indirect loss such as the cost of temporary housing, missed work, and lost business); ii) cost of prevention and suppression of fire; iii) the net cost of fire insurance which is the difference between the premium money taken in by fire insurers and the money paid out for claims; and iv) the building costs for fire protections. 20 Final Draft—April 6, 2010 Likewise, Ahrens (2008) identifies trends and patterns of the U.S. fire losses. The author finds that home fires dominate the structure fire problem. Even more important is the finding that 57% of all reported structure fires occurred in one- and two-family homes, which in turn accounts for 69% of the civilian deaths by major property class. These trends at the residential level either have remained relatively high or have increased when compared to statistics from two decades ago. For instance, the report American Burning Revisited (1987) shows that although the residential structure fires constituted only 25% of all fires, yet resulted in 74% of deaths, 62% of injuries and 43% of loss (1985 data). In absolute terms, there are more fire deaths in one- and two-family dwellings and apartments. These alarming statistics confirm why some communities around the country have taken a different approach to the fire problem in the residential sector. For example, in the study “Saving lives, saving money. Automatic sprinklers: A 10 year study” of the City of Scottsdale (1997), the effectiveness of the proactive policy to the fire problem has been proved. Scottsdale has a sprinkler ordinance that has been implemented since January 1, 1986. Since then, the local government promotes the use of built-in protection to replace some of traditional resources commonly used by the fire service. The Scottsdale’s study outlines all the steps that were taken to move forward the proactive policy for fire service. It mentions how the local government and fire department had to face the strong opposition of the residential building sector. The ordinance was developed once the community realized that despite the best efforts, large fire incidents often exceed the capacity of the local fire service. To reduce the opposition from builders there was a design freedom concept in the construction code with the focus on identifying which of the passive developments could be changed or modified to help reduce the initial cost of required sprinkler protection. Other factors that help to advance the ordinance were the analysis of the insurance cost for sprinklered and unsprinklered homes, the consistent reduction in the installation price of the sprinkler systems given the increased competition among sprinkler contractors, the expected reduction in operational and capital cost from the elimination of at least three fire stations. All of these factors 21 Final Draft—April 6, 2010 were compared with the changes in the number of deaths per fire event and the average reduction of the property loss. Other successful community that has benefited of residential fire sprinklers is Prince George’s County, Maryland. In the report prepared by Steve Weatherby (2009) are mentioned all the benefits after 15-year history (from 1992 to 2007) under the single-family residential dwelling fire sprinkler ordinance. With statistical comparisons the author demonstrates the effectiveness of sprinkler systems. The most obvious benefit is the direct impact in saving lives and reducing fire related injuries. Property protection is another important benefit; for example, the average loss per event in a non-sprinklered home was $9,983 per incident and $49,503 per incident when there was a fatality. The average loss for a sprinklered home was $4,883 per event and no fire deaths occurred in sprinklered-structure fires during the period studied. Weatherby (2009) shows that the per square foot cost to install the sprinkler system as in the City of Scottsdale3 has decreased over the years to under $2 per square foot, which is consistent with the average cost nationally. The NFSA attributes this reduction in the cost to new technology, combine with the development of an efficient industry and labor force to address the demand. In other words, competition forces drive the price down. Since the installation cost of residential fire sprinklers remains as a point of uncertainty and a potential barrier to broader adoption, the National Fire Protection Association [NFPA] (2008) performs a cost assessment of home fire sprinklers nationally (considering ten case study communities) and finds that the cost of sprinkler system to the homebuilder, in dollar per sprinklered square foot, ranged from $0.38 to $3.66 with the average cost being $1.61 per sprinklered square foot. Important variables that explain the differences in the installation cost are the extensive use of copper piping (instead of CPVC or PEX), an on-site water supply (instead of municipal water), local requirements to sprinkler additional areas like garages, and “The City of Scottsdale, Arizona, which have had a comprehensive sprinkler ordinance in place for single family dwellings, reported in 1997 that the average cost of system installation had been reduced from $1.14 per square foot in 1987 to $0.59 per square foot in 1997” (NFSA report). 3 22 Final Draft—April 6, 2010 higher local sprinkler permit fees. Complementary data to the cost analysis was the discounts of insurance premiums for sprinklered homes. The average premium discount is 7%. Butry et al (2007) focus not only on the cost part of the sprinkler systems at the residential level but also on their benefits. The authors present a cost-benefit analysis of fire sprinkler systems to measure the expected economic performance of those systems in newly constructed, single-family homes in the U.S. Butry et al (2007) apply the quantitative method of cost-benefit analysis, which uses the present value of net benefits equation for comparing benefits and costs attributed to the installation of a sprinkler system to a home with only smoke alarms. The benefits defined in this study include all the reductions in the risk of civilian fatalities and injuries, in homeowner insurance premiums, in uninsured direct property losses, and in uninsured indirect costs. The cost components are represented by the initial purchase and installation of the sprinkler system. Butry et al (2007) find evidence of the cost-effectiveness of the fire sprinkler systems that controverts the findings of the former study A Benefit-Cost Model of Residential Fire Sprinkler Systems, published in 1984. To reinforce their findings, Butry et al (2007) perform a sensitivity analysis which examines the influence of assumptions and input statistics. The sensitivity analysis confirms again the conclusions about the cost effectiveness of the fire sprinklers in single-family homes. Overall, all studies reflect that, on the one hand, the statistics of the fire problem at the residential level of one- and two-family homes are alarming, and on the other hand, the benefits of built-in protection surpass its costs. The requirement of installed fire sprinkler system improves life safety in the community regardless the role and operations associated with the fire suppression side of the fire departments. 2.3. Tax Incentives for Fire Sprinklers “Reduction in all forms of government spending, resulting from public pressure to reduce property taxes, is a prime factor in the future growth of the residential sprinkler concept. Many fire departments are forced to protect larger areas and more subdivisions with the same number 23 Final Draft—April 6, 2010 of, or even fewer people, in several communities since financial restrictions hamper a fire department’s ability to grow with the community. As a result, alternates to traditional firefighting techniques must be found. One of them is the use of residential sprinklers” (Madrzykowski and Fleming, 2002, p. 14). The use of fire sprinklers may be promoted by law or by tax incentives. This section illustrates some examples of communities that have implemented tax credits to increase the adoption of fire sprinkler systems. To promote the adoption of a more proactive fire safety policy, some local governments have approved property tax incentives for the installation of fire sprinklers at the residential level. Montgomery County, Maryland has been a precedent in the provision of a tax incentive for fire sprinklers. “Current law mandates that a home builder must offer residential fire sprinklers as an option and must sprinkler the model homes. This legislation provides a significant property tax benefit to families who choose this option” (NFSA, n.d., p. 30). The rationale for the tax incentive is to compensate the homeowners who install the sprinkler system given the burden that they would have to bear for fire protection, and thereby the expected reduced demand on community fire protection services, not to mention the external benefit (or positive externality) that neighbors receive in terms of reduced risk of fire close to their property. Thus, the tax incentive represents the corresponding reduction in the financial support homeowners are being asked to contribute to the community effort. Effective since September 18, 2000 residents of Montgomery are eligible for a one-time tax credit of up to 50 percent of their county property tax on dwellings (see Appendix A for the calculation of the tax credit). Thus, Montgomery County was the first county in the United States to offer this type of tax break. According to this law, the credit applies to owners of detached single-family houses and of any unit of a multifamily in which a fire sprinkler system is not required by law. Of course, the tax break cannot exceed the cost of the system (Freestone, 2000). Although Freestone (2000) affirms that Montgomery was the first county that introduced a tax credit for fire sprinklers, Madrzykowski and Fleming (2002) states that since 1981, the State of Alaska enacted into law a significant piece of legislation that has allowed tax incentives 24 Final Draft—April 6, 2010 for residential fire sprinklers. According to these authors, the law provides a property tax exemption of 2 percent of the assessed value of any structure if the structure is protected with a fire protection system. “The word “structure” is significant in the law, since it also applies to homes. In effect, if a home were assessed at $100,000 for purposes of taxation, the assessed value would be computed at $98,000, provided that it contained a fire protection system” (Madrzykowski and Fleming, 2002, p. 14). When looking at which Alaskan cities have implemented the mentioned tax exemption, Anchorage seems to be the only city that currently has the tax exemption for fire sprinklers. According to the Municipality of Anchorage’s official website, the tax exemption is available for a structure containing an approved fire protection system that is in working condition and incorporated as a fixture or part of the structure. The exemption is limited to an amount equal to 2% of the value of the area covered by the sprinkler. The state of South Caroline has also implemented a tax incentive for the installation of fire sprinklers at the commercial and residential levels. The law became effective on June 26, 2008. According to Entwistle (2008), participants who put sprinklers in residential or commercial buildings (where they are not required by law) are eligible for a 25% tax break in income tax from the local government and eligible to get 25% property tax credit of the cost of the system back from the state of South Carolina. Therefore, residents can save 50% on a sprinkler system. The previous examples show different approaches that local and state governments have adopted toward a more proactive fire safety policy. Each of these approaches will be considered in the estimation of the cost-benefit analysis (CBA) presented in the next section. CBA is an economic model that will help evaluate the benefits and costs of the adoption of sprinkler systems in the Mat-Su Borough. 25 Final Draft—April 6, 2010 3. Methodology 3.1. Introduction to Cost-Benefit Analysis The economic impacts of a public policy related to fire safety protection through the voluntary installation of fire sprinkler systems can be measured with the quantitative method of cost-benefit analysis. This method helps to judge whether a particular program or policy is worth its cost, which is a constant problem in public policy choice. Cost-benefit analysis (CBA) provides a method for categorizing and quantifying the costs and benefits that occur over time of a policy (Steinemann et al, 2005). The analysis estimates whether the gain to society (benefit) from the policy is greater than the social sacrifice (cost) required to produce the policy. If so, the policy is worthwhile (Mikesell, 2007). In economic terminology, worthwhile policies improve economic conditions because they direct resources where their use provides a greater return than would alternative uses. 3.2. Cost-Benefit Model In order to perform a CBA, the benefits and costs need to be expressed in monetary terms. This requirement may be difficult to accomplish in the evaluation of public policies because public sector goals are often broader and many services has no clear market prices. Even if costs and benefits can be quantified, as stated by Steinemann et al (2005), public decisions often require considering more than monetary effects. For the purpose of this study, variables that can be easily quantified in monetary terms will be included as proxy of the costs and benefits. Information on variables that have not a clear market price or are difficult to quantify in monetary terms will be taken from national studies and statistics. The CBA proposed in this study follows the methodology developed by Butry et al (2007), who prove the economic benefits of fire sprinklers at the residential level of one and two family homes using national fire statistics. CBA applies a decision criterion to the discounted cost and return flows to summarize the economic case for the policy. Two criteria are often used: the benefit-cost ratio (BCR) which is the present value of benefits divided by the present value of costs, and the net present value 26 Final Draft—April 6, 2010 (NPV) which is the present value of benefits less the present value of costs. The equations (1) and (2) represent these two criteria, respectively: 𝐵𝑡 (1 + 𝑟)𝑡 𝐵𝐶𝑅 = 𝐶𝑡 ∑𝑇𝑡=1 (1 + 𝑟)𝑡 ∑𝑇𝑡=1 (1) 𝑇 (2) 𝑁𝑃𝑉 = ∑ 𝑡=1 (𝐵𝑡 − 𝐶𝑡 ) (1 + 𝑟)𝑡 Where: Bt is the dollar value of benefits in period t Ct is the dollar value of costs in period t T is the number of discounting time periods in the study period r is the discount rate per time period For economic efficiency, BCR has to be greater than 1 or NPV has to be greater than 0. Thus, the present value of benefits can be expressed as: 𝑇 𝑇 𝑡=1 𝑡=1 𝐵𝑡 𝐷𝐹𝑆 + 𝐷𝐴𝑉 + 𝑇𝐵 + 𝐷𝐼 + 𝐼𝑃 + 𝐷𝐶 + 𝐼𝐶 (3) 𝑁𝑃𝑉𝐵 = ∑ =∑ 𝑡 (1 + 𝑟) (1 + 𝑟)𝑡 Where: DFS is the value of the annual benefit from the discounted fire service fee in the property tax for the installation of fire sprinklers in one- and two-family homes DAV is the value of the one-time 2% discount of the assess value in the property tax for the installation of fire sprinklers in one- and two-family homes TB is the value of the one-time 50% discount in property tax DI is the value of death and injury averted due to sprinkler use IP is the value of the reduced homeowner insurance premium due to fire sprinkler protection DC is the value of uninsured direct cost averted (direct property loss) IC is the value of uninsured indirect cost averted (e.g., costs of temporary shelter, missed work, extra food cost, and medical expenses) 27 Final Draft—April 6, 2010 The present value of the costs can be expressed as: (4) 𝑇 𝑇 𝑡=1 𝑡=1 𝐶𝑡 𝑆𝑆 𝑁𝑃𝑉𝐶 = ∑ = ∑ (1 + 𝑟)𝑡 (1 + 𝑟)𝑡 Where: SS is the purchase and installation cost of a sprinkler system (includes materials and labor) 3.3. Data Analysis 3.3.1. Data Sources This section presents the data sources and the way of how some local fire statistics such as probability of fire, number of fire fatalities per fire and average fire loss are used to generate the analysis of this study. There are four main sources of data. The first source is the information from the Mat-Su Department of Emergency Services which collects local fire statistics (e.g., number of fires, number of fire deaths, number of fire injuries, and amount of property loss). The department derives these statistics from the National Fire Protection Association (NFPA) Analysis Report for the MS Borough for the period 20032008. This period is chosen given the relatively completeness and consistency of the data. Before 2003, the data show drastic changes (a significant decrease of cases reported) that may affect the estimates for the analysis. The second source is the information from the Mat-Su Borough Division of Assessment which lists and appraises all real and personal property in MS Borough. Assess values, mill levy rates, fire service area fees for fire protection is used to calculate the average tax break that an individual homeowner would receive with the installation of a fire sprinkler system. Also, information about the number of one and two-family homes in the MS Borough for the period 1999-2008 is used in conjunction with the NFPA Analysis Report to estimate the annual probability of fire occurrence in the residential level of one and two-family homes. Because the MS Borough does not have statistics of homes with sprinkler systems, this study considers the national estimates for homes with sprinkler systems to compare the MS Borough’s homes. 28 Final Draft—April 6, 2010 The third source is the information from Home insurance companies which provides data regarding discounts in the home insurance premium for residential fire sprinkler systems. Unfortunately, primary data about value of actual fire loss, amount of claim paid, and indirect costs of fire was not collected from this source because of proprietary issues. In consequence, some these variables are estimated taking the information from NFPA Analysis Report and national averages as well. The last source of information comes from local contractors of fire sprinkler systems which provide information about the installation cost of residential fire sprinklers. 3.3.2. Estimation Cost-Benefit Model This section presents the estimates for the present value of the net benefits that an individual homeowner of a single or a two family home may get with the installation of fire sprinklers. The model is estimated for a single home of 4,336 sq. ft. with garage and for a twofamily home of 3891 sq. ft. with garage. In the Mat-Su Borough, homes rely on different water supply sources (either city water or well water); hence, estimations of the benefit-cost model are performed having into account this distinction to reflect the reality of the Mat-Su community. Also, this distinction implies a difference in the cost of the fire sprinklers. Usually, homes that rely on well water have a higher installation cost of fire sprinklers. The interest rate used for discounting, the discount rate, represents the minimum acceptable rate of return on investment. This rate can be chosen by looking at the current real interest rate, which an individual would be willing to accept as an alternative minimum acceptable return on investment. For this purpose, the Treasury Real Yield rate—commonly referred to as “Real Constant Maturity Treasury rate” for 30 year maturity is used as the discount rate of this study (2.22% as of April 2, 2010). 3.3.3. Findings On average, throughout the 2003 to 2008 period, 35 out of 10,000 single-family and twohomes caught fire each year in the Mat-Su Borough (see Table 3). This is equivalent to 63 home 29 Final Draft—April 6, 2010 fires each year, leading to millions of dollar losses. Direct property loss averaged $2,008,014 each year, which is equivalent to $32,097 dollar loss per fire, both amounts in 2005 constant dollars (see Table 4). Table 3. Mat-Su Borough Estimates of Fires and Probability of Ignition Occurrence in One- and Two-Family Dwellings Year Fires Homes Ignition Probability 2003 2004 2005 2006 2007 2008 75 78 51 47 60 68 15,399 16,506 17,814 19,071 19,947 20,628 0.0049 0.0047 0.0029 0.0025 0.0030 0.0033 Mean 63 18,228 0.0035 Source: NFPA Report for Mat-Su Borough (1999-2008) and MSB Division of Assessment. Table 4. Mat-Su Borough Estimates of One- and Two-Family Homes Civilian Fatality and Injury Rate and Average Direct Property Loss Year Civilian Fatality Rate Civilian Injury Rate Total Direct Property Loss (2005 constant $) Average Direct Property Loss Per Fire (2005 Constant $) 2003 2004 2005 2006 2007 2008 0.0133 0.0000 0.0000 0.0000 0.0000 0.0000 0.0400 0.0128 0.0000 0.0000 0.0000 0.0147 1,814,869 3,296,767 1,504,900 1,864,897 2,285,270 1,281,382 24,198 42,266 29,508 39,679 38,088 18,844 Mean 0.0022 0.0113 2,008,014 32,097 Source: NFPA Report for Mat-Su Borough (1999-2008) Table 5 exhibits the input parameters for the estimation of the potential benefits of the installation of fire sprinklers. The reduced risk of civilian fatalities and injuries as well as the reduced expectation of uninsured direct property loss and indirect costs were adopted from Butry et al (2007) study because there is no existing information of sprinklered homes in the Mat-Su Borough to calculate the probability of those variables and compare it with non-sprinklered homes. Some other annotations need to be discussed. 30 Final Draft—April 6, 2010 First, the dollar value of the statistical life or injury adverted were also considered from Butry et al (2007). These authors approach the value of a life saved taking the median value of a statistical life reported by Viscusi and Aldy (2003), who estimated to be about $7 million in 2000 dollars. Butry et al (2007) adjusted this value to 2005 dollars, which represents $7.94 million, and this is the value adopted in this study as well. Regarding the value of an injury averted, similarly, Butry et al (2007) adopted the middle value reported in two studies from the U.S. Consumer Safety Commission (CPSC), which found estimates of $150,000 (in 2005 dollars) per injury from fires involving mattresses and $187,000 (in 2004 dollars) per injury involving upholstered furniture (Zamula, 2005, as cited by Butry et al, 2007). Hence, the value used for injury averted is $171,620. Second, three kinds of tax incentives for the estimation of the benefits are considered: i. One time 50% exemption in the property tax suggested by Montgomery case. ii. One time 2% exemption in the assess value of a property suggested by Anchorage case. iii. The combination of a one-time 2% exemption in the assess value plus a 25% discount in the fire service fee included in the property as suggested for the MatSu Department of Emergency Services. Fatalities Averted: With a 100% reduction in the fatality rate between unsprinklered and sprinklered homes, the expected present value benefit is $1,328.74. Injuries Averted: Assuming 57% reduction in injuries between unsprinklered and sprinklered homes, this yields an expected present value benefit of $83.78. Direct uninsured costs averted: The average property damage was estimated to be $32,097 per fire for unsprinklered homes in the Mat-Su. According to Butry et al (2007), insurance companies assume about 80% of the property loss (Ruegg and Fuller, 1994, as cited by Butry et al, 2007). Therefore, 20% would be the uninsured portion of the direct property loss that is not covered by the home insurance, which for the MS Borough would be equivalent to $6,419.40. Assuming 57% reduction in direct property damages, the present value benefit of $154.60. It is important to mention that more accurate estimates of property loss can be obtained from insurance companies. Unfortunately, for this study there was no cooperation from local insurance 31 Final Draft—April 6, 2010 companies, which were unwilling to provide information because of proprietary issues. The information from insurance companies would have helped have a precise figure of the costs as well as the estimate of the costs to insurance companies of claims for fire damage. The direct property loss used in this report comes from NFPA report, which collects guess estimates of this variable. Table 5. Calculation Present Value Benefits Input Parameters Probability of Fire Fatalities Averted Injuries Averted Direct losses Averted 0.0035 0.0035 0.0035 Given a Fire, Reduction in the Annual Probability of Per fire, Expected Number of Statistical Value of Fatality1 Fatalities Life 1.000 0.0022 7,940,000 Injury2 Injuries Injury 0.5679 0.0113 171,620 Direct Uninsured property loss3 Direct Uninsured property loss 0.3166 Indirect Uninsured Indirect cost Averted Insurance Credit 50% Property Tax Discount 2% Discount Assess Value 0.0035 Annual Premium5 861 Calculated Outputs 6,419.40 cost4 0.3166 Annual or One Time Benefits ($) Present Value Benefits ($) 61.14 1,328.74 3.85 83.78 7.11 154.60 0.14 3.09 86.10 1,871.26 980.80 1,171.13 980.80 1,171.13 34.90 41.51 34.90 41.51 Indirect Uninsured cost 1,284 Reduction in Annual Homeowner Insurance 0.10 One time Reduction Single home: $980.80 Duplex: $1,171.13 One time Reduction Single home: $34.90 Duplex: $41.51 Annual reduction Single home: $54.24 Duplex: $66.70 25% Discount 54.24 Fire Service Fee 66.70 Source: Format adopted from Butry et al (2007). Note: Present value benefits are based on a 30-year study period. 1-4 Estimates are taken from Butry et al (2007), who calculated these probabilities at the national level. 5 Average national home insurance premium as of 2007 (Insurance Information Institute, 2007). 1,178.83 1,449.63 Indirect uninsured costs averted: Munson and Ohls (1980, as cited by Butry et al, 2007) suggest to use 10% of the direct property loss as an estimate of the indirect costs. Since the average property loss estimates for the MS Borough is $32,097, the estimated indirect cost per fire is $3,209.70. According to Butry et al (2007) part of the indirect costs of fires are covered by insurances, which on average recognize 60% of the indirect costs. In consequence, 40% is the 32 Final Draft—April 6, 2010 uninsured portion of the indirect costs of fire, which for this study are $1284. Then, the present value benefit, assuming 32% reduction in indirect property damages, is $3.09. Insurance premium credit: The Alaska average insurance premium was estimated to be $861. According to information provided by State Farm, the discount for complete sprinklered homes (attics, garages, small bathrooms, closets etc.) is about 10%. Thus, the expected annual benefit is $86.10, and the present value benefit over 30-year period is $1871.76. Tables 6, 7, and 8 summarize the results of the CBA model for each of the three tax incentives options. The price per square foot of the fire sprinklers for the four home styles ranges from $3.53 to $4.22. Unfortunately, it was only possible to get the quotes from one contractor. Perhaps, having more quotes would have allowed getting more competitive prices. Overall, the quoted prices are very high in comparison with the costs from other studies at the national level (Butry et al, 2007; NFPA, 2008; Weatherby, 2009). Table 6. Tax Incentive Option #1 as Montgomery case One-time 50% exemption in property tax Benefits Fatalities averted Injuries averted Direct property losses averted Indirect cost averted Insurance credit 50% discount property tax (one time) Benefit subtotal Cost Purchase and installation cost Price per sq. ft. Cost Subtotal Net Present Value (NPV) Benefit-Cost Ratio (BCR) Single home with garage on city water Single home with garage on well water Duplex with garage on city water Duplex with garage on well water 1,328.74 83.78 154.60 3.09 1,871.26 980.80 4,422.27 1,328.74 83.78 154.60 3.09 1,871.26 980.80 4,422.27 1,328.74 83.78 154.60 3.09 1,871.26 1,171.13 4,612.60 1,328.74 83.78 154.60 3.09 1,871.26 1,171.13 4,612.60 15,286.00 3.53 15,286.00 -10,863.73 0.29 18,286.00 4.22 18,286.00 -13,863.73 0.24 13,420.00 3.45 13,420.00 -8,807.40 0.34 16,422.00 4.22 16,422.00 -11,809.40 0.28 From Tables 6 to 8 can be concluded that the installation of a sprinkler system in a new single home and two-family home is not very economical (costs outweigh the benefits). The comparison among the three tax incentive options leads to the conclusion that the option suggested by the MSB Department of Emergency Services yields to the smallest net loss for all 33 Final Draft—April 6, 2010 the home types. Consequently, the benefit-cost ratio of this option is also the biggest. The onetime 50% exemption in property tax is the second option with the smallest net loss. The results of this study, contrary to Butry et al (2007) findings, do not find strong evidence to demonstrate net benefits for an individual homeowner from the installation of a fire sprinkler system. Unfortunately, the installation costs in the local area exceed the national average costs. Table 7. Tax Incentive Option #2 as Anchorage case One-time 2% exemption in the assess value Benefits Fatalities averted Injuries averted Direct property losses averted Indirect cost averted Insurance credit 2% discount assess value (one time) Benefit subtotal Cost Purchase and installation cost Cost Subtotal Net Present Value (NPV) Benefit-Cost Ratio (BCR) Single home with garage on city water Single home with garage on well water Duplex with garage on city water Duplex with garage on well water 1,328.74 83.78 154.60 3.09 1,871.26 34.90 3,476.37 1,328.74 83.78 154.60 3.09 1,871.26 34.90 3,476.37 1,328.74 83.78 154.60 3.09 1,871.26 41.51 3,482.98 1,328.74 83.78 154.60 3.09 1,871.26 41.51 3,482.98 15,286.00 15,286.00 -11,809.63 0.23 18,286.00 18,286.00 -14,809.63 0.19 13,420.00 13,420.00 -9,937.02 0.26 16,422.00 16,422.00 -12,939.02 0.21 Table 8. Tax Incentive Option #3 as suggested by Mat-Su Borough One-time 2% exemption in the assess value plus 25% annual discount in fire service fee Benefits Fatalities averted Injuries averted Direct property losses averted Indirect cost averted Insurance credit 2% discount assess value (one time) 25% annual discount fire service fee Benefit subtotal Purchase and installation cost Cost Subtotal Net Present Value (NPV) Benefit-Cost Ratio (BCR) Single home with garage on city water Single home with garage on well water Duplex with garage on city water Duplex with garage on well water 1,328.74 83.78 154.60 3.09 1,871.26 34.90 1,178.83 4,655.20 1,328.74 83.78 154.60 3.09 1,871.26 34.90 1,178.83 4,655.20 1,328.74 83.78 154.60 3.09 1,871.26 41.51 1,449.63 4,932.61 1,328.74 83.78 154.60 3.09 1,871.26 41.51 1,449.63 4,932.61 15,286.00 15,286.00 -10,630.80 0.30 18,286.00 18,286.00 -13,630.80 0.25 13,420.00 13,420.00 -8,487.39 0.37 16,422.00 16,422.00 -11,489.39 0.30 34 Final Draft—April 6, 2010 4. Summary, Conclusions, and Recommendations This study examined the feasibility of the fire sprinkler systems at the residential level of one- and two-family homes in the Matanuska Susitna Borough (MSB). Since the voluntary installation of fire sprinkler systems is encouraged by the State of the Alaska, the MSB wants to evaluate if a tax incentive to homeowners would persuade them to install fire sprinklers. For this purpose, the study sought to answer two questions: Would the Mat-Su Borough community be better served with a more proactive fire protection rather than relying in a more reactive fire protection? What are the cost and benefits for an individual homeowner from the installation of fire sprinkler systems at the residential level of one- and two-family homes? To answer the first question, the study established the need for a more proactive fire protection by analyzing the trends of fire statistics compared with the capabilities of the MSB Fire Department. The fire protection in the MSB community is based primarily on a reactive approach, meaning that fire department follows the traditional fire service where the department has to suppress the fire event by arriving soon enough to have a positive impact on the fire incident. Overall, the analysis of the fire statistics led to the conclusion that the fire problem is highly significant at the residential level of one- and two-family homes. In 2008, fires in oneand two-family homes represented 27% of all reported fires incidents in the Borough. This is a very alarming finding along with the finding that on average 95% of fires in residential structures occur in one- and two-family homes. Even worse is the fact that losses in one- and two-family homes represent about 77% of the losses among all fire incidents. Hence, the residential level of one- and two-family homes dominates the fire problem in the MSB. When looking at the current capabilities of the Mat-Su Fire Department, the statistics are not good either. The response time, one of the most important performance indicators of fire departments, is increasing measured either with the average response time or with the fractile 35 Final Draft—April 6, 2010 response time. This indicator has worsened since the year 2006 when the 80% of the calls are responded between 17.5 minutes and 19 minutes. This response time does not meet the national standards established for volunteer fire departments, that is, to respond at 10 minutes or less in 80% of the time. In addition, a review of the MSB Fire Department total expenditures shows an increase after 2004 as well as the operating expenditures per capita, but these increases seems not to be related with the improvement of the outcomes in the fire service. In consequence, the analysis of statistics suggested that there is a case towards the adoption of a more proactive fire protection policy, which embraces new, proven technology and built-in protection like the sprinkler systems combined with public education programs. Fire sprinklers in one- and two-family homes would allow acceptable increases in fire response times, especially in cases like the MSB where the fire service is offered to sparsely populated communities. In order to answer the second research question, the second part of the study consisted in measuring the costs and benefits of the installation of fire sprinklers for an individual homeowner. Because the MSB wanted to know the extent to which a tax incentive would encourage a homeowner to install fire sprinkler, a cost benefit analysis (CBA) was performed to facilitate to have an economic criterion for such decision. For the CBA, three tax incentive options were examined: one-time 50% discount in property taxes, one-time 2% discount in the assess value, and one-time 2% discount in the assess value plus 25% annual discount in the fire service fee. Four types of homes were considered for comparison: a single family home with garage on city water and on well water (4336 sq. ft.), and a duplex with garage on city water and on well water (3891 sq. ft.). Only one cost was considered in the analysis: the purchase and installation cost of a fire sprinkler system. It was not possible to find quotes for maintenance, repairs, and replacement costs. The results of the CBA do not find net benefits (benefits less costs) or a benefit-cost ratio greater than 1. For all the tax incentives options, the expected net present value (NPV) is negative, which means that the options do not appear to be economically feasible. The one-time 2% discount in the assess value plus 25% annual discount in the fire service fee is the option that exhibits the smallest net loss. 36 Final Draft—April 6, 2010 Although the CBA does not find evidence to persuade homeowners to install fire sprinklers, it is important to mention that the high costs of the sprinklers in the local area is the main reason that explains why sprinkler systems were not cost-effective. National studies have shown that residences with sprinkler systems suffered fewer deaths, injuries, and property damages than those without (City of Scottsdale Study, 1997; Weatherby, 2009). In fact, the NPV of the benefits calculated for an individual homeowner in the MSB are consistent with the NPV of the benefits estimated at the national level for Butry et al (2007). For the tax incentive option suggested by the MSB (one-time 2% discount in the assess value plus 25% annual discount in the fire service fee), the NPV ranges from $4,655.20 to 4,932.61, which is close to the NPV of benefits estimated by Butry et al (2007), i.e., $4,994.29. This observation suggest that one recommendation is to direct the attention toward the sprinkler industry or contractors in the local area. If the costs of fire sprinklers can be adjusted to the national averages, it is very probable to find net benefits for an individual homeowner. Discussions with members of the sprinkler industry would help identify the primary reasons behind the high cost of fire sprinklers in the MSB in comparison to the cost in other communities, which have a substantial reduced up-front purchase and installation cost. Perhaps, the local authorities would have to consider some regulations to allow an increased competition within this industry in the local area. As mentioned by the City of Scottsdale Study (1997), in order to expect a positive impact on the associated costs of fire sprinklers, what is important is the ability of the sprinkler industry to become more innovative, productive and cost effective when the market conditions allow open competition for the installation of these systems. Finally, other recommendation is to start building partnerships and mobilizing stakeholders. One point of start is to educate the community toward knowing the different outcomes from a fire incident between sprinklered and unsprinklered homes. When the unfortunate event of fire occurs, at that point only early warning from smoke alarms, escape planning, and quick emergency response are factors that all together minimize the negative outcomes of a fire event. However, having early suppression through fire sprinklers would minimize the losses and help the fire department to combat the fire more effectively. 37 Final Draft—April 6, 2010 References Alaska Department of Labor and Workforce Development, Research and Analysis Section (January, 2010). Population of Alaska by Labor Market Area, Borough and Census Area, 1990-2009. Alaska House Labor and Commerce Committee HCR001B (2009) encouraging the voluntary installation of fire sprinkler systems in residences. Ahrens, M. (2008). Trends and patterns of U.S. fire losses. National Fire Protection Association. Online available at: www.nfpa.org Butry, D., Brown M., Fuller, S. (2007, September). Benefit-Cost Analysis of Residential Fire Sprinkler Systems. U.S. Department of Commerce: National Institute of Standards and Technology. Office of Applied Economics. Gaithersburg, Maryland. City of Scottsdale, Rural/Metro Fire Department, and Home Fire Sprinkler Coalition. (1997). Saving lives, saving money. Automatic sprinklers: A 10 year study. National Fire Sprinkler Association. Online available at: http://www.nfsa.org Entwistle, Martha. (2008). South Carolina sprinkler bill is now law. Residential Fire Sprinkler.com. Retrieved March 8, 2010 from: http://www.residentialfiresprinklers.com/ blog/fire-sprinkler-bill-in-south-carolina-is-now-law/ ESRI (2007, January). GIS for fire stations locations and response protocol. White Paper. Retrieved on March 6, 2010 from: http://www.esri.com/library/whitepapers/pdfs/gis-forfire.pdf Fire in Alaska Report. (2008). State of Alaska Fire Statistics. Freestone, Ann. (2000, November-December). Sprinkler tax break. NFPA Journal. Retrieved online March 12, 2010 from: http://findarticles.com/p/articles/mi_qa3737/is_200011/ ai_n8909359/ Gerston (2002). Public policymaking in a democratic society: A guide to civic engagement. ME Sharpe. Armonk, NY and London, England. Hall, J. (2009). The total cost of fire in the United States. National Fire Protection Association. Online available at: www.nfpa.org Hensler, Bruce. (2008, July). NFPA 1710, 1720, and response time. Fire Bureau: Analysis + evaluation + planning for the fire/rescue service. Retrieved March 30, 2010 from http://www.firebureau.com/?p=50 38 Final Draft—April 6, 2010 Insurance Information Institute. (2007). Average premiums for homeowners and renters insurance, by state, 2007. Retrieved online April 1, 2010 from http://www.iii.org/media/facts/statsbyissue/homeowners/ Kingdon, J. (2003). Agendas, alternatives, and public policies. Second edition. Longman. New York. Madrzykowski, D & Fleming, R. P (2002, January) Review of residential sprinkler systems: Research and standards. National Institute of Standards and Technology [NISTIR]6941. Washington D.C.: US Matanuska Susitna Borough (n.d.). 2003 Fact Book. Planning and Land Use Department. Matanuska Susitna Borough Website, MSB Fire Department History. Retrieved March 1, 2010 from http://www.matsugov.us/cmsfd/index.php/fire/cmsfdhistory Mikesell, John L. (2007). Fiscal Administration: Analysis and Applications for the Public Sector. Seventh Edition, Belmont, CA: Wadsworth Publishers. Montgomery County. (n.d.). Calculation worksheet of the potential tax credit. Retrieved March 12, 2010 from http://www.montgomerycountymd.gov/content/frs-safe/resources/laws/ councilbill300.pdf Municipality of Anchorage. (n.d). Property Appraisal: Exemptions. Retrieved March 12, 2010 from: http://www.muni.org/Departments/finance/property_appraisal/Exemption/Pages/ default.aspx National Fire Protection Association [NFPA] (n.d.). Matanuska Susitna Borough Fire Statistics (1999-2008). National Fire Protection Association [NFPA] (2008, September). Home Fire Sprinkler Cost Assessment. The Fire Protection Research Foundation. Online available at: http://www.nfsa.org NFPA 1720 (2010). Standard of Fire Suppression Operations, Emergency Medical Operations, and Special Operations to the Public by Volunteer Fire Departments, 2010 Edition. National Fire Sprinkler Association [NFSA] (n.d.). Residential Fire Sprinklers: A step-by-step approach for communities. Second edition. Ray, Shane. (2002). Development of a system that addresses the impacts of growth and ensure quality of fire protection is not sacrificed as the Town of Pleasant view grows. Fire Team USA. Retrieved March 1, 2010 from http://www.fireteamusa.com/Documents/Shane% 20Ray%20EFO%20APR%202002.pdf 39 Final Draft—April 6, 2010 Routley, J. Gordon. (n.d.). Fractile Response Times. Palm Beach County. Retrieved March 29, 2010 from: http://www.co.palm-beach.fl.us/Fire%20Rescue%20LOS/Fractile%20 Report%20FINAL.pdf Rubin, Irene (2010). The Politics of Public Budgeting: Getting and Spending, Borrowing and Balancing, 6th edition. CQ Press. Steinemann, Anne, William C. Apgar and H. James Brown. (2005). Microeconomics for Public Decisions. Thomson/South-Western. U.S. Fire Administration (1987). America Burning Revisited. Online at: http://www.usfa.dhs.gov/downloads/pdf/publications/5-0133-508.pdf Viscusi, W. K. and J. E. Aldy. (2003). The value of a statistical life: A critical review of markets estimates throughout the world. The Journal of Risk and Uncertainty, 27(1): 5-76. As cited by Butry et al (2007). Weatherby, S. (2009). Benefits of residential fire sprinklers. Home Fire Sprinkler Coalition. Online available at: http://www.homefiresprinkler.org/ 40 Appendix A. Calculation Worksheet of Tax Credit in Montgomery County Source: Montgomery County Website: http://www.montgomerycountymd.gov/ 41 Appendix B. Response Time, Fire Growth and Temperature Curve This diagram illustrates fire growth over time and the sequence of events that may occur from ignition to suppression. Depending on the size of the room, contents of the room, and available oxygen, flashover can occur in less than 2 or more than 10 minutes. Flashover occurs most frequently between 4 and 10 minutes (Source: ESRI, 2007). 42