Market Credit Working Group update to the Wholesale Market

advertisement

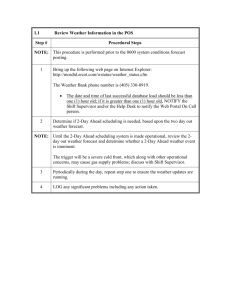

Market Credit Working Group update to the Wholesale Market Subcommittee 04/06/2015 1 MCWG update to WMS • Joint meeting of MCWG and CWG on Tuesday, March 10th • 4 NPRRs reviewed for credit impacts by email vote – 3 NPRRs were operational and had no credit impact – 1 NPRR, NPRR683, impacts credit • NPRR683 changes the Available Credit Limit calculation – 90% buffer applied to ACL which penalizes entities that ‘overcollateralize’ – NPRR683 applies the 90% to gross up TPE instead of decreasing ACL – Improves the incentives to provide additional collateral above credit exposure 2 MCWG update to WMS • Seasonal Adjustment Factor for summer of 2015 – ERCOT has proposed a methodology to calculate SAFs using the ratio of historical prices to the previous month – ERCOT provided additional analysis requested by MCWG/CWG members at the Feb meeting – CWG/MCWG voted to endorse the SAF values below for summer of 2015 2015 Month June July August September 2014 Value 100% 200% 300% 150% ERCOT Calculation 115% 101% 224% 100% CWG/MCWG Recommendation 115% 125% 200% 100% 3 MCWG update to WMS • Mitigation of credit tail risk exposure – Formation of the Credit Risk Impacts and Modeling (CRIM) sub group to develop tail risk scenarios and assist ERCOT modeling – Initial meeting on March 10th established scope and objectives – CRIM will meet after the regularly scheduled CWG/MCWG meetings • Capacity forecast report – Daily posting commenced week of February 24rd – http://www.ercot.com/services/rq/credit/index.html – CWG/MCWG reviewed initial results 4 MCWG update to WMS • Consolidation of Other Binding Documents related to credit – Creditworthiness Standards (NPRR690 submitted) – Credit Application (NPRR pending) • ERCOT Credit and Legal will jointly draft NPRR – Procedures for Setting Nodal Day Ahead Market (DAM) Credit Requirement Parameters and Credit Formulas (NPRR671) • Draft NPRR formalizing prepay account procedures – Targeting April PRS • Audited financials and Standard Form Agreement Attachment A required by April 30th for CounterParties with December 31, 2014 FYE. 5 Update on NPRR638 • NPRR638 is currently tabled at PRS • Technical issues under consideration – Gas price adjustment using a FIP ratio (gas price normalization) • To be considered at PRS (estimated May PRS) – Apply a minimum and maximum heat rate to limit application of gas price adjustment • To be considered at PRS (estimated May PRS) – ERCOT analysis on NPRR638 & Lookback parameters • ERCOT published detailed analysis on gas price adjustments and lookback parameter impacts on April 2nd • PLEASE REVIEW THIS ANALYSIS PRIOR TO APRIL 22 CWG/MCWG MEETING AND BE PREPARED TO VOTE ON LOOKBACK PARAMETER 6 Update on NPRR638 • Policy issues under consideration – Process to update the Market Adjustment Factor (MAF) • History of the MAF in NPRR638 – July 2014: ERCOT submits NPRR638, ERCOT has sole discretion to use MAF based on price increases due to market rule changes, 14 day notice – Oct 2014: ERCOT submits comments to increase MAF notice period to 45 days – Jan 22, 2015: CWG/MCWG submits comments endorsing process where TAC recommends MAF change and Board approves – Jan 30, 2015: ERCOT submits comments removing TAC/Board approval, reinstates sole discretion with 45 day notice, corrects greybox section – Feb 9, 2015: F&A Committee discusses MAF process and requests stakeholder feedback – Feb 24, 2015: Reliant submits comments supporting CWG/MCWG endorsed version of MAF process – March 9, 2015: ERCOT submits comments expanding use of MAF to changes in market conditions; maintains sole discretion and 45 day notice • ERCOT & Stakeholders are negotiating a compromise. An update will be discussed at April 22 CWG/MCWG – Targeting vote at May PRS 7