September 22 Class slides BAT4M

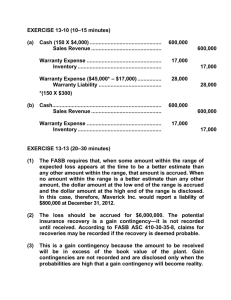

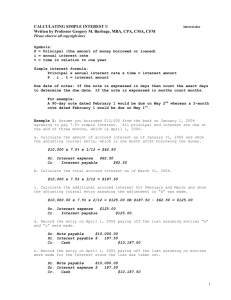

advertisement

Chapter 3! The Adjusting Entry Unit 1 Test (cover chapter 1 to 4) will occur on Friday September 26! Accrual Accouning Accrual Accounting means recording revenues and expenses when they happen, regardless of whether cash is received or paid. Cash basis Accounting means recording transactions only when cash is received or paid. In reality, nobody uses cash basis accounting any more. Financial Statement Comparability The Time Period Concept ensures that the Comparability objective in accounting is met. This means that reporting period must be consistent such as one year, one month or one quarter Some revenues and expenses occur continuously, and accrural accounting require accounting clerks to record them as they happen. Accounting clerks make entries only when there is source document. Adjusting Entry There are many different types of adjusting entries accountants make at the end of the fiscal period: Prepaid Expense Prepaid Insurance Accrued Revenue Supplies adjustment (Accrued Expense) Unearned Revenue Late-Arriving Purchase Invoice (Accrued Expenses) Prepaid Insurance Insurance premium is paid for assets (building, equipment or car) to protect against fire, theft etc…. We use : “Prepaid Insurance” (= asset) account is used to record Journal Entry: Purchase July 1Prepaid Insurance 2400 Bank 2400 Paid for annual insurance premium Prepaid Insurance Insurance premium is paid for assets (building, equipment or car) to protect against fire, theft etc…. Adjustment on Dec 31, 2013 Insurance Expense1200 Prepaid Insurance 1200 Adjusting Insurance premium Prepaid Insurance Prepaid Expenses An expense is paid in advance to benefit more than one accounting period. Any current asset costs will be used up in the near future. Example: Prepaid Insurance, Licenses, Rent and Advertising Oct 1 you paid $5000 for radio ads which will go on for 5 months. Oct 1 Prepaid Advertising 5000 Bank 5000 Prepaid Expenses Dec 31, you will make an adjusting entry: Advertising Expense 3000 Prepaid Advertising (asset) 3000 Adjusting Entry for prepaid advertising Accrued Revenue Some Revenues are earned but not yet received in cash or recorded at the statement date. Accrued revenues may accumulate (or accrue) with the passage of time, as happens with interest revenue and rent revenue. An adjusting entry is required for two purposes: to record the accurate revenue and to record increase in AR or NR. Accrued Revenue In October, Pioneer Advertising Agency earned $200 (they performed their service) in fees for adverting services that were not billed to clients until November. Because these services have not been billed, they have not been recorded. Accrued Revenue The following adjusting entry is made on October 31: Oct 31 AR 200 Service Revenue 200 To accrue revenue earned but not billed On November 10, Pioneer receives $200 cash for the services they performed in October. Accrued Revenue On November 10, Pioneer receives $200 cash for the services they performed in October: JE Nov 10 Cash 200 AR 200 Received $200 from Oct revenue Invoice#156 Accrued Revenue BMO’s perspective: Park Accounting borrowed $50,000 at 5% interest on September 1, 2014 which is due August 31, 2015. What kind of JE is made on September 1, 2014? Sept 1 Loan Receivable $50,000 Bank $50,000 Accrued Revenue Adjusting Entry that BMO has to make on December 31, 2014? (5% * 50000 * 4 months / 12 months = 1667) Dec 31, 2014 Interest Receivable $1667 Interest Revenue $1667 Accrued Revenue JE on August 31 2015? Aug 31 Cash $52500 Loan Receivable Interest Receiable Interest Revenue $50000 $1667 $833 Accrued Expense Expenses incurred not yet paid or recorded but at the statement date are called “accrued expenses.” Interest, Rent, Property Tax and salaries can be accrued expenses. For example, Park Accounting would make a JE on September 1 2014 Sep 1 Cash $50,000 Loan Payable $50,000 Accrued Expense For example, Park Accounting would make a JE on September 1 2014 Sep 1 Cash $50,000 Loan Payable $50,000 On December 31, Park would make the following Adjusting Entry: Dec 31 Interest Expense $1667 Interest Payable $1667 Accrued Expense Park Accounting would make a JE on August 31, 2014, as they pay back the loan with interest . Aug 31 Interest Expense $833 Loan Payable $50000 Interest Payable $1667 Cash $52500 Classwork / Homework P137 E3-2, E3-3 (except d, e and i), E3-6 P142 P3-4