BA (Hons) Accounting and Business (Sept 2013)

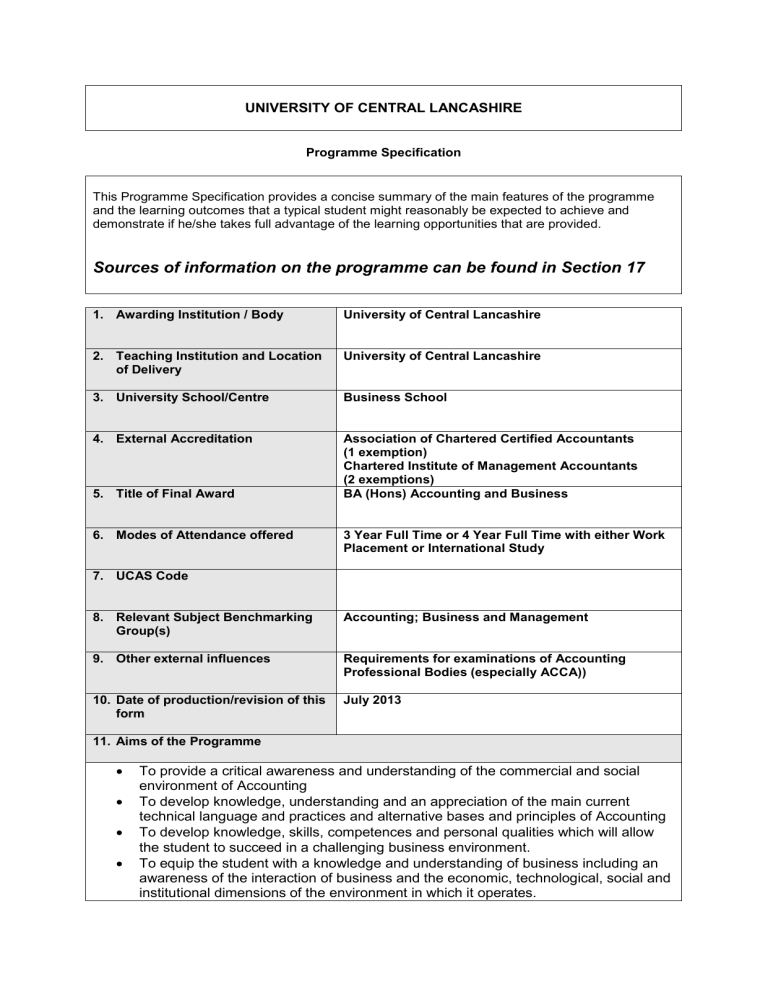

UNIVERSITY OF CENTRAL LANCASHIRE

Programme Specification

This Programme Specification provides a concise summary of the main features of the programme and the learning outcomes that a typical student might reasonably be expected to achieve and demonstrate if he/she takes full advantage of the learning opportunities that are provided.

Sources of information on the programme can be found in Section 17

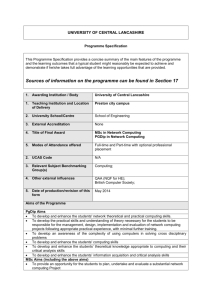

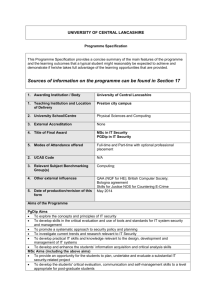

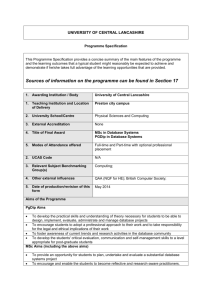

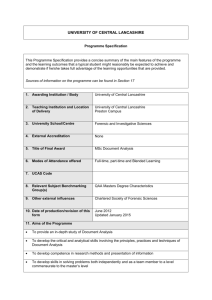

1. Awarding Institution / Body

2. Teaching Institution and Location of Delivery

3. University School/Centre

4. External Accreditation

University of Central Lancashire

University of Central Lancashire

Business School

5. Title of Final Award

6. Modes of Attendance offered

7. UCAS Code

8. Relevant Subject Benchmarking

Group(s)

9. Other external influences

10. Date of production/revision of this form

Association of Chartered Certified Accountants

(1 exemption)

Chartered Institute of Management Accountants

(2 exemptions)

BA (Hons) Accounting and Business

3 Year Full Time or 4 Year Full Time with either Work

Placement or International Study

Accounting; Business and Management

Requirements for examinations of Accounting

Professional Bodies (especially ACCA))

July 2013

11. Aims of the Programme

To provide a critical awareness and understanding of the commercial and social environment of Accounting

To develop knowledge, understanding and an appreciation of the main current technical language and practices and alternative bases and principles of Accounting

To develop knowledge, skills, competences and personal qualities which will allow the student to succeed in a challenging business environment.

To equip the student with a knowledge and understanding of business including an awareness of the interaction of business and the economic, technological, social and institutional dimensions of the environment in which it operates.

To develop the following non subject-specific skills: numeracy skills, use of information technology, extraction of data, drawing conclusions from case study information, oral and written reporting.

Work Placement Route Course Aim – to offer students an opportunity to undertake a placement year constituting an introduction to business practice through practical training and development and to integrate their academic studies with such experience

International Study Route Course Aim – to offer students an opportunity to study abroad, demonstrate initiative, independence and motivation. They may also be required to develop a working knowledge of another language.

12. Learning Outcomes, Teaching, Learning and Assessment Methods

A. Knowledge and Understanding

A knowledge and understanding of:

A1. The commercial and social environment of Accounting and alternative bases and principles of advanced Accounting

A2. Current technical language and practices of advanced Accounting, finance and related business subjects

A3. The economic, financial, environmental, ethical, legal, political and sociological contexts of business activity

A4. Business problems and the variety of approaches to resolving them

Teaching and Learning Methods

Acquisition of knowledge and understanding (A1-A4) is by lectures, seminar work and workshops (A1, A2).

Assessment methods

Outcomes A1-A4 are assessed by a variety of methods, including examinations, coursework tests, essays, problem solving exercise (A1,A2) and presentations. In most Accounting modules the technical nature of the subject, and the requirements of the relevant Accounting professional bodies regarding exemptions, leads to a major proportion of the assessment weighting being allocated to assessment by examination – usually 70%.

B. Subject-specific skills

An ability to :

B1. Prepare statement of financial performance, statement of financial position, statements of cash flow and internal management accounting information such as budgets and costing

B2. Use information technology to prepare, analyse, interpret and evaluate accounting information and business data

B3. Frame business problems in an appropriate economic, ethical, environmental and political context

B4. Communicate business ideas in a clear and cogent manner and apply appropriate business theories, models and methods

Teaching and Learning Methods

Teaching and learning is mostly by lectures followed by seminar work involving case studies or discussion of theoretical concepts. Learning outcomes are also assessed by a variety of methods, including examinations, coursework tests, essays and presentations. Where appropriate, computer-based seminars are used.

Assessment methods

For outcomes B1-B4 the assessment methods described in Part A are used.

C. Thinking Skills

An ability to:

C1. Analyse, interpret and critically evaluate accounting and business information; theoretical accounting and business concepts and issues.

C2. Apply different approaches to different experiences and situations and to reflect and learn from those experiences.

C3. Strategic thinking. Learning the importance of the roles of opportunities, strategies, outcomes, information and motivation in the analysis of strategic actions, including conflict, bargaining and negotiation.

Teaching and Learning Methods

Teaching and learning is achieved through lectures, case study seminar work, group seminar discussions and course work, if appropriate.

Outcome C2, The opportunities provided to work in business (work placement route) and study abroad (international study option) can serve to widen and enhance the student experience. A broad experience provides the foundation for developing higher level critical thinking skills.

Assessment methods

For outcome C1-C3 the assessment methods described in Part A are used.

Outcome C2-C3 is also achieved through the work placement opportunity available to students.

D. Other skills relevant to employability and personal development

An ability to:

D1. Communicate effectively in writing

D2. Extract and collate information

D3. Engage in independent self-motivated study and working

D4. Manage personal development

D5. Work effectively within a team

Teaching and Learning Methods

Outcomes D1-D2 are covered in Parts A-C;D3-D4 are monitored by individual review of completed work prior to seminars, and by periodic in-semester tests, where appropriate.

D1-D5 can be achieved through the common core of personal and professional development modules studied throughout the programme seek to enhance the students’ employability, initiative and focus on life choices post- University

Assessment methods

The outcomes (D1-D2) are assessed by coursework and examination.

Acquisition of skills relevant for employability and personal development (D3-D5) is through the variety of teaching methods and through the experience gained from the work placement.

13. Programme Structures*

Level Module

Code

Module Title

Level 6 AC3100

AC3200

BU3413

BU3016

BC3010

AC3300

AC3400

AC3600

AC3650

AC3908

BC3001

HR3024

BU3207

CD3114

BC3000

BC3008

Advanced Financial Accounting

Advanced Management

Accounting

Business Strategy

Contemporary Issues in

Business

Dissertation

Plus ONE of the following options

Auditing Theory and Practice

Corporate Finance

Taxation Theory and Practice

Risk and Capital Markets

International Financial

Environment

Continuing Professional

Development

Evaluating HRM

International Management

Start a Business

Or ONE option available within the School that the Course

Leader deems appropriate for the programme of study. Further such options must be agreed upon by the External Examiner

Work Placement

International Study

Credit rating

20

20

20

20

20

20

20

20

20

20

20

120

120

20

20

20

14. Awards and Credits*

Bachelor Honours

Degree BA Hons in

Accounting and

Business

Requires 360 credits including a minimum of

220 at Level 5 or above and 100 at Level 6

Work placement route requires successful completion of BC3000 which has a notional credit rating of 120 credits.

International study route requires successful completion of

BC3008 which has a notional credit rating of

120 credits

Bachelor Degree BA in

Accounting and

Business

Requires 320 credits including a minimum of

180 at Level 5 or above and 60 at Level 6

Work placement route requires successful completion of BC3000 which has a notional credit rating of 120 credits.

International study route requires successful completion of

BC3008 which has a notional credit rating of

120 credits

Level 5 AC2100

AC2200

BC2000

Or

CD2001

EC2102

MG2008

AC2410

AC2000

AC2500

AC2650

AC2906

EC2401

EC2006

HR2050

Financial Accounting

Management Accounting

Transition to Work (for students aiming to gain a placement)

Planning Your Career (for students on the 3 year route)

The Global Environment of

Business

Project and Operations

Management

Plus ONE of the following options

Finance for Managers

Enterprise Operations for

Financial Managers

Accounting Information Systems and Control Issues

Introduction to Financial

Services Markets

International Financial

Management Techniques

Business Economics

Economics and Business in the

European Union

Managing Personnel and

Human Resources

Or ONE option available within the School that the Course

Leader deems appropriate for the programme of study. Further such options must be agreed upon by the External Examiner

20

20

20

20

20

20

20

20

20

20

20

20

20

20

Diploma of Higher

Education in

Accounting and

Business

Requires 240 credits including a minimum of

100 at Level 5 or above

Level 4 AC1100

AC1200

AC1300

BC1000

EC1401

BU1005

Introduction to Financial

Accounting

Introduction to Management

Accounting

Information Systems and the

Business Environment

Introduction to Personal and

Professional Practice

Introduction to Business

Economics and Finance

Business Relationships

20

20

20

20

20

20

Certificate of Higher

Education in

Accounting and

Business

Requires 120 credits at

Level 4 or above

15. Personal Development Planning

The students’ ability to reflect upon their skills base and plan for future personal development is developed, practiced, monitored and assessed throughout the programme and there is a strong focus on developing the individual’s employability and lifelong learning skills.

Personal Development Planning exists as a formal strand in years 1, 2, and 3/4. These modules are designed to equip students with the ability to enhance personal, academic and professional skills and plan for their future career development.

16. Admissions criteria

Programme Specifications include minimum entry requirements, including academic qualifications, together with appropriate experience and skills required for entry to study.

These criteria may be expressed as a range rather than a specific grade. Amendments to entry requirements may have been made after these documents were published and you should consult the University’s website for the most up to date information.

Students will be informed of their personal minimum entry criteria in their offer letter.

The University’s minimum standard entry requirements for degree level study is a 12 unit profile, made up from one of the following:

At least two A2 level subjects including

One A2 level subject plus one single award Advanced VCE

One double or two single award(s) Advanced VCE

Other acceptable qualifications include:

Scottish Certificate of Education Higher Grade

Irish Leaving Certificate Higher Grade

International Baccalaureate

BTEC National Certificate/Diploma

Kite marked Access Course

Applications from individuals with non-standard qualifications, relevant work or life experience and who can demonstrate the ability to cope with and benefit from degree-level studies are welcome and will these applicants will be interviewed. If applicants have not studied recently they may need to undertake an Access programme first.

17. Key sources of information about the programme

Prospectus http://www.uclan.ac.uk/information/courses/prospectus.php

University Admissions Department: http://www.uclan.ac.uk/information/services/sss/admissions/admissions_apply.php

Advice about applications: http://www.uclan.ac.uk/information/services/sss/admissions/admissions_contact.php

Open Days and Campus Tours:

http://www.uclan.ac.uk/study/open_days/try_an_applicant_day.php

Programme/Course Leader: Mohamed Parker, GR038, Ext.4672, MSParker@uclan.ac.uk

Information about UCLan www.uclan.ac.uk

Information about the city of Preston http://www.uclan.ac.uk/study/up_north/up_north.php

Information about student life at UCLan http://www.uclan.ac.uk/students/student_life.php

Level

Module

Code Module Title

Core (C) or

Compulsory

(comp) or

Option (O)

AC3100 Advanced Financial Accounting (Comp)

AC3200 Advanced Management Accounting (Comp)

BU3413 Business Strategy (Comp)

BU3016 Contemporary Issues in Business (Comp)

BC3010 Dissertation

BC3000 Work Placement

(Comp)

(O)

Knowledge and understanding Subject-specific Skills Thinking Skills

Other skills relevant to employability and personal development

*

*

*

A1 A2 A3 A4 B1 B2 B3 B4 C1 C2 C3 D1 D2 D3 D4 D5

* * * * * * * * *

* * * * * * * *

* * * * * * * * * *

*

* * * * * * *

*

* * * * * *

* * *

*

* * * * * *

BC3008 International Study

AC2100 Financial Accounting

(O)

(Comp)

AC2200 Management Accounting (Comp)

EC2102 The Global Environment of Business (Comp)

MG2008 Project and Operations Management (Comp)

BC2000 Transition to Work (Comp)

*

*

*

*

*

*

*

*

*

*

*

*

* *

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

CD2001 Planning Your Career (Comp)

AC1100 Introduction to Financial Accounting (Comp)

AC1200

Introduction to Management

Accounting (Comp)

BC1000

AC1300

EC1401

Introduction to Personal and

Professional Practice

Information Systems & the Business

Environment

Introduction to Business Economics and Finance

(Comp)

(Comp))

(Comp)

*

*

*

*

*

*

*

*

*

* *

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* * * * * * * *

BU1005 Business Relationships (Comp) * * * * * * * * *

Note: Mapping to other external frameworks, e.g. professional/statutory bodies, will be included within Student Course Handbooks

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*