Monika Sharma - operationsclub

advertisement

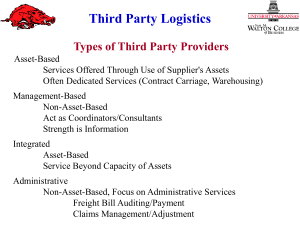

Supply Chain Management Term Project “Analysis of 3PL Industry in India” Post Graduate Programme in Management By Monika Sharma 102029 Submitted to: Prof. Arindam Lahiri Indus World School of Business Greater Noida Date: 2nd, September, 2011 Content 1. Logistics Management: ……………………………………………………..Page #3 2. Third Party Logistics………………………………………………………...Page #3 3. Why 3PL? ..........................................................................................Page #3 4. Market Structure……………………………………………………………..Page #4 5. Key Players………………………………………………………………..…Page #9 6. Challenges for 3Pl Industry………………………………………………….Page #11 7. Results of using 3PL services Page………………………………………….Page #12 8. Future Prospects……………………………………………………………..Page #13 9. Some Factors that are Driving Indian Logistics towards 3PL. ……………..Page #13 10. Conclusion …………………………………………………………………..Page #14 2|Page Logistics Management1: Logistics is a channel of the supply chain which includes planning, implementing and controlling the efficient cost effective flow of material. It is a process which adds the value of time and place utility. In other words logistics is the management of the flow of goods and services between the point of origin and the point of use in order to meet the requirements of customers or corporations. Logistics involves the integration of information, transportation, inventory, warehousing, material handling, and packaging, and often security. Third Party Logistics2: Third-party logistics is the use of an outside company to perform all or part of the firm’s material management and product distribution functions. Relationships in 3PL are said to be more complex than traditional logistics supplier relationships. The benefit of using 3PL companies is very clear. No investment in warehouse and transportation fleet is required by customers and although it incurs additional cost to hire a company but it is proved to be very less as compared to a 3PL provider. Then money they are left with, they can use to do something they have high competency. After knowing the definition of 3PL industry, people many confuse the concept of 3 PL with freight forwarding. Distinction between 3PL and freight forwarders is that 3PL tends to perform more value added activities while freight forwarders focus on transportation (air/sea/land transportation) and warehousing aspect of logistics management. Why 3PL?3 There are several reasons for using 3PL over home-manufacturing. That is listed below: Cost Savings: 3PLs should be focused on delivering value, and that value equates to savings to the shipper/customer. This is the most basic factor that is needed to be considered in selecting a particular provider. For that you should show your cost very well so that you can compare that with the cost of using an outsourcing firm. Core Competency: By selecting a 3PL, the shipper’s company can focus on their core competency versus the distraction of building a supply chain. With resources becoming increasingly limited, it is 1 Designing and Managing the Supply Chain by David Simchi, Philip Kaminsky, Edith Simchi, Ravi Shanker Designing and Managing the Supply Chain by David Simchi, Philip Kaminsky, Edith Simchi, Ravi Shanker 3 Designing and Managing the Supply Chain by David Simchi, Philip Kaminsky, Edith Simchi, Ravi Shanker 2 3|Page often difficult to be an expert of the every face of the business. Hence by logistics outsourcing, the company can focus on the company’s particular area of expertise, leaving the logistics expertise to the logistics company. 4 Technology: The investment in technology is quite discouraging, and today’s 3PLs have invested in the technology that can reduce overall costs while providing visibility and other valueadded services. Customers today would need tremendous outlays of cash to support this initiative while securing internal IT resources. 3PLs have turnkey solutions at their disposal to support complex supply-chain challenges4. Specialization of the 3PL: When 3PL providers are chosen, majorly companies roots lies in the particular area of logistics that is most relevant to the logistics requirement in question. For example, Roadway Logistics, Menlo Logistics, Blue dart and Yellow Logistics evolved from major LTL carriers. Decreased Cycle Times: 3PLs deliver the shipping community visibility into all modes of transportation. This will reduce overall supply-chain cycle times and allow for superior customer service. Awareness of current scenario of the industry: By hiring a 3PL, customers get the latest industry information and trends. The 3PL provides feedback on “best-of-breed” practices based upon its experiences in multiple vertical markets. Continuous Improvement By selecting a 3PL, the customer receives constant feedback on how to improve the overall supply chain. This is accomplished through a formal review process that has established benchmarks for improvement. Management and Reporting The 3PL community provides leading industry expertise across the supply chain, from inventory management to carrier management to customer delivery management. The 3PL industry is focused on delivery value and savings across all modes of transportation and distribution. Compliance. Across the supply chain, 3PLs deliver technology and resources to support vendor compliance and low-cost carrier utilization. This process ensures cost and service optimization. http://www.logisticsmgmt.com/ 4|Page Leverage. 3PLs leverage the collective spending of their clients, increasing the buying power of an individual shipper. 3PL technology allows for collaboration and consolidation to further leverage the purchasing of transportation services Market Structure5 3PL industry’s origin in India can be traced back to mid 1990s. Indian subsidiaries of multinational companies in these sectors took evidence from their parent companies and began to outsource a share of their logistics functions to these specialist service providers. Though it was proved to be insignificant in the first few years, Indian 3PL industry is experiencing a rapid growth after year 2000. We can analyze that by a survey under taken by Dr. B.S. Sahay, Professor of supply chain management. By the help of pie chart we can analyze the reach of 3Pl industry in India. Distribution of the 3 PL industry sector wise: Following data are taken from a survey held by Dr. B.S. Sahay, Professor of supply chain management. In which no. of respondents were: 14, 6% No of Users 112, 44% 126, 50% 5 No of 3PL Providers Total No of Responces http://logistics.about.com/od/strategicsupplychain/a/select_3PL.htm 5|Page Distribution of 3Pl industry By Turnover Distribution of 3Pl industry By Industry Automotive Engineering >Rs10 bn 22% Rs5bn- Rs10 bn 18% 11% Rs1bn- Rs5 bn Others 2% 4%3% 4% 5% 4% 27% Metals 7% 13% Rs500 mRs1bn 36% <500m Chemicals/Fertiliz ers FMCG 21% 23% Textiles/Apparel Services Telecommunicati ons Transportation The number of participants in this industry had grown to be more than 400 by year 2005. 6|Page Current Market Performance:6 Market Share of 3PL industry in overall industry: 100.00% 50.00% 0.00% India Europe U.S Japan Analysis: We can analyze through graph that share of 3PL in Japan is highest among developing countries i.e. 80 % and In India 3Pl providers are very less (10%). Cost: 15.00% 10.00% 5.00% 0.00% India Europe U.S Japan Analysis: We can infer from the graph that, being a developing country the logistics cost in India is most i.e. 13 % and the reasons behind is lack of good infrastructure, industry fragmentation, tax regime etc. In MNCs in all over world have been prominent users of 3PL services but Indian companies are not. In order to gain market share significant cost reductions 6 www.iactglobal.in/supplychain 7|Page and other service benefits are provided by these companies. This is one of the reason for high cost in India. Logistics Performance Index: Chart Title 4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% High Income Countries Low Income Countries Analysis: Graph indicates that the performance of logistics is high in developed countries in developed countries as compared to developing nations, while India occupying the middle position. As managerial and physical effectiveness of Indian logistics is not so good hence the industry is not capable of attracting the 3Pl providers in a high level 8|Page Key Players:7 All though the 3PL industry in India is in nascent stage, but if we can talk in reference to the present growth rate, like increase in manufacturing sector in India as well as increase in out sourcing trend 3PL industry is estimated to grow by 30 % year by year. Some of the basic 3PL providers like Federal Express (FedEx) and DHL have contributed to the transformation of services and the business practices across the entire sector. Other than that many companies are providing value added services like inventory management, warehousing packaging, labeling and tracking of shipments etc. Some of them are listed below: DHL Menlo Worldwide UPS NEXUS BAX Global FedEx TRINITY transport. Inc Menlo Worldwide8: Menlo provides a complete integrated solution to their customers. Menlo Worldwide Logistics specializes in the integration of all functions across the supply chain, from sourcing of raw materials, through product manufacturing to the distribution of finished goods. Mainly Menlo deals with the top-tier companies around the world which look to Menlo Worldwide Logistics for innovative solutions that help plan business strategies, improve customer service, accelerate order cycle times, and tighten control of the supply chain — all while reducing costs in transportation, inventory and order fulfillment. Menlo help firms attain operational excellence across their global supply chains. Through practical and incremental solutions that leverage leading technologies and the best in third party logistics services, we enable clients to address complex global supply chain management issues by providing them with better visibility of their worldwide inventory, lower costs for systems integration and management, and lower transportation expense. Menlo Worldwide Logistics serves a broad spectrum of commercial and public sector industries. They develop dedicated teams for each industry, each tailored to create and implement industry-specific solutions. They 7 8 http://www.slideshare.net/ResearchOnIndia/third-party-logistics-india-sample www.menloworldwide.com 9|Page also share best logistics practices among industries, offering our customers leading-edge supply chain solutions. DHL9: DHL provides the following services to its customers: Freight Transportation: DHL is a logistics partner which delivers freight of any kind, to any place via air, ocean, road or rail, but capable of giving its customers the personal attention they need. Welcome to DHL. Warehousing and Distribution: By understanding customer’s issues and anticipating their business and logistics needs, DHL experts provide robust solutions that will drive value for their customer’s business. Whatever industry sector people operate in, DHL provides dedicated and shared warehousing and distribution operations to ensure that they can deliver their service promise to their customers worldwide. Customs, Security & Insurance: With their network of customs brokerage offices, they are able to solve the difficulties of cross border trade. Their efficient customs brokerage, clearance and compliance service is designed to take the complexity out of the customs process. As well as moving goods seamlessly across international borders, they ensure complete security in challenging environments and provide insurance against unforeseen events. Supply Chain Solutions: They offer a comprehensive suite of services drawing on the global scale and local insight to deliver value across all supply chain. From the initial consultancy and design, to final mile delivery and reverse logistics, they provide customized supply chain solutions across all industry sectors. Industry Sector Solutions: DHL's focus on selected industry sectors means customers benefit from working with specialists – not just in logistics, but also in their particular marketplace. They provide leading solutions to their customers with real competitive advantage. Their people work with a huge variety of customers to solve practical problems – from achieving shorter lead times to delivering temperature-controlled freight – in the following industry sectors: Customer Resource Area: They also keep track of freight, with alerts and the latest tracking information. This is also the place to get in touch with DHL, as well as keep up with the latest information in white papers and guides. 9 www.dhl.com/ 10 | P a g e Challenges for 3PL industry in India 10:11 In India LSPs have to pay numerous other taxes, octrois and face multiple check posts and police harassment. Complicated varying documentation process requirements of different states make the business unattractive like documentation process changes with high cost and delays involved in compliance. On an average an Indian vehicle loose 2448 hours in paper work and formalities while traveling on road and the cost associated with that is 25 5 in the form of various taxes including fuel duty. Hence freight cost becomes major component of cost in India. Low Margin: Being High Cost and Low Margin Business, Organized players are not able to withstand unfair completion with unorganized players, who can get away without paying taxes and following operating norms stipulated in the Motors Vehicles act such as quality of drivers and vehicles, volume and weight restrictions etc. Lack of Economies of scale in the 3PL industries. Failure in implementation of value added tax structure across different states has created a major problem for 3PL industry. There is lack of trust among Indian 3PL providers and their customers due to awareness. Value of outsourcing is very low in India (10%) if we compare it to developed countries which are having outsourcing share in the range of 50%-80%. There is lack of awareness about possible benefits, perceived risk and losing control of sensitive information among customers and which raise the willingness in keeping activities in-house. Indian 3PL industry is facing stiff completion from multinational 3Pl providers. MNCs because of their large sizes and extended operations in many countries are able to provide low costs and extended credit period. Poor infrastructure is another huddle in attracting the 3PL sectors. Slow movement of cargo due to bad road conditions, multiple check posts and documentation requirements, delay in government clearances, couples with unreliable power supply and slow banking customers. This all makes difficult to meet the deadlines for their international customers. To expedite shipments they have to book airfreight rather sea freight, which adds to the costs making them uncompetitive in international market. Geographic diversity of India needing varied logistics expertise for each region is a major challenge to be addressed by 3PL service providers. India has a diverse geographic scenario coupled with a diverse consumer habit scenario in each of its 25 states. Logistics operation in each state requires a suitable model that facilitates the effective storage and transportation of goods mostly sold in that state, making it very difficult for adopting a uniform logistics model. 3PL service companies interested in serving a particular 10 Designing and Managing the Supply Chain by David Simchi, Philip Kaminsky, Edith Simchi, Ravi Shanker http://www.managementparadise.com/forums/elements-logistics-logs/198853-inputs-research-project-3plservices-india.html 11 11 | P a g e company would have to offer multiple solutions to fulfill the nationwide logistics needs of that company. There is also inability for Indian 3PL service providers to offer more value added services. This de motivates the Indian customers to go for 3PL. Other than all the above mentioned points there is also lack of knowledgeable ,skilled manpower in the logistic sector. To expand this industry companies have to look beyond the level of brokers and transportations to attract and retain talent. Results of using 3PL services: However, domestic major companies in leading industry sectors have also begun to follow the footsteps of their multinational counterparts, starting with outsourcing their basic logistics functions. Realizing the significant cost reductions and several other benefits gained by these companies, the large numbers of small to medium companies in all the industries are gearing up to use 3PL services in their logistic functions, resulting in a tremendous potential market for the 3PL market in India. Financial Improvements12 Financial Indicator 13.50% Improvements in Sales revenue 12.30% Working Capital Improvement 9.20% Capital Asset Reduction 10.50% Production Cost Reduction 10.00% Labor Cost Reduction 10.00% ROA Improvement 10.00% Logistics Cost Reduction 15.00% 12 http://www.docstoc.com/docs/74960915/3PL-usage-in-India 12 | P a g e Future Prospects13: Despite all this challenges Indian logistic industry is growing at 30 % vis a via annual growth rate which is 10 %. Nevertheless, considering that the most important logistics functions for Indian industries still are transportation and warehousing, which are likely to be outsourced to 3PL in increasing share, a high level of growth is estimated for the Indian 3PL market in the next 5-7 years. The Indian 3PL market, estimated at about US$890.3 billion in 2005, is expected to grow at a compound annual growth rate of 21.9 percent to reach US$3,556.7 million in 2012. Frost & Sullivan’s research identified that the largest end-user industry for 3PL services as of 2005, is the auto industry. A lot of multinational automobile makers, like Suzuki, Honda, and Ford, have set up manufacturing bases in India, and have been major users of 3PL services. Expansion of manufacturing facilities by most of these companies indicates huge potential for 3PL services in this industry. Other sectors that have shown substantial contribution to 3PL market and significant growth potential include the information technology (IT) hardware and electronics, Fast Moving Consumer Goods (FMCG), and retail sectors. Some Factors that are Driving Indian Logistics towards 3PL14 There are various policies implemented by government which will help in the boom of the industry. In 2005 Government of India introduced value Added Tax (VAT) that will drive Indians towards using more 3PL services. A full implementation of this regime is having centralized large warehouses in regional hub cities, to achieve best efficiency in logistics. . Since building such large warehouses requires huge investments, most Indian companies are likely to outsource the warehousing function, creating immense potential market for 3PL service providers. Leading companies in major industries have already started planning for the new scenario and the required warehousing capacity to be outsourced. Others are expected to follow them soon. The focus of government of India is increased on improving logistics infrastructure is expected to have a huge positive impact on 3PL market. The government has invested US $17 billion to upgrade highway networks, with the implementation of two major projects, namely the Golden Quadrilateral network and the North-South-East-West (NSEW) Corridor. Apart from this, in a remarkable infrastructure related decision, the government has opened up rail freight operations to private players, thereby creating opportunities for cheaper and faster movement of goods. Transportation by rail is definitely cheaper than by road, as trains are faster and have lower costs per unit distance traveled. This is expected to enable 3PL service providers in offering more costeffective services to clients, thereby increasing the 3PL usage by all industries. 13 14 http://www.rncos.com/Press_Releases/3PL-Industry-in-India-to-Grow-at-25-CAGR-RNCOS.htm http://www.slideshare.net/ResearchOnIndia/third-party-logistics-india-sample 13 | P a g e Apart from these factors, the increasing list of multinational companies starting operations in India is expected to fuel the growth of 3PL market. Entry of giants like BMW, Flextronics, and Wal-Mart are expected to contribute to considerable growth of 3PL usage in their respective industry sectors. The opening up of the Indian economy to foreign investments is expected to attract more companies into the country, thereby adding momentum to 3PL market growth. The wide-spread information technology awareness and expertise in India is also expected to help 3PL companies in offering several value added services using IT such as Fleet Management Systems, Warehouse Management Systems, and integrated Supply Chain Management systems. Conclusion By analyzing all the factors we can surely say that the Indian 3PL industry is set to grow tremendously in the next 5-7 years, leading the growth of logistics market. There are several factors including government’s support are instrumental in this growth and the new regulations set by the government will surely support the 3PL industry in India. Though certain challenges remain to be addressed, the general trend is highly positive. With scenario highly favorable for them, now the focus is on 3PL service companies to offer quality services at affordable pricing, and delivering Even most of the established logistics companies are moving towards 4 PL. The need of the hour is consistent added facilities to maintain the momentum. For now, surely 3PL is the way forward for Indian Logistics Market. 14 | P a g e