Slides - Electrical and Computer Engineering

advertisement

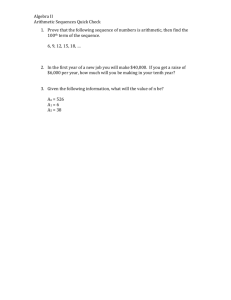

Topics Today • • • • Conversion for Arithmetic Gradient Series Conversion for Geometric Gradient Series Quiz Review Project Review 1 Series and Arithmetic Series • A series is the sum of the terms of a sequence. • The sum of an arithmetic progression (an arithmetic series, difference between one and the previous term is a constant) sn a (a d ) (a 2d ) (a 3d ) ... (a (n 1)d ) • Can we find a formula so we don’t have to add up every arithmetic series we come across? 2 Sum of terms of a finite AP S n a (a d ) (a 2d ) ... [a (n 2)d ] [a (n 1)d ] S n a (a d ) (a 2d ) ... (a nd 2d ) (a nd d ) S n (a nd d ) (a nd 2d ) ... (a 2d ) (a d ) a 2 S n a (2a nd ) (2a nd ) ... (2a nd ) (2a nd ) a There are (n) 2a terms 2a n 2an; There are (n - 1) nd terms nd (n - 1) nd (n - 1) ; Therefore, 2Sn 2an nd (n 1) 2 S n n[2a (n 1)d ] n S n [2a (n 1)d ] 2 3 Arithmetic Gradient Series • A series of N receipts or disbursements that increase by a constant amount from period to period. • Cash flows: 0G, 1G, 2G, ..., (N–1)G at the end of periods 1, 2, ..., N • Cash flows for arithmetic gradient with base annuity: A', A’+G, A'+2G, ..., A'+(N–1)G at the end of periods 1, 2, ..., N where A’ is the amount of the base annuity 4 Arithmetic Gradient to Uniform Series • Finds A, given G, i and N • The future amount can be “converted” to an equivalent annuity. The factor is: 1 N ( A / G, i , N ) i (1 i )N 1 • The annuity equivalent (not future value!) to an arithmetic gradient series is A = G(A/G, i, N) 5 Arithmetic Gradient to Uniform Series • The annuity equivalent to an arithmetic gradient series is A = G(A/G, i, N) • If there is a base cash flow A', the base annuity A' must be included to give the overall annuity: Atotal = A' + G(A/G, i, N) • Note that A' is the amount in the first year and G is the uniform increment starting in year 2. 6 Arithmetic Gradient Series with Base Annuity 7 Example 3-8 • A lottery prize pays $1000 at the end of the first year, $2000 the second, $3000 the third, etc., for 20 years. If there is only one prize in the lottery, 10 000 tickets are sold, and you can invest your money elsewhere at 15% interest, how much is each ticket worth, on average? 8 Example 3-8: Answer • Method 1: First find annuity value of prize and then find present value of annuity. A' = 1000, G = 1000, i = 0.15, N = 20 A = A' + G(A/G, i, N) = 1000 + 1000(A/G, 15%, 20) = 1000 + 1000(5.3651) = 6365.10 • Now find present value of annuity: P = A (P/A, i, N) where A = 6365.10, i = 15%, N = 20 P = 6365.10(P/A, 15, 20) = 6365.10(6.2593) = 39 841.07 • Since 10 000 tickets are to be sold, on average each ticket is worth (39 841.07)/10,000 = $3.98. 9 Arithmetic Gradient Conversion Factor (to Uniform Series) • The arithmetic gradient conversion factor (to uniform series) is used when it is necessary to convert a gradient series into a uniform series of equal payments. • Example: What would be the equal annual series, A, that would have the same net present value at 20% interest per year to a five year gradient series that started at $1000 10 and increased $150 every year thereafter? Arithmetic Gradient Conversion Factor (to Uniform Series) 1 2 3 4 5 1 2 3 4 5 $1000 $1150 A A A A A $1300 $1450 (1 i ) n (1 ni ) A Ag G i[(1 i ) n 1] $1600 (1 0.20)5 (1 5 * 0.20) $1,000 $150 0.20[(1 0.20)5 1] $1,246 11 Arithmetic Gradient Conversion Factor (to Present Value) • This factor converts a series of cash amounts increasing by a gradient value, G, each period to an equivalent present value at i interest per period. • Example: A machine will require $1000 in maintenance the first year of its 5 year operating life, and the cost will increase by $150 each year. What is the present worth of this series of maintenance costs if the firm’s minimum attractive rate of return is 20%? 12 Arithmetic Gradient Conversion Factor (to Present Value) $1600 $1450 $1300 $1150 $1000 1 2 3 4 5 P (1 i ) n 1 1 (1 ni )(1 i ) n PA G n i (1 i ) i2 (1 0.20)5 1 1 (1 5 * 0.20)(1 0.20) 5 $1,000 $150 5 0.20(1 0.20) (0.20) 2 $3,727 13 Geometric Gradient Series • A series of cash flows that increase or decrease by a constant proportion each period • Cash flows: A, A(1+g), A(1+g)2, …, A(1+g)N–1 at the end of periods 1, 2, 3, ..., N • g is the growth rate, positive or negative percentage change • Can model inflation and deflation using geometric series 14 Geometric Series • The sum of the consecutive terms of a geometric sequence or progression is called a geometric series. • For example: Sn a ak ak 2 ak 3 .... ak n 2 ak n 1 Is a finite geometric series with quotient k. • What is the sum of the n terms of a finite geometric series 15 Sum of terms of a finite GP Sn a ak ak 2 .... ak n 2 ak n 1 kSn ak ak 2 .... ak n 2 ak n 1 ak n Sn kSn a 0 0 ..... 0 0 ak n Sn (1 k ) a (1 k n ) (1 k n ) Sn a (1 k ) • Where a is the first term of the geometric progression, k is the geometric ratio, and n is the number of terms in the progression. 16 Geometric Gradient to Present Worth • The present worth of a geometric series is: A A(1 g ) A(1 g )N 1 P 2 (1 i ) (1 i ) (1 i )N • Where A is the base amount and g is the growth rate. • Before we may get the factor, we need what is called a growth adjusted interest rate: i 1 i 1 1 g 1 so that 1 g 1 i 1 i 17 Geometric Gradient to Present Worth Factor: (P/A, g, i, N) (1 i )N 1 1 (P / A, g, i , N ) N 1 g i (1 i ) (P/A,i ,N) ( 1 g) Four cases: (1) i > g > 0: i° is positive use tables or formula (2) g < 0: i° is positive use tables or formula (3) g > i > 0: i° is negative Must use formula (4) g = i > 0: i° = 0 A P N 1 g 18 Compound Interest Factors Discrete Cash Flow, Discrete Compounding To Find F P Given P F Name of Factor Compound Amount Factor (single payment) Present Worth Factor (single payment) F A Compound Amount Factor (uniform series) A F Sinking Fund Factor Factor (1 i) n (1 i ) n (1 i ) n 1 i i (1 i ) n 1 19 Compound Interest Factors Discrete Cash Flow, Discrete Compounding To Find A P A P Given P A G G Name of Factor Factor Capital Recovery Factor i (1 i ) n (1 i ) n 1 Present Worth Factor (uniform series) Arithmetic Gradient Conversion Factor (to uniform series) Arithmetic Gradient Conversion Factor (to present value) (1 i) n 1 i (1 i) n (1 i ) n (1 ni ) i[(1 i ) n 1] 1 (1 ni)(1 i ) n i2 20 Compound Interest Factors Discrete Cash Flow, Continuous Compounding To Find F P F A Given P F A F Name of Factor Compound Amount Factor (single payment) Present Worth Factor (single payment) Factor e rn Compound Amount Factor (uniform series) e rn 1 er 1 Sinking Fund Factor er 1 e rn 1 e rn 21 Compound Interest Factors Discrete Cash Flow, Continuous Compounding To Find A P A P Given P A G G Name of Factor Factor Capital Recovery Factor e rn (e r 1) e rn 1 Present Worth Factor (uniform series) Arithmetic Gradient Conversion Factor (to uniform series) Arithmetic Gradient Conversion Factor (to present value) e rn 1 e rn (e r 1) 1 n rn r e 1 e 1 e rn 1 n(e r 1) e rn (e r 1) 2 22 Compound Interest Factors Continuous Uniform Cash Flow, Continuous Compounding To Find C C F P Given F P C C Name of Factor Sinking Fund Factor (continuous, uniform payments) Capital Recovery Factor (continuous, uniform payments) Compound Amount Factor (continuous, uniform payments) Present Worth Factor (continuous, uniform payments) Factor r e rn 1 re rn e rn 1 e rn 1 r e rn 1 re rn 23 Quiz---When and Where • • • • • • • Quiz: Tuesday, Sept. 27, 2005 11:30 - 12:20 (Quiz: 30 minutes) Tutorial: Wednesday, Sept. 28, 2005 ELL 168 Group 1 (Students with Last Name A-M) ELL 061 Group 2 (Students with Last Name N-Z) 24 Quiz---Who will be there • • • • • U, U, U, U, and U!!!! CraigTipping ctipping@uvic.ca Group 1 (Last NameA-M) ELL 168 LeYang yangle@ece.uvic.ca Group 2 (Last Name N-Z) ELL 061 25 Quiz---Problems, Solutions • • • • Do not argue with your TA! Question? Problems? TAWei Solutions will be given on Tutorial Bring: Blank Letter Paper, Pen, Formula Sheet, Calculator, Student Card • Write: Name, Student No. and Email 26 Quiz---Based on Chapter 1.2.3. • • • • • Important: Wei’s Slides Even More Important: Examples in Slides 1 Formula Sheet is a good idea 5 Questions for 1800 seconds. Wei used 180 seconds (relax) 27 Quiz---Important Points • • • • • • Simple Interests Compound Interests Future Value Present Value Key: Compound Interest Key: Understand the Question 28 Quiz---Books in Library!!! Engineering Economics in Canada, 3/E Niall M. Fraser, University of Waterloo Elizabeth M. Jewkes, University of Waterloo Irwin Bernhardt, University of Waterloo May Tajima, University of Waterloo Economics: Canada in the Global Environment by Michael Parkin and Robin Bade. 29 Calculator Talk • • • • • No programmable No economic function Simple the best Trust your ability Trust your teaching group 30 • Questions? • (Sorry I forget the problems) 31 Project----Time Table • • • • • Find your group: Mid-October Select Topic: End of October Survey finished: End of October Project: November (3 Weeks) Project Report Due: Final Quiz 32 Project----Requirements • • • • • Group: 3-6 Students Topic: Practical, Small Report: On Time, Original Marks: 1 make to 1 report Report: 25 marks out of 100 33 Project Topic----What to do • • • • • • • You Find it Practical Example: Run a Pizza Shop Example: Run a Store for computer renting Example: Survey on the Tuition Increase Example: Why ??? Company failed….. Team Work 34 Project----Recourse • • • • • • • Not your teaching group No spoon feed: Independent work Example: Government Web Example: Library, Database, Google Example: Economics Faculty Example: Newspaper, TV Example: Friends 35 Summary • • • • Conversion for Arithmetic Gradient Series Conversion for Geometric Gradient Series Quiz: My slides and the examples in slides Project: Good Idea, be open, independent 36