Partnership Dissolution

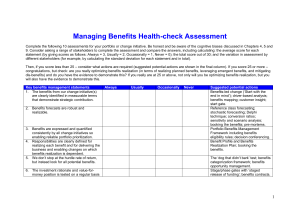

advertisement

Partnership Dissolution 1 Introduction A partnership may dissolve due to disagreement among the partners, poor performance of the firm or being taken over by another business. The assets of the partnership will be realized to pay off the liabilities. The sales proceeds should be applied in the following order, as required by the Hong Kong Ordinance: Pay off creditors first, then the partners’ advances, Finally the partners’ capital and 2 Realization Account In the partnership dissolution, an account named as ‘Realization Account’ will be opened to compute the profit or loss from realization which should be shared among the partners according to the profit or loss sharing ratio 3 Nature of partnership dissolution Dissolution where the assets are sold separately Dissolution where partnership is sold as a whole 4 Dissolution where Assets are sold separately 5 Procedures of Dissolution 1. 2. 3. 4. All assets will be sold to other persons or taken over by partners Settle the liabilities of the partnership to outsider or partners Transfer any ‘profit or loss on realization’ to each partner’s capital accounts in profit/loss sharing ratio Merge the balances in the partners’ current accounts to their capital accounts 6 5. Any credit balance in each partner’s capital account represents the amount which can be withdrawn from the partnership to each partner; any debit balance in a partner’s capital account represents additional cash to be injected by that partners 7 Transactions Accounting entries Close all asset accounts with net book value to the realization account (except cash and bank because these assets need not be disposed of) Cost of dissolution or any losses or expenses incurred on realization Proceeds from the disposal of assets Dr Realization Cr Assets Assets taken over by a partner without payment Dr Capital Cr Realization Dr Realization Cr Bank Dr Bank Cr Realization 8 Transactions Accounting entries Asset taken over by partners No entries required as a gift Creditors taken over by a partner Dr Creditors Cr Capitals Payment to creditors with discounts received Dr Creditors Cr Realization – discount Cr Bank Dr Realization – profit Cr Capitals or Dr Capital Cr Realization - loss Profit or loss on realization to be shared among the partners according to the profit-sharing ratio 9 Transactions Repayment of loan to an partner Accounting entries Dr Loan from partner Cr Bank Repayment of loan to an outsider ( creditors) Dr Loan from outsider Cr Bank Transfer any balances in partners’ current accounts Dr Current (for credit balance) Cr Capitals Or Dr Capital Cr Current (for debit balance) Repayment of remaining capital to partners Dr Capital Cr Bank 10 Example 1 11 John, Peter and Tom were partners sharing profits and losses in the ratio 1:1:3. The balance sheet as at 31 December 1996 was as follows: Balance Sheet as at 31 December 1996 Fixed Assets Cost Dep NBV Premises 180000 10000 170000 Motor Vehicles 27500 5500 22000 207500 15500 192000 Current assets Stock 68250 Debtors 172500 Less: provision for bad debt 1265 171235 Bank 26065 265550 Less: Current Liabilities Creditors 60000 Working Capital 205550 397550 12 Capital: John Peter Tom Current: John Peter Tom Long – term liabilities Loan from Tom 100000 40000 160000 300000 30000 (10000) 70000 90000 7550 397550 Assets and liabilities were disposed of as follows: 1. The premises were sold at $ 200000 and legal charges from the sale amount to $10000 2. Tom took over the stock and motor vehicles at book value 3. Except for $2500, all debts were collected 4. The creditors were discharged for $56000 5. Realization expenses of $10000 were paid Required: Prepare the realization, Bank, Capital and Current account for the dissolution 13 of partnership Premises Bal b/f Realization 170000 Premises 180000 Prov. for depreciation Realization 180000 10000 170000 180000 Provision for depreciation Premises 10000 Bal b/f 10000 14 Premises Motor Vehicles Bal b/f Realization 170000 22000 Motor Vehicles Prov. for depreciation 27500 Realization 27500 5500 22000 27500 Provision for depreciation Motor Vehicles 5500 Bal b/f 5500 15 Premises Motor Vehicles Debtors Bal b/f Realization 170000 22000 171235 Debtors 172500 Prov. for bad debts Realization 172500 1265 171235 172500 Provision for Bad Debts Motor Vehicles 1265 Bal b/f 1265 16 Premises Motor Vehicles Debtors Stock Bal b/f Realization 170000 22000 171235 68250 Stock 68250 Realization 68250 17 Premises Motor Vehicles Debtors Stock Bank- realization expenses Realization 170000 Bank – premises (200000-10000) 190000 - Debtors (172500-2500) 170000 22000 171235 Creditors – discount received 4000 68250 10000 Loan from Tom Bank Bal b/f Realization – premises - debtors 7550 Bal b/f Bank 26065 Realization - expenses 190000 Creditors 170000 Loan from Tom 7550 10000 56000 7550 Creditors Bank 56000 Bal b/f Realization – discount received 4000 60000 60000 18 60000 Premises Motor Vehicles Debtors Stock Bank- realization expenses Gain on realization: John 1/5 2553 Peter 1/5 2553 Tom 3/5 7659 John Realization: Stock MV Realization 170000 Bank – premises (200000-10000) - Debtors (172500-2500) 22000 171235 Creditors – discount received 68250 Tom – stock 10000 - MV 12765 454250 190000 170000 4000 68250 22000 454250 Capital Peter Tom John Peter Tom Bal b/f 100000 40000 160000 68250 Gain on realizaiton 2553 2553 7659 22000 19 Realization: Stock MV Current Bank Capital John Peter Tom John Peter Tom Bal b/f 100000 40000 160000 68250 Gain on realizaiton 2553 2553 7659 30000 70000 22000 Current 10000 132553 32553 147409 132553 32553 147409 132553 32553 147409 John Bal b/f Capital Peter 10000 30000 Current Tom Bal b/f 70000 Capital John 30000 Peter Tom 70000 10000 30000 10000 70000 30000 10000 70000 Bank Bal b/f 26065 Realization - expenses 10000 Realization – premises 190000 Creditors 56000 - debtors 170000 Loan from Tom 7550 Capital: John 132553 Peter 32553 Tom 147409 20 386065 386065 Dissolution where partnership is sold as a whole 21 Purchase consideration The purchase consideration is to be discharged by the limited company (buyer) to partners(seller) to take over the business Goodwill = Purchase consideration – ( assets at take-over value – liabilities at take-over value) 22 Transactions Accounting entries For dissolution of Old partnership (seller) Close all asset accounts with Dr Realization net book value to the Cr Assets realization account (Bank and cash may be taken over) Cost of dissolution or any losses or expenses incurred on realization Proceeds from sale of the business (purchase consideration) Dr Realization Cr Bank Dr Vendee (buyer) Cr Realization 23 Transactions Accounting entries Liabilities taken over by the buyer Dr Liabilities Cr Realization The purchase consideration settled by cheque, shares and debentures Dr Bank/ Shares/ debentures in purchaser’s company Cr Bank Repayment of remaining capital to partners Dr capital Cr Bank/ shares/ debentures in purchaser’s company 24 Transactions Accounting entries For opening entries of New Company (buyer) Assets taken over Dr Assets Cr Business Purchase Liabilities taken over Dr Business Purchase Cr Liabilities The purchase consideration offered Dr Business Purchase Cr Vendor (seller) The purchase consideration settled by cheques, shares and debentures Dr Vendor (seller) Cr Bank/Shares/Debentures 25 Example 2 26 John, Peter and Tom were partners sharing profits and losses in the ratio 1:1:3. The balance sheet as at 31 December 1996 was as follows: Balance Sheet as at 31 December 1996 Fixed Assets Cost Dep NBV Premises 180000 10000 170000 Motor Vehicles 27500 5500 22000 207500 15500 192000 Current assets Stock 68250 Debtors 172500 Less: provision for bad debt 1265 171235 Bank 26065 265550 Less: Current Liabilities Creditors 60000 Working Capital 205550 397550 27 Capital: John Peter Tom Current: John Peter Tom Long – term liabilities Loan from Tom 100000 40000 160000 300000 30000 (10000) 70000 90000 7550 397550 On 31 December 1996, they incorporated a limited company, Fortune limited, to take over the partnership business. Fortune Limited had an authorized capital of $500000 ordinary shares of $1 each. 28 Assets and liabilities were disposed of as follows: 1. John took over the stock at book value. Tom collected all the debts except $2500 2. The company took over the premises at a valuation of $200000, motor vehicles at $25000, cash at bank and all the liabilities. Goodwill was valued at $70000 for the purpose of the takeover 3. The purchase consideration was to be discharged by the issue to the partners of 150000 ordinary shares at $1.2 each, according to the profit-sharing ratio, and the balance was to be in cash 4. The company also issued 50000 ordinary shares at $1.2 for cash to outsiders Required: Prepare the realization, Capital and the opening balance sheet for the new company 29 Realization Premises 170000 MV 22000 Stock Bank be taken over 68250 Debtors 171235 Bank 26065 Capital: John 20353 Peter 20353 Tom 61059 101765 559315 Liabilities taken over by Ltd. Co. Creditors Loan from Tom Tom: debtors (172500-2500) John: stock 60000 7550 170000 68250 Fortune Ltd – purchase consideration [(200000+25000+26065-7550-60000) +70000] 253515 559315 Purchase consideration=Asset-liabilities +goodwill 30 John Peter 10000 Capital Tom John Peter Tom Bal b/f 100000 40000 160000 Current 30000 70000 Current Realization Stock 68250 Debtors 170000 Shares in Fortune Ltd 36000 36000 108000 Bank 46103 14353 13059 (Bal. fig.) 150353 60353 291059 Realization -profit 20353 20353 61059 150353 60353 291059 Shares in Fortune Ltd. 150000*1.2 = 180000 John 1/5 36000 Peter 1/5 36000 Tom 3/5 108000 180000 31 Fortune Limited Balance sheet as at 1 Jan 1996 Fixed Assets Goodwill Premises MV Current Assets Bank [26065 + (50000*1.2) –(46103+14353+13059)] Less: Current liabilities Creditors Working Capital Share Capital Ordinary Shares (150000*$1+50000*$1) Share Premium (150000*$0.2+150000*$0.2) Long-term liabilities Loan from Tom 70000 200000 25000 295000 12550 60000 (47450) 247550 200000 40000 240000 7550 247550 32 Cash distribution among partners 33 Cash Distribution Among Partners With the application of the Garner vs. Murray rule When cash is to be distributed as soon as possible ( Piecemeal realization) 34 With the application of Garner vs. Murray rule 35 With the application of Garner vs. Murray rule Any CREDIT balance in each partner’s capital account represents the amount which can be withdrawn from the partnership to each partner Any DEBIT balance in a partner’s capital account represents additional cash to be injected by that partner. If he is insolvency to repay the amount, the solvency partners will be shared the amount in: Profit & loss sharing ratio Any agreed ratio given in the examination question GARNER vs. MURRAY rule may be applied 36 What is Garner vs. Murray rule? 37 Garner vs. Murray rule Under the rule, a partner is required to contribute cash to eliminate the debit balance in his capital account In the court case of Garner vs. Murray (1904), it was held that subject to any agreement to the contrary, such a debit balance deficiency was to be shared by the other partner not in their profit and loss sharing ratio but “ the ratio of their last agreed capitals” 38 If one partner is insolvent, his capital deficiency will be shared by other partners according to the ‘last agreed capital ratio’ (the ratio of the balances in the capital accounts before the dissolution, in the absence of any agreement to the contrary 39 Piecemeal Realization 40 Piecemeal realization Cash is distributed as it becomes available, instead of waiting for all the assets to be realized first Assets are sold piecemeal, and then outstanding debts are paid and the remaining cash is finally distributed to the partners as soon as possible This situation occurs because some assets can be sold quickly, and some assets take longer time to be sold (i.e. less liquid) 41 Assumed Loss/Notional Loss Method This is possible loss by assuming that the remaining assets do not have any scrap value Any unsold assets will be assumed loss in each distribution 42 Steps on Piecemeal Dissolution 1. Find out the maximum possible loss Maximum possible loss = NBV of assets to be realized - Total proceeds form disposal OR Maximum possible loss = Total capital balances - Total cash to be distributed to partners( i.e. cash available) 43 2. The maximum possible loss is shared by the partners according to the profitsharing ratio 3. Apply the Garner vs. Murray rule if there is any capital deficiency 4. Distribute any available cash to the partners according to their remaining capital balances 5. Repeat the process until all assets have been realized 44 Example 3 45 Au, Chow and Lee were partners sharing profits and losses in the ratio 2:2:1. The balance sheet as at 31 December 1996 was as follows: Balance Sheet as at 31 December 1996 Fixed Assets Cost Dep NBV Goodwill 100000 100000 Land 150000 150000 Plant & Machinery 133000 55800 77200 Fixture & Fittings 30000 13000 17000 Motor Vehicles 32000 24000 8000 445000 92800 352200 Current assets Stock 64000 Debtors 65000 Less: provision for bad debt 6000 59000 Cash 160 123160 Less: Current Liabilities Creditors 57000 Bank Overdraft 128360 Working Capital 62200 46 290000 Capital: Au Chow Lee Current: Au Chow Long – term liabilities Bank loan 120000 80000 30000 20000 20000 230000 40000 20000 290000 On 31 December 1996 the partners agreed to dissolve the partnership due to a disagreement between the partners. Assets were to be realized, outstanding debts to be paid and the remainder to be shared by the partners in an equitable manner. Distributions of cash were to be made as soon as possible. January • Provision was made for dissolution expenses of $2400 • Land was sold for $200000 • The cash available was utilized to settle in full the bank overdraft, the bank overdraft, the bank loan and all creditors after receiving discounts 47 March • Stock which had originally costed $40000 was sold for $32000 • $15000 was received form debtors April • Plant & Machinery were sold for $51000 after paying carriage of $2000 • Fixtures and fittings were sold for $12000 May • All the outstanding debtors, with the exception of a customer who owed $4000 settled their accounts • Motor vehicles were sold for $25000 • The remaining stock was sold for $22000 • Dissolution expenses amounted to $2100 Prepare distribution statement of cash at each stage 48 Distribution Statement Total $ Capital accounts Current accounts Au $ Chow $ Lee $ 230000 120000 80000 30000 40000 20000 20000 270000 140000 100000 30000 1st Distribution: Cash available (w1) Maximum possible loss (2:2:1) ( 47000) 223000 89200 89200 44600 50800 10800 (14600) Lee’s capital deficiency shared by Au And Chow in the last agreed capital ratio (120000:80000) Cash distributed 2nd Distribution: Capital balance Cash available (51000+12000) Maximum possible loss (2:2:1) (8760) (5840) 14600 42040 4960 0 223000 (63000) 160000 140000-42040 Lee’s capital deficiency shared by Au And Chow in the last agreed capital ratio (120000:80000) Cash distributed 97960 95040 30000 64000 64000 32000 33960 31040 (2000) (1200) (800) 2000 49 32760 30240 0 3rd Distribution: Capital balance Cash available (W2) Maximum possible loss (2:2:1) Cash distributed 160000 65200 64800 30000 (93300) 66700 26680 26680 13340 38520 38120 16660 97960-32760 50 W1 Cash available for 1st distribution: January Opening balance Receipt from land Less: Payment Assumed dissolution expenses (i.e. not actual expenses) ‘Settle in full’ means no more payment will be Bank overdraft paid. => the difference Bank loan between 57000 and 49400 Creditors (Bal. Fig.) is discount received 160 200000 200160 2400 128360 20000 49400 200160 0 => no cash distribution to partners on January March Receipts: Stock Debtors First cash distributed to partners 32000 15000 47000 Back 51 Notes: •Very often no cash is distributed to partners at first or second month since outstanding debts must be repaid first and then the remaining cash can then be distributed to partners. •Even though the questions have not mentioned to repay outstanding debts, you should make sure to keep some cash to prepare to repay debts and could not be distributed it to partners 52 W3 Cash available for 3rd distribution: May Receipts Surplus in dissolution expenses(2400-2100) Collection remaining debtors balance (65000-15000-400) Receipts from MV Receipts from remaining stock 300 46000 25000 22000 93300 Back 53 Realization Goodwill 100000 Cash: Land 200000 Land 150000 Stock (32000+22000) 54000 Plant & Machinery 77200 Debtors (15000+46000) 61000 Fixtures & fittings 17000 Plant & machinery 51000 Motor Vehicles 8000 Fixture & fittings 12000 Stock 64000 Motor vehicles 25000 Debtors 59000 Creditors – discount rececived Cash - dissolution expenses 2100 (57000-49400) 7600 Capital: Au (2/5) 26680 Chow (2/5) 26680 Lee (1/5) 13340 66700 477300 477300 54 Au Chow Capital Lee Au Chow Bal b/f 120000 80000 Current 20000 Cash in March 40240 4960 In April 32760 30240 in May 38520 38120 16660 Realization -loss 26680 26680 Lee 30000 20000 26680 140000 100000 30000 140000 100000 30000 55