Chapter 4 - Adjusting Entries and The Worksheet

advertisement

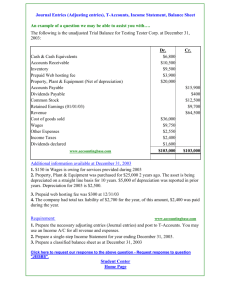

Adjusting Entries and The Worksheet Chapter 4 Expected Learning Outcomes List the classifications of the accounts that occupy each column of a tencolumn worksheet Complete a worksheet for a service enterprise Journalize and post adjusting entries Prepare statements from worksheet How the Course Is Organized Chapter 1 – Introduction Chapter 2 – Analyzing business transactions Chapter 3 – Journalizing and posting Chapter 4 – Adjustment data and worksheet Chapter 5 – Closing entries Fiscal Period Period of time covering a complete accounting cycle through closing entries A day, week, month, whenever you want Monthly is normal for comparison purposes Fiscal year Complete cycle for 12 months Need not coincide with calendar year The 10-Column Worksheet Working paper Simply a tool used for accounting To record necessary updates for financial statements Central place for bringing together information for adjustments Ten Column Worksheet (Overlay pages - Page 120) 10 columns for recording dollar amounts 2 columns for each heading (debit/credit) Trial balance Adjustments Adjusted trial balance Income Statement Balance Sheet Trial Balance Columns You have done this in the homework A listing of each account in the order of Assets Liabilities Owner’s equity Revenue Expenses Trial Balance Columns Noting the balance in each account Foot the debit and credit columns and make sure they balance If you are not in balance, fix it here before continuing Adjustments These update the ledger accounts Internal transactions where no money has changed hands….cash is NOT involved Cash account is NEVER used in adjustment columns Adjustment Example Paid $360 for Insurance for 1 Year on February 1 Analyze the transaction Debit Prepaid Insurance $360 Credit Cash $360 March 1st – How have the accounts changed? $360/12 = $30 of Prepaid Insurance used Insurance Expense increased $30 Depreciation Depreciation Expense is recorded every period that an asset was in use This “expenses” the cost of the asset over its useful life At the end of its use, an asset has a “trade-in value” or salvage value. Depreciation The amount in the asset account is the cost of the asset until disposed The amount in the asset account minus the amount in the Accumulated Depreciation account is called “book value” Depreciation is not deducted directly from the asset account – a new account called “Accumulated Depreciation” is created for each asset. This way, you can see on the balance sheet how much of the asset has expired. Depreciation of Equipment (page 115) Estimated useful life of equipment is 7 years Estimated value of equipment at end of 7 years is $6,880 (trade-in or salvage value) Cost of equipment ($49,720) minus tradein value ($6,880) divided by the number of years of use (7) is the annual depreciation This annual depreciation is divided by 12 to get the Depreciation Expense amount for each month (continued next slide) Depreciation Example Bought Equipment for $49,720 $49,720 - $6,880 (trade-in) = $42,840 $42,840 / 7 years = $6,120 per year Divide the depreciation for one year by 12 to get the depreciation for one month ($6,120 per year / 12 = $510 per month) Each month the depreciation expense is recorded in Depreciation Expense as a debit of $510 (Income Statement) Each month Accumulated Depreciation is credited $510 (Balance Sheet) You are matching expenses against revenue for a certain period Depreciation (review) Record assets at the purchase price Expense the asset over its useful life Expense claimed each period during the useful life is called Depreciation Expense Each asset has its own Accumulated Depreciation account (contra account) See p. 116 for how it will look on the Balance Sheet. Adjustments -Wages Expense (page 116) End of the reporting period Owe wages to employees Haven’t paid them yet but the books are “being closed” so they must be accounted for Figure out how much they have earned up to the date you are closing the books Debit Wages Expense account Credit Wages Payable account Wages Expense Example End of Month on a Wednesday You pay wages of $300 every week on Friday to your employees Equals $60 per day (5-day week) Your employees worked 3 days in this calendar month (Mon., Tues., Wed.) $180 of wages earned ($60 x 3) Wages Expense debited $180 Wages Payable credited $180 What Happens Friday When You Pay Wages •Debit – Wages Payable Wages Payable 180 •Credit - Cash Cash 180 If you debit Wages Expense here then you will be recording it twice The Worksheet Adjustment Columns Page 120 Make sure that debits equal credits here Label each adjusting entry with letter labels, for example, (a) for each debit and credit adjustment to insurance, (b) for each adjustment to depreciation, and (c) for each adjustment to wages Write notes explaining each adjustment, labeled by letter, at the bottom of the Account Name column on the worksheet. Adjusted Trial Balance You have added the columns (up and down) up until now. Now you are going to add/subtract the rows (across) from the trial balance and adjustments This gives you the current status of the accounts (Adjusted Trial Balance) Page 123 Income Statement Column Copy the figures from the adjusted trial balance for all accounts that go into the Income Statement Revenue and expenses only See overlay after page 120 Foot the columns – and debits will NOT equal credits – why not? You haven’t considered profit Balance Sheet Column Copy the balances from all other than Income Statement accounts from the adjusted trial balance column to these accounts Foot the columns and they will not balance….why not? Balance Sheet Column We haven’t considered profit The difference here will be the exact same difference from the Income Statement columns Steps in Completing the Worksheet 1. Complete trial balance columns, foot and double underline if in balance (rule) 2. Complete the adjustments columns, foot and rule 3. Complete adjusted trial balance, foot and rule Steps in Completing the Worksheet 4. Record balances in the Income Statement and Balance Sheet columns, foot 5. Record net income or net loss in Income Statement columns by subtracting the smaller side from the larger side and adding the difference to the smaller side, foot and rule Steps in Completing the Worksheet 6. Record net income or net loss in Balance Sheet column by subtracting the smaller side from the larger side and adding the difference to the smaller side, foot and rule 7. The numbers in step 5 and 6 should be the same Completing Financial Statements The worksheet helps us do this The Income Statement is taken directly from the Income Statement columns of the worksheet Completing Financial Statements When completing the Statement of Owner’s Equity – you need to look at the ledger account…NOT the worksheet for the beginning total The Balance Sheet figures come directly from the Balance Sheet columns EXCEPT Capital, which is taken the Statement of Owner’s Equity After Completing the Statements Journalize and post adjustments You do this by looking at the adjustment columns on the worksheet and making the journal entries. Then post the journal entries to your ledger accounts to update your books. Depreciation Accounts Contra Assets Are on the Balance Sheet following the asset See page 125 Learning Outcomes Review List the classifications of the accounts that occupy each column of a tencolumn worksheet Complete a worksheet for a service enterprise Journalize and post adjusting entries Prepare statements from worksheet Monday, October 1 In-class demonstration problems p. 137 – Exercise 4-8 – Journalize adjusting entries p. 133 – Exercise 4-2 – Classify accounts and indicate normal balances and statement columns p. 135 – Exercise 4-5 – Prepare adjustments and adjusted trial balance Wednesday, October 3 In-class demonstration problem pp. 141-142 – Problem 4-1B Record amounts in the Trial Balance columns of the work sheet Complete the work sheet by making adjustments Homework for Chapter 4 p. 139 – Problem 4-2A Prepare Income Statement, Statement of Owner’s Equity, Balance Sheet, and adjusting entries pp. 139-140 – Problem 4-3A Complete the work sheet by making adjustments Journalize the adjusting entries Not due until October 17, but keep current!