Hierarchical Production Plannning

advertisement

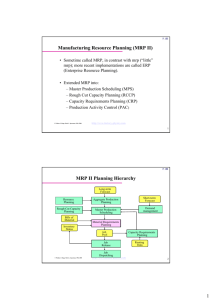

Forecasting The future is made of the same stuff as the present. – Simone Weil © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 1 MRP II Planning Hierarchy Demand Forecast Resource Planning Aggregate Production Planning Rough-cut Capacity Planning Master Production Scheduling Bills of Material Inventory Status Material Requirements Planning Job Pool Capacity Requirements Planning Job Release Routing Data Job Dispatching © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 2 Forecasting Basic Problem: predict demand for planning purposes. Laws of Forecasting: 1. Forecasts are always wrong! 2. Forecasts always change! 3. The further into the future, the less reliable the forecast will be! Forecasting Tools: • Qualitative: – Delphi – Analogies – Many others • Quantitative: – Causal models (e.g., regression models) – Time series models © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 3 Forecasting “Laws” 1) Forecasts are always wrong! 2) Forecasts always change! 3) The further into the future, the less reliable the forecast! 40% Trumpet of Doom 20% +10% -10% Start of season 16 weeks 26 weeks © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 4 Quantitative Forecasting Goals: • Predict future from past • Smooth out “noise” • Standardize forecasting procedure Methodologies: • Causal Forecasting: – regression analysis – other approaches • Time Series Forecasting: – – – – – moving average exponential smoothing regression analysis seasonal models many others © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 5 Time Series Forecasting Historical Data A(i), i = 1, … , t © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 Forecast Time series model http://factory-physics.com f(t+t), t = 1, 2, … 6 Time Series Approach Notation: A(i ) observatio n in period i t current period f (t t ) forecast for period t t F (t ) smoothed estimate as of period t T (t ) smoothed trend as of period t © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 7 Time Series Approach (cont.) Procedure: 1. Select model that computes f(t+t) from A(i), i = 1, … , t 2. Forecast existing data and evaluate quality of fit by using: MAD MSD BIAS n f (t ) A(t ) n t 1 n ( f (t ) A(t )) 2 n t 1 n ( f (t ) A(t )) n t 1 3. Stop if fit is acceptable. Otherwise, adjust model constants and go to (2) or reject model and go to (1). © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 8 Moving Average Assumptions: • No trend • Equal weight to last m observations Model: F (t ) t i t m 1 f (t t ) F (t ), © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 A(i ) m t 1, 2, ... http://factory-physics.com 9 Moving Average (cont.) Example: Moving Average with m = 3 and m = 5. Month t 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Demand A (t ) 10 12 12 11 15 14 18 22 18 28 33 31 31 37 40 33 50 45 55 60 © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 Forecast (m =3) f (t ) 11.33 11.67 12.67 13.33 15.67 18.00 19.33 22.67 26.33 30.67 31.67 33.00 36.00 36.67 41.00 42.67 50.00 Forecast (m =5) f (t ) 12.0 12.8 14.0 16.0 17.4 20.0 23.8 26.4 28.2 32.0 34.4 34.4 38.2 41.0 44.6 http://factory-physics.com Note: bigger m makes forecast more stable, but less responsive. F (t ) t i t m 1 f (t t ) F (t ), A(i ) m t 1, 2, ... 10 Exponential Smoothing Assumptions: • No trend • Exponentially declining weight given to past observations Model: F (t ) A(t ) (1 ) F (t 1) f (t t ) F (t ), © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 t 1, 2, ... http://factory-physics.com 11 Exponential Smoothing (cont.) Example: Exponential Smoothing with = 0.2 and = 0.6. Month t 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Demand A (t ) 10 12 12 11 15 14 18 22 18 28 33 31 31 37 40 33 50 45 55 60 © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 Forecast (a =0.2) f (t ) 10.00 10.40 10.72 10.78 11.62 12.10 13.28 15.02 15.62 18.09 21.08 23.06 24.65 27.12 29.69 30.36 34.28 36.43 40.14 Forecast (a =0.6) f (t ) 10.00 11.20 11.68 11.27 13.51 13.80 16.32 19.73 18.69 24.28 29.51 30.40 30.76 34.50 37.80 34.92 43.97 44.59 50.83 http://factory-physics.com Note: we are still lagging behind actual values. F (t ) A(t ) (1 ) F (t 1) f (t t ) F (t ), t 1, 2, ... 12 Exponential Smoothing with a Trend Assumptions: • Linear trend • Exponentially declining weights to past observations/trends Model: F (t ) A(t ) (1 )( F (t 1) T (t 1)) T (t ) ( F (t ) F (t 1)) (1 )T (t 1) f (t t ) F (t ) tT (t ) © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 Note: these calculations are easy, but there is some “art” in choosing F(0) and T(0) to start the time series. http://factory-physics.com 13 Exponential Smoothing with a Trend (cont.) Example: Exponential Smoothing with Trend, = 0.2, = 0.5. Note: we start with trend equal to difference between first two demands. F (t ) A(t ) (1 )( F (t 1) T (t 1)) T (t ) ( F (t ) F (t 1)) (1 )T (t 1) f (t t ) F (t ) tT (t ) Month t 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 Demand A (t ) 10 12 12 11 15 14 18 22 18 28 33 31 31 37 40 33 50 45 55 60 Smoothed Estimate F (t ) 10.40 12.32 13.62 15.20 16.25 17.66 19.62 20.63 23.17 26.69 29.73 32.30 35.42 38.67 40.01 43.78 46.41 50.38 55.02 http://factory-physics.com Smoothed Trend T (t ) 2.00 1.96 1.63 1.61 1.33 1.37 1.67 1.34 1.94 2.73 2.89 2.72 2.92 3.09 2.21 2.99 2.81 3.39 4.01 Forecast f (t ) 12.40 14.28 15.26 16.81 17.57 19.03 21.29 21.97 25.11 29.42 32.62 35.02 38.34 41.76 42.22 46.77 49.23 53.77 14 Exponential Smoothing with a Trend (cont.) Example: Exponential Smoothing with Trend, = 0.2, = 0.5. Note: we start with trend equal to zero. F (t ) A(t ) (1 )( F (t 1) T (t 1)) T (t ) ( F (t ) F (t 1)) (1 )T (t 1) f (t t ) F (t ) tT (t ) Month t 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 Demand A (t ) 10 12 12 11 15 14 18 22 18 28 33 31 31 37 40 33 50 45 55 60 Smoothed Estimate F (t ) 10.00 10.40 10.88 11.18 12.20 13.09 14.70 17.11 18.74 21.96 26.14 29.77 32.80 36.25 39.67 41.05 44.75 47.23 50.99 55.40 http://factory-physics.com Smoothed Trend T (t ) 0.00 0.20 0.34 0.32 0.67 0.78 1.19 1.81 1.71 2.47 3.33 3.48 3.25 3.35 3.39 2.38 3.04 2.76 3.26 3.84 Forecast f (t ) 10.60 11.22 11.49 12.86 13.87 15.89 18.92 20.45 24.43 29.47 33.25 36.06 39.59 43.06 43.43 47.79 49.99 54.25 15 Effects of Altering Smoothing Constants Exponential Smoothing with Trend: various values of and Note: these assume we start with trend equal diff between first two demands. n MAD f (t ) A(t ) n t 1 n MSD ( f (t ) A(t )) 2 n t 1 n BIAS ( f (t ) A(t )) n t 1 © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 0.1 0.1 0.1 0.1 0.1 0.4 0.4 0.4 0.4 0.4 0.7 0.7 0.7 0.7 0.7 1.0 1.0 1.0 1.0 1.0 0.2 0.4 0.6 0.8 1.0 0.2 0.4 0.6 0.8 1.0 0.2 0.4 0.6 0.8 1.0 0.2 0.4 0.6 8.0 1.0 MAD 4.11 3.98 3.76 3.63 3.54 3.75 3.83 3.93 4.01 4.08 4.34 4.53 4.74 4.99 5.27 4.94 5.25 5.83 6.66 7.72 http://factory-physics.com MSD 27.56 24.82 21.98 20.07 19.26 21.82 22.52 23.87 24.82 25.44 27.18 30.00 33.65 38.39 44.59 39.82 48.75 61.27 78.86 104.06 BIAS -2.00 -1.94 -1.73 -1.47 -1.20 -1.07 -0.85 -0.78 -0.74 -0.67 -0.75 -0.60 -0.50 -0.41 -0.34 -0.56 -0.42 -0.32 -0.25 -0.17 16 Effects of Altering Smoothing Constants Exponential Smoothing with Trend: various values of and Note: these assume we start with trend equal to zero. 0.1 0.1 0.1 0.1 0.1 0.1 0.2 0.2 0.2 0.2 0.2 0.2 0.3 0.3 0.3 0.3 0.3 0.3 0.1 0.2 0.3 0.4 0.5 0.6 0.1 0.2 0.3 0.4 0.5 0.6 0.1 0.2 0.3 0.4 0.5 0.6 © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 MAD 10.23 8.27 6.83 5.83 5.16 4.69 6.48 5.04 4.26 3.9 3.73 3.65 4.98 4.11 3.82 3.66 3.65 3.68 MSD 146.94 95.31 64.91 47.17 36.88 30.91 60.55 37.04 27.56 23.75 22.32 21.94 37.81 26.3 22.74 21.81 21.78 22.06 BIAS -10.23 -8.27 -6.69 -5.43 -4.42 -3.62 -6.29 -4.49 -3.29 -2.51 -2.02 -1.71 -4.45 -3.03 -2.23 -1.77 -1.52 -1.38 http://factory-physics.com 0.4 0.4 0.4 0.4 0.4 0.4 0.5 0.5 0.5 0.5 0.5 0.5 0.6 0.6 0.6 0.6 0.6 0.6 0.1 0.2 0.3 0.4 0.5 0.6 0.1 0.2 0.3 0.4 0.5 0.6 0.1 0.2 0.3 0.4 0.5 0.6 MAD 4.3 3.89 3.77 3.75 3.76 3.79 4.13 3.91 3.88 3.9 3.94 3.97 4.12 4.03 4.04 4.09 4.14 4.21 MSD 30.14 23.78 22.25 22.11 22.36 22.67 27.4 23.61 23.02 23.26 23.73 24.27 26.85 24.63 24.69 25.35 26.25 27.29 BIAS -3.45 -2.34 -1.77 -1.46 -1.29 -1.18 -2.84 -1.94 -1.49 -1.25 -1.1 -1 -2.42 -1.66 -1.29 -1.08 -0.95 -0.84 17 Effects of Altering Smoothing Constants (cont.) Observations: assuming we start with zero trend • = 0.3, = 0.5 work well for MAD and MSD • = 0.6, = 0.6 work better for BIAS • Our original choice of = 0.2, = 0.5 had MAD = 3.73, MSD = 22.32, BIAS = -2.02, which is pretty good, • although = 0.3, = 0.6, with MAD = 3.65, MSD=21.78, BIAS = -1.52 is better. © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 18 Winters Method for Seasonal Series Seasonal series: a series that has a pattern that repeats every N periods for some value of N (which is at least 3). Seasonal factors: a set of multipliers ct , representing the average amount that the demand in the tth period of the season is above or below the overall average. Winter’s Method: • The series: • The trend: F (t ) A(t ) / c(t N ) (1 )F (t 1) T (t 1) T (t ) F (t ) F (t 1) (1 )T (t 1) • The seasonal factors: c(t ) A(t ) / F (t ) (1 )c(t N ) • The forecast: f (t t ) F (t ) tT (t )c(t t N ) © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 19 Winters Method Example Smoothed Time Actual Estimate Period t Demand A(t) F(t) 1 4 2 2 3 5 4 8 5 11 6 13 7 18 8 15 9 9 10 6 11 5 12 4 8.33 13 5 8.54 14 4 9.37 15 7 9.69 16 7 9.57 17 15 9.83 18 17 10.04 19 24 10.26 20 18 10.36 21 12 10.55 22 7 10.59 © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 Smoothed Trend T(t) 0.00 0.02 0.10 0.12 0.10 0.12 0.13 0.13 0.13 0.14 0.13 Seasonal Factor c(t) 0.480 0.240 0.600 0.960 1.320 1.560 2.160 1.800 1.080 0.720 0.600 0.480 0.491 0.259 0.612 0.937 1.341 1.573 2.178 1.794 1.086 0.714 Forecast f(t) http://factory-physics.com alpha beta gamma 4.00 2.06 5.68 9.43 12.76 15.52 21.97 18.72 11.33 7.69 0.1 0.1 0.1 20 Winters Method - Sample Calculations 12 F (12 ) c(1) A(t ) t 1 12 4 2 4 8.33 12 A(1) 4 0.480 F (12 ) 8.33 Initially we set: • smoothed estimate = first season average • smoothed trend = zero (T(N)=T(12) = 0) • seasonality factor = ratio of actual to average demand F (13) ( A(13) / c(13 12 ) (1 )( F (12 ) T (12 )) 0.1(5 / 0.480 ) (1 0.1)(8.33 0) 8.54 From period 13 on we can use initial values and standard formulas... T (13) ( F (13) F (12 )) (1 )T (12 ) 0.1(8.54 8.33) (1 0.1)(0) 0.02 c(13) ( A(13) / F (13)) (1 )c(1) 0.1((5 / 8.54 ) (1 0.1)(0.48) 0.491 © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 21 Conclusions Sensitivity: Lower values of m or higher values of will make moving average and exponential smoothing models (without trend) more sensitive to data changes (and hence less stable). Trends: Models without a trend will underestimate observations in time series with an increasing trend and overestimate observations in time series with a decreasing trend. Smoothing Constants: Choosing smoothing constants is an art; the best we can do is choose constants that fit past data reasonably well. Seasonality: Methods exist for fitting time series with seasonal behavior (e.g., Winters method), but require more past data to fit than the simpler models. Judgement: No time series model can anticipate structural changes not signaled by past observations; these require judicious overriding of the model by the user. © Wallace J. Hopp, Mark L. Spearman, 1996, 2000 http://factory-physics.com 22