Balance of Trade

advertisement

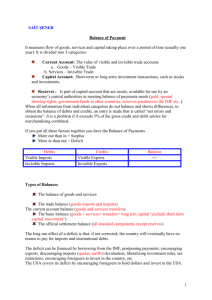

Balance of Trade Merchandise Trade Balance • The gap between exports and imports if goods only – – – – – Not services Not other payments between countries Exports > Imports—Trade Surplus Exports < Imports—Trade Deficit About 30 years ago we had ship and planes filled with cargo and this was important • But today we have call centers in India, movies over the internet and others that make the merchandise trade balance seem limitd Current Account Balance • The single statistic that captures the most comprehensive picture of a nation’s balance of trade – Goods – Services • Net Exports or Commercial Balance – Net primary income or factor income • Earnings on foreign investments – Net unilateral transfers Current Account Balance for 2003 www.bea.gov Exports/Credit Imports/Debit Balance Merchandise trade $713 billion $1,261 billion -$548 billion Services trade $307 billion $256 billion $51 billion Investment income $294 billion $261 billion $33 billion Unilateral transfers -$67 billion TOTAL -$531 billion Trade • Trade is very closely related to national saving • Everything on the surplus side of the trade balance involves money flowing into a county – Like exports and investment income • The deficit side of the balance involve money flowing out of the country – Like when we buy imports or paying some other country investment income Trade Deficit • When the trade balance is zero then the flow of funds out is equal to the flow of funds in • We have a deficit which mean dollar are flowing out of the country – We were importing and there was not a corresponding flow back in sufficient to offset our imports What Happened to Those Extra Dollars? • They are not coming back so something must have happened—we know what did not happen – Not used to buy US goods – Not used as payment for investments purchased by Americans – Not given back as a gift • You need to remember that US dollars are only legal tender in the US (well sort of) More • That Honda purchased in the 80s involved a transfer of dollars • And Honda does not want dollars—it needs yen to pay its workers • Honda will want to trade dollar with someone who has yen in the foreign exchange market • In one way or another they end up invested in US assets – Either it goes to someone who buys stocks or bonds directly – Or property – Or put in a dollar denominated bank account—and then the bank will loan out the dollars • The money is returning as a flow of investment—it is the US economy, as a whole, borrowing from foreigner who have earned dollars and are not investing National Savings and Investment Identity • Domestic Savings + Inflows of Foreign Capital • = • Domestic Investment + Government Borrowing • The left side is the sources of financial capital and the right side is the demand for financial capital • S=D Trade Deficit • An extra source of money flowing into the economy; an extra source of capital which can be borrowed by firms or by the US government Identity • This is an identity and it must be true • If one side changes, something else must change to bring it back into equality – Say the government budget deficit increases – It must be one of the three—do not know which one – In the 80s it was an inflow of capital and the US became a net debtor to the world Remember the CA • This translates into the US owns foreign assets and the Rest Of World owns US assets—in fact they own more of us than we own of them • People that own assets expect a rate of return – Remember the current account—this is where the investment income comes from Is This Good? • Relying on foreign capital may be better than not having financial capital • Did you know that we ran trade deficits year after year through the 19th century—we had large inflows of international funds—they help us grow—helped us build the canals and the railroads • Korea had huge trade deficits in the 60s and 70s and look at the result Is This Bad? • Yes! You can borrow too much. You can borrow expecting to build up your economy and then not be able to sell – Argentina, Mexico, Russia • You can borrow to fund consumption – Greece • You need to borrow in a way that generates sufficient benefit so that you can repay—like your student loans What Are The Causes of a Large Trade Deficit • National Savings and Investment Identity • Domestic Savings + Inflows of Foreign Capital • = • Domestic Investment + Government Borrowing • If the trade deficit went up, it must be that something else went up as well – One reason could be large budget deficits • Money could be sucked in by large government borrowing – One reason could be a surge in investment in the US – One reason could be a drop in private savings 80s and early 2000s • We were running large budget deficits – In some cases the government was borrowing from abroad – In some cases they were soaking up the domestic investment and firms went abroad to seek funds • A budget surplus is not always a trade surplus— the late 90s had budget surpluses but the dot com boom was pulling money from abroad and we still had a trade surplus Agenda for Trade Deficits and Agenda for Long-Term Growth • Reducing the trade deficit, if we are going to try to keep domestic investment high, this will require higher domestic savings • If you want to increase the growth rate you also need to keep the investment rate high • In both cases the policy response to encourage increasing domestic savings What is the Trade Deficit About? • We just talked about it – They are macroeconomic in nature • National savings • National investment • Budget deficits • Most of the stuff I hear people complaining about are just myths Myths • The trade deficits is because of unfair foreign trade • Foreign countries are shutting out US goods • There are unfair exports to the US • They have nothing to do with the trade deficit – Look at the pattern—you trying to tell me that in recent years foreign trade has gone from fair to unfair back to fair and then back to unfair Myths • Protectionism—restricting imports from abroad – This will neither cause nor fix trade deficits – Yes, you can restrict imports from abroad • But if there is a big gap between national saving and national investment it will show up somehow in a trade imbalance • Beside it deprives the country of the benefits of trade Myths • Trade deficits are not determined by the level of international trade • World exports are about 25% of world GDP – Do countries that export more than 25% have greater trade deficits or surpluses – Do countries that have exports less than 25% (less exposed to international trade) have smaller trade deficits or surpluses • There is no pattern Look at US and Japan • The US has exports at about 10-12% of GDP, significantly lower that the world level of 25%, and it currently has a trade deficit • Japan also has exports at about 10% of GDP but has a high surplus because of its high saving rate Bilateral Trade Deficits • You hear more about bilateral trade deficits or trade deficits with one country like China – They may be a large trading partner, although Canada is larger, but this does not have macroeconomic importance – We should expect the US to have surpluses with some countries and deficits with others it is the macro view that is important High Income Countries • High income countries over time have tended to run trade surpluses – And thus have been net investors abroad investing in low income countries • Today the rest od the world is investing in us, the richest economy in the world – I wonder if this will continue—at some point we will need to pay our bills If it Does Change • Will we continue to be a net borrower – Will foreigner continue to want to hold our assets – What will need to adjust • Either – A lower budget deficit » Higher taxes or less spending – Higher domestic savings (difficult with low interest rates) which means less consumption – Or less investment by firms in plants and equipment