Regulation of Import Competition and Unfair Trade

advertisement

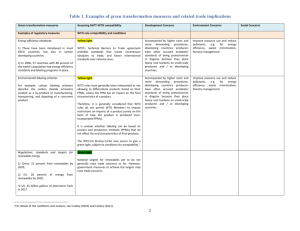

Regulating Import Competition and Unfair Trade Chapter 11 © 2002 West/Thomson Learning 1 Free Trade & Protectionism How do international rules serve to check competing national interests Focus on laws that safeguard domestic industry from import competition GATT / WTO & US law Authorize “import relief” or “ adjusting imports” “Safeguards” against injury from imports 2 GATT Escape Clause GATT Article XlX allows escape from previous tariff concessions GATT 1994 Agreement on Safeguards sets rules for safeguarding domestic industry and providing import relief Is product being imported in such increased quantities and under such conditions as to cause or threaten to cause serious injury to domestic industry? Country seeking to apply safeguard must first undertake administrative investigation Safeguards only temporary – 4 years, subject to extension to 8 years Safeguards must be non-discriminatory, and lifted gradually as conditions warrant 3 GATT 1994 Agt. on Safeguards Countries imposing safeguards must notify WTO Safeguards Committee – monitors compliance Tariffs preferred “safeguard” mechanism If use quotas, must allocate among supplying nations based on proportion of total imports and can’t reduce imports below average of last 3 years Limits on imposing safeguards on developing countries GATT encourages countries imposing safeguards to compensate supplying nations for burden Reduce tariffs on other products If no agreement on compensation, supplying nation can raise tariffs in retaliation 4 Argentina Safeguard Measures on Imports of Footwear (WTO App. Body, 1999) Argentina initiated safeguard investigation and determined that increased imports of footwear caused serious injury to domestic producers Increased duty on imported footwear to 200%, except for imports from MERCOSUR nations EU requested WTO panel, US joined as 3rd party Must events leading to increased imports be “unforeseen developments” to justify imposition of safeguards? Safeguards to be extraordinary measures – when member confronted with unexpected events Art. 4.2 of Agt on Safeguards requires investigation to examine all relevant factors – included those listed Argentina’s investigation didn’t examine 2 of listed factors – didn’t comply with Agt. on Safeguards – can’t justify excluding imports from non-MERCOSUR nations 5 US Law on Safeguards: Section 201 of Trade Act, as Amended Allows import relief when“article being imported in such increased quantities as to be a substantial cause of serious injury or threat thereof to domestic industry producing an article like or directly competitive with the imported article” President may “adjust” imports after ITC investigation if it will “facilitate efforts by domestic industry to make positive adjustment” and if provides greater economic and social benefits than costs6 Enforcement of S. 201 Initiated by petition filed with ITC – or ITC can self-initiate ITC holds public hearings considers statutory list of factors Prepares detailed analysis of affected market ITC makes recommendation to the President President decides whether to implement safeguards; temporary (4-8 yrs. maximum) 50% tariff increase tariff rate quotas absolute quotas negotiated agreements 7 Trade Adjustment Assistance Workers displaced by increased imports may file petition with the Dept. of Labor Sec. of Labor must determine that imports have contributed to separation Program administered through sate unemployment programs Direct cash payments to workers Job retraining for workers and relocation Help for companies as well Separate assistance program for workers losing jobs as result of NAFTA 8 US Steel Industry: Case Study “Glut” of steel on world market – US firms face heavy competition 2002 – ITC finds imports “substantial cause of serious injury or threat” Bush Admin. Imposes 30% tariff under S. 201 – some countries excepted – for 3 years WTO complaint filed by many countries WTO panel held not result of “unforeseen developments” and couldn’t show imports have increased, no showing of serious injury and violated non-discriminatory principle 2003 – WTO Appellate Body upholds panel Japan and EU threaten $2 Bil in retaliatory tariffs Bush Admin. removes tariffs in Dec. 2003 9 Unfair Imports Dumping Subsidies 10 Dumping Dumping is the selling of products in a foreign country for less than the price charged in producer’s home market Alleged price discrimination causing injury to domestic competitors Controversy over economic effects of dumping Anti-dumping provisions most commonly used trade laws in EU and US 11 GATT Provisions on Dumping GATT 1994 Antidumping Agreement allows members to impose duties if dumped goods threaten or cause material injury to domestic industry GATT says dumping is at less than normal value US states dumping is a sale at less than “fair value” Normal value - export price = dumping margin Export price = price w/o shipping charges sold to unrelated buyer in importing country Use “constructed price” if products from “nonmarket” country GATT requires formal investigation to determine material injury before imposing duties 12 US Antidumping Provisions Petition filed with government to initiate process ITA determines if goods sold in US at less than fair value ITC determines extent of material injury to US producers If injury due to dumping, impose antidumping duties US Customs Service collects antidumping duties 13 Pesquera Mares Australes v. US (Fed. CA 2001) Facts: PMA, Chilean salmon exporter accused of dumping ITA based “normal value” on sales in Japan Japanese sales of higher grade – ITA held was “like product” ITA imposed duties; affirmed by Court of Int. Trade; PMA appeals Issue: Were Japanese sales of “like product”? Decision: Yes, affirm CIT decision Reasons: distinctions btwn grades nominal Commercial practice didn’t recognize grade above “superior” ITA definition of “identical in physical characteristics” as not requiring products be exactly the same is permissible under 14 statute WTO Role in Anti-Dumping WTO Committee on Antidumping Practices created in 1994 Dumping disputes may be submitted to WTO DSB for resolution WTO panel may review final antidumping order of admin. Agency for consistency with GATT Antidumping Agt If order violated GATT, panel can recommend measures to be taken against importing country Limited scope of review: Can’t reconsider determinations of fact from investigation Can’t overturn interpretation of agreement made by investigating agency 15 Dumping and Non-Market Economies US – specific rules for calculating dumping margins in NME countries Define “surrogate normal value” by price of factors of production in market economy country at same level of development and significant producer of comparable merchandise Market–oriented industries: inputs procured at free market prices, production due to market forces and producers mostly privately-owned Bulk Aspirin from PRC (ITA 2000): R alleges that aspirin from PRC being dumped on US market Only 2 Chinese firms responded to request for information – they weren’t subject to govt. control Apply single PRC-wide rate to all other producers Use India as surrogate – significant producer of comparable merchandise – use Indian figures for normal value 16 Subsidies Government confers a benefit on a domestic firm and provides income, price support or financial contribution (not collecting a tax, providing grant or loan at favorable rate) Domestic subsidies are permitted as part of government’s responsibility to fund social programs and provide growth Subsidies distort trade patterns, give unfair competitive advantage, and encourage activity unprofitable without subsidy 17 GATT and Subsidies GATT provides 3 types of subsidies: Prohibited subsidies: Export or import substitution subsidies Domestic or adverse subsidies: government programs as part of legitimate responsibility of government to direct industrial growth and fund social programs Socially-beneficial subsidies: subsidies to expand knowledge through R & D; subsidies to poor or depressed regions, or subsidies to help firms meet one-time costs of environmental or antipollution requirements Member nations should notify WTO Committee on Subsidies and Countervailing Measures in advance of granting subsidy 18 GATT and Subsidies 1994 Agreement on Subsidies and Countervailing Measures WTO member can appeal to WTO for dispute resolution WTO can recommend elimination of subsidy, elimination of harmful effects, or countermeasures Adverse effects of subsidies actionable under WTO if: Cause injury to domestic industry in another WTO member Cause nullification and impairment of member rights under GATT Cause “serious prejudice” to another member Importing country may also initiate admin. proceedings to impose countervailing duties to eliminate subsidy advantage 19 US Procedure for Countervailing Duties Complaint filed with ITA ITA determines is subsidy exists ITC then determines if subsidy causes material injury to domestic industry “material injury” standard less than “serious injury” standard required for action under safeguard provisions If injury exists, impose CVD’s to offset subsidy advantage ITA and ITC decisions subject to judicial review in US Court of International Trade if final or negative determinations Finding of material injury must be reviewed every 5 years if antidumping order in effect NAFTA Arbitration Panel for dumping of Mexican or Canadian goods 20 Dumping and Subsidy Offset Act of 2000 Toughened CVD and Antidumping laws Applied to CVD’s and antidumping duties assessed after Oct. 1, 2000 US Customs will now collect and distribute duties to injured parties WTO held transfer payments was subsidy, affirmed on appeal Aug. 2004 – WTO approves retaliatory sanctions against US US repeals provisions in Feb. 2006 – but repeal not effective until Oct. 1, 2007 21 US-Countervailing Measures Concerning European Steel (WTO Appellate Body 2002) Facts: Govt. support or ownership of European steel industry US responded with countervailing duties Later, govts. privatized industry – new private firms sell steel in US ITA imposed countervailing duties on steel imports – held benefits from subsidies were “passed through” to new firms – used “same person” rule EC – transfer was at arm’s length – fair market value – no govt. control Issue: Did “same person” rule application violate GATT SCM Agt.? Decision: Yes, “same person rule” impedes ITA from examining if benefit continues to exist after change in ownership ITA must consider broad range of factors to determine if benefits “pass through” ITA adopts new rule – rebuttable presumption 22 Section 301 Actions Allows retaliation by USTR against countries violating US rights under international trade agts S. 301 actions initiated by petition to USTR Investigation of alleged violations Commerce Dept. – investigate if CVD or subsidy – if so, negotiations If no resolution, USTR can impose measures Remedies include: Suspend trade concessions Impose duties Import restrictions Compensatory benefits to US 23 S. 337 of Tariff Act of 1930 Allows relief for unfair methods of competition in importation or sale of imported goods Used to prevent infringement of IP rights – pirated or counterfeit goods Investigation by ITC – petition by domestic producer or holder of IP rights Remedy is exclusion of goods Cease and desist order – permanent exclusion order Penalty for violation is $100K fine or 2X domestic value of goods 24 Web Sites http://www.wto.org http://www.usitc.gov http://www.doleta.gov http://www.ita.doc.gov http://www.european.cu.int/comm/trad e http://www.ia.ita.doc.gov 25