School District Expenditures - Arkansas Association of Educational

advertisement

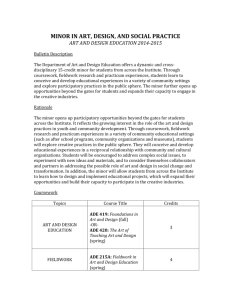

School District Expenditures SF101B Introduction to School Finance Benny L. Gooden ASBO July 9, 2012 Why are you/we here? ASBO Certification Increase personal knowledge Tier 1 Requirement—Expenditures Tier 1 annual update To make the day complete Summer heat causes delirium Bad economy prevents excessive shopping Evolution of Account Classifications Handbook II, Financial Accounting for Local and State School Systems: Standard Receipt and Expenditure Accounts, 1957 Handbook II Revised, Financial Accounting: Classification and Standard Terminology for Local and State School Systems, 1973 Account Classification Standards-Present Edition Handbook II R2- 1990 Reflects changes and clarifications in generally accepted accounting principles (GAAP) Financial Accounting for Local and State School Systems. 2003 Edition (NCES) NCES Revised Edition published June, 2009. http://nces.ed.gov/ppubsearch/pubsinfo.asp?pubid2009325 State Accounting Systems (ADE, etc.) adapt Handbook II R2 for use by local school districts Note: Account structures and codes are changed with relative frequency—check latest ADE guidelines. Access on APSCN site Legal Authority for School District Revenue in Arkansas Constitution of Arkansas (1874 as Amended) Article 14 § 1. Free school system § 2. School fund—use –Purposes § 3. School tax—Budget—Approval of tax rate Amendments 11, 40 & 74 § 4. Supervision of schools Selected Statutory Guidelines for School District Finance• • • • • • • • • • • Attend meetings of school board. Determine mission and direction of district. Adhere to state and federal laws. Enact, enforce and obey policies. Employ staff. Understand and oversee school district finances. Manage facilities. Approve curriculum and ensure that it is taught. Visit district schools and classrooms. Obtain training and professional development. Do “all other things necessary and lawful..” Revised 2009 § 6-13-620 A.C.A. Selected Statutory Guidelines..continued Board disbursing officer § 6-13-618 Best Financial Practices § 6-15-2301 Classified School Employee Minimum Salary Act § 6-17-2203 Teacher compensation guidelines § 6-17-2104 and § 6-17-2403 Independent Audit deadlines • Training Requirements § 6-20-1801 § 6-20-1805 Basis of Accounting Establishes point-in-time when revenues or expenditures and related assets and liabilities are recognized in district accounts and reported in financial statements Determines timing with which the accounting system recognizes transactions Basis of Accounting-Options Cash Basis- Recognized when cash is received or disbursed Accrual Basis- Measures financial position based on economic resources and obligations Single Entry/Double Entry Accounting Cash Basis Revenue recorded when cash is received Expenses recorded when cash is paid Financial condition measured by cash balance Receivables, payables or accrued items are not recognized Accrual Basis Revenues are recognized when earned—regardless of when received Expenses are recognized when incurred—regardless of when paid Economic status reflects resources and obligations—regardless of cash flow timing Single-Entry/Double Entry Accounting Involves choosing method of recording transactions Many school districts use a combination of single/double-entry records Single-entry records can be converted to double entry in the preparation of a balance sheet Electronic systems imbed these qualities into their program features. Double Entry Accounting Provides for Equality of Debits and Credits Maintains balance between assets and liabilities Balances reserves and fund equities Provides date specific financial status Provides checks and balances in system Documents financial position of district Good Expenditure Planning begins with Now Required by Law! With a penalty clause! Classification of Account Revenues and Expenditures Fund Source of Funds Function Location/Operational Unit Program Subject/Project Object X XXX XXXX XXX XXX XX XXXXX The Budget Strip-in practice 2281-1105-040-987-00 Fund/Source of Funds Function 66100 Object Program Location Subject Fund/Source of Funds/Project Fiscal and accounting entity with a selfbalancing set of accounts recording cash and other financial resources. Funds are established to account for financing or specific activities of the district’s operations. Source of funds codes are required for a number of categories—ADE provides Revenues may be segregated by source or further classified using the program code. Expenditures may be segregated by purpose Fund Classifications 1 2 3 4 5 6 7 8 9 X Teacher Salary Fund Operating Fund Building/Capital Projects Fund Debt Service Fund Capital Outlay/Dedicated M & O Fund Federal Grants Fund Activity Fund Food Service Fund Fixed Asset Fund Function Describes the activity being performed when a service is provided or a material object is received. Functions of a school district are classified into five broad categories. Functions and subfunctions consist of activities which have somewhat the same general operational objectives. Function Classification XXXX Instruction Regular Programs Special Education Workforce Education Adult/Contin. Education Compensatory Education Other Instruction 1000 1100 1200 1300 1400 1500 1900 Function Classification XXXX continued Support Services Student Support Services Instructional Staff Support General Administrative Support School Administration Support Business Support Operation/Maintenance Services Student Transportation Central Support Other 2000 2100 2200 2300 2400 2500 2600 2700 2800 2900 Function Classification XXXX Continued Operation of Non-Instructional Services 3000 Food Service 3100 Other Enterprise Operations 3200 Community Service 3300 Other Non-Instructional Services 3400 Function Classification XXXX Continued Facilities Acquisition & Construction Supervision of Acquis/Constr. Site Acquisition Site Improvement Architect/Engineering Services Educational Spec/Development Building Acquisition/Construction Building Improvement Services Other 4000 4100 4200 4300 4400 4500 4600 4700 4800 Function Classification XXXX Continued Other Uses (Governmental Funds Only) 5000 LEA Indebtedness 5100 Fund Transfers 5200 Payment to other LEA’s(AR) 5300 Payment to LEA’s outside AR 5400 Indirect Costs 5500 Other Non-Programmed Costs 5900 Location/Operational Unit Assigned by LEA’s to Identify attendance centers As designator of budgetary or cost center indicator As means of segregating costs by building structure As location code for payroll check distribution Location Classification XXX Assigned by local school district to designate specific school units, sites and/or location/centers Regular school units must use the last three digits of the schools LEA number in this field Example: Fort Smith Public Schools Ballman Elementary School 66-01-001 Program Code Associated with a plan of activities and procedures designed to accomplish a set of objectives. This enables all expenditures associated with a particular program to be tracked across various functions, funds, locations, etc. Examples: NSLA salary supplements, athletics, special education, alternative education, gifted and talented, etc. Object Describes the service or commodity obtained as a result of a specific expenditure. Subdivisions of the major categories provide for greater detail and analysis for review and planning purposes. Object Classification XXXXX Personal Services-Salaries 61000 Personal Services-Benefits 62000 Purchased Professional/Technical Services 63000 Purchased Property Services 64000 Other Purchased Services 65000 Supplies and Materials 66000 Property-Assets 67000 Other objects 68000 Other Uses of Funds 69000 Account Structure Concept Salary Benefits Pur/Serv Mat/Supplies Capital Other Instruction Regular Special Support Services Community Services Facility Acquisition Other ****Each Function & Object is also classified by Fund and Unit Fund/Function/Object Summary Example Foundation Aid Tracking As noted in the discussion on Revenues, the General Assembly has required separate accounting for expenditures made from Foundation Aid to document educational services paid with these funds. Foundation aid accounting in Fund 2000. See ADE coding guidelines for specific directions. Refer to Commissioner’s Memo’s FIN-09-047, FIN-10-008 and FIN-11-080 for details. Interest—if not information—relative to Handbook IIR2 is widespread Account coding is required to reveal: Athletic expenditures Student transportation District administration School administration Instructional facilitators Supervisory aides Substitutes Property Insurance Is Handbook IIR2 really designed to account for these? Act 1006 requires gathering information on these expenditures: Student growth Declining enrollment Special education catastrophic occurrences Special education services Technology grants Debt service supplement General facilities Distance learning Gifted and talented Do it Right…or Pay the Price! Act 1006 provides for ADE to publish rules to identify error rates by local schools in reporting and provides that fines or other penalties may be assessed. Keys to Sound Budget Management Systematic Classification of Revenue and Expenditures Encumbrance of commitments Control of Account Structure Frequent Monitoring of Accounts Periodic Review by Third-Party Maintenance of Archives from Past Salary Projections Essentials for Accuracy Orderly Schedule for Various Groups of Employees Calculation of Extended Terms for Selected Groups of Employees Benefit Calculation Health Insurance-District Paid FICA .0765 Employer Retirement Contribution .14 Other Consider T-DROP Impact-- 14% for all Other Salary Issues Educational Increments Savings from Retirees vs. new hires Early Retirement Incentives Sick Leave Buyback Severance Issues Substitute Payroll Multi-year impact of salary policy Educational Excellence Trust Fund compliance Salary Increases and NSLA funds Act 1590 of 2007 governs the use of NSLA funds for general classroom teacher salaries. •Bonuses only •Conditions prior to use of NSLA •Compliance with ACSIP, Accreditation, etc. •Phase out if included in scheduled salaries •Reports, reports, reports Spending Requirements for Categorical Funds Act 1220 of 2011 Effective by June 30, 2012 At least 85% of NSLA Funds must be spent Transfer authority among categories is granted Commissioner may grant waivers Balance in categorical funds shall not exceed 20% of annual allocation Provisions for 10% annual reduction required Failure to comply results in deduction Subject to rules promulgated by State Board of Education Estimation of Unavoidable Costs Debt Payments-Principal & Interest Property Insurance Utilities Salaries and Benefits Required Costs Facility Operation & Maintenance costs equal to 9% of Foundation Aid Classified Salary increases if at minimum wage—2012-2013 minimum $8.02 per hr. Certified Salary schedule: minimum/inc. Other mandated services Mandates with Financial Implications Full Credit for Service in higher education and private schools Act 2307 of 2005 Certified staff base salary increase Act 2130 of 2005-Act 19 (First Extraordinary Session of 2006) Act 272 of 2007 Certified staff annual experience step Act 59 of 2003 (2nd Extraordinary Session Classified staff cost-of-living increase Act 1138 of 2001, Act 1773 of 2003 Scheduled teacher preparation periods during the instructional day Act 1943 of 2005 Teacher Evaluation System Training NEW Mandates with Financial Implications continued Requirements for bonus payments in high priority districts Act 1044 of 2007 Duty-free lunch 100% of time Act 1881 of 2005 Required music and art in elementary grades taught by certified specialists Act 245 of 2005 Vision screening standards Act 1438 of 2005 Certified Physical Education ratios in elementary schools Act 1220 rules Estimation of Essential but Avoidable Costs—or NOT Materials and Supplies-$ 500/class $20 per student Equipment Replacement Building Repairs Vehicle Repair and Replacement New Programs Additional Staff-Required by mandates Salary Increases-unless at minimum Required Purchasing Issues Bidding Requirements Commodities School Buses Construction Property Insurance Sales and Use Tax Payments and Exemptions Encumbrances Credit Cards Expenditure Responsibilities for Leaders/Business Officials Know areas of responsibility Inform and supervise others Be especially vigilant in problem areas Bidding Requirements Credit Cards Careful shopping Travel Expenses Use available resources—ask questions Plan ahead and Check behind! Specific Issues Relative to School Buildings Engineer required if over $ 25,000 Architect required if over $ 100,000 Less than $10,000 by solicitation $ 10,000-$50,000 advertised one time Over $50,000 advertised two times Bid Bond of 5% if over $ 20,000 Performance Bond if over $ 20,000 Contractor’s License if over $ 20,000 Federal Project Expenditures Review Specific Requirements of Categorical Project Funds Maintain time records for prorated employees Maintain Adequate Documentation for Audit Monitor Timelines for Obligation of Funds Reconcile Federal Reporting with General Ledger Include program expenditures in required ACSIP format Other Federal Issues Indirect Cost Rules Maintenance of Effort Rules Federal Education Jobs Fund ARRA Funds Classify Fixed Assets Maintain Definition of “Supplies” and “Equipment” in accordance with Handbook IIR2 guidelines Record expenditures correctly classified Add fixed assets to Fixed Asset Fund with proper accounting and controls Regularly verify inventory/location Importance of Integrity in Data Classification and Reporting Legal Certification by Officials Public Disclosure by Local Districts and ADE Reports-Web Site requirements Comparisons to Other Districts/States Sound Data for Decisions by Legislators Facts vs. Faulty Information Reporting Requirements Vendor/Beverage Contract Proceeds Athletic Expenditures Employee Contracts Anything anyone wants to know FISCAL DISTRESS The rocky financial road to state takeover of local schools Indicators And Consequences Targets of “Fiscal Distress” Declining balance to jeopardize fiscal integrity of a school district Act or violation to jeopardize fiscal integrity Any other fiscal condition of a school district deemed to have a material detrimental negative impact on the continuation of educational services by that school district. Potential “acts or violations” Material failure to… Properly maintain school facilities Violation of local, state, or federal fire, health or safety code provisions Violation of local, state, or federal construction code provisions or law Material state or federal audit exceptions Failure to provide timely and accurate legally-required financial reports to ADE, Division of Legislative Audit, General Assembly or IRS Other ways to violate…. Materially… Insufficient funds to cover payroll, salary, employment benefits or legal tax obligations Failure to meet legally binding minimum teacher salary schedule obligations Failure to comply with state law governing purchasing or bid requirements Default on any school district debt obligations Discrepancies between budgeted and actual school district expenditures Other material ways… Materially…. Failure to comply with audit requirements of 6-20-301 Failure to comply with any provision of the Arkansas Code that specifically places a school district in fiscal distress based on noncompliance. What Happens then? Finding by State Board of Education Publication of notices Limited rights of appeal Submit plan to ADE within 10 days ADE oversight of plan and implementation Required ADE approval of plan ADE technical assistance ADE recommendations/mandated staffing and fiscal practices Other ADE actions… Replace superintendent Suspend local board authority Transfer authority to new board/superintendent Required reporting requirements ADE monitoring of accounts and operations Training required for district board members and employees Final Action Consolidation Annexation Reconstitution Other appropriate action Certification or Report? Tomato or Tomato? Rose or Thorn? ADE requires numerous “reports,” “data certifications” and “assurances of compliance” with regard to information maintained by local schools and relative to various mandates, rules, statutes, etc. Great care must be taken to be certain that any document attested to be accurate correctly represents factual data or school activity. ADE Annual Financial Report and Budget – Fiscal XXXX Required Certification X 9 Due October 15 Additional Verification And Assurance More…… And more…… Even More… Yet More….. Enough! What?? Penalty The Legal Fund Balance: What is it? Reported fund balance includes: Cash Ending Soon Revenues receivable (36% pullback) Taxes collected but not distributed Accrued Expenditures (encumbrances) Inventories Designated reserves Debt Service Things are seldom what they seem. What about balances in targeted/restricted funds? NSLA ELL ALE Professional Development Federal Funds The fact that allocations are static makes fund balances mandatory to ensure program continuity. Controlled by Act 1220 of 2011. What about Rules? Many Acts provide…”The Department of Education shall promulgate rules … to implement the provisions of this Act…” These rules are subject to the Administrative Procedures Act and require notice, hearing, comments, final adoption and Legislative review. READ THEM CAREFULLY! Ethics Issues Conflicts of Interest involving Board Members and School Employees Employment Contracts Purchasing Approval by ADE Act 1599 of 2003 as amended by Act 1381 More Ethics Issues Certified personnel are subject to the Ethics Rules for Educators and may be recommended for sanction by the Professional Licensure Standards Board. Using resources improperly Using position for personal gain …… …… The BIG Question? The Best Expenditure Estimate is one based on past experience and upon Reasonable Projections!