Advances in Risk Management –

Beyond Basel II

EY refers to the global organization, and/or one or more of the independent member firms of Ernst & Young Global Limited

Contents

About the Speaker

Pratik Shah,

Ernst & Young LLP, India

Partner- Advisory Services

Leader- Financial Services Risk Management

Associate Member of the Institute of Chartered Accountants, India, has a Masters of Business Administration from

Peter F. Drucker Graduate School

► Sixteen years of professional experience specialising in Governance, Risk & Compliance Assignments

►

►

1.

2.

1.

2.

3.

4.

Expertise:

Operational Risk

Credit Risk

Regulatory Compliance

Capital Management

Governance Risk

Enterprise Risk Management

►

1.

1.

2.

3.

4.

5.

6.

7.

Page 2

Key Markets

India

USA

UK

Australia

Switzerland

Singapore

Malaysia

Vietnam

►

1.

2.

3.

4.

5.

6.

7.

Key FS Clients

SBI Group

ICICI Group

Credit Suisse

ANZ

Morgan Stanley

GE Capital

Zurich Financial

Services

Contents

Content

1

Background and Context Setting

2

Integrated view of Risks

3

Using Risk Management to take Strategic Decisions

4

Linkage to Capital Management and Stress Testing

Boubyan Bank, Kuwait

3

Background and Context Setting

Page 4

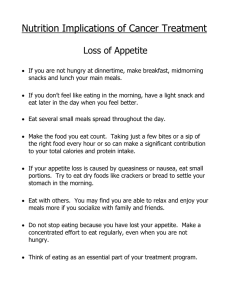

What is ERM and Why do we need it

ERM in a risk-based approach to managing an enterprise, integrating risk management of Pillar 1 risks, Pillar 2

risks, internal control and strategic planning. It helps to manage risk to be within its risk appetite, to provide

reasonable assurance regarding the creation and protection of value for stakeholders.

“It would be a mistake to conclude that the only way

to succeed in banking is through ever-greater size

and diversity.

Indeed, better risk management may be the only

truly

necessary element of success in banking.”

Silo

risk management

Enterprise risk management

AlanSafeguard

Greenspan

Key focus:

Key focus: Maximize Enterprise

Enterprise Value

• Compliance focused

• Works with in the boundary of

definition

• Focuses on Risk Mitigation &

usually not fully aligned to

strategic & operational

decisions

Necessary but value addition is

limited to risk definition

Page 5

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

Value

• Value focused

• Comprehensive coverage of

risk universe (ex: Strategic,

model risk)

• Focuses on emerging risks

and core to strategic &

operational decisions

An organizational capability that

drives substantial value Vs

competes

Risk Appetite and Material risk assessment sets the tone for

fully functional ERM

ERM Component

Objective

Use

Risk Appetite: Risk Appetite is the

amount of risk, on a broad level, that

an organization is willing to take on in

a pursuit of its strategic business

objectives

• Drive range of business decisions

including resource allocation, new

business opportunities, liquidity

and capital planning by

incorporating risk perspective

• Improves the way risk is explicitly

considered when management

makes strategic decisions

• Helps establish meaning reports

for senior management and the

board.

• Provide focus to risk assessments

and stress testing.

Material Risk Assessment:: The

Integrated Material Risk Framework

provides the board and senior

management relevant information

concerning the Bank’s risk profile, in

a timely and concise manner.

Integrated Material Risk Assessment

is driven by:

Page 6

• Provide a top down approach to

obtain integrated view of risks

across the organization and

connect risk profile to approved

risk appetite

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

• Provices synthesized, actionable

risk dashboard: Drawn from reports

& documents used by top

management to provide insights

on past, present and future

ERM framework builds on Basel- II elements to facilitate the

risk informed business decisions

Vision, Guiding Principles, Stakeholder, Risk

Capacity

Business &

Financial

objectives

Identification

of metrics

Primary capital allocation

Setting risk-adjusted return on equity

Analysis of

resources &

constraints

Integrated view of risk

basis impact om risk

appetite

Market &

Competition

Performance

mgmnt

Re-allocation

• Performance Vs

original targets

•

Sub-allocation

– BU / Portfolio

• Portfolio reallocation

•

Performance

metrics

j

1

Risk Appetite

Metrics

KRI

2

Earnings, Capital, Reputation, Governance

Identify and measure indicators for each risk that impacts the risk appetite values

Risk

Quantification

1

Page 7

VaR ,CVA, PFE,PD, LGD, EAD CCF,ALM, EaR, BEICF score

Risk

Assessment

Market Risk

Credit Risk

Liquidity / IRR

Operational

Risk

Sources of

risk

Trading book

Banking book

Balance Sheet

Profit & Loss

Governance

Integration of risk an finance

2 Risk based performance management

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

Basel II

Framew

ork

Taking an Integrated view of risks –

Beyond Basel II

Page 8

Risk Appetite – Tool to align the risk the Bank takes is

aligned to the strategy

Objective

A practical and simple approach to facilitate financial and business planning through improved

returns

Attributes of Good Risk Appetite

Linked to Strategy

Comprehensive Coverage

►

►

►

Linkage to mid to long

term strategy

Benchamrked to Peers /

Competes

►

RAS should

comprehensively cover all

fundamental risks the

bank faces

Include quantitative and

qualitative statements

Govern Decision Making

►

►

Govern decision making

across all businesses and

risk types

Allocate group level risk

appetite to specific risk

categories, lines of

business, legal entities

etc.

Key Steps

Establish Risk Appetite

Identify risk and finance

metrics and define

tolerances for risk

appetite at bank level

Cascade Risk Appetite

Manage & Monitor

Integrate Risk Appetite into

major decisions such as

capital planning, budgeting,

liquidity planning

Establish monitoring

templates that are linked

to Risk Appetite but are

also relevant to Business

Units

Report & Escalate

Develop reporting

dashboards and action

tracking mechanism for

board and sr.

management

Driving Strategic Decisions on Capital Allocation through

Risk Appetite: Illustrative – RAROC

Risk Appetite

Implementation

Risk Adjusted Return on Capital (RAROC): Provides risk based profitability measurement

framework

for measuring risk

adjusted financial performance across the bank. It is calibrated down to business groups, portfolio and borrowers

Illustrative Risk Appetite Statement: The bank should target a risk adjusted return greater than the weighted average cost of

capital employed at all times (Hurdle Rate).

Risk Appetite Statement – Risk Adjusted Return on Capital (Illustrative)

Use test – Periodic monitoring and

update

Target RAROC > Hurdle Rate

20.00%

18.25%

18.00%

16.00%

• Target RAROC computed based on:

• Peer Group Benchmarking

• Hurdle rate - Cost of capital i.e capital

based on WACC plus liquidity premium

considered as minimum RAROC for the

bank

• RAROC Vs ROE i.e RAROC > ROE

indicates a significant capital buffer or

inefficient use of capital

• Constraints- capital adequacy, priority

sector – External; portfolio focus and

capability - Internal

Page 10

• Target RAROC embedded into

• Capital utilization

• Financial Projections – Asset

growth

rate,

portfolio

diversification

and

capital

generation rate

• Business Strategy- Focus areas

based on RWA composition i.e

Reduce percentage of Risk

Weighted Assets systematically in

order to improve ROA

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

14.00%

12.34%

12.07%

12.00%

10.10%

10.00%

9.97%

10.20%

9.67%

9.17%

8.00%

6.00%

4.00%

2.15%

2.00%

0.00%

0.71%

Bank 1

RAROC

Bank 2

Bank 3

Bank 4

Weighted Average Cost of Capital

Material Risk Assessment – Tool to distil information and provide

integrated view of top risks and big bets shaping Bank’s performance

Objective

Risks by nature are interdependent, major negative outcomes are usually due to convergent of risk factors , so

to measure the these converged impact on earnings, capital, liquidity and reputation and provide an integrated

Attributes of Good MRA framwork:

Risk/ Reward Tradeoff

►

►

►

►

Insight on Top risks

Clarity on big bets

Major decisions

supported with risk

insights

Risk dialogue with top

management

Increased Board Involvement

►

►

Top management

involved in risk

processes-Oversight

Critical risk information

surfaced in timely manner

Robust Risk Management

►

►

Exhaustive identification

and prioritisation of risks

Should contain forward

looking elements,

historical risk metrics may

not be good indictors of

duture

Key Steps

Identify Metrics

Finalize Metrics

Link to Risk Appetite

Identify material risks and

corresponding metrics

aligned to current risks

undertaken based on

strategy

Shortlist material risks

and metrics based on

management workshops

and data analysis

Determine thresholds

and categorize into low,

medium, high based on

Risk Appetite of the bank

and business strategy

Page 11

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

Assessment & Reporting

Collect data, perform

assessment based on

defined scales and report

results through integrated

risk dashboards

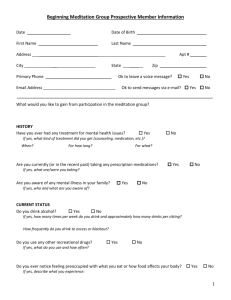

Material Risk Assessment – Illustrative view of risk

►

Risk Dashboard is a periodic snapshot of a top-down assessment of key risks facing the bank – it is presented by the

CRO to the Board of the Bank - impact assessment is based on multi-dimensions i.e., earnings, capital, people and

reputation – KRIs are used to track the trajectory of risk …

Impact

Rank

(Last)

Risk

Group

Likely

1

(x)

Credit Risk

Credit

High

2

(x)

Credit Concentration

Risk

Credit

High

3

(x)

Country Risk

Credit

Medium

4

(x)

Market Risk

Market

Medium

5

(x)

Liquidity Risk

Finance

Medium

6

(x)

Operational Risk

Operational

Medium

7

(x)

Compliance Risk

Operational

Medium

Page 12

Earnings

Capital

People

Reputation

Ear – H

Cap - M

Poe - L

Rep - L

Ear – H

Cap - H

Poe - H

Rep - H

Ear – M

Cap - M

Poe - L

Rep - L

Ear - M

Cap - L

Poe - M

Rep - M

Ear – M

Cap – M

Poe - L

Rep - H

Ear - L

Cap - L

Poe - H

Rep - M

Ear – M

Cap – L

Poe - M

Rep - M

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

Time

Horizon

Status

Owner

Action

Plan

Effective

NOW

↓

CRO

High

NOW

↑

CRO

Low

1 YEAR

↓

CRO

High

1 YEAR

↑

Treasury

Medium

NOW

↑

ALM

Medium

1 Year

↑

ORM

Low

1 Year

↑

Complia

nce

High

Risk Assessment and Reporting

Illustrative – Credit Risk

Definition

Credit Risk

• Credit Risk is the current and prospective impact on earnings and capital, arising from the loss to an entity due to inability or unwillingness of a borrower/counter-party to

borrower/counter-party to meet commitments in relation to lending, trading, settlement and other financial transactions or reduction in portfolio value arising from actual

portfolio value arising from actual or perceived deterioration in credit quality of borrowers/counterparties.

Name of the Entity: Bank xx

Key Risk Driver Description:

1. Percentage of unrated exposure to Total Credit Exposure

Exposure

2. Gross NPA to Gross Advances Ratio (%)

3. Total unsecured credit exposure as a % of Total Credit

Credit Exposure of Entity

4. Ratio of Risk Weighted Assets to Total Assets

5. Average DPD (xx days- YY days) as a % of Total Credit

Credit Risk Exposure

1

4

9

16

25

Entity Value

Assessment Rating

0-5

0-1

0-5

5-10

1-2

5-15

10-15

2-3

15-25

15-25

3-5

25-35

25 <

5<

35 <

12

2.4

26.4

9

9

16

0-40

40-50

50

2-4

50-60

60-70

70 <

63

16

4-6

6-8

8<

2.4

4

0-2

Overall Rating for Credit Risk (Average)

11

Key Performance Driver Description:

1. Actual vs Targeted Net Interest Income (Actual as a

as a percentage of Target)

85 >

Legend – Risk Index

1-7

Page 13

Low

85-90

90-110

Medium

110-125

8 - 14

125 <

High

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

112

15 - 22

16

Critical

> 23

Risk Assessment and Reporting

Illustrative – Credit Risk

Risk vs Performance Assessment Map

Legends

Risk is not commensurate with

the return generated

Risk is greater than return

generated

Risk is commensurate to the

return generated

Credit Risk

Unrated Exposure to Total Credit Exposure

15.00%

11.00%

10.00%

12.00%

9.00%

5.00%

0.00%

2012

2013

2014

Unrated Exposure to Total Credit

Exposure

Page 14

Gross NPA to Gross Advances

4.00%

3.00%

2.00%

1.00%

0.00%

2.90%

2.10%

2012

2013

Past Due Exposure to Total Exposure

2.40%

2014

Gross NPA to Gross Advances

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

2.50%

2.40%

2.30%

2.20%

2.10%

2.00%

1.90%

2.40%

2.20%

2.10%

2012

2013

SMA Exposure to Total Exposure

2014

Bringing ERM framework to life- An illustration – Credit Risk &

RAROC

Vision, Guiding Principles, Stakeholder, Risk

Capacity

Risk adjusted

Resources &

profitability

constraints:

and resource

- Cost of Capital

Metrics:

allocation

- Income &

RAROC

Volatility, risk

free return,

peer returns

Risk Profile

Primary capital allocation

Target risk-adjusted RAROC

Performance Management

business mix

- Reg capital /

provisions

Portfolio RAROC | Re-allocation |Capital

Optimization

j

1

2

Risk Appetite

Metrics

Capital - RAROC

•

KRI

•

•

•

Unrated exposure to Total Exposure

Gross NPA to Gross Advances

Past Due to Total Exposure

Interest Expended to Average Liabilities

Page 15

•

•

•

•

Negative

Negative

Negative

Positive

Risk Quantification

PD, LGD, EAD CCF

Risk Assessment

Basel II- Credit Risk

Source of Risk

1

RAROC Relationship

Banking book

Integration of risk an finance

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

Credit Risk

2

Risk based performance management

Bringing ERM framework to life- An illustration – Credit Risk

Vision, Guiding Principles, Stakeholder, Risk

Capacity

Integrated Risk Profile

Primary capital allocation

Business &

Financial

objectives

Setting risk-adjusted RAROC

Analysis of

resources &

constraints

Identification

of metrics

Performance Management

Integration of Risk and

Finance Data

Market &

Competition

• Allocation of Capital based on

performance of portfolios and BUs

• Portfolio re-allocation

• Capital Optimization

1

Risk Appetite

Metrics

Capital - RAROC

••

KRI

KRI

••

••

••

2

RAROC Relationship

Unrated

Unratedexposure

exposuretotoTotal

TotalExposure

Exposure

Gross

NPA

to

Gross

Advances

Gross NPA to Gross Advances

Past

PastDue

DuetotoTotal

TotalExposure

Exposure

Interest

Expended

Interest ExpendedtotoAverage

AverageLiabilities

Liabilities

••

••

••

••

Negative

Negative

Negative

Negative

Negative

Negative

Positive

Positive

Risk Quantification

PD, LGD, EAD CCF

Risk Assessment

Basel II- Credit Risk

Credit Risk

Source of Risk

1

Page 16

Banking book

Integration of risk an finance

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

2

Risk based performance management

ERM Framework impacts most business processes

Strategic

Planning and

Corporate

Strategy

Risk and

Performance

Reporting:

•

•

•

•

Manage expectations

Proactive Management

Risk Dashboards

Monitoring of KRIs / KPIs

Resource Management and

Product Approval

Strategy

Identification

Monitoring /

Disclose

Target

Setting

Strategy

Execution

• Efficient utilization of

capacity

• Identify acceptable and

unacceptable sources of

risk

Page 17

• Identify optimal mix of business

strategies

• Medium term aspirations

• Provide guidelines

• Assess Earnings implications of

strategies

• Outline best use of spare

capacity

Risk and

Performance

Measurement

• Calculate Economic

Capital, RAROC/ EVA

• Calculate EaR

• BU cascading of limits

• Maintain Desired Profile

Target Evaluation and

Portfolio Management

• Execute contingency

planning

• New Business

Opportunities

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

Using Risk Management to take Strategic

Decisions – Case: Capital Management

Page 18

RAROC based capital allocation

𝑹𝑨𝑹𝑶𝑪

𝑰𝒏𝒕𝒆𝒓𝒆𝒔𝒕 + 𝑭𝒆𝒆 𝑰𝒏𝒄𝒐𝒎𝒆 − 𝑰𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝑬𝒙𝒑𝒆𝒏𝒔𝒆𝒔 − 𝑶𝒑𝒆𝒓𝒂𝒕𝒊𝒏𝒈 𝑬𝒙𝒑𝒆𝒏𝒔𝒆𝒔 − 𝑬𝑳

=

𝑹𝒆𝒈𝒖𝒍𝒂𝒕𝒐𝒓𝒚 𝑪𝒂𝒑𝒊𝒕𝒂𝒍

Expand business and allocate capital only in those geographies/

sectors/ borrowers who can match the target return , which is

determined by the Bank through WACC and other mark - ups

Step 2: Determine Target Risk Premium above base rate

Step 1: Determine Target Return

Cost per Rupee Exp

Risk Appetite

Segment

Determine

Bank-wide

cost of

capital

(WACC)

Determine

Target

Return (%)

for the

balance

portfolio

Determin

e Bankwide

Target

Return

(%)

Add the mark-up to factor in

overall spread / margin that

the bank targets to achieve

Add the mark-up to factor in

discounts on Priority Sector

DRI, staff loans, etc.

Interest

Operating

Capital %

Provisions

Trend of

Interest

Income

(%)

Corporate

BBB )

Corp- (below

Base

Rate

(%)

Target Risk

Target Income

Premium

(%) to meet

above base

Target Return

rate

1.00%

2.00%

XX PSE

%

MSME –

Guaranteed

MSME no

guarantor

Home loan

0.25%

Other Retail

3.50%

3.00%

4.00%

2.00%

….

Yes

Allocate

Capital Prioritize

growth

No/Less

Allocation

Page 19

Reduce

required

Regulatory

Capital

Yes

No

Can charge

premium to

the

customer?

Guarantee

s

Collateral

Ratings

On-BS

Netting

No

Can charge

premium to

the

customer?

Step 3: Take Capital Allocation

Decisions

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

Apply market

constraints,

competitor

pricing,

relationship /

strategic

portfolio

constraints

Enable senior management monitoring of capital efficiency

across the bank

Cost

Region

Interest

Operating

Provisions

Capital

Required

Interest

Target

Income (%)

Return (%)

Segment Capital Efficiency Dashboard

Segment

Exposure

RAROC

Target Return

(%)

NPA

(%)

Avg. RW

(%)

Overall Bank

RM dept.

•

•

Monitor the

Capital

Efficiency

across the

bank, follow up

with braches,

BUs

Mumbai

Corporates

Delhi

SME

Chennai

Retail –

Personal

Hyderabad

Region Avg.

Pune

Granular analysis for segments where returns are

below the target returns

Reporting of

key metrics to

Senior

Management

Templates

provided

for RAROC

based

capital

allocation

would

form an

input to

the MIS

EY will develop MIS dashboards for the senior management for strategic decisioning to target/exit

portfolios – geographies, products , industries, etc.

Page 20

PRIVATE & CONFIDENTIAL NOT TO BE SHARED WITH THIRD

PARTIES WITHOUT PRIOR WRITTEN CONSENT OF EY

Senior

Management

•

Analyze the

overall Capital

Efficiency metrics

within the Bank

•

Drive strategic

decision making

•

Support IRM in

prioritizing and

rolling out key

initiatives

EY | Assurance | Tax | Transactions | Advisory

About EY

EY is a global leader in assurance, tax, transaction and advisory services.

The insights and quality services we deliver help build trust and confidence

in the capital markets and in economies the world over. We develop

outstanding leaders who team to deliver on our promises to all of our

stakeholders. In so doing, we play a critical role in building a better working

world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the

member firms of Ernst & Young Global Limited, each of which is a separate

legal entity. Ernst & Young Global Limited, a UK company limited by

guarantee, does not provide services to clients. For more information about

our organization, please visit ey.com.

The MENA practice of EY has been operating in the region since 1923. For

over 90 years, we have evolved to meet the legal and commercial

developments of the region. Across MENA, we have over 4,200 people

united across 18 offices and 13 Arab countries, sharing the same values

and an unwavering commitment to quality.

© 2015 Ernst & Young

All Rights Reserved.

This publication contains information in summary form and is therefore

intended for general guidance only. It is not intended to be a substitute for

detailed research or the exercise of professional judgment. Neither EYGM

Limited nor any other member of the global EY organization can accept any

responsibility for loss occasioned to any person acting or refraining from

action as a result of any material in this publication. On any specific matter,

reference should be made to the appropriate advisor.

ey.com/in