Business Transactions (cont'd.)

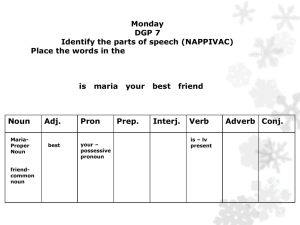

advertisement

Review from 3.1: Balance between property and property rights • Property = Creditor’s Financial Claim + Owner’s Financial Claim Accounting concepts: • Assets: items of value owned by a business • Liabilities: creditor’s claims to assets of a business/debts of a business (amount of money owed to creditors) • Equity: financial claim to assets – Owner’s Equity: owner’s claims to assets of the business, measured by the dollar amount of owner’s claims to the total assets of the business Accounting Equation: • ASSETS = LIABILITIES + OWNER’S EQUITY Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit What You’ll Learn How accounts are used in business transactions. The steps used to analyze business transactions. How investments by the owner affect the accounting equation. How a cash payment transaction affects the accounting equation. How a credit transaction affects the accounting equation. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Why It’s Important You can analyze real-world business transactions by using the accounting equation. Key Terms business transactions account accounts receivable accounts payable on account Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Business Transactions An economic event that causes a change — either an increase or a decrease — in assets, liabilities, or owner’s equity. The increases and decreases caused by business transactions are recorded in specific accounts. Accounts may be classified as either assets, liabilities, or owner’s equity. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Business Transactions Assets Cash in Bank Accounts Receivable Computer Equipment Office Equipment Delivery Equipment = (cont'd.) Liabilities + Owner’s Equity Accounts Maria Sanchez, Payable Capital Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Effects of Business Transactions on the Accounting Equation Analyzing business transactions: 4- step process to transaction analysis Business Transaction 1. Identify the accounts affected. Classify 2. Classify the accounts affected. +/3. Determine the amount of increase or decrease for each account. Balance 4. Make sure the accounting equation remains in balance. ANALYSIS Identify Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Investments by the Owner Business Transaction 1 Maria Sanchez took $25,000 from personal savings and deposited that amount to open a business checking account in the name of Roadrunner Delivery Service. ANALYSIS Identify 1. Cash transactions are recorded in the account Cash in Bank. Maria Sanchez is investing personal funds in the business. Her investment in the business is recorded in the account called Maria Sanchez, Capital. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Investments by the Owner (cont'd.) Business Transaction 1 (cont'd.) Maria Sanchez took $25,000 from personal savings and deposited that amount to open a business checking account in the name of Roadrunner Delivery Service. ANALYSIS Classify 2. Cash in Bank is an asset account. Maria Sanchez, Capital is an owner’s equity account. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Investments by the Owner (cont'd.) Business Transaction 1 (cont'd.) Maria Sanchez took $25,000 from personal savings and deposited that amount to open a business checking account in the name of Roadrunner Delivery Service. ANALYSIS +/– 3. Cash in Bank is increased by $25,000. Maria Sanchez, Capital is increased by $25,000. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Investments by the Owner (cont'd.) Business Transaction 1 (cont'd.) Maria Sanchez took $25,000 from personal savings and deposited that amount to open a business checking account in the name of Roadrunner Delivery Service. ANALYSIS Balance Assets 4. The accounting equation remains in balance. = Liabilities + Cash in Bank Trans. 1 +$25,000 Owner’s Equity Maria Sanchez, Capital = 0 + +$25,000 Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Investments by the Owner (cont'd.) Business Transaction 2 The owner, Maria Sanchez, took two telephones valued at $200 each (total $400) from her home and transferred them to the business as Office Equipment. ANALYSIS Identify 1. The business received two telephones. Since a telephone is office equipment, the account Office Equipment is affected. Maria Sanchez invested a personal asset in the business, so the account Maria Sanchez, Capital is affected. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Investments by the Owner (cont'd.) Business Transaction 2 (cont'd.) The owner, Maria Sanchez, took two telephones valued at $200 each (total $400) from her home and transferred them to the business as Office Equipment. ANALYSIS Classify 2. Office Equipment is an asset account. Maria Sanchez, Capital is an owner’s equity account. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Investments by the Owner (cont'd.) Business Transaction 2 (cont'd.) The owner, Maria Sanchez, took two telephones valued at $200 each (total $400) from her home and transferred them to the business as Office Equipment. ANALYSIS +/– 3. Office Equipment is increased by $400. Maria Sanchez, Capital is increased by $400. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Investments by the Owner (cont'd.) Business Transaction 2 (cont'd.) The owner, Maria Sanchez, took two telephones valued at $200 each (total $400) from her home and transferred them to the business as Office Equipment. ANALYSIS Balance 4. The accounting equation remains in balance. Trans. 2 Assets = Liabilities + Owner’s Equity Cash Office Maria Sanchez, in Bank Equip. Capital $25,000 0 0 $25,000 +400 +400 Balance $25,000 + $400 Prev. Bal. = 0 + $25,400 Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Cash Payment Transactions Business Transaction 3 Roadrunner issued a $3,000 check to purchase a computer system. ANALYSIS Identify 1. The Computer Equipment account is used to record transactions involving any type of computer equipment. The business paid cash for the computer system, so the account Cash in Bank is affected. (Payments made by check are treated as cash payments and are recorded in the Cash in Bank account.) Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Cash Payment Transactions (cont'd.) Business Transaction 3 (cont'd.) Roadrunner issued a $3,000 check to purchase a computer system. ANALYSIS Classify 2. Computer Equipment and Cash in Bank are both asset accounts. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Cash Payment Transactions (cont'd.) Business Transaction 3 (cont'd.) Roadrunner issued a $3,000 check to purchase a computer system. ANALYSIS +/– 3. Computer Equipment is increased by $3,000. Cash in Bank is decreased by $3,000. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Cash Payment Transactions (cont'd.) Business Transaction 3 (cont'd.) Roadrunner issued a $3,000 check to purchase a computer system. ANALYSIS Balance 4. The accounting equation remains in balance. = Liabilities + Owner’s Equity Assets Cash Computer Office in Bank Equip. Equip. Prev. Bal. Trans. 3 Balance $25,000 0 $400 Maria Sanchez, Capital 0 $25,400 – 3,000 +3,000 $22,000 + $3,000 + $400 = 0 + $25,400 Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Credit Transactions Business Transaction 4 Roadrunner bought a used truck on account from North Shore Auto for $12,000. ANALYSIS Identify 1. Roadrunner purchased a truck to be used as a delivery vehicle, so the account Delivery Equipment is affected. The business promised to pay for the truck at a later time. This promise to pay is a liability; therefore, the Accounts Payable account is affected. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Credit Transactions (cont'd.) Business Transaction 4 (cont'd.) Roadrunner bought a used truck on account from North Shore Auto for $12,000. ANALYSIS Classify 2. Delivery Equipment is an asset account. Accounts Payable is a liability account. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Credit Transactions (cont'd.) Business Transaction 4 (cont'd.) Roadrunner bought a used truck on account from North Shore Auto for $12,000. ANALYSIS +/– 3. Delivery Equipment is increased by $12,000. Accounts Payable is also increased by $12,000. Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Credit Transactions (cont'd.) Business Transaction 4 (cont'd.) Roadrunner bought a used truck on account from North Shore Auto for $12,000. ANALYSIS Balance 4. The accounting equation remains in balance. = Liabilities + Owner’s Equity Assets Cash Computer Office Delivery in Bank Equip. Equip. Equip. Prev. Bal. Trans. 4 Balance $22,000 – +3,000 $400 Accounts Payable 0 0 +12,000 +12,000 $22,000 + $3,000 + $400 +$12,000 = $12,000 + Maria Sanchez, Capital $25,400 $25,400 Section 2 Transactions That Affect Owner’s Investment, Cash, and Credit (cont'd.) Check Your Understanding When a business transaction occurs, what is the role of the accountant or accounting clerk?