NAIC Partnership Training - Corporation for Long

advertisement

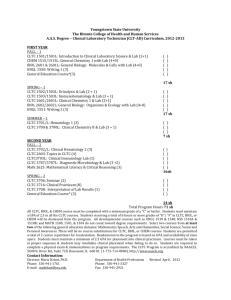

NAIC Partnership Training: Threat or Opportunity? Skip Liddell CLU, ChFC, LLIF, CLTC National Sales & Marketing Director CLTC and CLTC Partnership Training 1 CLTC Partnership Training 09/25/07 DRA 2005 Known for Medicaid eligibility changes Opened Partnership Programs to all states Requires new LTC agent training mandates 09/25/07 CLTC Partnership Training 2 The Deficit Reduction Act of 2005 and its impact on Medicaid planning The basics… The look-back period has been increased from 3 to 5 years. The start of the penalty for gifts made during the preceding 5 years begins on the date of application for benefits: there is no “credit” for the penalty which, under the old law started on the date the gift was made. The use of Medicaid friendly annuities is still allowed but the state must be named the beneficiary. Continued… The state can deny eligibility if a home has more than either $500,000 or $750,000 in equity regardless of whether a spouse is at home. Entrance fees in CCRC’s must be spent on nursing home care before Medicaid will pay. States can easily apply for partnership plans. Winners & losers Increasing the look-back period Losers Winners The state. Nursing homes. Long-term care insurance: If people want to protect assets they have to anticipate they will need nursing home care at least 5 years before they actually go in. That is next to impossible to determine. Reverse mortgage companies: The family may decide to keep the person home longer and pay for it by taking equity out of the house. Assisted living facilities: An ALF is cheaper than a nursing home. Medicaid planning attorneys. With a 3 year look-back they can likely make a fee by telling the family of an institutionalized loved one that they only have to pay for this period. A 5 year look-back basically bankrupts the family. A Medicaid plan i.e. gifting assets must not take place 5 years before applying for benefits. It is unlikely the family will dispose of assets. Changing the start of the penalty period Winners The state Nursing homes: No more half-aloaf equals more private pay. Long-term care insurance: Nothing can be protected if a person is near to or actually in a facility. There is a strong incentive to purchase the product likely now supported by elder law attorneys. Losers Medicaid planning attorneys: a significant source of revenue was half-a-loaf. It’s now dead. Medicaid friendly annuities Winners The state. See a trend here? Nursing homes: In theory there should be more private pay patients. (See “Losers”. Long-term care insurance: Promoters of these schemes regularly bad mouthed the product. less Medicaid planning options = more LTCi if sold correctly. Losers Nursing homes: Making the state the beneficiary of the annuity does not help the facility. They still get the Medicaid rate. Medicaid planning attorneys. Promoters of Medicaid friendly annuities. Why would a person purchase the product when the state, not the children will get the balance anyway? No eligibility based on equity Winners The state. Nursing homes. Home equity conversion companies: The applicant will be forced to take money out of the house to reduce the equity to either $500,000 or $750,000 depending on the state LTCI: A no brainer. Losers Families: They can’t hide assets in a home anymore. Medicaid planning attorneys: Another significant source of fees bites the dust. Real estate brokers. No house means no commission. Entrance fees in CCRC’s Winners The state. CCRC’s: They can receive a private pay rate until the entrance fee is spent. See also “Losers: LTCi. Losers CCRC’s: Few have the entrance fee. They likely will have to borrow it and “front” the monthly nursing home fee to the individual. They will recover the fees plus interest at death. Children: No more inheritance. Medicaid planning lawyers: Although not used often purchasing a CCRC’s was a way to shelter large amounts of money. Partnership Winners The states Facilities and companies that provide long-term care services. Families: LTCi protects the family not the individual and protects lifestyle. Both are devastated when Medicaid planning is employed. Losers No one Long Term Care Partnership Plans The Deficit Reduction Act reinstated the ability of states to establish a Long-Term Care Partnership Program WHO ARE THE PARTNERS? State Consumer Insurer/Agent WHO PAYS NOW? State governors’ concerns today focus on rising Medicaid costs Medicaid: 49 % Medicare: 20 % Out-of-pocket: 18 % Private LTC insurance: 8% Other: 5% * Source: CMS, Georgetown Univ. 2007 PIE Charts THE PARTNERSHIP PREMISE To reduce Medicaid expenditures by delaying or eliminating the need for people to rely on Medicaid Encourage purchase of private LTC insurance by giving an incentive for the consumer to buy CONSUMER INCENTIVE By purchasing a LTC policy sold through the Partnership, asset protection from Medicaid would equal the amount of LTC insurance coverage This amount of assets would not have to be spent down to qualify for Medicaid Example of Asset Disregard Partnership Policy Assets Example 1 Example 2 Example 3 $ 50,000 $ 200,000 $1,000,000 Non-Partnership Policy Example 4 $200,000 Partnership Plan Payout $ 50,000 $200,000 $500,000 $0 Medicaid Spend Down Required $0 $0 $500,000 $200,000 Partnership Programs include “Asset Disregard” Consumer buys private LTCI with a total benefit value of $250,000 Consumer needs care Consumer uses LTCI first If they use up the entire $250,000, their application to Medicaid will allow them to keep that amount in addition to their primary protected assets like the home and car INFLATION SPECIFICS Age 60 and under: • Some form of compound inflation protection must be included Age 61 – 75: • Some form of inflation protection must be included Age 76 +: • • Must offer inflation protection (but is not required for application) Partnership Training NAIC Model Regs Every licensed agent must complete this new training in order to sell LTC insurance, regardless of the state’s adoption of Partnership plans and regardless of representing a Partnership policy. 09/25/07 CLTC Partnership Training 21 NAIC Model Regs The one-time training required shall be no less than eight (8) hours and the ongoing training required by this Section shall be no less than four (4) hours every 24 months. 09/25/07 CLTC Partnership Training 22 The Monkey Wrench: States Authority Each state has the right to adopt or modify the NAIC Model Regulation Results: The normal chaos associated with a national program regulated by 50 Departments of Insurance 09/25/07 CLTC Partnership Training 23 Example: Virginia Regs New Training is required for agents selling Partnership policies only 8 hours is broken down into 6 hour LTC & 2 hour Partnership Past Credit: all LTC specific CE since 1/01/05 if completed by 12/31/07 Deadline for training completion: Sept 1, 2007 09/25/07 CLTC Partnership Training 24 Critical Issues Interpretation of each state’s regulations Understanding the options available to meet the training requirements Having multiple training solutions Easy recording of CE 09/25/07 CLTC Partnership Training 25 State Updates VA ID FL MN RI 9/1/2007 11/01/07 12/31/07 12/31/07 12/31/07 Class On-Line Yes Yes Pending Pending Pending Yes Yes Pending Pending Pending What’s the solution? CLTC Partnership Training www.LTCPartnershipTraining.com 09/25/07 CLTC Partnership Training 27 Objectives To develop and offer multiple training options that satisfy the state specific regulations that are: Simple Quick Inexpensive Continuing Education Classroom Correspondence 8 hours Sign in/out No Exam Recorded 7-14 days Course/ On-line Exam triggers CE Proctor/Affidavit Recorded 24 hours 09/25/07 CLTC Partnership Training 29 Training Options: Classroom 8 hrs CE : entire LTC/Partnership course or 2 hrs Accelerated Prep Review (No CE) Prepares for On-Line course with Exam 09/25/07 CLTC Partnership Training 30 Training Options: Correspondence On-Line course with exam State specific material included 8 hours CE from passing exam 09/25/07 CLTC Partnership Training 31 Tuition On-Line Course & exam: $100 CLTC graduate discount: $50 Discount code: K02407HA 09/25/07 CLTC Partnership Training 32 Tuition Classroom subject to class sponsor 09/25/07 CLTC Partnership Training 33 “ “Train the Trainers” Options: CLTC Staff will conduct: 3-hour webinar training or 4-hour live training Provide Powerpoint for 8-hour class Strategies for 2-hour Exam Review 09/25/07 CLTC Partnership Training 34 Reciprocity Multi State Licensing? One Tuition covers all CE required 09/25/07 CLTC Partnership Training 35 CLTC Partnership Training Simple Quick Inexpensive Flexible 09/25/07 CLTC Partnership Training 36 CLTC Partnership Training LTCPartnershipTraining.com 09/25/07 CLTC Partnership Training 37 Questions? Please email your questions…… 09/25/07 CLTC Partnership Training 38