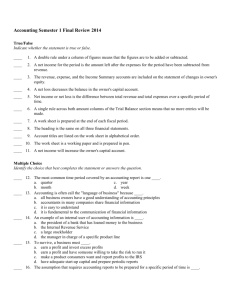

JOURNAL

advertisement

JOURNAL • A journal is a book in which transactions are recorded in the same order in which they occur, i.e., in a chronological order. A journal is called a book of prime entry/original entry, because all business transactions are first of all entered in this book. The process of recording a transaction in journal is called journalizing. An entry made in the journal is called a journal entry. Following is the format of a journal: • Date Particulars L.F. Debit Credit Amount Amount (Rs.) (Rs.) 1 Journal • Date column: In this column, the date on which the transaction takes placed is recorded. • Particulars column: In this column, first the name/names of the accounts to be debited, with the abbreviation Dr. written at the end of the column. In the next line, after leaving some space title of the account to be credited is written and the word ‘To’ is prefixed. In the next line a brief explanation of the transaction is given, which is called a narration. After narration, a line is drawn in the particulars column to indicate the end of the entry. • Ledger Folio: This column is not filled at the time of journalising but a record is made in this column at the time of posting in the ledger. It is a record of the page number of the ledger in relation to a particular account. 2 Journal • Debit amount column: This column records the amount to be debited. • Credit amount column: This column records the amount to be credited. • Rules of Debit and Credit: All transactions in the journal are recorded on the basis of the rules of debit and credit. For this purpose business transactions have been classified into three categories. In other words we can say that there three types of accounts: (1) Personal Accounts: These are the accounts of persons with whom the business deals. There are three categories of personal accounts: (a) Natural personal accounts: These are the accounts of natural human beings like, Ram, Shyam, Mohan, Geeta and Abha etc. (b) Artificial personal accounts: These are the accounts of corporate bodies, institutions etc., which are recognised as persons in business dealings. For example, the account of a limited company, the account of a club, the account of government and the account of insurance company etc. 3 Journal (c) Representative personal accounts: These accounts represent a certain person or group of persons. For example, for rent due to landlord, an outstanding rent account will be opened. Similarly, for salary payable to employees, outstanding salaries account will be opened. These two accounts represent the landlord and employees respectively and hence, are termed as representative personal accounts. Rule: Debit the receiver, Credit the giver 4 Journal (2) Real Accounts: These are the accounts of property, assets and goods etc. These accounts may be classified into: (a) Tangible real accounts: These accounts relate to such items which can be touched, seen, felt and measured. The examples are, cash, land and building, plant and machinery, furniture and fixtures etc. (b) Intangible real accounts: These accounts relate to such items which cannot be touched and seen like, goodwill, patent rights etc. Rule: Debit what comes in and Credit what goes out 5 Journal (3) Nominal Accounts: These are the accounts of expenses, losses, incomes and gains etc. These accounts are opened to explain the nature of transactions. They do not really exist. For example , in a business, salary is paid to the employees, rent is paid to the landlord, commission is paid to the salesman and so on. Cash, which is of tangible nature, goes out of business, while salary, rent or commission, as such, do not exist. These accounts are simply opened to explain the outflow of cash. Rule: Debit all expenses and losses and Credit all incomes and gains • These three rules are termed as golden rules of accounting. • A good number of numerical problems will be discussed in the class covering these types of accounts. 6 Types of Journal Entries Broadly speaking there are two types of journal entries, but some authorities have divided the journal entries into three. (1) Simple journal entry: When there is only one debit and one credit in an entry, it is called a simple journal entry. For example, goods sold to Mohan Rs.1000, in this case Mohan’s a/c will be debited with Rs.1000, sales a/c being credited with the same amount. (2) Compound journal entry: When there is more than one debit or credit in an entry, it is called a compound journal entry. In the above example, if Mohan pays Rs.975 in full settlement, it means we have allowed him a discount of Rs.25 which is a loss/expense for us. In this case, cash a/c will be debited with Rs.975, discount will be debited with Rs25 and Mohan’s a/c will be credited with Rs.1000. 7 Types of Journal Entries: Opening Entry • • • • • • • • • • • • • • • Opening entry: It is also a type of compound journal entry as generally there are many debits and credits in this entry. As already stated, business enterprises are to run for a fairly long period of time and as such the balances appearing at the end of the year are to be carried forward in the next accounting year. For this purpose we make an entry which is called an opening entry. All assets accounts are debited and liabilities are credited and the balancing figure generally appears on the credit side which is credited to capital account. Date Particulars L.F. Debit Credit 2009 April,1 Sundry debtors a/c-----Dr. Land& Building a/c-----Dr. Plant&Machinery a/c--Dr. Furniture&Fixtures a/c-Dr. To sundry creditors a/c To bills payable a/c To bank loan a/c To capital a/c (bal. figure) (Being opening entry) --------------------------------------- (Rs.) 20,000 50,000 40,000 30,000 - (Rs.) 15,000 10,000 20,000 95,000 8 Advantages of Journal • Recording of business transactions in a journal on the basis of rules of double entry system has been universally accepted because of the following merits: (1) Complete information about a business transaction (2) Explanation of the transaction (3) Minimum chances of errors (4) Reliance on the memory of the accounts keeper is substantially reduced 9 Limitation of Journal When the number of transactions is very large, it may practically be difficult, if not impossible, to record all the transactions through one journal because of the following reasons: (1) The system of recording all the transactions in a journal requires the writing down the name of the account involved as many times as the transactions occur. (2) Such a system does not provide the information on prompt basis. (3) Such a system does not facilitate the installation of an internal check system, since the journal can be handled only by one person. (4) The journal becomes bulky and voluminous. If we have a serious look on the limitations, it can be observed that most of them have been done away with, because of the advent of computer vis a vis accounting related softwares like tally. 10 LEDGER • After recording the business transactions in journal, recorded information is classified by preparing different accounts and this book containing various accounts related to assets, liabilities, persons, expenses, incomes etc., is called a ledger. • “A group of accounts is known as a ledger. The general ledger is the main book of account. It contains an account for each asset, liability, proprietorship, revenue and expense account. The ledger contains the same information as the journal. However, in the journal, each transaction is completely recoded as a unit. The entire effect of a transaction is completely recorded at one place in the journal. Periodically the same information is posted to the ledger where it is accumulated according to individual items. The ledger includes all the basic accounts needed for the preparation of the financial statements.”-----Encyclopedia Britannica • Ledger is a register, containing a number of pages which are numbered consecutively. One account is usually assigned 11 Ledger • one page in the ledger. However, if there are many transactions pertaining to a particular account, it may be assigned the number of pages based on past experience. An index of various accounts maintained in the ledger is given at the beginning of the ledger for the purpose of easy and ready reference. It is the principal book of accounts. Name of the account Dr. Cr. Date Particulars F Amount Date Particulars F Amount To (Rs.) By (Rs.) • 12 Ledger • Posting: It is the process of transferring the transactions recorded in the books of original entry in the concerned accounts in the ledger. It may be done daily, weekly, fortnightly or monthly according to the convenience and requirements of the business. Posting has to be followed in the context of: (1) Simple journal entries (2) Compound journal entries (3) Opening entry 13 Ledger Utility of Ledger: (a) It provides complete information about all the accounts in one book and at one look. (b) It enables to ascertain what the main items of revenue are. (c) It enables to ascertain what the main items of expenses are. (d) It enables to ascertain what the assets are and of what value. (e) It enables to ascertain what the liabilities are and of what amounts. (f) It facilitates the preparation of final accounts. In nutshell it can be said that the position of any account can be known at any time. 14 Difference between Journal and Ledger Distinction between journal and ledger can be made on the following grounds: (1) Name of the book (2) Basis of preparation (3) Stage of recording (4) Object (5) Format (6) Balancing (7) Narration (8) Name of the process of recording (9) Basis of preparation of final accounts 15 TRIAL BALANCE • When all the accounts of a concern are thus balanced off then they are put in a statement/list, debit balances being put on the debit side and credit balances on the credit side. The statement/list, so prepared is called a trial balance. Total of the debit side of trial balance must be equal to the credit side, because in double entry system, for every debit there is always a corresponding credit. • The preparation of a trial balance is an essential part of accounting cycle because if the total of the debits is equal to the credits, it is a sufficient proof that the books of accounts are arithmetically correct, at least to a reasonable extent. • Thus, at the end of a financial year or at any other time, the balances of all the ledger accounts are extracted and entered in trial balance. 16 Trial Balance • The Substance of Accountancy defines, “Trial Balance is a statement containing the balances of all ledger accounts, as at any given date, arranged in the form of debit and credit columns, placed side by side and prepared with the object of checking the arithmetical accuracy of ledger posting.”— M.S. Gosar • “A Trial Balance is a statement, a list of all the balances standing on the ledger Account and Cash Book of a concern at any given time.”—Spicer and Peglar • “A Trial Balance is a statement of debit and credit balances extracted from the ledger, with a view to testing the arithmetical accuracy of the books.”—J.R.Batliboi 17 Trial Balance If the trial balance does not agree it means that there are some errors which must be located to prepare correct (if not fool proof) final accounts. Till the errors are located and rectified the difference in trial balance is put in a separately opened a/c, called suspense account. Even the agreement of trial balance does not ensure it to be a conclusive proof of the arithmetical accuracy of the books of accounts. As there are some errors which are not disclosed by the agreement of a trial balance. This very important issue will be discussed towards the end of this topic. Methods of preparing a trial balance: There are two methods of preparing a trial balance. (1) Total Method: In this method, the debit and credit totals of each account are transferred in the two columns of trial balance. It becomes too much voluminous and that is why this method is rarely used. 18 Trial Balance • (2) Balance Method: In this method, the difference of each a/c is ascertained. The debit balances of the accounts are put on the debit side of trial balance and credit balances on the credit side. This method is more in vogue as it reduces the figure work considerably. Trial Balance of------As on-----Serial No. Name of the account Dr. Cr. Balance Balance (or total) (or total) (Rs.) (Rs.) 19 Trial Balance The accounts which generally have debit balances are: assets, purchases, returns inward, expenses, losses, drawings, The accounts which generally have credit balances are: liabilities, sales, return outwards, incomes, gains, profits, reserves, provisions (except provisions on creditors) and funds. Objectives of preparing a trial balance: (1) To check arithmetical accuracy of the books of accounts. (2) To facilitate the preparation of financial statements. (3) To help in the detection of errors. (4) To serve as an aid to management. (5) To have a proof that double entry system has been followed. In the words of J.R. Batliboi, “it forms a useful connecting link between ledger accounts and the final accounts”. 20 Trial Balance • Errors not disclosed by the agreement of trial balance: Sometimes both the sides of a trial balance agree but there are chances that some errors may still be there. (1) Errors of omission: It refers to omission of a transaction at the time of recording in the books of original entry/posting to ledger. When a transaction is not recorded at all, the agreement of trial balance is not affected. For example, goods sold to Ramesh Rs.500 are neither debited to Ramesh, nor credit is given to sales a/c. (2) Errors of principle: Sometimes accounting principles are violated in accounting process. Errors involving violation of accounting principles are termed as errors of principle. Generally, these errors relate to distinction between capital and revenue items. For example, machinery worth Rs.50,000 is purchased from Saini Sons. Instead of debiting machinery, debit is given to say purchases a/c, credit being given correctly to Saini Sons. In the debit side of trial balance Rs.50,000 will appear, does not matter if an error of principle has been committed, so far as the agreement of trial balance is concerned. (3) Compensating errors: When two or more one sided errors take place in such 21 Trial Balance a way that their effect is nullified. For example, if Rs.500 credit sale to Geeta, to be posted to the debit side of Geeta’s a/c is omitted at the time of posting and Rs.500 credit purchases from Seeta, to be posted to the credit side of Seeta’s a/c is not posted to the credit side of Seeta’s a/c, these are termed as compensating errors. First error reduces debit side total by Rs.500 and second error reduces credit side total by the same amount. • From the above we can conclude by saying that the agreement of a trial balance is only a reasonable proof for the arithmetical accuracy of the books of accounts and is not a conclusive proof for the same. • It is pertinent to mention here that there is another category of errors called, errors of commission. Sometimes, business transactions are recorded and posted in a wrong manner. Such errors are referred to as errors of commission. Such error may or may not affect the agreement of trial balance. For example, recording of wrong amount in subsidiary books, posting an amount to wrong account etc., are two sided errors and as such do not affect the agreement of trial balance. However, wrong totaling of subsidiary books, posting of wrong side of an account, posting of wrong amount , wrong balancing of an account etc., are one sided errors and hence, affect the agreement of trial balance. 22