Slide 1 - NCSU Statistics - North Carolina State University

advertisement

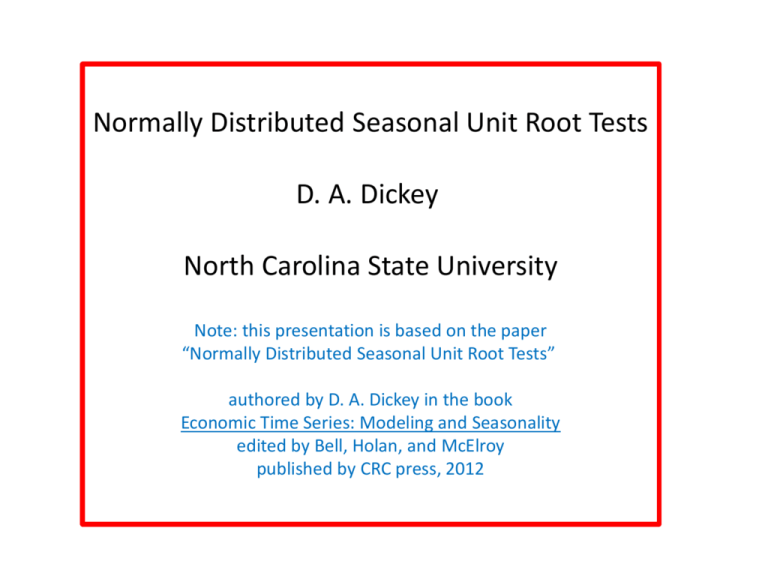

Normally Distributed Seasonal Unit Root Tests

D. A. Dickey

North Carolina State University

Note: this presentation is based on the paper

“Normally Distributed Seasonal Unit Root Tests”

authored by D. A. Dickey in the book

Economic Time Series: Modeling and Seasonality

edited by Bell, Holan, and McElroy

published by CRC press, 2012

Model: Seasonal AR(1)

Yt = r Yt-s + et,

et is White Noise

rˆ r Yt s et / Yt 2 s

Goal: Test H0: r=1

Yt Yi,j=Ymonth, year

J

Yr. 1

Yr. 2

|

Y1,1

Y2,1

F

M

A M

J

J A

S

O

N

D (s=12)

Y1,2 Y1,3 Y1,4 Y1,5 Y1,6 Y1,7 Y1,8 Y1,9 Y1,11 Y1,11 Y1,12=Y1,s

Y2,2 Y2,3 Y2,4 Y2,5 Y2,6 Y2,7 Y2,8 Y2,9 Y2,21 Y2,11 Y2,12=Y2,s

|

Yr. m

Ym,1 Ym,2 Ym,3 Ym,4 Ym,5 Ym,6 Ym,7 Ym,8 Ym,9 Ym,21 Ym,11 Ym,12=Ym,s

Yt = r Yt-s + et Yt – Yt-s = (r-1) Yt-s + ei,j Yi,j - Yi,j-1 = (r-1) Yi,j-1 + ei,j

Previous work:

Yt = r Yt-s + et Yi,j = r Yi,j-1 + ei,j Yi,j - Yi,j-1 = (r-1) Yi,j-1 + ei,j

OLS :

s

s m

s m 2 s

rˆ 1 Y j 1,i e j ,i / Y j 1,i Ni / Di

i 1

i 1 j 1

i 1

i 1 j 2

Ni / 2

0

m(m 1)(m 2) / 3

m(m 1) / 2

~

,

2

2

Di / m(m 1) / 2 m(m 1)(m 2) / 3 m(m 1)(m m 1) / 3

Dickey & Zhang (2011, J. Korean Stat. Soc.)

Under H0:

(1) S large CLT t stat NORMAL (0,1) (O(s-1/2) mean adjustment helpful )

(2) Known O(s-1/2) adjustments to mean (same) for k periodic regressors added (k<<s)

(3) MSE2

n.b.: Does not apply to seasonal dummy variables

Known mean 0

OLS :

s

s m

s m 2 s

rˆ r Yi , j 1ei , j / Yi , j 1 Ni / Di

i 1

i 1 j 1

i 1

i 1 j 2

Ni / 2

0

(m 2) / 3

1/ 2

~

,

m

m

1

2

2

m

(

m

1)

/

2

(

m

2)

/

3

(

m

m

1)

/

3

D

/

i

N 0 , D0

*****Add seasonal dummy variables:*****

OLS :

s

s

s m

s m

2

rˆ r (Yi , j 1 Yi , )ei , j / Yi , j 1 Yi , N i / Di

i 1

i 1 j 1

i 1

i 1 j 2

(m 2)

m6

12

Ni / 2

2

~

, m 2

2

m

Di / m(m 2)

6

6

N 0 , D0

m

6

2

m(2m 4m 9)

90

w.o.l.o.g. Assume 2 = 1

Notation: E{Ni}=N0 E{Di}=D0

(different for mean 0 versus seasonal means)

MSE=Mean Square Error = (Total SSq – Model SSq)/df

MSE in seasonal means case is (regressing

deseasonalized differences on deseasonalized lag levels)

s m

2

sN 2

N2

2

ei , j ei

/ s (m 2) ˆ

D

(m 2) D

i 1 j 2

N 02

N2

p

2

2

ˆ

only for mean 0 case !!!

s

(m 2) D

m 2 D0

2

OLS :

s

s

s m

s m

2

rˆ r (Yi , j 1 Yi , )ei , j / Yi , j 1 Yi , N i / Di

i 1

i 1 j 1

i 1

i 1 j 2

Standard error [(X’X)-1(MSE)]1/2 =

t statistic, seasonal means model:

f ( N , D, ˆ 2 )

MSE / ( sD)

N

D

MSE / ( sD)

sN

2

N2

D ˆ

m

2

D

3

2

1 3(m 2)

p

2

f

N

,

D

,

( 1)

0

0

s

2 2m 3

2

N2

D ˆ

m

2

D

N

No Mean

f ( N , D, ˆ

2

p

)

0

s

Seasonal Means

m2

2

m( m 2)

D0

6

N0

Taylor Series, seasonal means :

N i / 2 N 0 0 VN VND

~

,

2

D

V

V

D

/

0

D

ND

i

s

N

2

N2

ˆ

D

m

2

D

sN 0

N 02

D0 1

(

m

2)

D

0

g N , D, ˆ 2 R

(N0=(m-2)/2<0)

2 D

1

s ˆ

2

N

m

2

1/2

3s(m 2)

1

g N , D, ˆ 2 Op

2m 3

s

g N , D, ˆ 2

1 D0

1

(1) 2

2 N0 m 2

3

2

A s N N 0 B s D D0 C s ˆ 2 1

1 D

1

(1) 02

2 N0 m 2

m6

12

m

2

Cov Ni , Di , ˆ (m 2)

6

1

(m 2)

1 D0

1

(1)

4 N02 m 2

3

3

2

A s N N B s D D C s ˆ 1

2

0

m

6

m 2m 2 4m 9

90

m

6(m 2)

0

2 D0

8m

1 A

(1)

2

3

N

3

m

2

0

(m 2)

4

m B 1 (1)

2

2

N

m

2

0

6(m 2)

2

D0

2m

2

C

2

m 2

N0 3 m 2

V11 V12 V13 A

3

2

64m 168m 108m)

A B C V21 V22 V23 B

3

80

m

1.

5

V V V C

33

31 32

Approximate variance of in seasonal means case

COMPARISON

No Mean Model

2 m2

E{ }

3 s m(m 1)

Var{ } 1

Seasonal Means Model

3s m 2

E{ }

2m 3

64m

Var{ }

3

168m2 108m)

80 m 1.5

3

0.8

m

Calculation “recipe” for Seasonal Means Model

(1) Regress Yt-Yt-s on seasonal dummies and Yt-s. Get = t test for Yt-s

3s m 2

2m 3

(2) Compute

E{ }

(3) Compute

64m

Var{ }

(4) Compare

Z

3

168m2 108m)

80 m 1.5

3

E

to N(0,1) to get p-value.

Var ( )

Alternative approach: Expand around (N, D) only, run large (1/2

million) simulation fixup for small m.

Result for variance:

m 64m2 48m 108 0.8777

4.4705

1 2.2215

0.0853

3

3/2

m 1.5 m 1.5

s m 1.5

80 m 1.5

Similar empirical adjustments to mean:

0.0505

3s m 2 1 0.2118

0.3704

2

m

3

m

1.5

s

s

Compare limit (sinfinity) variance

formulas: Taylor 3 variable versus Taylor

2 variable with and without adjustments

1 million replicates s=12, m=6

Unadjusted (N,D) only

(10 seconds run time)

Reference normal variance

from empirical adjustment

from 3 variable Taylor:

Notes:

Graphs use sample means (both expansions give same mean

approximation)

3 variable Taylor variance 1.1556 closer to simulated statistics’ variance

1.2310 than is empirical adjusted if no s adjustment used. With the

finite s part in the empirically adjusted formula, that formula gives

1.2024

The choice m=6 gave the biggest vertical gap between the limit (s)

variance formulas. In previous graph.

NEXT: Sequence with m=6, s =4, 6, 12, 24

THEN: Sequence with s=4, m=6, 8, 10, 20, 100

Histogram Stats (reps = 1,000,000)

formula 2

2formula

m skew

4

6

0.34 0.65 2.59 2.51

1.39 1.29

6

6

0.26 0.35 3.06 2.99

1.31 1.25

12 6

24 6

0.18 0.15 4.16 4.12

0.13 0.07 5.77 5.74

1.23 1.20

1.19 1.17

52 6

0.09 0.03 8.40 8.38

1.17 1.14

s

skew

m

kurt

s

kurt

formula 2

2formula

4 6

0.34 0.65 2.59 2.51

1.39 1.29

4 8

0.19 0.33 2.60 2.54

1.16 1.11

4 10

4 20

0.11 0.22 2.60 2.56

0.02 0.08 2.61 2.59

1.05 1.03

0.90 0.89

4 100 0.10 0.04 2.62 2.62

0.80 0.79

4 1000 0.12 0.04 2.62 2.62 0.78 0.76

(formulas from book)

Higher order models (seasonal multiplicative form)

(1 r B s )(Yt ) Zt

( ( B))Zt et ( AR( p))

( ( B))(1 r B s )(Yt ) et

Suggested estimation (Dickey, Hasza, Fuller (1984))

(1) (under H0:r=1) Regress Dt = Yt-Yt-s on p lags of D AR(p) and residual rt

(2) Filter Y using AR(p) model for D.

Ft = filtered Yt

(3) Regress rt on Ft-s & p lags of D

(t test on Ft-s is

Dickey, D. A., D. P. Hasza, and W. A. Fuller (1984).

“Testing for Unit Roots in Seasonal Time Series”,

Journal of the American Statistical Association, 79, 355-367.

Example 1: Oil Imports (from book, s=12, m=36)

Levels

First

Differences

& Seasonal

Means

Variable

Intercept

Ft-12 filter12

D1

D2

D3

D4

D5

D6

D7

D8

DF

Parameter

Estimate

1

1

1

1

1

1

1

1

1

1

-163.62422

-0.81594

0.01853

-0.00511

0.00016148

0.02891

0.02369

0.00623

-0.01025

-0.04440

t Value

-0.20

-16.19

0.48

-0.11

0.00

0.58

0.48

0.13

-0.22

-1.13

Pr > |t|

0.8442

<.0001

0.6349

0.9128

0.9974

0.5617

0.6344

0.8998

0.8268

0.2604

+--------------------------------------------------------------+

| Formulas from Economic Time Series Modeling and Seasonality |

| pg. 398

(Bell, Holan McElroy eds.)

|

|

|

|

s = 12 m = 36

|

| Tau = -16.19 Mean = -4.2118 variance = 0.8377

|

|

|

|

Tau ~ N(-4.2118,0.8377)

|

|

|

|

Z=(-16.19-(-4.2118))/sqrt(0.8377)

|

|

|

|

Pr{Z <-13.09 } = 0.0000

|

|

|

+--------------------------------------------------------------+

Maximum Likelihood Estimation

Estimate

515.88809

Standard

Error

4154.0

t Value

0.12

Approx

Pr > |t|

0.9012

Lag

0

AR1,1

0.17664

0.05113

3.45

0.0006

12

amt

0

AR2,1

AR2,2

AR2,3

AR2,4

AR2,5

AR2,6

AR2,7

AR2,8

-0.67807

-0.40409

-0.19310

-0.23710

-0.20400

-0.17344

-0.18688

-0.07802

0.04966

0.05916

0.06194

0.06232

0.06233

0.06259

0.06021

0.05122

-13.65

-6.83

-3.12

-3.80

-3.27

-2.77

-3.10

-1.52

<.0001

<.0001

0.0018

0.0001

0.0011

0.0056

0.0019

0.1277

1

2

3

4

5

6

7

8

amt

amt

amt

amt

amt

amt

amt

amt

0

0

0

0

0

0

0

0

NUM1

NUM2

NUM3

NUM4

NUM5

NUM6

NUM7

NUM8

NUM9

NUM10

NUM11

6522.6

-25856.9

16307.1

6196.3

5578.6

2777.3

3490.6

3538.0

-13966.8

5738.4

-11305.0

7137.8

5920.4

5505.8

6060.5

6051.0

5744.2

6036.5

6079.1

5499.4

5910.3

7131.6

0.91

-4.37

2.96

1.02

0.92

0.48

0.58

0.58

-2.54

0.97

-1.59

0.3608

<.0001

0.0031

0.3066

0.3566

0.6287

0.5631

0.5606

0.0111

0.3316

0.1129

0

0

0

0

0

0

0

0

0

0

0

month1

month2

month3

month4

month5

month6

month7

month8

month9

month10

month11

0

0

0

0

0

0

0

0

0

0

0

Parameter

MU

Variable

amt

Shift

0

Autocorrelation Check of Residuals

To

Lag

6

12

18

24

30

36

42

48

ChiSquare

.

0.94

7.50

12.23

15.66

24.97

31.62

40.27

DF

0

3

9

15

21

27

33

39

Pr >

ChiSq

.

0.8169

0.5851

0.6615

0.7883

0.5761

0.5358

0.4140

--------------------Autocorrelations-------------------0.001

-0.003

-0.007

0.004

-0.001

-0.010

0.016

0.006

-0.009

-0.009

0.038

0.002

-0.048

0.076

0.016

-0.054

-0.052

-0.029

0.017

0.059

-0.048

-0.022

0.059

-0.019

0.014

0.022

0.023

-0.002

0.079

0.000

-0.002

0.061

-0.007

0.097

0.018

0.080

-0.019

0.024

-0.033

-0.074

-0.075

-0.030

0.002

-0.008

-0.097

0.051

0.024

0.072

Example 2: Airline Series from Box & Jenkins

Original

Scale

Logarithmic

Scale

Log Passengers (1,12) with lags at 1, 12, 23

Parameter

MU

AR1,1

AR1,2

AR1,3

Estimate

Standard

Error

0.0002871

-0.28601

-0.43072

0.30157

0.0022107

0.06862

0.07154

0.07270

t Value

Approx

Pr > |t|

Lag

0.13

-4.17

-6.02

4.15

0.8967

<.0001

<.0001

<.0001

0

1

12

23

Autocorrelation Check of Residuals

To

Lag

6

12

18

24

ChiSquare

6.22

10.23

15.87

24.25

DF

3

9

15

21

Pr >

ChiSq

0.1016

0.3319

0.3909

0.2809

--------------Autocorrelations----------------0.050 -0.066 -0.096 -0.105

0.112

0.075

-0.009 -0.045

0.137 -0.044

0.037 -0.063

-0.110

0.022

0.063 -0.094

0.100

0.045

-0.154

0.002

0.007 -0.014

0.015 -0.169

Parameter Estimates

Variable

Intercept

filter12

D1

D12

D23

DF

Parameter

Estimate

Standard

Error

t Value

1

1

1

1

1

-0.00095084

-0.42340

0.11925

0.24740

0.09924

0.00309

0.13897

0.08262

0.14225

0.07566

-0.31

-3.05

1.44

1.74

1.31

Pr > |t|

0.7587

0.0029

0.1517

0.0847

0.1923

+--------------------------------------------------------------+

| Formulas from Economic Time Series Modeling and Seasonality |

| pg. 398

(Bell, Holan McElroy eds.)

|

|

|

|

s = 12 m = 12

|

| Tau = -3.05 Mean = -4.1404 variance = 0.9550

|

|

|

|

Tau ~ N(-4.1404,0.9550)

|

|

|

|

Z = (-3.05-(-4.1404))/sqrt(0.9550)

|

|

Pr{Z <1.1158 } = 0.8677

|

|

|

+--------------------------------------------------------------+

Weekly Lower 48

States Natural Gas

Working

Underground

Storage (Billion

Cubic Feet)

Example 3: Weekly Natural Gas Supplies

(Energy Information Agency)

November

April

Lag 1 model fits well for Natural Gas Series First and Span 52 Differences

Conditional Least Squares Estimation

Parameter

MU

AR1,1

Estimate

Standard

Error

0.23692

0.39305

2.51525

0.03101

t Value

Approx

Pr > |t|

Lag

0.09

12.68

0.9250

<.0001

0

1

Autocorrelation Check of Residuals

To

Lag

ChiSquare

DF

Pr >

ChiSq

6

12

18

24

30

36

42

48

1.61

12.55

18.20

19.60

20.56

25.35

34.76

40.70

5

11

17

23

29

35

41

47

0.8997

0.3237

0.3764

0.6656

0.8747

0.8847

0.7432

0.7295

------------------Autocorrelations----------------0.007

-0.051

0.018

0.003

0.013

0.023

-0.031

0.034

-0.026

0.000

0.059

-0.033

0.008

0.016

-0.082

0.054

0.029

0.034

0.020

-0.009

0.014

-0.011

-0.007

-0.030

-0.013

0.042

0.027

-0.013

0.008

-0.051

-0.042

0.005

-0.006

0.008

0.005

-0.010

-0.019

0.011

0.009

0.036

-0.003

0.081

0.036

-0.011

0.012

-0.040

-0.024

0.008

Natural Gas Example – OLS Regression

Parameter Estimates

Variable

DF

Parameter

Estimate

Standard

Error

t Value

Pr > |t|

Intercept

1

-0.27635

1.05426

-0.26

0.7933

filter52

1

-1.04170

0.03343

-31.16 <.0001

D1

1

0.00313

0.02138

0.15

0.8838

+----------------------------------------------------------+

|

|

|

s = 52 m = 18

|

| Tau = -31.16 Mean = -8.6969 variance = 0.8877

|

|

|

|

Tau ~ N(-8.6969,0.8877)

|

|

|

| Z = (-31.16 - (-8.6969))/sqrt(0.8877) =

-23.84

|

|

|

|

Pr{Z <-23.84 } = 0.0000

|

|

|

+----------------------------------------------------------+