3

Assessing the Internal

Environment of the Firm

McGraw-Hill/Irwin

Strategic Management: Text and Cases, 4e

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

3-3

Learning Objectives

•

After reading this chapter, you should have a good

understanding of:

-

-

The benefits and limitations of SWOT analysis in conducting an

internal analysis of the firm.

The primary and support activities of a firm’s value chain.

How value-chain analysis can help managers create value by

investigating relationships among activities within the firm and

between the firm and its customers and suppliers.

The resource-based view of the firm and the different types of

tangible and intangible resources, as well as organizational

capabilities.

3-4

Learning Objectives

•

After reading this chapter, you should have a good

understanding of:

-

-

-

The four criteria that a firm’s resources must possess to

maintain a sustainable advantage and how value created can

be appropriated by employees.

The usefulness of financial ratio analysis, its inherent

limitations, and how to make meaningful comparisons of

performance across firms.

The value of recognizing how the interests of a variety of

stakeholders can be interrelated.

How firms are using Internet technologies to add value and

achieve unique advantages. (Appendix)

3-5

Purpose of Internal Analysis

• An organization’s future success depends on

its own internal conditions as well as external

conditions

• Managers need to be able to identify

- Strengths that the company can relay on in

order to compete

- Weaknesses that need to be corrected or

minimized as competitive factors

3-6

Managers must understand

–The role of resources, capabilities, and

distinctive competencies in the process

by which companies create value and

profit

–The importance of superior efficiency,

innovation, quality, and responsiveness

to customers

–The sources of their company’s

competitive advantage (strengths and

weaknesses)

3-7

Competitive Advantage

•

•

•

The collection of factors that sets a

company apart from its competitors

and gives it a unique position in the

industry/market

Means to add value for stakeholders

Focus especially on adding value for

customers

3-8

Core Competence(ies)

A unique set of lasting capabilities that

a company relies on to achieve

competitive advantage and add value

• Innovation

• Efficiency

• Customer Responsiveness

• Quality

• Special Expertise

3-9

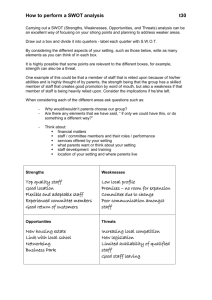

The Limitations of SWOT Analysis

• Strengths may not lead to an advantage

• SWOT’s focus on the external environment is too

narrow

• SWOT gives a one-shot view of a moving target

• SWOT overemphasizes a single dimension of

strategy

• Does not lead to rigorous examination of

components to external and internal

environments

3 - 10

Question

Which of the following is true regarding the SWOT analysis?

A) By itself, the SWOT analysis often helps a firm develop

competitive advantages that can be sustained over time.

B) The SWOT analysis's not the best starting point for creating

strategies.

C) The SWOT analysis simulates self-reflection and group

discussions on how to improve a firm and position it for

success.

D) The SWOT analysis is not a tried-and-true tool of strategic

analysis.

3 - 11

Value-Chain Analysis

• Sequential process of value-creating activities

• The amount that buyers are willing to pay for

what a firm provides them

• Value is measured by total revenue

• Firm is profitable to the extent the value it

receives exceeds the total costs involved in

creating its product or service

3 - 12

Example

• IBM Electronics Value Chain Management helps

companies save money by streamlining their value chain.

• The benefits of streamlining a business with value chain

management include:

- Lower infrastructure costs associated with collaboration.

- Create commonality in parts and suppliers.

- Control inventory by getting the supply chain talking to the

demand chain.

- Cut transaction costs by integrating with public and private

exchanges.

- Deliver products to market faster while minimizing risk and

capital investment.

Source: www.ibm.com

3 - 13

The Value Chain

Adapted from Exhibit 3.1 The Value Chain: Primary and Support Activities

Source: Adapted with permission of The Free Press, a division of Simon & Schuster, Inc., from Competitive Advantage:

Creating and Sustaining Superior Performance by Michael E. Porter.

3 - 14

Value Chain Interpretation

• Represents a company or any organization

• Simplified illustration of all activities that an

organization must perform

• Framework for analyzing a company’s

strengths and weaknesses

• Margin represents profit- expand margin by

- Being able to charge a higher price

- Operating at a lower cost within the Value

Chain

3 - 15

Primary Activity: Inbound Logistics

• Associated with receiving, storing and distributing

inputs to the product

- Location of distribution facilities

- Material and inventory control systems

- Systems to reduce time to send “returns” to

suppliers

- Warehouse layout and designs

3 - 16

Primary Activity: Operations

• Associated with transforming inputs into the final

product form

-

Efficient plant operations

Appropriate level of automation in manufacturing

Quality production control systems

Efficient plant layout and workflow design

3 - 17

Primary Activity: Outbound Logistics

• Associated with collecting, storing, and

distributing the product or service to buyers

-

Effective shipping processes

Efficient finished goods warehousing processes

Shipping of goods in large lot sizes

Quality material handling equipment

3 - 18

Primary Activity: Marketing and Sales

• Associated with purchases of products and

services by end users and the inducements used

to get them to make purchases

-

Highly motivated and competent sales force

Innovative approaches to promotion and advertising

Selection of most appropriate distribution channels

Proper identification of customer segments and needs

Effective pricing strategies

3 - 19

Primary Activity: Service

• Associated with providing service to enhance or

maintain the value of the product

- Effective use of procedures to solicit customer

feedback and to act on information

- Quick response to customer needs and emergencies

- Ability to furnish replacement parts

- Effective management of parts and equipment

inventory

- Quality of service personnel and ongoing training

- Warranty and guarantee policies

3 - 20

Support Activity:

General Administration

Firm Infrastructure

• Typically supports the entire value chain and not individual

activities

- Effective planning systems

- Ability of top management to anticipate and act on key

environmental trends and events

- Ability to obtain low-cost funds for capital expenditures

and working capital

- Excellent relationships with diverse stakeholder groups

- Ability to coordinate and integrate activities across the

value chain

- Highly visible to inculcate organizational culture,

reputation, and values

3 - 21

Support Activity:

Human Resource Management

• Activities involved in the recruiting, hiring,

training, development, and compensation of all

types of personnel

- Effective recruiting, development, and retention

mechanisms for employees

- Quality relations with trade unions

- Quality work environment to maximize overall

employee performance and minimize absenteeism

- Reward and incentive programs to motivate all

employees

3 - 22

Support Activity:

Technology Development

• Related to a wide range of activities and those

embodied in processes and equipment and the

product itself

- Effective R&D activities for process and product

initiatives

- Positive collaborative relationships between R&D and

other departments

- State-of-the art facilities and equipment

- Culture to enhance creativity and innovation

- Excellent professional qualifications of personnel

- Ability to meet critical deadlines

3 - 23

Support Activity: Procurement

• Function of purchasing inputs used in the firm’s

value chain

- Procurement of raw material inputs

- Development of collaborative “win-win” relationships

with suppliers

- Effective procedures to purchase advertising and

media services

- Analysis and selection of alternate sources of inputs to

minimize dependence on one supplier

- Ability to make proper lease versus buy decisions

3 - 24

Applying Value Chain Analysis

• Framework for identifying company’s strengths

and weaknesses

• Means to focus on where the company’s core

competencies exist and can be used to

achieve competitive advantage and add value

• Comparison with competitors reveals

opportunities for improving company’s

competitive position

3 - 25

Interrelationships among Value-Chain

Activities within and across Organizations

• Importance of relationships among value

activities

- Interrelationships among activities within the firm

- Relationships among activities within the firm and with

other organization (e.g., customers and suppliers)

3 - 26

Resource-Based View of the Firm

• Two perspectives

- The internal analysis of phenomena within a company

- An external analysis of the industry and its competitive

environment

• Three key types of resources

- Tangible resources

- Intangible resources

- Organizational capabilities

3 - 27

Resource-Based View (RBV)

1. RBV is a method of analyzing and identifying

a firm’s strategic advantages based on

examining its distinct combination of assets,

skills, capabilities, and intangibles

2. The RBV’s underlying premise is that firms

differ in fundamental ways because each

firm possesses a unique “bundle” of

resources

3. Each firm develops competencies from these

resources, and these become the source of

the firm’s competitive advantages

3 - 28

Types of Resources:

Tangible Resources

• Relatively easy to identify, and include physical

and financial assets used to create value for

customers

• Financial resources

- Firm’s cash accounts

- Firm’s capacity to raise equity

- Firm’s borrowing capacity

• Physical resources

- Modern plant and facilities

- Favorable manufacturing locations

- State-of-the-art machinery and equipment

3 - 29

Types of Resources:

Tangible Resources

• Technological resources

- Trade secrets

- Innovative production processes

- Patents, copyrights, trademarks

• Organizational resources

- Effective strategic planning processes

- Excellent evaluation and control systems

3 - 30

Types of Resources:

Intangible Resources

• Difficult for competitors (and the firm itself) to

account for or imitate, typically embedded in

unique routines and practices that have evolved

over time

- Human

•

•

•

•

Experience and capabilities of employees

Trust

Managerial skills

Firm-specific practices and procedures

3 - 31

Types of Resources:

Intangible Resources

• Innovation and creativity

- Technical and scientific skills

- Innovation capacities

• Reputation

- Brand name

- Reputation with customers

- Reputation with suppliers

3 - 32

Types of Resources:

Organizational Capabilities

• Competencies or skills that a firm employs to

transform inputs to outputs, and capacity to

combine tangible and intangible resources to

attain desired end

-

Outstanding customer service

Excellent product development capabilities

Innovativeness of products and services

Ability to hire, motivate, and retain human capital

3 - 33

Firm Resources and

Sustainable Competitive Advantages

Is the resource or

capability…

Valuable

Rare

Difficult to imitate

Implications

• Neutralize threats and

exploit opportunities

• Not many firms possess

• Physically unique

• Path dependency

• Causal ambiguity

• Social complexity

Difficult to substitute

• No equivalent strategic

resources or capabilities

Adapted from Exhibit 3.7 Four Criteria for Assessing Sustainability of Resources and Capabilities

3 - 34

Question

In the bookseller industry, can different firm

resources become strategic substitutes for

Amazon.com? Explain.

3 - 35

Criteria for Sustainable Competitive

Advantage and Strategic Implications

Exhibit 3.8 Criteria for Sustainable Competitive Advantage and Strategic Implications

Source; Adapted from J. Barney, “Firm Resources a Sustained Competitive Advantage,

‘ Journal of Management 17 (1991), pp. 99-120.

3 - 36

Evaluating Firm Performance

• Two approaches for evaluating firm performance

- Financial ratio analysis

•

•

•

•

•

Balance sheet

Income statement

Historical comparison

Comparison with industry norms

Comparison with key competitors

- Balanced scorecard (stakeholder perspective)

• Employees

• Customers

• Owners

3 - 37

Financial Ratio Analysis

• Five SIX types of financial ratios

-

Short-term solvency or liquidity

Long-term solvency measures

Asset management (or turnover)

Profitability

Market value

Growth

• Meaningful ratio analysis must include

- Analysis of how ratios change over time

- How ratios are interrelated

3 - 38

The Balanced Scorecard

• Provides a meaningful integration of many issues

that come into evaluating a firm’s performance

• Four key perspectives

- How do customers see us? (customer perspective)

- What must we excel at? (internal perspective)

- Can we continue to improve and create value?

(innovation and learning perspective)

- How do we look to shareholders? (financial

perspective)

3 - 39

Customer Perspective

• Time

• Quality

• Performance and service

• Cost

3 - 40

Internal Business Perspective

• Processes

- Cycle time

- Quality

- Employee Skills

- Productivity

• Decisions

• Actions

• Coordination

• Resources and capabilities

3 - 41

Innovation and Learning Perspective

• Introduction of new products and services

• Greater value for customers

• Increased operating efficiencies

3 - 42

Example

•

The world’s 10 most innovative companies, according to

Business Week in 2007 are:

1. Apple

2. Google

3. Toyota Motor

4. General Electric

5. Microsoft

6. Proctor & Gamble

7. 3M

8. Walt Disney Co.

9. IBM

10. Sony

Source: www.businessweek.com

3 - 43

Financial Perspective

• Profitability

• Growth

• Shareholder value

• Increased market share

• Reduced operating expenses

• Higher asset turnover

3 - 44

Potential Limitations of the

Balanced Scorecard

• Lack of a clear strategy

• Limited or ineffective executive sponsorship

• Too much emphasis on financial measures rather

than nonfinancial measures

• Poor data on actual performance

• Inappropriate links to scorecard measures to

compensation

• Inconsistent or inappropriate Terminology

3 - 45

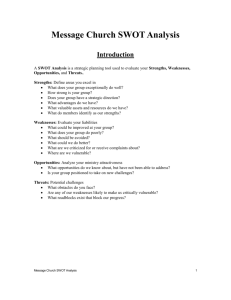

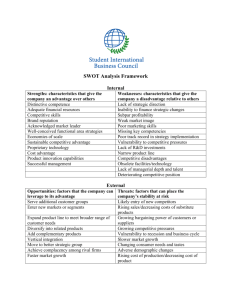

Combining Internal and

External Analyses

• Internal and External Analyses commonly referred to

as SWOT:

- Strengths

- Weaknesses

- Opportunities

- Threats

• Strengths and Weaknesses identified from Internal

Analysis

• Opportunities and Threats identified from External

Analyses

3 - 46

Internal Analysis

• Strengths and Weaknesses identified through

the use of tools such as:

- Vision, Mission, Objectives

- Stakeholder Analysis

- Core Competencies

- Value Chain

- Balanced Scorecard

- Financial Analysis

3 - 47

External Analysis

• Opportunities and Threats identified through

the use of tools such as:

- General Environment Assessment

- Five Force Analysis

- Key Success Factors in Industry

- Competitive Changes during Industry

Evolution

- Strategic Groups

- National Competitive Advantage

3 - 48

Results of Internal and External

Analysis

• Requires creative interpretation

• Understanding of company’s competitive

position in its industry

• Identification of strategic issues the company

faces

• Strategic issues

- Represent dangers to the company’s longterm survival

- Suggest areas where the company should

concentrate its efforts in order to grow

3 - 49

Internal Analysis

External Analysis

•Strengths

•Opportunities

•Weaknesses

Tools

•Threats

Strategic

Issues

Strategic

Alternatives

Strategy

Tools