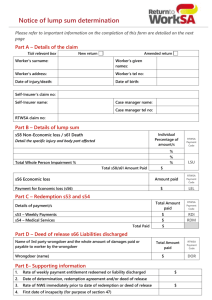

Australian Tax Office position paper on redemption payments under

advertisement

ATO position paper – assessability of lump sum redemption amounts Page 1 of 10 Income tax: assessability of lump sum redemption amounts under section 53 or section 54 of the Return to Work Act 2014 (SA) Facts Entitlement to payments in respect of injury or medical costs 1. The Return to Work Act 2014 (SA) (RWA) entitles certain injured workers to weekly payments in respect of incapacity for work resulting from a work injury, as well as compensation for certain medical costs reasonably incurred by the worker in consequence of having suffered a work injury. Weekly payments: sections 39, 40 and 41 of the RWA 2. Section 39 of the RWA provides that a worker, other than a seriously injured worker, who suffers a work injury that results in incapacity for work is entitled to weekly payments in respect of that incapacity. 3. Similarly, section 41 of the RWA provides that a seriously injured worker1 who suffers a work injury that results in incapacity for work is entitled to weekly payments in respect of that incapacity. 4. For these purposes, a ‘work injury’ is an injury that arises from employment. Broadly, an injury arises from employment where it arises out of or in the course of employment and the employment was a significant contributing cause of the injury.2 5. Section 40 of the RWA entitles an injured worker, other than a seriously injured worker, to supplementary income support payments where, some time after 104 weeks from the date on which their incapacity for work resulting from the work injury first occurred, they have an incapacity for work resulting from certain surgery approved by the Return to Work Corporation of South Australia (ReturnToWorkSA). 6. During the first 52 weeks from the date on which their incapacity for work resulting from the work injury first occurs, sections 39 and 41 of the RWA entitle the injured worker to weekly payments equal to:3 their notional weekly earnings for periods when they have no current work capacity; and the difference between their notional weekly earnings and their current weekly earnings for periods when they have some current work capacity. 7. Broadly,4 a worker’s notional weekly earnings comprise the worker’s average weekly earnings, being the average weekly amount they earned during the preceding 12 months. 8. Broadly, after 52 weeks from the date on which their incapacity for work resulting from the work injury first occurs: The term ‘seriously injured worker’ is defined in section 21 of the RWA. See further, section 7 of the RWA. 3 See further, paragraphs 39(1)(a) and 41(1)(a) and subsections 39(2) and 41(2) of the RWA. 4 For complete definitions of relevant terms, see sections 4 and 5 of the RWA. 1 2 ATO position paper – assessability of lump sum redemption amounts Page 2 of 10 seriously injured workers are entitled to weekly payments equal to 80% of the amounts described in paragraph 14 above;5 and other injured workers are entitled to: o weekly payments during the next 52 weeks, equal to 80% of the amounts described in paragraph 14 above;6 and o weekly payments after that second 52 weeks for periods of incapacity for work of up to 13 weeks after certain approved surgery where the incapacity for work results from that surgery.7 Compensation for medical costs: section 33 of the RWA 9. Section 33 of the RWA entitles a worker to compensation for the costs of various medical services they reasonably incur in consequence of having suffered a work injury. These costs are set out in subsection 33(2) of the RWA. Retiring age 10. Weekly payments are not payable in respect of a period of incapacity for work falling after the date when the worker reaches their retiring age.8 However, if a worker who is within 2 years of or above their retiring age becomes incapacitated for work while still in employment, weekly payments are payable for any period of incapacity falling within 104 weeks after the date on which the incapacity for work first occurred.9 Agreement to redeem entitlement to weekly payments or compensation for medical costs 11. In certain circumstances a worker can enter into an agreement with ReturnToWorkSA to redeem a liability to make weekly payments or compensation payments for medical costs: sections 53 and 54 of the RWA. Weekly payments: section 53 of the RWA 12. Section 53 of the RWA concerns the redemption of a liability to make weekly payments. Section 53 relevantly provides: (1) A liability to make weekly payments under Division 4 may, by agreement between the worker and the Corporation, be redeemed by a capital payment to the worker. (2) An agreement for the redemption of a liability under this section cannot be made unless (a) the worker has received competent professional advice about the consequences of redemption; and (b) the worker has received competent financial advice about the investment or use of money to be received on redemption; and See further, paragraph 41(1)(b) of the RWA. See further, paragraph 39(1)(b) of the RWA. 7 See further, section 40 and paragraphs 33(21)(b) and 39(1)(b) of the RWA. 8 ‘Retiring age’ is defined to mean (a) if there is a normal retiring age for workers in employment of the kind from which the worker’s injury arose – that age; or (b) the age at which the worker would, subject to satisfying any other qualifying requirements, be eligible to receive an age pension under the Social Security Act 1991 of the Commonwealth: see subsection 44(1) of the RWA. 9 Subsection 44(3) of the RWA. 5 6 ATO position paper – assessability of lump sum redemption amounts Page 3 of 10 (c) the Corporation has consulted with the employer out of whose employment the injury arose and has considered any representations made by the employer; and (d) a recognised health practitioner has certified that the extent of the worker's incapacity resulting from the work injury can be determined with a reasonable degree of confidence. (3) The amount of the redemption payment is to be fixed by the agreement. (4) If the Corporation notifies a worker in writing that it is prepared to enter into negotiations for the redemption of a liability by agreement under this section, the Corporation is liable to indemnify the worker for reasonable costs of obtaining the advice required under this section up to a limit prescribed by regulation. Compensation for medical costs and supplementary income support payments: section 54 of the RWA 13. Section 54 of the RWA addresses redemption of a liability to pay compensation for medical costs or to make supplementary income support payments. Section 54 relevantly provides: (1) In this section "designated liability" means (a) a liability to make payments under section 33 in relation to a work injury suffered by a worker; and (b) in association with a liability under paragraph (a) (if relevant), a liability to make weekly payments under section 40. (2) This section applies (and only applies) in relation to workers who are not seriously injured workers. (3) A designated liability may, by agreement between the worker and the Corporation, be redeemed by a capital payment to the worker. (4) An agreement for the redemption of a liability under this section cannot be made unless (a) the worker has received competent professional advice about the consequences of redemption; and (b) the worker has received advice from a recognised health practitioner about the future medical services (and, if relevant, therapeutic appliances and other forms of assistance related to his or her future health) that the worker will or is likely to require on account of the work injury and any related surgery, treatment or condition. (5) The amount of the redemption payment is to be fixed by the agreement. ATO position paper – assessability of lump sum redemption amounts Page 4 of 10 Proposed ATO view Lump sum received on redemption of the right to receive weekly payments under section 39, 40 or 41 of the RWA: sections 53 and 54 of the RWA Ordinary income 14. A lump sum received by a worker under section 53 of the RWA on redemption of the worker’s right to receive weekly payments under section 39 or 41 of the RWA is ordinary income and is included in the worker’s assessable income under section 6-5 unless the lump sum is an ‘employment termination payment’ covered by paragraph 16 of this Ruling. 15. The same treatment applies to a lump sum received by a worker under section 54 of the RWA on redemption of the worker’s right to receive weekly payments under section 40 of the RWA. Employment termination payment 16. A lump sum received by a worker under section 53 of the RWA on redemption of the worker’s right to receive weekly payments under section 39 or 41 of the RWA is an employment termination payment if: it is received by the worker in consequence of the termination of their employment; and is received no later than 12 months after that termination (or the worker is covered by a determination by the Commissioner under subsection 82-130(5) or (7) that this 12 month limitation does not apply in the circumstances). 17. Where such a redemption amount is an employment termination payment: the taxable component of the payment (if any) is included in the worker’s assessable income under subsection 82-10(2); and the tax free component (if any) is not assessable income or exempt income under subsection 82-10(1). 18. The treatment in paragraphs 24 to 25 above also applies to a lump sum received by a worker under section 54 of the RWA on redemption of the worker’s right to receive weekly payments under section 40 of the RWA. Capital gains tax 19. CGT event C2 (section 104-25) happens if a worker receives a lump sum redemption amount under section 53 of the RWA. 20. However, any capital gain the worker makes from that CGT event is reduced to the extent that the amount is included in the worker’s assessable income under section 6-5 or is an employment termination payment: section 118-20. 21. The same treatment applies to a lump sum amount received by a worker under section 54 of the RWA on redemption of their right to receive weekly payments under section 40 of the RWA. ATO position paper – assessability of lump sum redemption amounts Page 5 of 10 Lump sum received on redemption of the right to receive compensation for medical costs under section 33 of the RWA: section 54 of the RWA Ordinary income 22. A lump sum received by a worker under section 54 of the RWA on redemption of the worker’s right to be compensated under section 33 of the RWA for in respect of the costs of medical services is not included in the worker’s assessable income under section 6-5 as it is not ordinary income. Employment termination payment 23. Such a lump sum is not included to any extent in the worker’s assessable income under subsection 82-10(2) as it is not an employment termination payment. Capital gains tax 24. CGT event C2 (section 104-25) happens if a worker receives a lump sum under section 54 of the RWA on redemption of the worker’s right to be compensated under section 33 of the RWA for the costs of medical services. 25. However, any capital gain or capital loss the worker makes from that CGT event is disregarded under paragraph 118-37(1)(a). Further Explanation Lump sum received on redemption of the right to receive weekly payments under section 39, 40 or 41 of the RWA: sections 53 and 54 of the RWA Ordinary income 26. A lump sum received by a worker under section 53 of the RWA on redemption of the worker’s right to receive weekly payments under section 39 or 41 of the RWA is considered to be ordinary income, included in the worker’s assessable income under section 6-5, unless it is an ‘employment termination payment’. The same treatment is considered to apply to a lump sum received by a worker under section 54 of the RWA on redemption of their right to receive weekly payments under section 40 of the RWA. 27. The legislation does not provide specific guidance on the meaning of ordinary income. However, a substantial body of case law exists which identifies likely characteristics. Amounts that are periodic, regular or recurrent and relied upon by the recipient for their regular expenditure are likely to be ordinary income, as are amounts that are the product of any employment of, or services rendered by, the recipient.10 Further, amounts which compensate for lost income or serve as a substitute for other income are themselves income according to ordinary concepts. This is the case, even though there may not be a precise degree of correspondence between the weekly payments and the actual loss of earnings suffered by the worker.11 Character of weekly payments 28. Amounts covered by section 39, 40 or 41 of the RWA are payable weekly and calculated by reference to the worker’s past and current earnings. This indicates that the objective purpose of the payments is to provide an income replacement or to compensate the injured worker for the loss of earnings which resulted from their incapacity to work. On 10 11 Federal Commissioner of Taxation v. Rowe (1995) 60 FCR 99; 95 ATC 4691; (1995) 31 ATR 392 Federal Commissioner of Taxation v. Darcy Peter Smith 81 ATC 4114 at 4116. ATO position paper – assessability of lump sum redemption amounts Page 6 of 10 this basis, it is considered that weekly payments to a worker under sections 39, 40 or 41 of the RWA are ordinary income of the worker. 29. The purpose of a statutory payment is an important but not conclusive aid to determining whether it constitutes income.12 The question to be considered in this context is what the payment is objectively intended to be for, rather than how the parties label it or whether they intended it to be taxed.13 The calculation and timing of amounts payable under sections 39, 40 or 41 of the RWA indicate that the objective purpose of such amounts is to replace lost income. 30. This characterisation of weekly payments under the RWA is not considered to be inconsistent with their description as being ‘in respect of … incapacity’.14 It is the worker’s incapacity for work which provides the occasion for the replacement of lost income. This approach is confirmed by cases in which amounts described as compensation in respect of incapacity15 or injury16 have been found to have the character of income. Character of redemption payments 31. Section 53 of the RWA addresses the redemption of a liability to make payments under section 39 or 41 by a ‘capital payment’. Similarly, section 54 of the RWA addresses the redemption of a liability to make supplementary income support payments under section 40 of the RWA. 32. These redemption payments are also considered to be income according to ordinary concepts, since they represent a replacement of the income that would otherwise be derived in the form of weekly payments. 33. The character of a redemption payment of this kind was considered in Brackenreg v. Federal Commissioner of Taxation.17 There the taxpayer received weekly compensation payments from Comcare, based on a statutory formula which took into account her normal weekly earnings.18 Comcare’s liability to make these payments was subsequently redeemed for a lump sum.19 The AAT found that the taxpayer’s weekly compensation was income, since it was in substitution for and was paid for loss of earnings; and the character of that compensation did not change upon being redeemed by the payment of a lump sum.20 34. The payment in Brackenreg can be distinguished from the payment considered in Coward v. Commissioner of Taxation (Coward).21 There the taxpayer received weekly compensation payments, based on his previous average weekly earnings. Upon turning FC of T v. Slaven 84 ATC 4077 at 4085. See FC of T v. Slaven 84 ATC 4077 at 4085. In contrast, in Re Barnett and Commissioner of Taxation (Cth) [1999] AATA 950; (1999) 43 ATR 1221; 99 ATC 2444, the AAT held that a redemption payment was of a capital nature on the grounds that it would be contrary to the legislative intent of the payment for it to be subject to income tax. It is considered that the Tribunal erred in characterising the payment by reference to the intended tax treatment of the payment, in preference to an objective analysis of the character of the payment in the hands of the recipient. 14 Subsections 39(1) and 41(1) of the RWA. 15 Coward v. Federal Commissioner of Taxation [1999] AATA 132; 99 ATC 2166; (1999) 41 ATR 1138. 16 Commissioner of Taxation v. Pitcher [2005] FCA 1154; 2005 ATC 4813; (2005) 60 ATR 424; Brackenreg v. Federal Commissioner of Taxation 2003 ATC 2196’ [2003] AATA 824. 17 2003 ATC 2196. 18 Sections 131 and 132A of the Safety, Rehabilitation and Compensation Act 1988. 19 Pursuant to section 137 of the Safety, Rehabilitation and Compensation Act 1988. 20 Similarly, see Commissioner of Taxation v. Pitcher [2005] FCA 1154; 2005 ATC 4813; (2005) 60 ATR 424, at [56] where it was held that a lump sum redemption amount received under section 30 of the Safety, Rehabilitation and Compensation Act 1988 had the character of ordinary income, despite being assessable as an eligible termination payment. 21 [1999] AATA 132; 99 ATC 2166; (1999) 41 ATR 1138 12 13 ATO position paper – assessability of lump sum redemption amounts Page 7 of 10 65, the amount of these payments was reduced by reference to an aged-based formula and the taxpayer became entitled to redeem his right to receive further payments for a lump sum. In holding that the lump sum was of a capital nature, Matthews J took the view that the object of the payment was not to compensate the taxpayer for lost earnings, since the taxpayer had reached retirement age. 35. The payment in Coward can also be contrasted with a lump sum payable under section 53 or 54 of the RWA on redemption of a liability to make weekly payments under section 39, 40 or 41 of the RWA. The RWA only permits such weekly payments to a worker who has reached retiring age where the worker remains employed; and upon reaching that age there is no recalculation of the amount of weekly payments. These factors indicate that such weekly payments under the RWA retain their character as a substitution for or replacement of lost earnings, even when payable after the worker has reached retiring age. On this basis, a lump sum received on redemption of an entitlement to receive such weekly payments is also considered to have the character of income. 36. The characterisation of such lump sums received as ordinary income is considered to follow, despite their label as a ‘capital payment’22 in the RWA. A State Parliament cannot determine by its own legislation whether a receipt answers the description of income or capital.23 The tax treatment of the receipt is determined by an assessment of its character in the hands of the recipient, rather than the label given to it. Employment termination payment 37. A lump sum received by a worker under section 53 of the RWA on redemption of the worker’s right to receive weekly payments under section 39 or 41 of the RWA is an employment termination payment if: it is received by the worker in consequence of the termination of their employment; and is received no later than 12 months after that termination (or the worker is covered by a determination by the Commissioner under subsection 82-130(5) or (7) that this 12 month limitation does not apply in the circumstances). 38. A lump sum received under section 53 of the RWA is not considered to be excluded from the definition of ‘employment termination payment’ on the basis that it is a capital payment for, or in respect of, the personal injury of the worker: paragraph 82-135(i). Such a receipt constitutes proceeds from the redemption of an entitlement to receive weekly payments. These payments vary according to the worker’s current earnings, indicating that they reflect an actual loss of income as opposed to a loss of income earning capacity.24 The objective purpose of such payments is therefore to replace lost income rather than to place a monetary value on the worker’s injury.25 A lump sum received under section 53 of the RWA is considered to have the same character, since it represents the proceeds of redeeming a liability to make weekly payments. 39. The analysis above is also considered to apply to a lump sum received under section 54 of the RWA on redemption of a right to receive weekly payments under section 40 of the RWA. Received in consequence of termination of employment Subsection 53(1) of the RWA. FC of T v. Slaven 84 ATC 4077 at 4085; see further, footnote 13 in this Ruling. 24 In contrast, see FC of T v. Inkster 89 ATC 5142. 22 23 25 Federal Commissioner of Taxation v. Scully 2000 ATC 4111; [2000] HCA 6; Bond v. Federal Commissioner of Taxation 2015 ATC 20-499; [2015] FCA 245. ATO position paper – assessability of lump sum redemption amounts Page 8 of 10 40. A payment is only an employment termination payment if it is received by a worker in consequence of the termination of the worker’s employment. Accordingly, the worker’s employment must be terminated; and there must be a causal connection between the termination and the payment. 41. The question whether a payment is received in consequence of the termination of employment depends on the facts in each case.26 However, in considering this question the following principles may be noted: A payment under section 53 or 54 of the RWA is not made in consequence of termination of employment merely because the termination was about the same time as the payment.27 Such a payment is not in consequence of the termination of employment merely because it represents proceeds from the redemption of an entitlement to weekly payments. There is no necessary connection between a worker’s entitlement to weekly payments under the RWA and the termination of their employment.28 Conversely, a payment under section 53 or 54 of the RWA will be in consequence of the termination of a worker’s employment where termination of employment is a necessary condition of the agreement to make the payment29 Received within 12 months of termination 42. A payment under section 53 or 54 of the RWA will not be an employment termination payment unless it is received no later than 12 months after the termination of the worker’s employment: paragraph 82-130(1)(b). 43. However, the Commissioner may make a determination under subsection 82-130(5) or (7) that the 12 month limitation does not apply. Such a determination under subsection 82-130(5) may be made if the Commissioner considers the time between the employment termination and the payment to be reasonable, having regard to:30 The circumstances of the employment termination, including any dispute in relation to the termination; The circumstances of the payment; The circumstances of the person making the payment; and Any other relevant circumstances. 44. Alternatively, under subsection 82-130(7), the Commissioner may, by legislative instrument, make a determination that the 12 month limitation does not apply to either or both of the following, as specified in the determination: a class of payments; a class of recipients of payments.31 See further, Taxation Ruling TR 2003/13, ‘Income Tax: eligible termination payments (ETP): payments made in consequence of the termination of any employment: meaning of the phrase ‘in consequence of’. 27 Bond v. Federal Commissioner of Taxation 2015 ATC 20-499; [2015] FCA 245. 28 By way of contrast, see Commissioner of Taxation v. Pitcher [2005] FCA 1154; 2005 ATC 4813; (2005) 60 ATR 424 and Seabright v. Federal Commissioner of Taxation 99 ATC 2011; (1998) 40 ATR 1160. 29 McCunn v. FC of T 2006 ATC 2191 at [52]. 30 Subsection 82-130(5). 31 See subsection 82-130(8) for further details about a determination under subsection 82-130(7). 26 ATO position paper – assessability of lump sum redemption amounts Page 9 of 10 Taxation treatment 45. Where a lump sum received by a worker under section 53 or 54 of the RWA on redemption of the worker’s right to receive weekly payments under section 39, 40 or 41 of the RWA is an employment termination payment: the taxable component of the payment (if any) is included in the worker’s assessable income under subsection 82-10(2); and the tax free component (if any) is not assessable income or exempt income 46. The tax free component of the payment (if any) is so much of the payment as consists of an invalidity segment or a pre-July 83 segment for the purposes of section 82-140. Capital gains tax 47. A worker’s right to receive weekly payments under the RWA is a CGT asset. CGT event C2 (section 104-25) happens if a worker receives the lump sum redemption amount in satisfaction of that right. 48. However, any capital gain the worker makes from that CGT event is reduced to the extent that the amount is included in the worker’s assessable under section 6-5: subsection 118-20(1). 49. Further, any such capital gain is reduced to the extent that the amount is an employment termination payment: section 118-22. Lump sum received on redemption of right to receive compensation for medical costs under section 33 of the RWA: section 54 of the RWA Ordinary income 50. A lump sum received by a worker under section 54 of the RWA on redemption of their right to be compensated under section 33 of the RWA for the cost of medical services is not included in the worker’s assessable income under section 6-5 as it is not considered to be ordinary income. 51. Such a receipt is a one-off lump sum compensation receipt. It is not a substitute for ordinary income, nor does it possess any other characteristics of ordinary income. Employment termination payment 52. A lump sum received by a worker under section 54 of the RWA on redemption of the worker’s right to be compensated under section 33 of the RWA for the cost of medical services is not included to any extent in the worker’s assessable income under subsection 82-10(2) as it is not considered to be an employment termination payment. 53. Such a lump sum is considered to be excluded from the definition of employment termination payment on the grounds that it is a capital sum payable in respect of personal injury which is reasonable, having regard to the nature of the injury and its likely effect on the worker’s capacity to derive income from personal exertion: paragraph 82-135(i). 54. Such an amount is considered to be in respect of personal injury, as it is designed to place a partial ‘monetary value’ on the worker’s injury, comparable to the ‘special damages’ component of a legal claim for personal injury.32 The fact that these payments do not also compensate the worker for lost income earning capacity is not considered to 32 See FC of T v. Scully 2000 ATC 4111 at [30]. ATO position paper – assessability of lump sum redemption amounts Page 10 of 10 affect their reasonableness. A lump sum payable under section 54 of the RWA represents a redemption of a right to receive compensation for costs which have been ‘reasonably incurred’33 by the worker in consequence of having suffered a work injury. Capital gains tax 55. A worker’s right to be compensated under section 33 of the RWA for the cost of medical services is a CGT asset. CGT event C2 (section 104-25) happens if a worker receives a lump sum redemption amount under section 54 of the RWA in satisfaction of that right. 56. However, any capital gain or capital loss the worker makes from that CGT event is disregarded under paragraph 118-37(1)(a), since the lump sum is considered to constitute compensation received by the worker for personal injury. Case references Bond v. Federal Commissioner of Taxation 2015 ATC 20-499; [2015] FCA 245 Brackenreg v. Commissioner of Taxation 2003 ATC 2196 Coward v. Federal Commissioner of Taxation 99 ATC 2166, (1999) 41 ATR 1138 Federal Commissioner of Taxation v. Darcy Peter Smith 81 ATC 4114 Federal Coke Co Pty Ltd v. Federal Commissioner of Taxation (1977) 34 FLR 375 at 402; 77 ATC 4255 at 4273; (1977) 7 ATR 519 at 539 Federal Commissioner of Taxation v. Dixon (1952) 86 CLR 540 at 568; (1952) 10 ATD 82 at 92; (1952) 5 AITR 443 at 456 (per Fullagar J) Federal Commissioner of Taxation v. Inkster (1989) 24 FCR 53; 89 ATC 5142; (1989) 20 ATR 1516 McCunn v. FC of T 2006 ATC 2191 GP International Pipecoaters Pty Ltd v. Federal Commissioner of Taxation (1990) 170 CLR 124 at 138; 90 ATC 4413 at 4420; (1990) 21 ATR 1 at 7 Hayes v. Federal Commissioner of Taxation (1956) 96 CLR 570; (1956) 11 ATD 68 Re Barnett and Commissioner of Taxation (Cth) 1999] AATA 950; (1999) 43 ATR 1221; (1999) 99 ATC 2444 Federal Commissioner of Taxation v. Pitcher [2005] FCA 1154 Federal Commissioner of Taxation v. Rowe (1995) 60 FCR 99; 95 ATC 4691; (1995) 31 ATR 392 Scott v. Federal Commissioner of Taxation (1966) 117 CLR 514 at 526; (1966) 14 ATD 286 at 293; (1966) 10 AITR 367 at 375 Federal Commissioner of Taxation v. Scully 2000 ATC 4111; [2000] HCA 6 Seabright v. Federal Commissioner of Taxation 99 ATC 2011; (1998) 40 ATR 1160 FC of T v. Slaven 84 ATC 4077 Sommer v Commissioner of Taxation [2002] FCA 12(6)05 Tinkler v. Federal Commissioner of Taxation 79 ATC 4641; (1979) 10 ATR 411 Whitaker v. Federal Commissioner of Taxation (1998) 153 ALR 334; 98 ATC 4285 33 Subsection 33(1) of the RWA.