Cash

advertisement

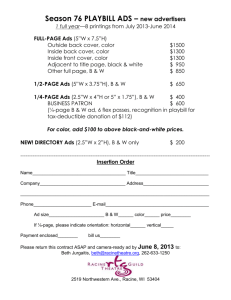

Building Business Acumen® Acumen Learning ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 2 Important Questions How much do you know about Alliance Data System’s (ADS) Key Success Measures? (or Key Performance Indicators (KPIs)) Let’s find out! ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary Pop Quiz For fiscal year 2010: 1 - How much Cash was on hand? 3 ADS $______ 2 - How much Cash was generated by Operating Activities? $______ 3 - What was our Total Revenues? $______ 4 - What was our Net Income? $______ 5 - What was our EBITDA Margin? ______% 6 - What was our Net Margin? ______% 7 – What was our Return on Assets? ______% 8 - How much did Total Revenue change YOY? ______% 9 - How much did EBITDA change YOY? ______% 10 - How much did Net Income change YOY? ______% ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 4 Learning Objectives Understand the 10 key performance measures that are important to ADS and the Executive Team. List and describe the five business drivers all successful businesses must focus on. Teach specific components of ADS financial statements. Better articulate company performance & strategy. Create a personal action plan that can positively impact personal performance and company results. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 5 Acumen Means? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 3 6 ~Wayne Gretzky~ “The Great One” When Gretzky’s Dad was asked by a reporter, “What makes your son so great?” He responded by saying; “Wayne doesn’t skate to where the puck is.” “ He skates to where the puck… is going to be.” (Hockey Acumen!) ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 7 Acumen Means? …the ability to make good business decisions in a timely manner with an understanding of how the decision should impact the business. ©2009 ADS Alliance Data Systems, Inc. 3 Confidential and Proprietary 8 Business can be tough! Only 5-10% of business start-ups survive past 5 years. 16% of CEOs lose their job every year. Booz Allen Hamilton 5th annual Study 70% of merger and acquisition activity do not live up to expectation. Wall Street Journal 2007 Why do businesses fail? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 6 9 Business Acumen: Every business must focus on five business drivers. If they do, they will be successful. If they don’t, they’ll fail. Let’s Start a Business! ©2009 ADS Alliance Data Systems, Inc. 4 Confidential and Proprietary 10 Cash is King! “Cash is a company’s oxygen supply.” -Ram Charan “Cash is more important than your mother." Al Shugart Former Seagate CEO What happens to a company who runs low on cash? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 11 Cash & Cash Flow Sources of Cash • Earn it Pro: No Cost -Con: Time •cash from Operation • Sell Assets Pro: Immediate -Con: Reduces Assets •Cash from Investing • Borrow it Pro: Immediate -Con: Cost (Interest) •Cash from Financing Can a company have too much Cash? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 9 12 Cash Can a company have too much Cash? 1)More attractive in a buy-out. 2)Low return. 3)Shareholders don’t like it. 4)May make poor decisions. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 9 13 How much cash should you have? Companies ought to keep just enough cash to cover their interest, expenses and capital expenditures; plus they should hold a little bit more in case of emergencies. Investopedia ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 14 Definition: Cash DEFINITION What is required to grow and maintain the business. MEASURES Cash Cash – the bills and coins in the register, petty cash, and cash in the bank. Also includes cash equivalents, like CD’s and other highly liquid investments, that easily convert into cash within 90 days. Cash Flow – The cash generation from core business activities calculated from the difference between the cash that flows into and out of the business in a given period of time (month, quarter, annual) ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 8 15 Cash ADS (In Millions) ADS ADS ADS ADS 2010 2009 2008 2007 $2,791 $1,964 $2,025 $1,962 Cash and Equivalents $139 $213 $157 $219 Cash as % of Revenue 4.98% 10.86% 7.75% 11.17% $903 $358 $451 $572 Business Measures and Metrics Total Revenue Cash Cash from Operating Activities ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 9 16 Cash Benchmarks (In Millions) Business Measures and Metrics Total Revenue Cash Cash and Equivalents Cash as % of Revenue Cash from Operating Activities ADS VISA AMEX HarteHanks, Inc. ACXIOM 2010 $2,791 2010 $8,065 2010 $30,242 2010 $861 2010 $1,160 $139 4.98% $903 $3,867 47.95% $2,691 $2,498 8.26% $9,288 $86 9.99% $95 $207 17.85% $166 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 9 17 Epsilon Financial Statements The Annually Reported Financial Statements • Statement of Income (P&L) • Balance Sheet • Statement of Cash Flows 1. What is the basic equation for each statement? 2. What is the purpose of the statement? 3. What are the key numbers and how are they trending? 4. How can you impact each statement? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 18 Equation: Purpose: Cash from operations + Cash from investing + Cash from financing = Net Change in Cash Cash Management ? Net Change in Cash Started Year Ended Year ? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 19 Definition: Profit DEFINITION What is left over after you have subtracted expenses. Can be expressed in dollars ($) or percent (%). Profit MEASURES EBITDA/EBITDA Margin– Reflects earnings before interest and taxes. Net Profit / Net Profit Margin – Profit after all expenses have been subtracted from sales. ©2009 ADS Alliance Data Systems, Inc. 10 Confidential and Proprietary 20 Every business must earn a return that is greater than the cost of using other people’s money. -Ram Charan No Margin, No Mission. -Stephen R. Covey ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 21 Two ways to impact PROFIT Total Revenues (Sales) $100 - Cost of Operations $ 55 - Provisions For Loan loss $ 14 - General & Admin. (G&A) $ 100% 3 =EBITDA $ 28 -Depreciation & Amortization $ = Operating Income $ 23 28% 5 -Interest & Other Expense $ 11 -Taxes $ 4 = Income From Continuing Operations $ 7 -Losses from discontinued operations $ -- = Net Income $ 7 23% 7% 7% ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 22 Driving Profit High and Low Profit Margins S&P Average TTM: 11% Who has much higher profit margins? Coca Cola Microsoft Google Apple 33% 30% 29% 21% Why the high margins? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 23 Driving Profit High and Low Profit Margins S&P Average TTM: 11% Who has lower profit margins? ExxonMobil Wal-Mart Costco 8% 3.8% 1.7% Why the low margins? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 24 Calculating Adjusted EBITDA 2010 EBITDA $ 772,446 +Stock Compensation Expense $ +Loss on Sale of Assets $ -- +Merger and Other Costs $ -- = Adjusted EBITDA $ 822,540 50,094 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 25 Profit ADS (In Millions) Business Measures and Metrics Total Revenue Net Income ADS ADS ADS ADS 2010 2009 2008 2007 $2,791 $1,964 $2,025 $1,962 $206 $164 Epsilon 613,374 514,272 $194 $144 Profit EBITDA Margin 27.67% 27.14% 29.45% 27.94% Net Margin 6.94% 7.32% 10.19% 8.36% ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 11 26 Profit LoyaltyOne (In Millions) Business Measures and LoyaltyOne LoyaltyOne Metrics Q2-2011 6 Month Total Revenue Profit $203 $421 LoyaltyOne LoyaltyOne LoyaltyOne 2010 2009 2008 $800 $715 $756 Epsilon 613,374 514,272 Adjusted EBITDA Margin 26.05% 26.43% 25.58% 28.07% 27.12% Operating Income Margin N/A N/A 21.32% 23.32% 21.51% ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 11 27 Profit Epsilon (In Millions) Business Measures and Epsilon Epsilon Metrics Q2-2011 6 Month Total Revenue Profit $188 $344 Epsilon Epsilon Epsilon 2010 2009 2008 $613 $514 $491 Epsilon 613,374 514,272 Adjusted EBITDA Margin Operating Income Margin 21% 21% 24.83% 24.94% 25.78% N/A N/A 10.61% 9.62% 8.06% ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 11 28 Profit Private Label (Retail) (In Millions) Business Measures and Metrics Total Revenue Profit Retail Retail Q2-2011 6 Month $351 $720 Retail Retail Retail 2010 2009 2008 $1,386 $708 $762 38.23% 44.49% 48.53% 35.13% 39.7% 44.50% Epsilon 613,374 514,272 Adjusted EBITDA Margin 46.68% 48.22% Operating Income N/A N/A Margin ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 11 29 Profit Benchmarks (In Millions) ADS VISA AMEX HarteHanks, Inc. ACXIOM 2010 2010 2010 2010 2010 $2,791 $8,065 $30,242 $861 $1,160 $194 $2,966 $4,057 $54 $(23) EBITDA Margin 27.67% 60.19% 19.72% 13.30% 2.67% Net Margin 6.94% 36.78% 13.42% 6.23% -2.00% Business Measures and Metrics Total Revenue Net Income Profit S&P 500 Averages: Net Margin = 11% ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 11 30 Profit In Action United Parcel Services (UPS) – Avoiding left-hand turns -92,000 trucks worldwide -Saved over 28,541,472 miles -Saved 3 million gallons of fuel -Reduced insurance premiums -Reduced maintenance frequency and costs ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 11 31 Table Discussion (Page 11) How do you individually impact PROFIT? Capture your ideas on page 11 in the participant guide. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 11 Indicates: Equation: Revenues- Expenses= Income P&L 32 Profitability SG&A: (Revenue = Sales) = Top Line • Salaries •Sales commissions •Benefits/Severance • Rental Expense • Bad debt charges • Merger integration costs • Professional services: Attorney fees, Accounting (G&A) EBITDA margin =27.67% = EBIT = Bottom Line Net profit margin = 6.94% EBITDA Margin Total Revenue: 2,791,421 EBITDA: EBIT 629,220 +67,806 +75,420 = 772,446 ÷ 2,791,421 = 27.67% Net Profit Margin Net Income: Total Rev. 2,791,421 193,737 ÷ = 6.94% = Net income / Diluted # of shares S&P 500 Ave. = 11% ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 33 If your team was able to help generate an additional 100K in revenue by selling more, what would be the impact on our net income? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 34 Increase revenue by 100K Statement of Income (P&L) 100K 55K 55K 45K 45K ©2009 ADS Alliance Data Systems, Inc. 17K Confidential and Proprietary 28K 35 If your team was able to help lower production and delivery costs by 100K, what would be the impact on net income? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 36 Lower costs by 100K Statement of Income (P&L) 100K 100K 100K 100K 37K ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 63K 37 Which is better? Raising Revenues $100M = -or- $28 Cutting Costs by $100M $63 = What are the implications of each action? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 38 Street Vendor Case Study x Section 3 Assets Your supplier has suggested that you take delivery less often. What are the advantages and disadvantages? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 12 39 Assets (Read from guide book p. 12) Balancing… Asset Strength & i.e. cash, inventory and ratings Asset Utilization ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 40 Definition: Assets DEFINITION Assets What we have and how well we use what we have. MEASURES Return on Assets (ROA)— percent value of Net Income to Total Assets ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 12 41 Example of Profits and Assets “In 1912, the Model T for the first time cost less than the prevailing average annual wage in the United States.” “Ignoring conventional wisdom, Henry Ford continually sacrificed margins to increase sales. In fact, profits per car did fall as he slashed prices from $220 in 1909 to $99 in 1914.” “But Sales Exploded!” “Ford demonstrated that a strategic, systematic lowering of prices could boost profits, as net income rose from… $3 million in 1909 to $25 million in 1914.” ~Daniel Gross, Forbes Greatest Business Stories ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 13 42 Example: Return On… What we Get: • Income • Earnings • Profit What it Costs: • Debt • Assets • Capital ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 4 43 Assets ADS (In Millions) Business Measures and Metrics Total Revenue Net Income ADS ADS ADS ADS 2010 2009 2008 2007 $2,791 $1,964 $2,025 $1,962 $194 $144 $206 $164 2.34% 2.75% 4.75% 3.94% Assets Return on Assets (ROA) ROA = Net Income = $194 = 2.34% Total Assets $8,272 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 13 44 Assets Benchmarks (In Millions) Business Measures and Metrics Total Revenue Net Income HarteACXIOM Hanks, Inc. ADS VISA AMEX 2010 2010 2010 2010 2010 $2,791 $8,065 $30,242 $861 $1,160 $194 $2,966 $4,057 $54 $(23) 2.34% 8.88% 2.76% 5.78% -1.77% Assets Return on Assets (ROA) ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 13 45 Class Discussion (notes on page 13) Best practices currently employed by companies, including ours, to improve asset strength and utilization: Increase revenues. Lower costs. Getting more done with fewer employees. Reducing inventory levels to increase inventory turnover. Spending only on capital (equipment) upgrades that will provide a return. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 46 Why call it a Balance Sheet? •What balances? •What is the average price of a home? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 46 Indicates: Equation: Assets = Liabilities + Equity 47 Financial (asset) Strength Snapshot in time Most Liquid Becomes Cash < 1 year Least Liquid Current Ratio = 1.6 Due First Due in < 1 year Balance Due Last ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 48 Definition: Growth DEFINITION The ability to increase year over year, quarter over quarter, and/or month over month. “In today’s business world, no growth means lagging behind in a world that grows every day…” Growth “Investors expect it, employees are energized by it, customers are generally attracted to it and executives are measured by it.” MEASURES Revenue Growth EBITDA Growth Net Income Growth ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 14 49 Business in Rapid Decline… • Best & brightest leave first. • Productivity goes down. • Morale goes down. • Costs are cut, which limits ability to grow, company becomes less profitable. Studies Show: It usually takes 4 or 5 years for the company to recover. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 15 50 Business in Rapid Growth… • Attracts/Retains the best & brightest! • Productivity goes up = more profit = more cash = more ability to grow! • Morale is high. • You have the ability to grow in your career! Growth gets more time & attention than any of the 5 elements in a public company. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 15 51 Growth ADS (In Millions) ADS ADS ADS 2010 2009 2008 $2,791 $1,964 $2,025 $194 $144 $206 Revenue Growth 42.10% -3.01% 3.22% EBITDA Growth 44.91% -10.62% 8.78% Net Income Growth 34.79% -30.36% 25.81% Business Measures and Metrics Total Revenue Net Income Growth ©2009 ADS Alliance Data Systems, Inc. 15 Confidential and Proprietary 52 Growth LoyaltyOne (In Millions) Business Measures and LoyaltyOne LoyaltyOne Metrics Q2-2011 6 Month LoyaltyOne LoyaltyOne LoyaltyOne 2010 2009 2008 Total Revenue $203.1 $420.8 $800 $715 $756 Adjusted EBITDA $52.9 $111.2 $205 $201 $205 6% 8% 11.8% -5.4% N/A -10% -1% 1.9% -2% N/A Profit Revenue Growth Adjusted EBITDA Growth ©2009 ADS Alliance Data Systems, Inc. 15 Confidential and Proprietary 53 Growth Epsilon (In Millions) Business Measures and Epsilon Epsilon Metrics Q2-2011 6 Month Epsilon Epsilon Epsilon 2010 2009 2008 Total Revenue $188 $344.2 $613 $514 $491 Adjusted EBITDA $39.3 $73 $152 $128 $127 38% 31% 19.26% 4.68% N/A 26% 25% 18.8% 1.3% N/A Profit Revenue Growth Adjusted EBITDA Growth ©2009 ADS Alliance Data Systems, Inc. 15 Confidential and Proprietary 54 Growth Private Label (Retail) (In Millions) Business Measures and Metrics Retail Retail Q2-2011 6 Month Retail Retail Retail 2010 2009 2008 Total Revenue $350 $720 $1,386 $708 $762 Adjusted EBITDA $164 $347 $152 $128 $127 2% 5% 96% -7% N/A 23% 27% 68% 1.3% N/A Profit Revenue Growth Adjusted EBITDA Growth ©2009 ADS Alliance Data Systems, Inc. 15 Confidential and Proprietary 55 Growth Benchmarks (In Millions) HarteACXIOM Hanks, Inc. ADS VISA AMEX 2010 2010 2010 2010 2010 $2,791 $8,065 $30,242 $861 $1,160 $194 $2,966 $4,057 $54 $(23) EBITDA Growth 42.10% 44.91% 16.70% 28.96% 13.14% 109.93% 0.05% 1.84% 5.53% -68.71% Net Income Growth 34.79% 26.05% 90.47% 12.32% -151.96% Business Measures and Metrics Total Revenue Net Income Growth Revenue Growth ©2009 ADS Alliance Data Systems, Inc. 15 Confidential and Proprietary 56 Page 56 Q2 Earnings Release ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 57 Page 57 Q2 Earnings Release ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 58 How can you personally impact Growth? • At your table, discuss how you individually impact Growth. • Capture your ideas on page 15 in the participant guide. • Be prepared to share one of your ideas with the class. ©2009 ADS Alliance Data Systems, Inc. 15 Confidential and Proprietary 59 Definition: People People DEFINITION -The External Customer, Vendor/Re-seller, or Internal Customer that has the ability to impact the success of the business... ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 16 60 People What is more important than meeting customer expectations? Exceeding? Anticipating Customer Needs & Expectations! “If I would have asked my customer what they wanted, they would have said a faster horse!” ~Henry Ford ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 17 61 Failing to Anticipate customer needs/expectation! What companies have failed to anticipate customer expectations? What were the results? • GM/Ford • Kodak – Unprepared for recession and required government bailout money. Ford secured line of credit prior and retained full ownership. – decided to move to digital product line. Polaroid did not and is no longer a serious competitor. • IBM – In 1943, the CEO said the customer need for their product was approximately 5 computers for the entire world. • Sony – Did not move to a digital music player and lost a significant market share to innovative companies like Apple. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 17 62 Goals for 2011 • Capitalize on our Leadership in Targeted and Data-Driven Consumer Marketing • Sell More Fully Integrated End-to-End Marketing Solutions. • Continue to Expand our Global Footprint • Optimize our Business Portfolio 2010 Year End Press Release Page 62 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 63 What are your best practices in anticipating CUSTOMERS needs? (Capture ideas on page 17) • Know your business and how you impact results! • Develop formal processes for listening to customers, both internal and external. • A quarterly meeting with your boss…ask, how am I doing? • What could I do to improve? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 64 Individual Activity (Page 17) Write down a specific action you will take to anticipate the needs of (get close to) your CUSTOMER. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 65 Business Drivers (Page 18) Cash -On hand -Generation Growth People Profit -Top Line -Bottom Line -Customers -Employees -Revenue -Expenses Assets -Strength -Utilization ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 66 How will I remember these? Cash Growth People Profit Assets ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 67 Finding our performance around the 5 Business Drivers Cash -On hand -Generation Growth People Profit -Top Line -Bottom Line -Customers -Employees -Revenue -Expenses Assets -Strength -Utilization ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 68 139 629 + 143 = 772 2,791 27.67 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 69 1 2 629 + 143 = 772 194 194 2,791 629 + 143 = 772 194 139 903 3 2,791 4 194 2,791 5 27.67 2,791 6 6.94 8,272 1,964 408 + 125 = 533 144 7 2.34 8 42.10 9 44.91 10 34.79 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 70 Epsilon Corporation’ Key Success Measures 1½ SCORING: Right answer = 1 point Somewhat close = ½ point (within: 10%) Missed it by a ways = 0 point 0 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 35 71 5 Business Driver Review (Pages 8-17) Cash -On hand -Generation Growth -Top Line -Bottom Line People -Customers -Employees Profit -Revenue -Expenses Assets -Strength -Utilization ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 72 Review and Teaching (page 30) 1) Assign one of the business drivers to each person at your table. 2) Take a few minutes to answer the questions below: How would you describe this business driver? Why is it important to our organization? How is it measured? How can I impact this business driver in my role? 3) Review with your group the answers you found. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 73 Demystifying the Annual Report (page 21) What is the Purpose of the Annual Report? General Communication Marketing Compliance ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 74 Getting to Know Your Company Which of the 5 “drivers” does your CEO & Chairman emphasize? Why? As table groups, What are Mr. Heffernan’s top 2 focus areas. What other key initiatives are also being talked about? Was this a good year or bad year? How can you tell? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 75 Finding our performance around the 5 Business Drivers Cash -On hand -Generation Growth -Top Line -Bottom Line People -Customers -Employees Profit -Revenue -Expenses Assets -Strength -Utilization ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 76 Company Reports LoyaltyOne Epsilon Retail Know Thyself. -Plato - ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 77 Finding Competitors Performance Around: Cash -On hand -Generation Growth -Top Line -Bottom Line People -Customers -Employees Profit -Revenue Expenses Assets -Strength Utilization ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 78 Getting to Know ADS Use these sources: 1) President Letter from Insight Magazine 2) Website 3) Team Members 4) Others in the Class To answer these questions on: What is the basic business model? How would you describe it to an outsider? Key Objectives for 2011 Opportunities & Threats What synergies do you see with the other two business lines? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 79 External Factors (page 40) How does the situation affect: People Cash Growth Profit Assets Heads Up! ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 80 Which External Factor has the biggest impact on Alliance Data Systems? (pg. 27) 0% ar ke k St oc A ca l og i M dv ... .. t 0% Te ch no l ic om on 0% of . ng es os C Ec 0% st at tc ha ul a tio n 0% us 0% n 6. eg 5. R 4. tit io 3. om pe 2. Competition Regulation Cost changes Economic status of customers Technological Advances Stock Market C 1. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 81 Google And Reuters ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 82 Competitor Reports Visa American Express Harte-Hanks ACXIOM Keep your friends close, and your enemies closer. --Lao Tzu ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 83 Finding Competitors Performance Around: Cash -On hand -Generation Growth -Top Line -Bottom Line People -Customers -Employees Profit -Revenue Expenses Assets -Strength Utilization ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 84 Getting to Know a Company (pages 36) Use these sources: 1) CEO letter 2) Financial analysis (fill out the NTF) 3) Recent quarterly earnings release 4) One year stock performance To answer these questions on page 36: Was this a good year or bad year? How can you tell? Which of the 5 business drivers are most important to them? Why? What does this company do that you were not aware of? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 85 Banks, Insur. Co’s Over leveraged. Did not understand FNMA & sub-prime FHLMC Over risk. U.S. Government Pushing more loans. Little oversight. Federal Reserve Aggressive rate cuts after 9/11 to spur Home spending.Builders What does Credit thisCrisis mean for FCX? leveraged with implied government Rating backing. Agencies Did not rate sub-prime loan risk Who is involved? Mortgage Companies Aggressive Sub-prime lending. increase supply of homes to Home meet Buyers demand. Buying more home than they can afford. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 86 The Role of the Stock Market 1) What role does the stock market play? 2) Who cares about your stock price and why? a. Investors b. Analysts ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 87 Analyst Recommendations September 19, 2011 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 88 The Role of the Stock Market 1) What role does the stock market play? 2) Who cares about your stock price and why? a. Investors b. Analysts c. Your CEO d. Employees 3) What are the benefits of a higher stock price? ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 89 6 Benefits of a Higher Stock Price: (Page 41) 1) Treasury stock is worth more. 2) Secondary offering brings more cash. 3) Better credit ratings = more access to cash at a cheaper rate. 4) More acquisition power. 5) Can attract talented people. 6) More expensive in a buy-out. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 90 Market Cap = shares outstanding X stock price Element Market Cap. ADS Visa AMEX 4.5 Billion 69 Billion 52 Billion HarteHank ACXIOM .5 Billion .85 Billion ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 91 The P/E Ratio-ADS (Page 42, 43) Price (of one share of stock) Earnings Per Share (for last 12 months) Price EPS $ 89.02 $ 4.55 = 19.5 P/E ratio ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 92 P/E Ratios Element P/E Ratio ADS Visa AMEX HarteHanks Acxiom 20 20 11 12 - “The P/E ratio tells you what people who have a dispassionate view of your company think of its future ability to make money. It reveals how much of their money they are willing to bet on your success in the quarters and years to come.” Ram Charan ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 93 ADS Stock Chart ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 94 ADS and S&P 500 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 95 ADS and Benchmark Companies ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 96 CEO Urgency Continuum (Page 49) URGENT CASH NEAR TERM PROFIT ASSETS LONG TERM GROWTH PEOPLE ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 97 Content Retention Retaining Content over Time Review Apply Teach 15% Time ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 52 98 Changing Behavior *Based on a 1993 Brigham Young University Study When a Person Says … Chances of the idea being incorporated into their life is... “That’s a good idea”… 10% “I’ll do it!” and commits... 25% Says when they’ll do it… 40% Plans how to do it… 50% Commits to another… 60% Sets a future specific appointment with the person they committed to... Good Management Technique! 95% ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 99 Accountability Conversations Find a Partner now and: 1. Set up a specific date and time in 30 days to report your progress on your action plan. 2. Exchange emails 3. Exchange phone numbers 4. Decide who will initiate the call 5. Determine a back-up plan 6. Transfer this information to your planner or PDA now. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 53 100 Post Course Action Items: 1. 7 days: Teach one of the principals learned in class today, to someone in your department. 2. 7 days: Discuss your action items with your manager in the next 7 days. 3. 30 days: Read the first 90 pages of: “What The CEO Wants You to Know“ 4. 30 days: Get with your class partner and give an account of your progress on your action item(s). Start now: Build and practice your new business acumen skills. When making decisions, determine how the outcome will impact Cash, Profit, Assets, Growth, People… ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 101 Learning Objectives Understand the 10 key performance measures that are important to ADS and the Executive Team. List and describe the five business drivers all successful businesses must focus on. Teach specific components of ADS financial statements. Better articulate company performance & strategy. Create a personal action plan that can positively impact personal performance and company results. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 102 Where to Find Information (page 55) * nasdaq.com * finance.google.com * reuters.com * hoovers.com * yahoo.com * smartmoney.com Glossary: page 58 ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 103 One final thought… People will work hard for a paycheck, harder for a person, and hardest for a reason. ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary 104 Thank You! Please complete the evaluation form Participant Feedback Form ~Please place at the front of your tables~ Feedback Evaluations Voting Cards Calculators ©2009 ADS Alliance Data Systems, Inc. Confidential and Proprietary