File - Economy Unit Portfolio

advertisement

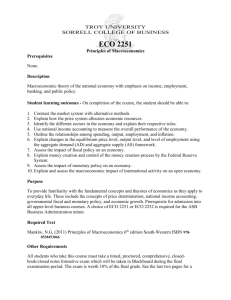

Unit 1: Economic Fundamentals Portfolio Michael Duthie AP Macro 7th period Economics Definition The social science that studies the choices that individuals, businesses, governments, and entire societies make as they cope with scarcity, the incentives that influence those choices, and the arrangements that coordinate them. Example The allocation of budget and time, goods and services that businesses produce and governments provide, and how goods and services will be proved and where production will be located. Scarcity Definition The condition that arises because wants exceed the ability of resources to satisfy them. Example Someone wants to buy a boat, and they also want to buy a television. The have enough money to buy either the boat or the television but not both. This person is facing scarcity. Opportunity Cost Definition The opportunity cost of something is the best thing you must give up to get it Example You have the choice of going to the mall, playing a video game, or doing your homework. If you choose to play a video game, then you cannot go to the mall or do your homework. The opportunity cost of playing a video game is the best alternative you forgo. If the best alternative is doing your homework, then the opportunity cost of playing a video game is doing your homework. Marginal Analysis Definition An examination of the additional benefits of an activity compared to the additional costs of that activity. Example If you exercise five times a week and are thinking of adding a sixth day, you would use marginal analysis to determine whether the benefits of the sixth day would be worth the cost of the sixth day. Micro vs Macroeconomics Definition Microeconomics is the study of the choices of individuals and businesses make and the way these choices interact and are influenced by governments. Macroeconomics is the study of the total effects on the national economy and the global economy of the choices that individuals, businesses, and governments make. Example Micro-the study of demand and supply, price ceilings, minimum wage, and opportunity cost. Macro- the study of the U.S. unemployment rate, international trade, and inflation. Normative vs. Positive Definition Normative statements are disagreements that can’t be settled with facts. They are based on values. Positive statements are disagreements that can be settled with facts. They are statements about what is. Example Normative- “We should decrease our use of coal.” That can’t be settled with facts. Positive- “Our planet is warming because of the quantity of coal we’re burning.” This can be tested with facts. Goods and Services Definition The objects (goods) and the actions (services) that people value and produce to satisfy human wants. Example Goods- popcorn, cars, clothes Services- a movie showing, a plane flight, etc. Factors of Production Definition The productive resources that are used to produce goods and services—land, labor, capital, and entrepreneurship. Example To make soda, Coca-Cola uses labor and capital. Costs of Production Definition A cost incurred by a business when manufacturing a good or producing a service. Example If costs are too high, these can be decreased or possibly eliminated. Production costs can be used to compare the expenses of different activities within a company. Comparative Advantages Definition The ability of a person to perform an activity or produce a good or service at a lower opportunity cost than anyone else. Example An American worker can make 2 game machines or 1 laptop. A German worker can produce 1 game machine and 2 laptops in the same amount of time. The American worker has a comparative advantage in making game machines and the German worker has a comparative advantage in making laptops. Absolute Advantage Definition When one person (or nation) is more productive than another—needs fewer inputs or takes less time to produce a good or perform a production task. Example Japan make 10 computers and 5 cars in an hour while American makes 8 computers and 3 cars in an hour. Japan has the absolute advantage. Substitute Definition A good that can be consumed in place of another good. Example If the price of cookies rises, Julie will switch to brownies. For Julie, cookies and brownies are substitutes. Complement Definition A good that is consumed with another good. Example Beth likes to eat potato chips with soda(can you blame her?). For beth, potato chips and soda are complements. Normal Good Definition A good for which the demand increases when income increases and demand decreases when income decreases. Example When Calahan was a student, was a student, he had one watch. But now that he has graduated and earns $40,000 a year, he has 5 watches. When his income increased, he bought more watches. Watches are a normal good for him. Inferior Good Definition A good for which demand decreases when income increases and demand increases when income decreases. Example Aiden ate hamburger meat for dinner everyday when he was a student. But when he graduated and started making more money, he started eating steak more than hamburgers. As Aiden’s income increased, his demand for hamburger meat decreased. Hamburger meat is an inferior good. Surplus Definition The amount by which the quantity supplied exceeds the quantity demanded. Example More chocolate is made than is demanded by consumers. Suppliers must cut the price of chocolate to sell the excess amount of chocolate. Shortage Definition The amount by which the quantity demanded exceeds the quantity supplied. Example Not enough chocolate is made for the demand of consumers. Suppliers raise the price in order to make less people buy it so they don’t run out. Price Floor Definition A government regulation that places a lower limit on the price at which a particular good, service, or factor of production may be traded. Example Suppose the government requires that milk producers receive a minimum of $4.00 a gallon for milk. Such a regulation is a price floor. Price Ceiling Definition A government regulation that places an upperlimit on the price at which a particular good, service, or factor of production may be traded Example Suppose the government passes legislation governing the maximum price that natural gas distributors can charge households. Such a regulation is a price ceiling. Marginal Benefit=Marginal Cost Explanation When the marginal benefit from something equals the marginal cost, the choice is rational and it is not possible to make a better choice. Scarce resources are being used in the best possible way. Example The marginal benefit and cost of playing video games rather than studying is the same, therefore you can play video games without it being a detriment to your grades. Law of Increasing Opportunity Cost Explanation As you increase production of one good, the opportunity cost to produced the additional good will increase. Example Each hat you make and sell brings in $30 in profit, and each belt brings in $20. To make more money, you shift more workers from belt production to hats. Some workers can make a hat just as quickly as a belt, so the opportunity cost it low: You give up $20 to make $30. But others are belt specialists. It might take them as much time to make one hat as it does to make four belts. With them, the opportunity cost is high: To make $30, you're giving up $80. Meanwhile, your stepped-up hat production has glutted the hat market, forcing you to cut prices and reduce profit to $25 a hat. The opportunity cost rises further because of the price decrease. Law of Demand Explanation Other things remaining the same, if the price of a good rises, the quantity demanded of that good decreases; and if the price of a good falls, the quantity demanded of that good increases. Example If the price of a computer falls, other things remaining the same, the quantity of computers demanded increases. If the price of dental services rises, other things remaining the same, the quantity of dental services demanded decreases. Nonprice Determinates of Demand Explanation Income, tastes and preferences, the price of related goods, changes in expectations od future relative prices, and market size/population. These factors shift the demand curve. Example A decrease in the market size/population of a good would cause a decrease in demand. The demand curve shifts to the left. Law of Supply Explanation Other things remaining the same, if the price of a good rises, the quantity supplied of that good increases; and if the price of a good falls, the quantity supplied of that good decreases. Example If the price of a movie ticket rises, other things remaining the same, the quantity of movie tickets supplied increases. If the price of banking services falls, other things remaining the same, the quantity of banking services supplied decreases. Nonprice Determinates of Supply Explanation Input costs, technology, taxes and subsidies, expectations of future relative prices, and the number of firms in the industry. These shift the supply curve Example New technology is made to make production faster. This increases supply and shifts the supply curve to the right. Market Equilibrium(formula) Explanation When the quantity demanded equals the quantity supplied—buyers' and sellers' plans are in balance. Example When people plan to buy 1,000 haircuts a week at a price of $60 each and the stylists plan to sell 1,000 haircuts a week at a price of $60 each, then buying and selling plans are balanced and the market for haircuts is in equilibrium. Production Possibilities Frontier Circulatory Flow Market Equilibrium(model) Unit 2: Macroeconomic Indicators Portfolio Michael Duthie AP Macro 7th period GDP Definition The market value of all the final goods and services produced within a country in a given time period. Example In the United States in 2013, the market value of all the final goods and services produced was $16,800 billion. U.S. GDP in 2010 was $16,800 billion. Unemployment Definition Being unemployed means that you are at or above the working age(16 years old), not institutionalized, and actively looking for a job. Example A new college graduate searching for a new job is a good example of unemployment. Frictional Unemployment Definition The unemployment that arises from normal labor turnover—from people entering and leaving the labor force and from the ongoing creation and destruction of jobs. Example A new college graduate looking for work, someone shifting jobs based on the seasons, someone quitting a job and looking for a new one. Structural Unemployment Definition The unemployment that arises when changes in technology or international competition change the skills needed to perform jobs or change the locations of jobs. Example An assembly line worker being replaced by a machine. Cyclical Unemployment Definition The fluctuating unemployment over the business cycle that increases during a recession and decreases during an expansion. Example A factory worker loses his job during a recession. Once the economy starts moving towards an expansion, he will likely be rehired. His period of unemployment is cyclical unemployment. Full Employment Definition When there is no cyclical unemployment or, equivalently, when all the unemployment is frictional, structural or seasonal. Example A good example would be when we are in an expansionary and there is a peak when there’s no cyclical unemployment. Inflation v. Deflation Definition Inflation is a situation in which the price level is rising and the inflation rate is positive. Deflation is a situation in which the price level is falling and the inflation rate is negative. Example A combination of recession and inflation occurred in the United States and the global economy in the mid-1970s and early 1980s. GDP= C + I + G + NX Explanation C stands for Consumption expenditure, I stands for Investment, G stands for Government expenditure on goods and services, and NX stands for Net eXports(the difference of imports and exports) of goods and services. Added together, they make total expenditure, or GDP Example All consumer expenditure, investment expenditure, government expenditure, and net exports added together. Real GDP Explanation Real GDP is nominal GDP divided by the price index. Real GDP is just nominal GDP adjusted for inflation. Example 11.24(nominal)/107(price index)=10.50(real) Economic Growth Rate Explanation (Real GDP in current year-Real GDP in previous year)/(Real GDP in previous year) X 100 Example (8.4 trill-8.0 trill)/(8.0 trill)X100=5 percent growth rate Unemployment Rate Explanation The percentage of the people in the labor force who are unemployed (Number of people unemployed/labor force)X100 Example (11.8 million/155.7 million)x100= 7.6 percent Output Gap Explanation real GDP minus potential GDP expressed as a percentage of potential GDP. Example Consumer Price Index Explanation (CPI is the cost of CPI basket at current period prices/cost of CPI basket at base prices) x100 Example (70/50)X100=140 Real Inflation Explanation The percentage change in the price level from one year to the next (CPI in current year-CPI in previous year)/(CPI in previous year)x100 Example (140-120)/(120)X100=16.7 percent Business Cycle Unit 3:AS-AD MODEL with FISCAL POLICY Portfolio Michael Duthie 7th Period AP Macroeconomics Aggregate Supply Definition The relationship between the quantity of real GDP supplied and the price level when all other influences on production plans remain the same Example Aggregate supply in the United States tells us the quantities of U.S.-produced goods and services that firms in the United States are willing to supply at various prices. Aggregate Demand Definition The relationship between the quantity of real GDP demanded and the price level when all other influences on expenditure plans remain the same. Example Aggregate demand in the United States tells us the quantities of U.S.-produced goods and services that everyone (people, businesses, and governments) in the world is willing to buy at various prices. Fiscal Policy Definition Changing taxes, transfer payments, and government expenditure on goods and services. The use of the federal budget to achieve the macroeconomic objectives of high and sustained economic growth and full employment. Example When the economy is in a recession, the federal government can implement fiscal policy that increases government expenditure or decrease taxes, which increases aggregate demand and returns the economy to full employment. Monetary Policy Definition Changing the quantity of money and the interest rate. Example The Federal Reserve conducts the nation's monetary policy to achieve the following goals: keep inflation in check, maintain full employment, moderate the business cycle, and contribute toward achieving economic growth. Macroeconomic Equilibrium Definition When the quantity of real GDP demanded equals the quantity of real GDP supplied at the point of intersection of the AD curve and the AS curve. Example On most days, the library has just enough desks for the students who plan to study. The desks in the library are fully employed. The quantity of desks supplied equal the quantity of desks demanded and a macroeconomic equilibrium exists. Full Employment Equilibrium Definition When equilibrium real GDP equals potential GDP. Example On most days, the campus food court has just enough chairs for the students who plan to eat lunch in the food court. The chairs in the food court are fully employed and the food court is at a full-employment equilibrium. Inflationary Gap Definition A gap that exists when real GDP exceeds potential GDP and that brings a rising price level. Example The quantity of hotel rooms that people around the world plan to book for the Olympic Games in London, England exceeds the quantity of rooms that London hotel owners plan to have available. This gap between the “quantity people plan to book” and the “quantity hotel owners plan to have available” will put pressure on the price of a hotel room in London to rise. If, in an economy, such pressure exists for prices in general (the price level) to rise, then the gap is called an “inflationary gap”. Recessionary Gap Definition A gap that exists when potential GDP exceeds real GDP and that brings a falling price level. Example The economy faces a recessionary gap when most businesses are unable to sell the quantity of goods and services that they have produced. Stagflation Definition A combination of recession (falling real GDP) and inflation (rising price level). Example A combination of recession and inflation occurred in the United States and the global economy in the mid-1970s and early 1980s. Cost-Push Inflation Definition An inflation that begins with an increase in costs. Example The two main sources of cost increases are increases in the money wage rate and increases in the money prices of raw materials such as oil. If OPEC raises the price of oil when the economy is at full employment, the price level rises. If Oil producers respond to the prices of everything they buy rising, they will raise the price of oil again to restore its new higher relative price. Demand-Pull Inflation Definition An inflation that starts because aggregate demand increases. Example A ketchup factory is located in Pennsylvania. When aggregate demand increases, the demand for ketchup increases and the price of ketchup rises. Faced with a higher price, the ketchup plant works overtime and increases production. The ketchup factory finds it hard to hang onto its best people, so it offers higher wages and as wages increase, so do the ketchup factory's costs. If aggregate demand continues to increase, so does the demand for ketchup, and the price of ketchup rises at the same rate as wages. The ketchup factory continues to operate above full employment, and there is a persistent shortage of labor. Prices and wages chase each other upward in an unending spiral. Expansionary Fiscal Policy Definition A form of fiscal policy in which an increase in government purchases, a decrease in taxes, and/or an increase in transfer payments are used to correct the problems of a business-cycle contraction. Example increasing aggregate expenditures and aggregate demand through an increase in government spending (both government purchases and transfer payments) or a decrease in taxes. Expansionary fiscal policy leads to a larger government budget deficit or a smaller budget surplus. Contractionary Fiscal Policy Definition A form of fiscal policy in which a decrease in government purchases, an increase in taxes, and/or a decrease in transfer payments are used to correct the inflationary problems of a business-cycle expansion. Example decreasing aggregate expenditures and aggregate demand through a decrease in government spending (both government purchases and transfer payments) or an increase in taxes. Contractionary fiscal policy leads to a smaller government budget deficit or a larger budget surplus. Discretionary Fiscal Policy Definition A fiscal policy action that is initiated by an act of Congress. Example A discretionary fiscal policy would be a decision by Congress to create jobs by spending money on improving bridges and highways. Automatic Stabilizers Definition Features of fiscal policy that stabilize real GDP without explicit action by the government. Example Cruise ships and airplanes are fitted with devices that keep them from rolling around in windy conditions. These devices are called automatic stabilizers and they work against the wind to make the passengers' ride much smoother than it would otherwise be. Induced Taxes Definition Taxes that vary with real GDP. Example When you graduate and take a job, the income tax that you will pay depends on the amount of income that you earn. Such a tax is an induced tax. Needs-Tested Spending Definition The government creates programs that entitle suitably qualified people and businesses to receive benefits. Example Food stamps MPC+MPS=1 Explanation MPC (Marginal Propensity to Consume) means extra consumption from an extra dollar of income. And, MPS (Marginal Propensity to Save) means extra saving from an extra dollar of income. That means, if you earn an extra dollar, how much would you spend out of it - this may be a certain % of that dollar. Example you usually earn $1,000 per month, spend $800 every month and save the rest $200 every month. This month, you earn extra $100 from tutoring a class. The question is how much would you spend out of this extra $100. Lets say, you spend $70 on watching movies and dining out, and save the rest $30. Then, your MPC would be = 70/100 = 0.7 your MPS would be = (100-70)/100 = 30/100 = 0.3. Now, if you add up 0.7 with 0.3 ,(0.7+0.3), you get 1. Spending Multiplier Explanation Spending multiplier (also known as fiscal multiplier or simply the multiplier) represents the multiple by which GDP increases or decreases in response to an increase and decrease in government expenditures and investment. Example Average per capita income in Anvilania rose from $42,300 dollars to $50,000 while corresponding figures for per capita consumption rose from $35,400 to $42,500. (42,500-355,400)/(50,000-42,300)=92.2% Tax Multiplier Explanation A measure of the change in aggregate production caused by changes in government taxes. Example M[tax]=-MPCx1/MPS=-MPC/MPS AS-AD at Full Employment Recessionary Gap with Fiscal Inflationary Gap with Fiscal Unit 4: Monetary Policy Portfolio Michael Duthie 7th period AP Macroeconomics Money Definition Any commodity or token that is generally accepted as a means of payment. Example Before the collapse of communism in Romania, people used Kent cigarettes to buy their goods and services. Kent cigarettes were a means of payment. Because Kent cigarettes were generally acceptable and widely used, they were money. Medium of Exchange Definition An object that is generally accepted in return for goods and services. Example When Annie buys her textbooks at the college bookstore she pays for them using dollar bills. The bookstore accepts the dollar bills and in return gives Annie her textbooks. The dollar bills are a medium of exchange. Unit of Account Definition An agreed upon measure for stating the prices of goods and services Example A rock concert costs a certain amount in comparison to other things. Like Rock concert is 16 dollars and gum is 2 dollars. The rock concert is worth 8 pieces of gum. It’s basically money. Store of Value Definition Any commodity or token that can be held and exchanged later for goods and services. Example Money is a store of value. Store of values are not stable. They change in value over time. Fiat Money Definition Objects that are money because the law decrees or orders them to be money. Example When Sam purchases a pack of gum for 50¢ he pays for it using 2 quarters. The quarters are money because the law decrees that they are money. And because the quarters are money they can be used as a means of payment M1 Definition Currency held by individuals and firms, traveler’s checks, and checkable deposits owned by individuals and businesses. Example People and businesses hold $6 million in currency, $1 million in traveler's checks, and $600 million in checkable deposits. Banks have $100 million in their vaults. M1 is equal to $607 million. The currency in the bank vaults is not counted in M1. M2 Definition M1 plus savings deposits and small time deposits, money market funds, and other deposits. Example People and businesses hold $6 million in currency, $1 million in traveler's checks, $600 million in checkable deposits, $700 million in savings deposits, $100 million in small time deposits, money market funds and other deposits. M2 is equal to $1,407 million. Reserves Definition The currency in the bank's vault splus the balance on its reserve account at a Federal Reserve Bank. Example So that banks have sufficient funds on hand to meet the demands of their customers, banks hold reserves. Normally banks will hold a constant fraction of deposits as reserves. Require Reserve Ratio Definition The minimum percentage of deposits that the Fed requires banks and other financial institutions to hold in reserves. Example The central bank sets the fraction of deposits that a bank must hold as reserves. If these minimum reserves are 10 percent of deposits, then the required reserve ratio is 0.1. Federal Funds Rate Definition The interest rate at which banks can borrow and lend reserves (interbank loans) in the federal funds market. Explanation Suppose Citibank has excess reserves and First Bank has a shortage of reserves. If the federal funds rate is 4 percent a year, then Citibank can loan its excess reserves to First Bank in the federal funds market at an interest rate of 4 percent a year. Federal Reserve Definition The central bank of the United States. The Chairman of the Board of Governors, the Board of Governors, the regional Federal Reserve Banks, the Federal Open Market Committee. Example The twelve Federal Reserve districts that make up the Federal Reserve System each have a Federal Reserve Bank. The twelve Federal Reserve Banks are: Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco. Central Bank Definition The entity responsible for overseeing the monetary system for a nation (or group of nations). Example The central banking system in the U.S. is known as the Federal Reserve System (commonly known as "the Fed"), which is composed of 12 regional Federal Reserve Banks located in major cities throughout the country. FOMC Definition Fed’s main policy-making committee. Meet every six weeks to review the state of the economy and to decide the actions to be carried out by the New York Fed. Example Consists of 12 members. The Chairman and the other six members of the Board of Governors, the president of the Federal reserve Bank of New York, and four presidents of the other regional Federal Reserve Banks. Discount Rate Definition Interest rate at which the Fed stands ready to lend reserves to commercial Example A change in the discount rate begins with a proposal to the FOMC by at least one of the 12 Federal Reserve Banks. If the FOMC agrees that a change to the Board of Governors for its approval. Open Market Operation Definition The purchase or sale of government securities—U.S. Treasury bills and bonds—by the New York Fed in the open market. Example When the Federal Reserve wants to increase the quantity of money in the United States, it can purchase government securities in the open market. When the Federal Reserve wants to decrease the quantity of money in the United States, it can sell government securities in the open market. Hyperinflation Definition Inflation at a rate that exceeds 50 percent a month (which translates to 12,875 percent a year). Example In 1994, the African nation of Zaire had a hyperinflation that peaked at a monthly inflation rate of 76 percent. In 1994, Brazil almost reached a hyperinflation with a monthly inflation rate of 40 percent. Money Multiplier Explanation 1/RR. The number by which a change in the monetary base is multiplied to find the resulting change in the quantity of money. Example If when the central bank changes the monetary base by $1 million, the quantity of money in the economy increases by $5 million, the money multiplier is 5 ($5 million divided by $1 million). Value of Money(present) Explanation PV=FV/(1+i)^n The present value formula is the core formula for the time value of money; each of the other formulae is derived from this formula. Example Equation of Exchange Explanation MxV=PxY M=money supply, usually M1, V=velocity of money, P=price level, y=RGDP/real output. Example This equation demonstrated a direct relationship between price and money supply. If V and Y are constant, a certain percentage change in money supply will cause a same amount of change in the price level. Money Market i=interest rate, MS=money supply, MD=money demand, Q$=quantity of money Bank Balance Sheet AS-AD(with expansionary) AS-AD(with contractionary)