print friendly version

advertisement

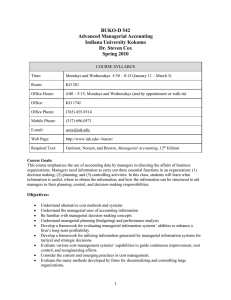

BUS-A 202 Introduction to Managerial Accounting Indiana University Kokomo Dr. Steven Cox Fall 2009 COURSE SYLLABUS Time: Monday and Wednesday 1:00 - 2:15 Room: KO 102 Office Hours: 10:45 - 11:25, Mondays and Wednesdays 4:00 - 5:25, Mondays (and by appointment or walk-in) Office: KO 174J Office Phone: (765) 455-9314 Home Phone: (317) 696-0571 E-mail: scox@iuk.edu Web Page: http://www.iuk.edu/~bussrc/ Required Text: Garrison and Noreen, Managerial Accounting, Twelfth Edition Prerequisite: Passing grade in A201, Introduction to Financial Accounting* * Students without the required prerequisite may be administratively withdrawn at any point in the semester. Goals: This course emphasizes the use of accounting data by managers in directing the affairs of business organizations. Managers need information to carry out three essential functions in an organization: (1) decision making; (2) planning; and (3) controlling activities. In this class students will learn what information is useful, where to obtain the information, and how the information can be structured to aid managers in their planning, control, and decision-making responsibilities. I have two additional personal goals relating to this course. First, I want to make managerial accounting interesting and perhaps even fun. Second, I want to award grades fairly. Students that come to class, do the reading, and practice the problems, will do well in my class. Objectives: At the completion of this class, the student should be able to: Prepare a statement of cash flows. In addition, students must understand the need for this statement as well as the nature of the information provided. 1 Calculate financial ratios. Students will be required to show an elementary level of ability in interpreting the ratios so they are better prepared for F301. Construct a statement of cost of goods manufactured and a Statement of Cost of Goods Sold. Understand cost classifications including: fixed versus variable, period versus product, direct versus indirect, and prime versus conversion. Understand the need for overhead cost allocation. Students will be required to show competence in job-order costing and process costing. Demonstrate an understanding of cost behavior including cost-volume-profit relationships. Students will be required to demonstrate the ability to solve break-even problems. Demonstrate competence in using standard costs to calculate variances. Students will be required to know how to calculate and interpret labor, materials, and overhead variances. The School of Business Web Page with Mission Statement: http://www.iuk.edu/~kobus/Mission.shtml Grading: Exam 1 100 pts Exam 2 100 pts Final Exam 100 pts Quizzes 100 pts Total Points 400 pts Grading Scale: 96% - 100% 86% - 89% 76% - 79% 66% - 69% Below 59% A+ B+ C+ D+ F 90% - 96% 80% - 86% 70% - 76% 60% - 66% A B C D 89% - 90% 79% - 80% 69% - 70% 59% - 60% ABCD- Exams: Unexcused absences will result in zeros on exams. Exams will be a combination of multiple choice, problems, and short essays. The first exam will be in class on September 28th. The second exam will be in class on November 2nd. The final exam will be in class on December 14th. 2 Quizzes: Short 10-point quizzes will be given in class on Wednesdays. The quiz question(s) will come from recently assigned problems. The quizzes encourage attendance and keeping up with the pace of the class. The material is somewhat complex and it is easy to fall behind. Obviously, you must attend class to take the quiz. In addition, the quiz material will be covered during class. You will receive your highest ten scores out of twelve quizzes. There are no make-ups on quizzes! Computer Usage: Grades and answers to the assigned problems are available on Oncourse. IUK also offers a variety of computer resources for course assignments and projects (e.g., word processing, spreadsheets, presentation software, database management, and statistical analysis packages). Library Usage: The IUK library system offers a large number and variety of resources for the student to use in this course. Examples include current newspapers (Wall Street Journal), magazines (Business Week), databases (ABI Inform), and access to the Internet. Disability Issues: Indiana University Kokomo provides equal access and support services to students with special needs. Students with documented disabilities should contact the Career Services Office (4559301) and discuss any necessary support services or accommodation with the instructor. 3 Course Schedule Chap Topic Problems Date(s) 1 Managerial Accounting none Aug. 24 9 Profit Planning 1, 2, 6, 9 Aug. 26 15 Statement of Cash Flows 4, 10, 14, 16 Aug. 31 Sep. 2, 9 16 Financial Statement Analysis 1, 2, 3, 4, 5, 11, 13, 19 Sep. 14, 16, 21, 23 Exam 1 Sep 28 (test), Sep 30 (results) 2 Cost Terms, Concepts, Etc. 1, 2, 5, 10, 11, 12, 25, 27 Oct. 5, 7 3 Job-Order Costing 1, 15, 23, 25, handouts Oct. 12, 14 4, 4A Process Costing 2, 3, 11, 12, 14, 15 Oct. 19, 21 5 Cost Behavior: Analysis and Use 6, 7, 8, 10, 11, 17 Oct. 26, 28 Nov. 2 (test), Nov. 4 (results) Exam 2 6 Cost-Volume-Profit Relationships 10, 11, 14, 16, 18, 19, 21, 28 Nov. 9, 11, 16 7 Variable Costing 5, 6, 7, 8 Nov. 18, 23 8, 8B Activity Based Costing 7, 24, 28 Nov. 30 Dec. 2 10 Standard Costs 2, 9, 10, 11, 12, 14, 17, 19, 27, 30 Dec. 7, 9 Dec. 14 Final Exam 4