Competition

advertisement

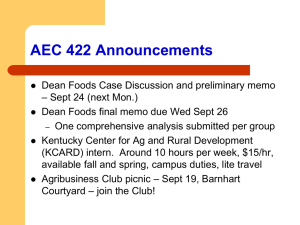

AEC 422 Announcements Diamond Foods Case Discussion and preliminary memo – Sept 29 (next Mon.) Diamond Foods final memo due Wed Oct 1 – One comprehensive analysis submitted per group Preliminary and final memos should follow case analysis format, but especially emphasize key concepts from Unit 1. Unit 1 Microeconomics of the Firm Competitors and Competition AEC 422 Sept 22 Industry An industry is a collection of firms offering goods or services that are close substitutes of each other. (V. Jain, 2007) North American Industry Classification System (NAICS) replacing the Standard Industrial Class (SIC) codes. Industry Definitions NAICS Code NAICS Description Classification Level 31-33 Manufacturing Sector 312 Beverage and tobacco product manufacturing Subsector 3121 Beverage manufacturing Industry group 31211 Soft drink and ice manufacturing Industry 312111 Soft drink manufacturing National Industry For detailed codes: http://www.census.gov/naics/2007/naics07.xls Other Empirical Approaches – – – – Bureau of Labor Statistics Market Classes BLS NAICS Aggregation Titles http://www.bls.gov/bls/naics_aggregation.htm Products that belong to the same genre or the same NAICS class need not be substitutes Organization of industry Driven by economics shaping firm size, scope, bounds, and vertical relationships Substitutes and complements Clusters – shared resources (tourism, port, university technology park); manufacturing and distribution relationships Competition If one firm’s strategic choice adversely affects the performance of another they are competitors In practice anyone who produces a substitute product is a competitor Competition can be either direct (between soft drinks) or indirect (soft drinks and milk) Important implications for product development, advertising, pricing Taco Bell: Who is my competition? Taco Bell: Who is my competition? Other Mexican restaurants – Other Mexican fast food Other fast food restaurants – – – – Abuelos? Burgers Pizza Chicken Italian In-store Mexican RTE meals Convenience stores & supermarket deli’s “healthy” fast food? Fine(r) dining restaurants? How do we define “market share”?....depends how we define the market (later) Characteristics of Substitutes Two products tend to be close substitutes when – They have similar performance characteristics – They have similar occasion for use and – Kroger brand mustard vs French’s Mustard Breakfast cereal vs Pop Tarts They are sold in the same (geographic) market area Various brands of gasoline in an area Performance Characteristics Empirical Approaches to Competitor Identification Cross price elasticity of demand Eab = (∆Qa/Qa)/ (∆ Pb/Pb) Substitutes, complements, or independent – If Eab > 1….then A and B are substitutes (Pepsi & Coke) If Eab < 1…then A and B are complements (hot dogs & buns) Price for turkey increases what will happen to the quantity demanded for turkey dressing around Thanksgiving? Price of gas increases, quantity of cars demanded decreases – Eab < 0 Price for pizza (fast food substitutes) increases, quantity demanded for Mexican fast food increases Price for UK tuition increases, quantity demand for BCTC classes increases – Complements: Substitutes: Eab > 0 Larger the magnitude of the cross-price elasticity, the more pronounced the effect. Occasion for Use Products may share characteristics but may differ in the way they are used Orange juice and cola are beverages but (generally) used in different occasions What about milk? Other examples – similar product – different use: – Hiking shoes versus court shoes – Desktop vs laptop computer vs iPad Whole and 1% Milk Consumption Lb/capita in U.S. Whole Milk 1% Milk Market (Geographic) Area Identical products in two different geographic markets may not be substitutes due to “transportation costs” – – Lawn care or construction services Banks?? Education?? Library? Bulky products like cement cannot be transported over long distances to benefit from geographic price difference Geographic Competitor Identification When a firm sells in different geographical areas, it is important to be able identify the competitor in each area Rather than rely on geographical demarcations, the firm should look at the flow of goods and services across geographic regions Two Step Approach to Identifying Competitors in the Area First step is to find out where the customers come from (the catchment area) The second step is to find out where the customers from the catchment area shop With the technological innovations, some products like books and drugs are sold over the internet bringing in virtual competitors – Amazon.com Market Structure Markets are often described by the degree of concentration Monopoly is one extreme with the highest concentration - one seller Perfect competition is the other extreme with innumerable sellers Measuring Market Structure A common measure of concentration is the N-firm concentration ratio - combined market share of the largest N firms (or brands) – Ice Cream Brands Example Edys, Breyers, Blue Bell, Haagen-Dazs, and Ben & Jerry’s make up 51.1% of the Ice Cream market share in the U.S. Dean Foods, Kraft Foods, and Land O’ Lakes made up 37.5% of the dairy processing sales in the U.S. in 2005 Also measured as 4-firm CR or 20-firm CR Industry Number of firms Bookstores Computer & software Casino Hotels Full service restaurants Florists Besanko et al, p.210, 5th Ed 12751 10133 283 195492 22753 4-firm CR 20-firm CR 62 51 44 9 2 70 65 76 16 4 Measuring Market Structure Herfindahl index is another which measures concentration as the sum of squared market shares – Sum of the squared market shares of all the firms in the market Ie a market divided between 2 firms would be: – 0.52 + 0.52 = 0.5 Four Classes of Market Structure Structure Perfect Competition Monopolistic Competition Oligopoly Monopoly Herfindahl Index Usually < 0.2 Intensity of Price Competition Fierce Usually < 0.2 Depends on the degree of product differentiation Depends on inter-firm rivalry Light unless there is threat of entry 0.2 to 0.6 > 0.6 Dairy Products, U.S., 2007 Source: The Food Institute Market Structure and Competition A monopoly market may produce the same outcomes as a competitive market (threat of entry) – Think of the one ice cream shop in a growing town A market with as few as two firms can lead to fierce competition With monopolistic competition, how well differentiated the products are will determine the intensity of price competition Perfect Competition Many sellers who sell a homogenous product and many well informed buyers (transparent market) Consumers can costlessly shop around and sellers can enter and exit costlessly Each firm faces infinitely elastic demand – Smallest hike in prices pushes them out of the market Conditions for Fierce Price Competition Even if the ideal conditions are not present, price competition can be fierce when two or more of the following conditions are met – – – There are many sellers Customers perceive the product to be homogenous There is excess capacity Vertical and Horizontal Differentiation Vertically differentiated products unambiguously differ in quality (USDA grade#1 tomatoes vs #2s) – Bourbon? Wine? Horizontally differentiated products vary in certain product characteristics to appeal to different consumer groups (cage free eggs, FSC) An important source of horizontal differentiation is geographical location – taking same products to different geographic markets Geography and Horizontal Differentiation Video rental outlets (or grocery stores) attract clientele based on their location – Move to movie downloads? Consumers choose the store based on “transportation costs” Transportation costs prevent switching for small differences in price Idiosyncratic Preferences Tastes differ substantially across consumers – Food products, beverages, entertainment, apparel Horizontal differentiation possible with idiosyncratic preferences Easier to segment the market Location and Taste are important sources of idiosyncratic preferences Willingness-to-pay across selected demographic variables Blueberry Vinegar Blueberry Syrup N 196 243 Variable (t-ratio) Constant Male Age Income Education Health Knowledge 2.0791 (4.13)*** 0.1994 (1.14) -1.1639 (-2.33)** 0.0580 (2.75)*** 0.7587 (2.31)** 0.0917 (0.40) 2.3174 (5.83)*** 0.2196 (1.68)* -1.0765 (-2.76)*** 0.0445 (2.46) ** 0.6447 (2.38)** 0.4646 (2.63)*** R2 0.12 0.12 Statistically significant at the 90% (*), 95%(**), or 99%(***) confidence level. Search Costs and Differentiation Search cost: Cost of finding information about alternatives Search costs discourage switching when prices are raised Low cost sellers try to lower the search costs (Advertising, distribution) Some markets have high search costs (Example: ie. highly regulated products – medical care) Switching Costs and Monopolistic Competition An important determinant of a firm’s demand is customer switching Switching is less likely when – Customer preferences are idiosyncratic – – Dentists, hairstylists, favorite restaurant Customers are not well informed about alternative sources of supply Customers face high transportation or search costs (what has the Internet done to this lately?) Price-Cost Margins and Concentration Theory would predict that price-cost margins will be higher in industries with greater concentration (fewer sellers) There could be other reasons for interindustry variation in price-cost margins (regulation, accounting practices, concentration of buyers and so on) Price-Cost Margins and Concentration It is important to control for these extraneous factors if one needs to study the relation between concentration and price-cost margin Most studies focus on specific industries and compare geographically distinct markets Evidence on Concentration and Price For several industries, prices are found to be higher in markets with fewer sellers See MacDonald’s 1999 ERS article Lysine, infant formula, western railroads, cattle slaughter See Hendrickson & Heffernan Economies of Scale and Concentration Industries with large minimum efficient scales compared to the size of the market tend to have high concentration The inter-industry pattern of concentration is replicated across countries When production/marketing enjoys economies of scale, entry is difficult and hence profits are high Concentration and Profitability The concentration and profitability have not been shown to have a strong relationship Possible explanations – – Differences in accounting practices may hide the differences in profitability When the number of sellers is small it may be due to inherently unprofitable nature of the business