Final Wireless Telecommunications Industry Paper

advertisement

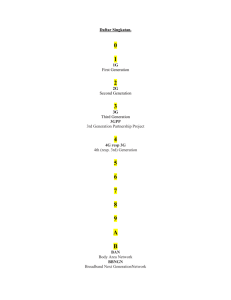

2010 Competition in the Wireless Telecommunication Industry: The Strategic Situation at Verizon Wireless and AT&T Taylor Boyd Nicole Teibel Trey Broome 12/1/2010 Table of Contents Part I: The Rivals............................................................................................................................... 3 Verizon Wireless VS. AT&T ..................................................................................... 3 Part II: Opportunity ........................................................................................................................ 4 Wireless Telecommunications Industry .................................................................. 4 Geographic Demand .............................................................................................. 6 Part III: Industry Analysis........................................................................................................... 7 5-Forces Analysis.................................................................................................... 7 Conclusions about the 5-Forces ............................................................................ 11 Key Success Factors (KSF) ..................................................................................... 12 KSF and Relative Defense against High-Power Threats to Profitability ................. 16 Part IV: Strength Assessment ................................................................................................. 17 Key Success Factors: Raw Data ............................................................................ 17 Key Success Factors: Distinctive Competency Scores ............................................ 17 Verizon Wireless: Most likely to Sustain a Competitive Advantage .................... 188 References………………………………………………………………………………………………19 2|Page Part I: The Rivals Verizon Wireless VS. AT&T Verizon Communications and AT&T are two publicly traded rivals that compete in a multitude of industries and offer varying products and services dependant on the industry, for the purposes of this report the industry to be discussed is that of Wireless Telecommunications Industry. Particular discussion will be limited to the Wireless Telecommunications industry and the related wireless devices and their accompanying services on which Verizon Wireless and AT&T Mobility compete in this industry. Cellco Partnership was incorporated in Delaware in 1994, and does business under the name Verizon Wireless. The partnership consists of 55% ownership by Verizon Communications Inc. and 45% ownership by United Kingdom based Vodafone Group Plc (Verizon Wireless 10-K, pg. 2). The corporate address of this partnership is One Verizon Way, Basking Ridge, New Jersey 07920. While both Verizon Communications and Vodafone compete in a vast array of industries which vie to deliver communication services to subscribers such as Internet and Land-Line, the subsidiary, Verizon Wireless, is the company used to compete in the Wireless Telecommunications Industry. The goal of Verizon Wireless is to, “be the market leader in providing wireless voice and data communication services in the United States” (Verizon Wireless 10-K, pg. 4). AT&T Mobility is a subsidiary of AT&T Incorporated. AT&T Inc. was incorporated in Delaware in 1983. Their corporate executive offices are located at 208 S. Akard St., Dallas Texas, 75202 (AT&T 10-K, pg. 1). AT&T Inc. operates in various market segments by offering various products and services such as: wireless communication, long-distance services, data/broadband and Internet services, managed networking, telecommunications equipment, and video services. However, for financial reporting purposes, AT&T operates in four segments: Wireless, Wireline, Advertising, and Other (AT&T 10-K, pg. 3). According to AT&T’s Annual Report their Wireless segment, “is our fastest-growing revenue stream and we expect to deliver continued revenue growth in the coming years” (pg. 42). 3|Page The two competitors, AT&T and Verizon Wireless hold a commanding lead over all other companies in the Wireless Telecommunications Industry. According to the Standard and Poors (S&P) Industry Survey, Verizon Wireless and AT&T hold a combined 64.1% of the total wireless subscribers (pg. 2). Part II: Opportunity Wireless Telecommunications Industry The past five years have been an extremely prosperous period for the Wireless Telecommunications industry, as the industry is in its growth stage experiencing strong consumer demand. FCC reports have shown that in the period from 2005 to 2009 wireless subscribers have increased by 77.7 million, “this growth in subscriber numbers has contributed to the estimated 4.6% annual increase in revenue since 2005,” (IBIS World). IBIS World also states that this industry is predicted to see further growth in 2010. Fierce competition has prompted increased technological innovation and new product development. Due to consumers readily adopting these new innovative products being offered by wireless providers such as AT&T and Verizon Wireless, these companies have seen greater revenues and increased margins. As a result of the positive earnings these companies have seen, they are then in turn able to offer lower prices, which has established product pricing in this industry as a factor that contribute to a company’s competitive advantage. IBIS world states that “increased scale and greater consolidation have ultimately improved the efficiency of this high fixed-cost industry and ensured healthy profits and consumer benefits,” further illustrating the recent success of this industry. GROWTH As a whole, the Wireless Telecommunications Industry has seen extensive growth in recent years. IBISWorld’s Industry Analysis states that since 2005, “consumers have become increasingly dependent on cellular phones to meet their communication needs,” and, “a significant number of consumers have disconnected their land-line services altogether and rely solely on their cell phones for voice and 4|Page messaging services” (pg. 5). Due to this large decline of subscribers in the Wireline market, it seems only appropriate that competing companies specifically tailor their product offerings to meet consumer demand for an all encompassing personal communication device. INNOVATION Companies originally competed on the attractiveness of their pricing plans, the amount of minutes available for calls, and text messages users can send; however, a new aspect has become a main focal point for Wireless Telecommunication providers: enter the smartphone. Due to, “the proliferation of new wireless applications, and higher-end operating systems such as Android and iPhone OS… The wireless industry is on the verge of significant changes…” (S&P Industry Survey, pg. 1). On the second page of their Form 10-K, AT&T cites their exclusivity deal with Apple’s iPhone as an area where they expect to see continued growth in their customer base. This touches on an important area on which providers will now begin to compete: operating system offerings. The current major players in operating system market are Google, which offers their open-platform Android OS, and Apple, which offers the iPhone OS. (The competition between these two operating systems alone could be the basis for a strategic analysis, but for the purposes of this report it will not be discussed in depth). These two operating systems account for 84% of United States smartphone web traffic (S&P Industry Survey, pg. 18). S&P’s Industry Survey goes on to bring to light an interesting idea: “Traditionally, subscribers chose a phone and the operating system followed. However, we believe the increasing adoption of the Android open operating system could challenge this notion” (pg. 18). With so many consumers now in the market for a phone which meets these needs, “service providers have aggressively pursued the latest smartphones with bigger screens and faster data speeds, both to draw new subscribers and to retain existing ones on their networks” (S&P Industry Survey, pg. 1). COMPETITION The competition in the Wireless Telecommunications Industry has intensified over recent years. The four largest wireless carriers now control more than 90.0% of industry revenue. This is primarily due to the increase consolidation that has occurred within in the wireless communications industry. “Industry 5|Page consolidation has made it more difficult for small and regional carriers to be competitive. Difficulties for these carriers include securing subscribers, making network investments, and offering the latest wireless phones necessary to compete in this dynamic industry,” (IBIS World). Geographic Demand Geographic Area with Greatest Demand: United States Amount of Demand in 2010: $193.6 Billion in Revenue Growth in Demand from 2005-2010: 4.6 % Growth in Revenue The geographic area with the largest demand in the Wireless Telecommunications Industry is the United States. This is due to the face that there is low globalization in the industry. IBISWorld states that, “The overwhelming majority of wireless revenue is generated on a national basis. International revenue is sourced from Figure 1: Distribution of Establishment Vs. Population in the US roaming termination charges, but these revenue sources account for much less than 25% of total revenue” (Industry Analysis, pg. 29). It is for this reason that they point out that, “At this stage, no real data is available with regards to the size of the international trade component of the industry.” IBISWorld states regarding the geographic demand in the United States that “the geographic spread of the Wireless Telecommunications Carriers industry follows the nation’s demographic profile, in particular its population density. Conventional wisdom would suggest that establishment shares correlate closely with population shares given that these areas provide bigger potential markets.” In this industry geographic demand is dictated by the population of each region in the US, as shown in Figure 1. 6|Page Part III: Industry Analysis 5-Forces Analysis THREAT OF SUPPLIERS An important aspect to consider when measuring the threat of suppliers to the profitability of a wireless telecommunications provider is the specified service the supplier is being used for. Most providers have diverse infrastructure already in place to manage their own networks; however, recent innovations in the marketplace have the ability to appropriate the wireless provider’s profits. In a recent Forbes article, Darcy Travlos states that, “The very phones that increase average revenue per customer do so at the expense of the carrier's analytic capabilities. If they don't proffer solutions, carriers could quickly become dumb pipes simply delivering innovative applications from other companies” (How Wireless Carriers Recapture the Market). The new and innovative phones, which have been driving profits in recent years, are creating problems for providers when they attempt to capture relevant market data. The logic behind this problem is simple: “While smartphones' features encourage greater usage and higher revenue per subscriber, they often bypass the carrier's browser and therefore the carrier's ability to analyze and control data usage” (Travlos, pg. 1). The real winners in this situation are the suppliers whose networks are being flooded with real-time, market data on which they can use to broaden their product offerings. However, there are preventative measures in place to prevent suppliers from forward integration, effectively stopping the makers of cell phone hardware from venturing into the realm of wireless service providers. Wireless Telecommunication providers are able to supply subscribers with their services via the use of radio frequency, using differing amounts of bandwidth to create their “spectrums.” Currently, the Federal Communications Commission (FCC) is the entity which makes laws and promulgations about how bandwidth can be used and sold. However, in the market place today the property rights about spectrum licenses are very unclear, and laws prevent “spectrum licenses to be competitively bought and sold” (The Spectrum Wars, pg.1). The current structure of licensing does all but give major wireless 7|Page services providers a monopoly on the industry. It is for both these reasons that we believe the threats of suppliers to the profitability of a wireless service provider are moderate. THREAT OF BUYERS The four main players in the Wireless Telecommunication Industry are AT&T, Verizon Wireless, T-Mobile, and Sprint (IBISWorld Industry Analysis, pg. 5). All of these players are attempting to lock in as many subscribers to their service as possible, which would normally indicate competition based on lowest price and give buyers high power. However, the Wireless Telecommunication Industry has a unique safeguard in place to attempt to limit the threat of the average consumer: one and two year contracts. The amount of services which all providers offer customers today are vast and at times even free (specifically the move from cellular to digital service); therefore, “In order to offset the cost of subsidized or free digital handsets, carriers sell these services through contracts that extend for one or two years”(S&P Industry Survey, pg. 22). The real competition takes place between service providers when they attempt to lock customers into contracts. However, an interesting phenomenon has been occurring in the industry. In the past, high switching costs have prevented buyers from moving to another carrier, but recently Darcy Travlos believes that the appeal of cell phone applications will be the area where buyers are won or lost. Travlos also states that, “a significant number of customers have already been willing to change from a carrier with perceived better service to a carrier with a more interesting smartphone” (How Wireless Carriers Recapture the Market). This phenomenon brings in the idea of customer churn. Churn is another measure that is used to evaluate the level of buyer power in this industry. The churn rate it is the percentage of current customers that a provider looses over a given period of time. Churn reflects consumers’ desire and ability to change service providers to better meet their wireless needs. IBISWorld states that, “Most players experience an average monthly churn rate of roughly 1.5% to 3.5%,” indicating that competition is very high (Industry Analysis, pg. 26), which results in a high percentage of consumers that are switching between providers. High churn rate indicates customers can and will switch easily (IBISWorld), and due to the industries high churn rate, the threat of buyers is high. 8|Page THREAT OF SUBSTITUTES The threat of substitutes to the profit of a company deals with the value proposition that their particular product or service offers. The current companies in the market are in the unique position of offering a product which can be used as a telephone, a computer, a messaging device, and a GPS. From the standpoint of customers, products from this industry are offering buyers the best possible value proposition in the modern market. It is for this reason that customers have continued to disconnect their Wireline services with Telecommunication providers (IBISWorld pg. 5). Standard and Poors also makes an interesting point about companies that also have strategic business units which sell Wireline products to customers when they say, “As a disadvantage, telcos carry heavy overhead costs, and they have huge investments in established infrastructure that will be cannibalized by emerging technologies” (Industry Survey, pg. 13). This the reason which we believe makes the threat of substitutes inherently low: the fact that modern day cell phones are the substitutes, and can be used as a multitude of different devices in one unique package. THREAT OF ENTRY The Wireless Telecommunication Industry is currently regulated by the FCC. In Verizon Wireless’ Form 10-K they state that, “To use the radiofrequency spectrum in the United States, wireless communications systems must be authorized by the FCC to operate the wireless network and mobile devices in assigned spectrum segments, and must comply with the rules and policies governing the use of the spectrum…” (pg. 13). Due to this heavily regulated environment, it is extremely difficult for new entrants to gain enough radiofrequency spectrum to allow them to compete with already entrenched companies. This regulation has created a situation where, “before a company can even establish compliant services, it must gain a license and win spectrum for delivering services” (IBISWorld Industry Analysis, pg. 6). AT&T points out on their Form 10-K that the licenses are issued for a specific amount of time, typically ten years, at which point the license must be renewed (pg. 6). However, the FCC and its licensing practices are not the only barriers stopping new entrants. IBISWorld points out that, “The cost associated with building base stations, towers and other network 9|Page infrastructure is exorbitant, particularly for those seeking national coverage in which case it runs into billions. The capital intensiveness of this industry acts as a deterrent to prospective entrants” (Industry Analysis, pg. 28). The heavy regulation, limited availability of spectrum licenses, and the extremely high fixed costs make entry into this industry very hard, and it is for this reason we feel there is a low-power threat to profitability. THREAT OF RIVALRY The threat to profitability due to the force of rivalry is extremely important to monitor in the Wireless Telecommunication Industry. There are four major players in the marketplace which combine to account for 85% of the market share (IBISWorld Industry Analysis, pg. 5). IBISWorld also predicts that the growth in subscribers will grow annually at a rate of 5.7% and, as noted above, the fixed cost to participate in this industry are very large. AT&T is under the opinion that, “It is widely recognized that the wireless industry in the United States is characterized by innovation, differentiation, declining prices and extensive competition among handset manufacturers, service providers and applications” (Form 10K, pg. 14). This allows us to infer that due to their extensive competition with other service providers, the power threat to profitability of rivalry is high. Furthermore, competition between rivals is highlighted through their use of contracts to lock-in subscribers. Verizon Wireless, for example and similar to most competitors, has the policy of, “an early termination fee that decreases after each full month that a customer remains on their contract and a phone upgrade credit every two years, provided that the customer signs a new two-year contract” (Form 10-K, pg. 12). The rivalry between service providers is based on their competition to sign and contract new subscribers who must pay termination fees when they want to switch to a different service provider. It is important to note, however, that recent trends suggest customers will switch providers when they find that one has more unique product offerings than the other (Travlos, pg. 1). 10 | P a g e Force Power Threat to Profitability Explanation Suppliers Moderate Buyers High Substitutes Low Threat of Entry Low Rivalry High New technology made by suppliers helps to give them more information, and allows them to dictate their own prices Suppliers are prevented from entering the market due to the spectrum licensing Four major players in the Industry Switching costs are not adequately stopping buyers from switching providers Buyers will switch when other companies have more differentiated applications Monthly churn rate is very high Products from this industry offer buyers the best value proposition, and allow users to have a single device that takes the place of many Many customers have begun to drop their subscriptions to Wireline services and have kept only a contract with their Wireless Service Provider. Heavily regulated by the Federal Communications Commission Limited availability of spectrum licenses and bandwidth on the open market Extremely high fixed costs associated with building the necessary infrastructure More than two major industry players of roughly the same size Fixed costs are high, and all competitors have the ability to service demand Heavy competition to attract subscribers and lock them into contracts Conclusions about the 5-Forces Due to 2 of the 5-Forces being low power threats to profitability, the expected profitability of the average seller with now unique resources or capabilities will be about equal to the cost of capital. In this 11 | P a g e situation, Profit is equal to Quantity Sold multiplied by Average Selling Price, and then reduced by Internal Costs (Profit = (# Sold * Avg. Price) – Costs). Key Success Factors (KSF) An important step for businesses to take in determining their expected profitability is to determine the competencies and resources necessary to achieve and maintain high levels of sales, justify higher average selling prices than rivals, and reduce their internal costs of operations. Paraphrased from Greg Young’s definition, Key Success Factors are specific resources and activities any competing company must be good at if they are to be profitable in satisfying demand while also defending against high-power competitive threats to profitability. They are the factors which affect an industry competitor’s ability to be prosperous in the marketplace. These factors are attributes, resources, competencies, capabilities, and market achievements that denote the differences between strong and weak market competitors. In the Wireless Telecommunication Industry there are a variety of Key Success Factors for providers to choose from when looking to defend against high-power threats to profitability, and in turn strengthening their competitive positions. In this industry six KSFs come to mind: economies of scale, exclusivity of product, level of network coverage, technological innovation, strategic alliance outside the industry, and the customer satisfaction. ECONOMIES OF SCALE In the past 5 years, competition between wireless carriers in the United States has heightened. The depth of the competition is described in the IBIS World Industry Report stating “the impending market maturity has propelled major players to establish a competitive position from which to defend their subscriber base.” A company’s subscriber base plays an instrumental role in a company in this industry’s economies of scale as a key success factor. The larger a company’s subscriber base, the larger 12 | P a g e their economies of scale, and the easier it becomes for a company in this industry to use this economies of scale as a key success factor to defend their market share, and profits. Economies of scale is achieved in this industry through increase the geographic areas that services are provided to, or as IBIS world states by “increasing their geographic footprint” (IBIS World). A large economy of scale is achieved by addressing many different market segments with similar products, selling to these segments at higher volumes allows operations on a large scale obtaining positive effects on a products cost. A provider’s economy of scale allows them to achieve a competitive advantage in the pricing aspect over competitors. “Merger and acquisition activity has decreased enterprise numbers since 2005, but the increasing size of industry participants has brought about economies of scale and made the industry more efficient” (IBIS World). Increased numbers of mergers and acquisitions in recent years have also contributed to increase economies of scale in the wireless industry “Merger and acquisition activity has decreased enterprise numbers since 2005, but the increasing size of industry participants has brought about economies of scale and made the industry more efficient” (IBIS World). Economies of scale has become a necessary key success factor in this industry, as increasing and maintaining a large subscriber base will be essential for a company to obtain a competitive advantage and compete effectively as this industry approaches maturity. The largest providers in this industry will have the greatest competitive advantage as they will have the greatest economies of scale. Economies of scale are measured by costs over total assets. EXCLUSIVE PRODUCT CONTRACTS One of the main ways that wireless service providers compete in the Wireless Telecommunications Industry is through achieving a key success factor through exclusivity of products offered by differentiating their products from that of their rivals. IBIS world states that “Product innovation is a critical competitive weapon within the cell phone space. This is because the commercialization of new technologies can be incredibly valuable in boosting usage, bolstering margins and attracting new customers” (IBIS World, pg.27). Offering new and 13 | P a g e innovative products has become increasingly important for wireless companies to not only compete, but survive in this industry. This is mainly due to wireless product life cycles being very short. “Innovative product bundling is also becoming a more significant competitive point as players offer integrated combinations of the latest products and services to encourage customers to become multiproduct users,” (IBIS World, pg. 27). One example of product exclusivity in the Wireless Telecommunications Industry is AT&T’s exclusive power to provide service for Apple’s iPhone. The S&P Industry report notes that “AT&T got an incredible advantage over the rest of the field with an exclusive deal to sell, first, the revolutionary iPhone, and then the 3G iPhone” (S&P Report, pg. 2). Likewise, Verizon Wireless also offers exclusive products such as Smartphones that run on Google’s Android technology and the Skype mobile application. Because the Wireless Industry is highly competitive, providers must constantly differentiate themselves from rivals by carrying exclusive products to create and sustain a competitive advantage. PRODUCT INNOVATION IBIS world states that “Product innovation is a critical competitive weapon within the cell phone space. This is because the commercialization of new technologies can be incredibly valuable in boosting usage, bolstering margins and attracting new customers.” Offering new and innovative products has become increasingly important for company’s in this industry to not only compete, but survive in this industry. This is mainly due to wireless product life cycles being very short. “Innovative product bundling is also becoming a more significant competitive point as players offer integrated combinations of the latest products and services to encourage customers to become multiproduct users,” (IBISWorld). STRATEGIC ALLIANCES In a strategic alliance, two or more organizations share resources, capabilities, or distinctive competencies to pursue a defined business purpose. In the Wireless Telecommunications Industry, strategic alliances are important key success factors on which companies in this industry seek to achieve to obtain a competitive advantage. 14 | P a g e IBIS World states that “It is important for wireless carriers to develop strategic alliances with leading businesses in supplier and buyer industries. Supply-side relationships are critical to providing competitive service offerings and the best devices.” The importance of strategic relationships can further be outlines in Verizon Wireless’ Annual Report in stating “one of our primary business strategies is to build and expand the capacity and coverage of our digital network so that we may provide sufficient capacity and seamless and superior coverage nationally on a cost effective basis” (Verizon Wireless 10-k, pg. 4). NETWORK COVERAGE The importance of network coverage as a key success factor in this industry can be seen is illustrated by IBIS world in stating “geographic coverage has increased in importance as witnessed by the scramble among players such as AT&T Mobility, Verizon Wireless and T-Mobile USA to achieve maximum US coverage.” Firms achieve network coverage as a key success factor by effectively using their resources to enlarge their geographic footprint. The recent trend to increase Network Coverage is seen through the increased mergers and acquisitions in the industry. Firms merge to obtain greater resources, and then work to effectively utilize these resources to obtain the greatest coverage. Greater network coverage can also be seen as a way to achieve greater economies of scale and increased efficiencies on which a company can obtain a competitive advantage CUSTOMER SATISFACTION The S&P Industry report identifies that “quality of service is a key ingredient in telecommunications services. Because the market has become more competitive in recent years, customer satisfaction and retention are primary drivers in fostering long-term revenue growth.” Customer satisfaction, keeping customer’s happy, is an important competitive weapon in obtaining and maintaining a loyal customer base. Customer satisfaction can be achieved through greater emphasis on service reliability and problem resolution (IBIS World). In Verizon Wireless’ Annual Report the company identifies that network coverage is another key factor in determining customer satisfaction(). 15 | P a g e IBIS world states that customer service is paramount in achieving customer loyalty through reduced churn rates (maintaining subscriber numbers). The churn rate is the percentage of current customers an operator loses over a given period of time, and this will be the basis in which we will measure customer satisfaction in this industry. The lower the churn rate, the greater the customer satisfaction a company has. The S&P Industry Report state that “most players experience an average monthly churn rate of roughly 1.5% to 3.5%,” indicating that competition is very high, and this displays the importance of customer satisfaction (low churn rates) as a key success factor. KSFs and Relative Defense against High-Power Threats to Profitability The key success factor of customer satisfaction is extremely important to be good at if a company wants to manage the high-power threat to profitability of buyers. In the profit equation, (Profit = (Avg. Price * Quantity Sold) – Internal Costs), the buyers are responsible for driving the average selling price and the quantity sold in an industry, such as the Wireless Telecommunications Industry, that has a highpower threat of buyers. Service providers that can justify a higher average selling price while selling higher quantities than their rivals will be the most profitable. For this reason, companies must be successful in managing the satisfaction of their customer base in order to achieve higher sales figures relative to their rivals. If customer satisfaction is measured by churn rate, then the company which best manages the rate at which it increases or decreases its customer base will be able to sell the highest quantity at the highest price. All else being equal, customers will select the company which they believe offers the best value in the industry, and terminate their contracts with the companies which do not satisfy them. Therefore, the key success factor of customer satisfaction is important in managing the high-power threat to profitability of buyers. 16 | P a g e Part IV: Strength Assessment Key Success Factors: Raw Data Key Success Factor Economies of Scale (Costs/Total Assets) Exclusive Product Contracts (Amount of Licensing) Product Innovation (Breadth of Product Line) Strategic Alliances (Amount of Investments in Partnerships) Network Coverage (Customer Base) Customer Satisfaction (Churn Rate) AT&T 101526 =.38 268752 Raw Data Verizon Wireless 45580 =.34 134352 [Source: 10K Income Statement & Consolidated Balance Sheet] $48 Million in Licensing [Source: 10K Income Statement & Consolidated Balance Sheet] $72 Million in Licensing [Source: 10K pg. 33] 52 Cellular Devices [Source: 10K pg. 92] 60 Cellular Devices [Source:AT&T Website] $2,921 Million Investments [Source: VZW Website] $1,988 Million Investments [Source: 10K pg. 50] 85.1 million customers [Source: 10K pg. 105] 91.2 million customers [Source: 10K pg.2] 1.48% [Source: 10K pg.9] 1.44% [Source: 10K pg. 6] [Source: 10K pg. 26] Key Success Factors: Distinctive Competency Scores Key Success Factor Economies of Scale (Costs/Total Assets) Exclusive Product Contracts (Amount of Licensing) Product Innovation (Breadth of Product Line) Strategic Alliances (Amount of Investments in Partnerships) Network Coverage (Customer Base) Customer Satisfaction (Churn Rate) AVERAGE SCORE AT&T Distinctive Competency Score Verizon Wireless 2 4 1 5 2 4 5 1 2 4 3 3 2.5 3.5 17 | P a g e Verizon Wireless: Most likely to Sustain a Competitive Advantage After examining the strength assessment, it is evident that Verizon Wireless is most likely to sustain a competitive advantage over its competitors. As a whole, Verizon performed better than AT&T with regard to five out of the six Key Success Factors selected. Most importantly, Verizon has a greater chance of sustaining a competitive advantage because of its superior customer satisfaction. As noted previously, a company’s churn rate is highly important in managing the high-power threat of profitability to buyers in the wireless industry and Verizon’s low rate indicates superior customer satisfaction to AT&T. It should also be noted that Verizon offers a vaster product line to a greater customer base than AT&T. Because of its superior performance in these measures, Verizon will continue to improve their churn rate which in turn will help distance themselves from competitors. Thus, due to superior strength regarding Key Success Factors in the wireless telecommunications industry, Verizon Wireless is most likely to sustain a competitive advantage. 18 | P a g e References AT&T. AT&T. Web. 3 Dec. 2010. <http://www.att.com/>. AT&T Form 10-K, . SEC Filings. Securities and Exchange Commission, 1 Jan. 2010. Web. 3 Dec. 2010. <http://sec.gov/cgi-bin/browseedgar?company=&match=&CIK=T&filenum=&State=&Country=&SIC=&owner=exclude&Find =Find+Companies&action=getcompany>. Furchtgott-Roth, Harold. The Spectrum Wars. Forbes, 30 June 2010. Web. 3 Dec. 2010. <http://www.forbes.com/2010/06/30/fcc-wireless-smartphone-obama-spectrum-opinionscolumnists-furchtgott-roth.html>. IBISWorld Wireless Telecommunications Carriers in the US (2010). Retrieved from NCSU Libraries Research Data Service. Standard & Poor's Telecommunications: Wireless (2010). Available: Standard & Poor's [Access Date]. Retrieved from NCSU Libraries Research Data Service. Travlos, Darcy. How Wireless Carriers Can Recapture the Market. Forbes, 22 Nov. 2010. Web. 3 Dec. 2010. <http://www.forbes.com/2010/11/22/wireless-smartphone-carriers-verizon-intelligentinvesting.html>. Verizon Wireless. Verizon Wireless. Web. 3 Dec. 2010. <http://verizonwireless.com> Verizon Wireless Form 10-K, . SEC Filings. Securities and Exchange Commission, 1 Jan. 2010. Web. 3 Dec. 2010. <http://sec.gov/cgi-bin/browseedgar?company=&match=&CIK=VZW&filenum=&State=&Country=&SIC=&owner=exclude& Find=Find+Companies&action=getcompany>. 19 | P a g e