Successfully Securing ED Call Coverage

advertisement

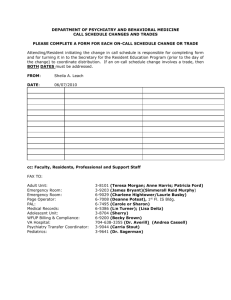

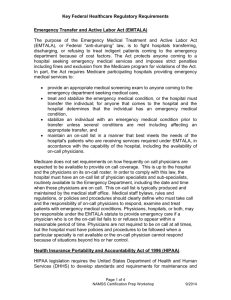

1 Overview Of HealthCare Appraisers, Inc. Founded in 2000 Sole business focus is FMV analysis of healthcare transactions and arrangements, such as On-call arrangements, medical directorships, employment agreements, hospital based MD collections guarantees, service and management agreements, etc. Staff consists of 4 principals with a highly educated and experienced staff of 14 professionals. Perform almost 2,000 FMV analyses each year. Of these reports, over 500 were related to on-call arrangements. 2 Kaufman and Canoles Overview 3 Root Causes of the Current On-Call Predicament Changes in Physician Practice Patterns and Attitudes Changes in Reimbursement Changes in the Methods of Health Care Delivery Malpractice Considerations Weakened EMTALA Requirements Relatively New Problem 4 Legislative Framework Florida Law Regarding Emergency Treatment Federal Law Regarding Emergency Treatment 5 Legislative Issues Florida Statute Section 395.1041 applies to every general hospital that has an emergency department and requires each such hospital to provide emergency services and care for any emergency condition when: Any person requests emergency services and care; or Emergency services are requested on behalf of a person by: Another hospital seeking a medically necessary transfer; or An emergency medical services provider rendering care or transporting a person. (Florida Statute Section 395.1041(3)(a)) 6 Legislative Issues (Cont’d) Except in certain limited circumstances, every Florida hospital shall ensure the provision of services “within the service capability of the hospital.” Florida Statutes Section 395.1041(3)(d)(1). An exception is to apply if, prior to the receiving of a patient needing such service capability, such hospital has demonstrated to AHCA that it lacks the ability to ensure such capability and it has exhausted all reasonable efforts to ensure such capability. In making this determination, AHCA is to look at all relevant factors inclusive of: The number and proximity of hospitals with the same service capability; The number, type, credentials and privileges of specialists; Frequency of procedures; and The size of the hospital. (Florida Statutes Section 395.1041(3)(d)(3)) 7 Emergency Medical Treatment and Active Labor Act of 1986 As of the 2003 amendments to EMTALA, hospitals are now obligated to provide “[n]ecessary stabilizing treatment for emergency medical conditions . . . within the capabilities of the staff and facilities available at the hospital.” 42 C.F.R. Section 489.24(d) 8 In pertinent part, the new regulations adopt the positions taken by the CMS State Operations Manual dated June 13, 2002: Each hospital has the discretion to maintain the on-call list in a manner to best meet the needs of its patients. Physicians, including specialists and subspecialists (for example, neurologists), are not required to be on call at all times. The hospital must have policies and procedures to be followed when a particular specialty is not available or the on-call physician cannot respond because of situations beyond his or her control. (Federal Register, Vol. 68, No. 174, Tuesday, September 9, 2003, page 53250) 9 NO LONGER A FEDERAL MANDATE FOR CALL COVERAGE In light of, among other events, the 2003 amendments to EMTALA, the political activity of state medical associations, the changes in practice patterns, and the pressure on physicians from the malpractice insurance industry, the obligations on physicians to take Emergency Department call have been waning. There simply is no longer any compelling state or federal regulatory or legislative method by which to force physicians to take call coverage as part of their medical staff participation on a hospital’s medical staff. Instead, hospitals are turning to independent economic incentives to induce physicians to assume call coverage obligations that the host hospitals deem to be integral parts of their operations and, more often than not, community obligation—whether for profit or not for profit in structure. 10 Legal Considerations Anti-Kickback Statute and Applicable Regulations Whoever knowingly and willfully solicits or receives any remuneration (including any kickback, bribe, or rebate) directly or indirectly, overtly or covertly, in cash or in kind in return for referring [or to refer] an individual to a person for the furnishing or arranging for the furnishing of any item or service for which payment may be made in whole or in part under a Federal health care program, or in return for purchasing, leasing, ordering, or arranging for or recommending purchasing, leasing, or ordering [or to purchase, lease or order] any good, facility, service, or item for which payment may be made in whole or in part under a Federal health care program, 11 Personal Services “Safe Harbor” The arrangement is set out in writing, signed by the parties, and specifies the services covered by the arrangement; The term of the arrangement is for at least one year; The agreement specifies the aggregate payment amount as well as the services covered; AND The payments are based upon fair market value and do not vary with the volume or value of any referrals reimbursed by a federal or state reimbursement program. 12 Stark Law and Applicable Regulations The Stark Law prohibits a physician (or his or her immediate family member) who has a financial relationship with an entity from referring patients to the entity for the provision of designated health services (“DHS”) covered by the Medicare or Medicaid programs, absent an applicable exception. DHS does include inpatient and outpatient services. Similarly, absent an exception, an entity that furnishes DHS pursuant to a prohibited referral may not submit a claim or bill for such DHS to the Medicare program. 13 Personal Services Exception The arrangement is set out in writing, signed by the parties, and specifies the services covered by the arrangement; The arrangement covers all of the services to be provided by the physician to the entity; The aggregate services contracted for do not exceed those that are reasonable and necessary for the legitimate business purposes of the arrangement; The term of the arrangement is for at least one year (to meet this requirement, if an arrangement is terminated during the term, the parties may not enter into the same or a substantially similar arrangement for a year); The compensation to be paid over the term of the arrangement is set in advance, does not exceed fair market value, and does not take into account the volume or value of referrals or other business generated between the parties; The services to be furnished under the arrangement do not involve the counseling or promotion of a business arrangement or other activity that violates any state or federal law; AND A holdover arrangement involving the same terms and conditions does not exceed six (6) months. 14 Advisory Opinions Expense Likelihood of Success/Result of Failure Utility Limitations May not address all federal and state laws Does not address FMV considerations by statute 15 OTHER LEGAL CONSIDERATIONS Revenue Procedure 97-13 Goal is to avoid Private Business Use Management Contracts means a management, service or incentive payment contract between a qualified user [the hospital] and a service provider under which the service provider provides services involving all, a portion of, or any function of, a facility. Per-unit fee means a fee based on a unit of service provided specified in the contract or otherwise specifically determined . . Separate billing arrangements between physicians and hospitals generally are treated as per-unit fee arrangements. Per-unit fee limitations No more than 3 years in length Terminable without cause and without penalty upon reasonable notice [i.e. 90 days] after second year Employment exception 17 REBUTTABLE PRESUMPTION OF REASONABLENESS (Treas. Reg. Section 53-4958.6) Arrangement must be considered and approved by an authorized body composed entirely of individuals who do not have a conflict of interest with respect to the transaction. Approving body must obtain and rely upon appropriate data as to comparability (pay attention to quality and quantity of data—use closest functional equivalent) Board or committee must adequately document the basis for its determination (no retroactive documentation) 18 Excess Benefits Transactions include: Non-fair market value transaction Unreasonable Compensation Transaction Prohibited Revenue Sharing Transaction (proportionality vs. reasonableness standards) Disqualified Persons generally means any person who, in the preceding five (5) years, was in a position to exercise substantial influence over the affairs of the exempt organization and includes certain relatives of and entities owned (3570 or more) by disqualified persons. IRC § 4958(f)(1) and (3). 19 Under Treas. Reg. § 53.4958(c) following are deemed to be disqualified persons: voting members of the Board President, CEOs, COOs, CFOs, treasurers, and anyone having ultimate responsibility for implementing board decisions or for supervising the management, administration, operations or finances of the entity persons with “material financial interests” in a provider sponsored organization. 20 Under Treas. Reg. § 53.4958-3(d) following are NOT deemed to be disqualified persons: other 501(c)(3) organizations employees receiving total direct and indirect economic benefits that are less than “highly compensated employee” threshold of IRS § 414(q) 21 Additional Considerations Deferred Compensation Rules under new Section 409(a) Antitrust Laws Florida Board of Medicine Decisions State Laws Others ? 22 How Is Fair Market Value for On-Call Coverage Established? 23 Business Considerations The Overall Cost of the Program (current and future) Who To Select to Staff the Program How Best to Administer the Program (moving from a reactive to a pro-active solution) Payment Options (e.g., pay for call, pay for call only when service required (Activation Fees), pay for call AND ongoing treatment, fee subsidies, malpractice subsidies in lieu of pay, other alternative payment options such as deferred compensation arrangements) Intrahospital vs. Interhospital solutions 24 Prevalence of Compensated Call Coverage Arrangements In a survey conducted by Sullivan & Cotter, almost 50% of all surveyed healthcare organizations reported that compensation is provided for on-call availability Establishing the FMV of on-call arrangements is HealthCare Appraisers’ most requested type of analysis 25 On-Call Compensation Payment Mechanisms Per diem (typically a 24-hour period) Per diem plus payment for unfunded care Payment earmarked to defray professional liability expense Payment for unfunded care (e.g., percentage of Medicare) “Activation fee” 26 Factors Affecting the Value of On-Call Services Frequency and nature of call events Telephone consults Required presence at the ED Required response time Integrity/availability of data Call frequency surveys 27 Factors Affecting the Value of On-Call Services Nature of the specialty OB (typically unfunded patients with no prenatal care) Surgeons (a surgical procedure is likely required, including follow up care) Compensation earned by such specialists for clinical work Number of physicians available to participate in call rotation 28 Factors Affecting the Value of On-Call Services Exposure to unfunded care Unfunded patients Low pay patients (e.g., Medicaid) Additional considerations “Restricted” vs. “unrestricted” call Required rapid response (e.g., TPA administration) Professional liability exposure Required coverage by medical staff bylaws 29 Establishing the Value of On-Call Services Approaches to Value There is no OIG safe harbor for on-call compensation The Market Approach is the most viable valuation approach A Cost Approach (i.e., hiring physicians) is generally impractical An Income Approach is not applicable 30 Establishing the Value of On-Call Services Market Values are of Limited Worth Generally, insufficient details are available to ensure comparability Two nearby hospitals may have significantly different operational characteristics Frequency of call Payer mix Trauma status 31 Establishing the Value of On-Call Services Physician-Reported Data May Be Unreliable The physicians are actually employed A certain number of days of call each month are uncompensated The compensation includes other services (e.g., GME responsibilities) The physician-reported values are simply incorrect 32 Establishing the Value of On-Call Services Proprietary Valuation Algorithm “Scores” the factors described above in a consistent and objective manner Certain factors are correlated. For example, if the call frequency is minimal, payer mix and professional liability may not be factors Establishes the value of clinical “work time” Determines the FMV range of “on-call time” as the product of the “score” and the value of “work time” Market data is still pertinent to corroborate the “analytical approach” 33 Hypothetical Example Specialty: General Surgery Step One: determine salary range for clinical services of general surgeons n= Mean 25th Percentile 1,001 $326,000 $236,000 $301,000 $376,000 $496,000 SCA 448 $283,000 $204,000 $264,000 $348,000 $400,000 HCS 377 $255,000 $192,000 $211,000 $296,000 n/a AMGA 971 $332,000 $241,000 $311,000 $393,000 $465,000 WW 134 $306,000 $245,000 $278,000 $350,000 $452,000 HG 215 $268,000 $207,000 $255,000 $322,000 $398,000 $255,000 $192,000 $211,000 $296,000 $398,000 $332,000 $245,000 $311,000 $393,000 $496,000 34 MGMA Lowest Value Highest Value 3,046 Median 75th Percentile 90th Percentile Hypothetical Example Step Two: “Gross up” salary range for benefits and taxes: Low: $255,000 + $45,000 = $300,000 High: $393,000 + $57,000 = $450,000 Then, convert to an hourly rate: Low: $300,000/2,080 hrs = $144/hour High: $450,000/2,080 hrs = $216/hour 35 Hypothetical Example Step Three: Determine appropriate oncall factor using proprietary algorithm Typical Factors: Nature of the subject specialty Number of specialists on the call panel Number of call shifts per physician per month % of poor payors (Indigent, Medicaid, etc.) Call frequency Events requiring physician presence at ED Events requiring telephonic response Payor Mix Other factors impacting the arrangement 36 Hypothetical Example Step Four: Calculate On-Call Rate Proprietary algorithm result: FMV range for On-Call hourly rate: 10% On-Call Factor (for example) Low: $144/hour x 10% = $14.40/hour High: $216/hour x 10% = $21.60/hour FMV range for On-Call per diem rate: Low: $14.40/hr x 24 hrs = $350 /24 hours High: $21.60/hr x 24 hrs = $520 /24 hours 37 Hypothetical Example Step Five: Consider Market Data Sullivan Cotter on-call market data Arrangements in our client database Other arrangements not in our client database Client/physician provided data for nearby hospitals 38 HealthCare Appraisers, Inc. East Coast-Corporate Office 75 NW 1st Avenue, Suite 201 Delray Beach, FL 33444 561-330-3488 West Coast 858 Happy Canyon Road, Suite 240 Castle Rock, CO 80108 303-688-0700 5175114v2 www.healthcareappraisers.com 39