Ted LeClair Presentation Fall 2012 CRM Forum

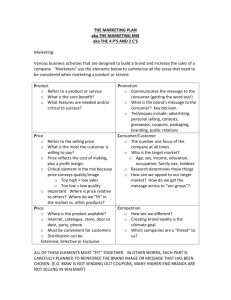

advertisement

Build your brand Essential strategies for uncovering your true value FOR INVESTMENT PROFESSIONAL USE ONLY ADVISOR EDUCATION Natixis Global Asset Management, S.A Asset management holding company • Over $706 billion in assets under management as of 12/31/11 • Among the top 15 largest asset management companies worldwide* • Our model allows for independent thinking among our asset managers FOR INVESTMENT PROFESSIONAL USE ONLY 2 Build your brand: Essential strategies for uncovering your true value Global presence, local insight Stockholm London Luxembourg Paris Boston Oakland Amsterdam Frankfurt Geneva/Zurich Milan Dubai Beijing Tokyo Taipei Singapore Santiago FOR INVESTMENT PROFESSIONAL USE ONLY 3 Build your brand: Essential strategies for uncovering your true value Sydney Our global capabilities Alternatives, equity and fixed-income solutions 1 Natixis Caspian Private Equity 1 1A division of Natixis Asset Management Advisors, L.P. FOR INVESTMENT PROFESSIONAL USE ONLY 4 Build your brand: Essential strategies for uncovering your true value Recognized for top money management talent NGAM Distribution, L.P. David Herro of Harris Associates L.P.1 Multisector Bond Team of Loomis, Sayles & Co.2 1. The Morningstar Manager of the Decade Award (2000-2009) is selected by Morningstar Fund analysts. The award is decided by evaluating the risks managers assumed to achieve investment return taking into account asset size, strength of the manager, strategy, and firm’s stewardship. There are five nominees for each award: domestic, foreign, and fixed-income. 2. Each year Morningstar selects managers who they believe have done right by shareholders, delivered superior long-term returns, and produced strong results for the year. Morningstar looks for good stewards who have developed sound strategies. FOR INVESTMENT PROFESSIONAL USE ONLY 5 Build your brand: Essential strategies for uncovering your true value Recognized as a global leader Natixis Global Asset Management, S.A Among 15 largest asset management companies worldwide1 •Among 15 largest asset management companies in Europe2 •Ranked #3 among European institutional managers as of June 20113 Investment & Pensions Europe •Ranked #3 among asset management companies in France as of June 20114 Markowitz Award: For paper, ‘Warning: Physics Envy May Be Hazardous to Your Wealth,’ Andrew Lo and Mark T. Mueller5 1. Cerulli Quantitative Update: Global Markets 2011, based on December 31, 2010 AUM of $713 billion. 2. IPE Survey, Listing of asset managers active in the European marketplace - June 2010, based on total assets under management as of 31 December 2009. 3. Investment & Pensions Europe, "The Top 400 Asset Managers", June 2011 - List of top 120 European institutional managers based on total third-party assets under management for all types of European institutional clients: pension funds, insurance companies, corporates, charities & foundations as of 12/31/2010. 4. Investment & Pensions Europe, "The Top 400 Asset Managers," June 2011 -- List of asset managers with headquarters in Europe on a country basis according to AUM worldwide as of 12/31/10. 5. The award, sponsored by The Journal of Investment Management and investment manager New Frontier Advisor, honors the influence of Mr. Markowitz’s work on both theoretical finance and the practice of asset management, according to a news release. FOR INVESTMENT PROFESSIONAL USE ONLY 6 Build your brand: Essential strategies for uncovering your true value Recognized for top money management talent Fixed-Income Fund Family of the Year Loomis Sayles Fixed-Income Family * Global Income Funds Category Winner for 10-Year Period Loomis Sayles Global Bond Fund, Institutional ** Multi-Sector Income Funds Category Winner for 10-Year Period *** Loomis Sayles Strategic Income Fund, Y *Loomis Sayles ranked #1 out of 41 eligible companies. Large complexes are defined as fund families with more than $34.5 billion in total net assets. Eligible asset class group awards are given to fund groups with at least five equity, five bond, or three mixed-asset portfolios in the respective asset classes. The lowest average decile rank of the three-year Consistent Return measure of the eligible funds per asset class and group will determine the asset class group award winner over the three-year period. In cases of identical results the lower average percentile rank will determine the winner. Asset class group awards will be given to the best large and small groups separately. Small groups will need to have at least three distinct portfolios in one of the asset classes – equity, bond, or mixed-asset. **The Lipper Fund Awards is part of an annual, global program of events held in 18 countries to reward funds that have delivered consistently strong riskadjusted performance relative to their peers. The winners were selected using the Lipper Leader rating for Consistent Return for the period ending December 31, 2010. Past performance is no guarantee of future results. ***The Lipper Fund Awards is part of an annual, global program of events held in 18 countries to reward funds that have delivered consistently strong riskadjusted performance relative to their peers. The winners were selected using the Lipper Leader rating for Consistent Return for the period ending December 31, 2010. Past performance is no guarantee of future results. FOR INVESTMENT PROFESSIONAL USE ONLY 7 Build your brand: Essential strategies for uncovering your true value Recognized for top money management talent Excellence in Fund Management Award Harris Associates: Clyde McGregor, Portfolio Mgr. * Mixed-Asset Target Allocation Funds Category Winner for 10-Year Period Oakmark Equity and Income Fund ** Large-Cap Core Category Winner for 3-Year Period Oakmark Fund *** *Managers had to have served a minimum of five years at a fund that is consistently top-rated by Lipper’s research analysts. Candidates were evaluated in criteria including risk-adjusted returns, total returns, expenses, and tenure. Evaluations were conducted in February 2011, based on data compiled through the end of 2010. **The Lipper Fund Awards is part of an annual, global program of events held in 18 countries to reward funds that have delivered consistently strong riskadjusted performance relative to their peers. The winners were selected using the Lipper Leader rating for Consistent Return for the period ending December 31, 2010. Past performance is no guarantee of future results. ***The Lipper Fund Awards is part of an annual, global program of events held in 18 countries to reward funds that have delivered consistently strong riskadjusted performance relative to their peers. The winners were selected using the Lipper Leader rating for Consistent Return for the period ending December 31, 2010. Past performance is no guarantee of future results. FOR INVESTMENT PROFESSIONAL USE ONLY 8 Build your brand: Essential strategies for uncovering your true value AlphaSimplex Group Expertise: Absolute return strategies Founded: 1999 Headquarters: Cambridge, MA AUM: $3.6 billion* Dr. Andrew Lo • Portfolio Manager and Chief Scientific Officer • Professor of Applied Mathematics, Massachusetts Institute of Technology • Author: A Non-Random Walk Down Wall Street *As of December 31, 2011 FOR INVESTMENT PROFESSIONAL USE ONLY 9 Build your brand: Essential strategies for uncovering your true value • Hedge fund beta replication strategies • Managed futures focus provides liquidity and transparency missing in many socalled alternatives • Based on Lo’s Adaptive Market Hypothesis Harris Associates Expertise: Value investments Founded: 1976 Headquarters: Chicago, IL AUM: $64.4 billion* David Herro Morningstar International Manager of the Decade, 2010 • Value specialists with experience that spans five decades • Reputation for consistency Bill Nygren *As of December 31, 2011 Past performance is no guarantee of future results. The Morningstar Manager of the Decade Award (2000-2009) is selected by Morningstar Fund analysts. The award is decided by evaluating the risks managers assumed to achieve investment return taking into account asset size, strength of the manager, strategy, and firm's stewardship. There are five nominees for each award: domestic, foreign, and fixed income. FOR INVESTMENT PROFESSIONAL USE ONLY 10 Build your brand: Essential strategies for uncovering your true value Gateway Investment Advisers Expertise: Hedged equity strategies Founded:1977 Headquarters: Cincinnati, OH AUM: $8.1 billion* Patrick Rogers CEO and Portfolio Manager Mike Buckius Portfolio Manager *As of December 31, 2011 FOR INVESTMENT PROFESSIONAL USE ONLY 11 Build your brand: Essential strategies for uncovering your true value • Hedged equity specialists • Call strategy born out of insights gained in 1987 market downturn Loomis, Sayles & Company Expertise: Actively managed, researchdriven equity and fixed-income portfolios Founded: 1926 Headquarters: Boston, MA AUM: $159.9 billion* Multisector Bond Team • Morningstar Fixed-income Manager of the Year, 20111 • Lipper Top Fixed-income Fund Family 20112 • Research-driven fixed-income and equity investments • Unique Analytical culture *As of December 31, 2011 Past performance is no guarantee of future results. Each year Morningstar selects managers who they believe have done right by shareholders, delivered superior long-term returns, and produced strong results for the year. Morningstar looks for good stewards who have developed sound strategies. 2 Criteria: Loomis Sayles ranked #1 out of 41 eligible companies. Large complexes are defined as fund families with more than $34.5 billion in total net assets. Eligible asset class group awards are given to fund groups with at least five equity, five bond, or three mixed-asset portfolios in the respective asset classes. The lowest average decile rank of the three-year Consistent Return measure of the eligible funds per asset class and group will determine the asset class group award winner over the three-year period. In cases of identical results the lower average percentile rank will determine the winner. Asset class group awards will be given to the best large and small groups separately. Small groups will need to have at least three distinct portfolios in one of the asset classes – equity, bond, or mixed-asset. 1 FOR INVESTMENT PROFESSIONAL USE ONLY 12 Build your brand: Essential strategies for uncovering your true value Today’s session is about helping you • Develop a strong personal brand as a financial advisor • Capture your share of the competitive high-net-worth market FOR INVESTMENT PROFESSIONAL USE ONLY 13 Build your brand: Essential strategies for uncovering your true value Our agenda • Review the meaning of a brand • Identify key elements of a STRONG personal brand • Provide tools, tips, and best practices for building your brand FOR INVESTMENT PROFESSIONAL USE ONLY 14 Build your brand: Essential strategies for uncovering your true value The dynamics of a corporate brand • Embody company values • Define an overall customer experience • Companies spend millions of dollars on extensive brand-building activities FOR INVESTMENT PROFESSIONAL USE ONLY 15 Build your brand: Essential strategies for uncovering your true value What’s the meaning of these brands? FOR INVESTMENT PROFESSIONAL USE ONLY 16 Build your brand: Essential strategies for uncovering your true value What’s the meaning of these brands? Instant information about anything you want to know FOR INVESTMENT PROFESSIONAL USE ONLY 17 Build your brand: Essential strategies for uncovering your true value What’s the meaning of these brands? FOR INVESTMENT PROFESSIONAL USE ONLY 18 Build your brand: Essential strategies for uncovering your true value What’s the meaning of these brands? Safety and reliability FOR INVESTMENT PROFESSIONAL USE ONLY 19 Build your brand: Essential strategies for uncovering your true value What’s the meaning of these brands? FOR INVESTMENT PROFESSIONAL USE ONLY 20 Build your brand: Essential strategies for uncovering your true value What’s the meaning of these brands? Excellence in quality coffee products – worth the price FOR INVESTMENT PROFESSIONAL USE ONLY 21 Build your brand: Essential strategies for uncovering your true value Everyone has a personal brand • It’s driven by what you believe in • It’s the impression your clients have of you • It’s demonstrated by your actions • Actions speak louder than words FOR INVESTMENT PROFESSIONAL USE ONLY 22 Build your brand: Essential strategies for uncovering your true value Strong personal brands lead to success Warren Buffett A master at uncovering hidden value Steve Jobs Creative innovator Oprah Winfrey Her stamp of approval is worth millions YOU! What is your brand? FOR INVESTMENT PROFESSIONAL USE ONLY 23 Build your brand: Essential strategies for uncovering your true value STRONG personal brands share three qualities: 1 2 They’re They’re unique relevant FOR INVESTMENT PROFESSIONAL USE ONLY 24 Build your brand: Essential strategies for uncovering your true value 3 They’re consistent QUALITY #1: They’re unique Your values – and the way you practice your values – make you unique. FOR INVESTMENT PROFESSIONAL USE ONLY 25 Build your brand: Essential strategies for uncovering your true value QUALITY #2: They’re relevant Advisors with strong brands attract the most attention from HNW clients because they offer something relevant. FOR INVESTMENT PROFESSIONAL USE ONLY 26 Build your brand: Essential strategies for uncovering your true value QUALITY #2: They’re relevant Relevant issues for high-net-worth individuals: • Resetting goals and expectations • Retirement income strategies • Risk management • Legacy planning and minimizing taxes FOR INVESTMENT PROFESSIONAL USE ONLY 27 Build your brand: Essential strategies for uncovering your true value QUALITY #3: They’re consistent If you fall short on consistency, you weaken your brand no matter how unique and relevant you are to clients. FOR INVESTMENT PROFESSIONAL USE ONLY 28 Build your brand: Essential strategies for uncovering your true value STRONG personal brands share three qualities: 1 2 They’re They’re unique relevant FOR INVESTMENT PROFESSIONAL USE ONLY 29 Build your brand: Essential strategies for uncovering your true value 3 They’re consistent Five steps to build your brand Key questions in developing your brand • What do you stand for? • How are you perceived? • What are the priorities and needs of your audience? • What is your plan? • How do you measure results and refine your approach accordingly? FOR INVESTMENT PROFESSIONAL USE ONLY 31 Build your brand: Essential strategies for uncovering your true value Step 1: Define what you stand for • Articulate the values that are important to you • Understand how you currently demonstrate these values to your clients • Determine your strengths • Identify where you need to improve Action items FOR INVESTMENT PROFESSIONAL USE ONLY 32 Build your brand: Essential strategies for uncovering your true value 1. Values Profiler 2. Kolbe Index Step 1 Action item: Values Profiler FOR INVESTMENT PROFESSIONAL USE ONLY 33 Build your brand: Essential strategies for uncovering your true value Step 1 Action item: Values Profiler Rate yourself: • Expertise and knowledge • Communications • Service delivery • Relationship building These scores will help identify where you’re strong, where you’re average, and where you have room for improvement. FOR INVESTMENT PROFESSIONAL USE ONLY 34 Build your brand: Essential strategies for uncovering your true value Step 1 Action item: Kolbe Index (www.kolbe.com) • A methodology to discover your natural abilities • An in-depth questionnaire that zeroes in on your personal, instinctive strengths FOR INVESTMENT PROFESSIONAL USE ONLY 35 Build your brand: Essential strategies for uncovering your true value Step 1 Action item: Kolbe Index (www.kolbe.com) Results show: • The value you can bring to a group/team • How to home in on your strengths and use them • How to make better use of your time FOR INVESTMENT PROFESSIONAL USE ONLY 36 Build your brand: Essential strategies for uncovering your true value Step 2: Understand how you are perceived • What do your clients say about you? • How do you emphasize your unique qualities? • How well are you meeting client needs? Action items 1. Win/loss checklist 2. Annual review questionnaire FOR INVESTMENT PROFESSIONAL USE ONLY 37 Build your brand: Essential strategies for uncovering your true value Step 2 Action item: Win/loss checklist • Track your wins and losses • Look for trends FOR INVESTMENT PROFESSIONAL USE ONLY 38 Build your brand: Essential strategies for uncovering your true value Step 2 Action item: Annual review questionnaire FOR INVESTMENT PROFESSIONAL USE ONLY 39 Build your brand: Essential strategies for uncovering your true value Step 3: Determine the priorities and needs of your audience • How well are you staying on top of client needs and concerns? • Are you leading with the strengths they value the most? • What feedback can you gain to deliver on client needs? • Are you maximizing your opportunities for referrals? Action item FOR INVESTMENT PROFESSIONAL USE ONLY 40 Build your brand: Essential strategies for uncovering your true value 1. Client Advisory Board Step 3 Action item: Client Advisory Board FOR INVESTMENT PROFESSIONAL USE ONLY 41 Build your brand: Essential strategies for uncovering your true value Step 3 Action item: Client Advisory Board themes New clients have been with you between 1 and 3 years Clients by profession or trade business owners, physicians, corporate executives Long-standing clients have been with you for more than 5 years Clients by demographic or lifestyle Executives, widowed/divorced, Gen-Xers Large clients as measured by assets or profitability Boards can be an invaluable tool to you and your team while making your important clients feel special. FOR INVESTMENT PROFESSIONAL USE ONLY 42 Build your brand: Essential strategies for uncovering your true value Step 4: Develop and implement a plan • What does your personal brand statement say about you? • Identify a timeline of activities to help you stay true to your personal brand and reach your potential as an advisor Action items 1. Personal brand message 2. Brand Builder Action Planner FOR INVESTMENT PROFESSIONAL USE ONLY 43 Build your brand: Essential strategies for uncovering your true value Step 4 Action item: Create a brand message FOR INVESTMENT PROFESSIONAL USE ONLY 44 Build your brand: Essential strategies for uncovering your true value Step 4 Action item: Brand Builder • Identify areas for improvement • Action items • Target completion dates FOR INVESTMENT PROFESSIONAL USE ONLY 45 Build your brand: Essential strategies for uncovering your true value Step 5: Measure results and refine your approach • Track your progress • Identify where you want to make changes Action items 1. Review scorecard results 2. Refine your plan, including your personal brand message/statement FOR INVESTMENT PROFESSIONAL USE ONLY 46 Build your brand: Essential strategies for uncovering your true value Step 5 Action item: Review scorecard FOR INVESTMENT PROFESSIONAL USE ONLY 47 Build your brand: Essential strategies for uncovering your true value Step 5 Action item: Refine results Review results with your coach Fine tune your Brand Builder action plan Complete Values Profiler — again! Invest in additional personal development Revisit and refine your personal brand statement FOR INVESTMENT PROFESSIONAL USE ONLY 48 Build your brand: Essential strategies for uncovering your true value Building Your Brand Natixis Global Asset Management is a partner and a TEAM with: • Ideas • Tools • Training • Resources FOR INVESTMENT PROFESSIONAL USE ONLY 49 Build your brand: Essential strategies for uncovering your true value Advisor Academy Seminars Build your brand Essential strategies for uncovering your true value Build your ideal practice Strategies to help take your practice to the next level Face to face Proactive communication strategies for volatile times Talk/Listen Four principles of effective client communication The referral generator Acquire ideal clients through existing ones Portfolio construction in a new era of risk How alternatives may help enhance portfolio diversification and better manage risk FOR INVESTMENT PROFESSIONAL USE ONLY 50 Build your brand: Essential strategies for uncovering your true value Fight the fear Strategies for confident investing Taking control of your retirement A guide to investing for the next stage of life To learn more, call 800-862-4863 or visit ngam.natixis.com Natixis Global Asset Management consists of Natixis Global Asset Management, S.A., NGAM Distribution, L.P., NGAM Advisors, L.P., NGAM International, LLC, NGAM, S.A., and NGAM, S.A.’s business development units across the globe, each of which is an affiliate of Natixis Global Asset Management, S.A. The affiliated investment managers and distribution companies are each an affiliate of Natixis Global Asset Management, S.A. This material should not be considered a solicitation to buy or an offer to sell any product or service to any person in any jurisdiction where such activity would be unlawful. NGAM Distribution, L.P. is located at 399 Boylston Street, Boston, MA 02116. FOR INVESTMENT PROFESSIONAL USE ONLY 51 Build your brand: Essential strategies for uncovering your true value AA40-1211 430543