ARENS 24 2158 02 Completing the Audit

advertisement

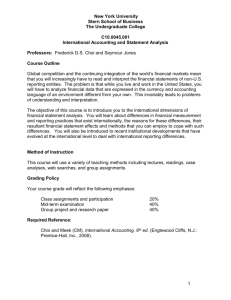

chapter 24 Completing the Audit auditing fall 2015 1 Jena describe what is meant by Interim Testing. auditing fall 2015 2 interim A auditing date on balance sheet B fall 2015 date report issued end of field work report date 12/31/15 C D 3 interim A auditing date on balance sheet B fall 2015 date report issued end of field work report date 12/31/15 C D 4 Contingent Liabilities / Attorney’s Letter Subsequent Events Management Representations analytical procedures Final assessment of audit risk - opinion communications to audit comm or mgmt • AU-c 260 Communication with Those Charged with Governance • AU-c 265 Communicating Internal Control Related Matters Identified in an Audit subsequent discovery of facts auditing fall 2015 5 unrecorded liabilities examining subsequent payments to suppliers and other creditors to ensure that they were correctly recorded. almost $5 million of purchases applicable to Dec. 31 audit period that had not been included as liabilities. auditing fall 2015 6 Contingent Liabilities / Losses • A potential future payment to an outside party from an existing condition • Uncertainty about the amount • Outcome will be resolved by future events auditing fall 2015 7 Contingent Liabilities / Losses • Lawsuits are an example of a contingency • Income tax disputes • Product warranties • Guarantees of the debts of others auditing fall 2015 8 Katie what does SFAS No. 5 (ASC 450) teach us about contingent losses or contingent liabilities auditing fall 2015 9 SFAS 5 (ASC 450) contingencies probable estimable probable reasonably possible reasonably possible not estimable estimable or not estimable disclose “ “ remote ignore ignore auditing fall 2015 record loss 10 SFAS 5 (ASC 450) contingencies auditing estimable can’t be estimated Probable accrue loss fn disclose Possible fn disclose fn disclose Remote do nothing do nothing fall 2015 11 Contingencies – lawsuits audit procedures • Inquire of management • Review minutes of BoD meetings • Analyze legal expense • Obtain a letter from each major attorney auditing fall 2015 12 Nicole Management is our primary source of information about Litigation, Claims and Assessments what is our most important source of evidence to corroborate managements’ representations regarding LCA ? auditing fall 2015 13 Inquiry of Client’s Attorney A list including (provided by client’s Senior Management) – Pending litigation – Asserted or unasserted claims Information about each item on list – Likelihood of an unfavorable outcome – Amount or range of potential loss A statement that the list is complete Page 348 auditing fall 2015 14 Huyen “Inquiry of a Client’s Attorney” this is an auditing procedure Who sends this letter to the attorney ? To whom does their attorney respond ? auditing fall 2015 15 Romy “Inquiry of a Client’s Attorney” what kind of problem do we have if their attorney refuses to respond ? what kind of report will we issue ? auditing fall 2015 16 Julissa Do we modify the first paragraph? Do we modify the Management’s Responsibility paragraph? Do we modify the Auditor’s Responsibility paragraph? Do we modify the Opinion paragraph? Is there a Basis for Opinion paragraph? Before or after? auditing fall 2015 17 auditing fall 2015 18 auditing fall 2015 19 interim A auditing B fall 2015 date report issued end of field work report date 12/31/15 C D 20 Katina describe the two types of subsequent events how do we decide whether to make an adjusting entry to include the effects of the subsequent event in the financial statement balances or just disclose the event in the footnotes auditing fall 2015 21 subsequent events Type I - adjusting journal entry a. Those (subsequent events) that provide evidence of conditions that existed at the date of the financial statements Type II - disclose b. Those (subsequent events) that provide evidence of conditions that arose after the date of the financial statements auditing fall 2015 22 Type I - adjusting journal entry • Declaration of bankruptcy by a customer with a large account receivable • Settlement of litigation for an amount greater than recorded • Sale of investments for less than recorded amount auditing fall 2015 23 Type II - disclosure • Issue bonds or equity securities • Merger or acquisition • Loss due to fire or natural disaster auditing fall 2015 24 subsequent events – auditing procedures inquire of management read internal financial statements read minutes of Bd of Directors’ meetings obtain a letter of representation page 353 auditing fall 2015 25 auditing fall 2015 26 AU-C Section 580* Written Representations Source: SAS No. 122. Effective for audits of financial statements for periods ending on or after December 15, 2012. Introduction Scope of This Section .01 This section addresses the auditor's responsibility to obtain written representations from management and, when appropriate, those charged with governance in an audit of financial statements. .02 Exhibit D, "List ofAU-C Sections Containing Requirements for Written Representations," lists other AU-C sections containing subject matter-specific requirements for written representations. The specific requirements for written representations of other AU-C sections do not limit the application of this auditing fall 2015 27 Letter of representation Management is responsible for the financial statements Management believes the f/s conform to GAAP All financial records have been made available All minutes have been made available Information concerning fraud or illegal acts Information concerning related party transactions Unasserted claims that are probable have been disclosed Subsequent events Page 355 auditing fall 2015 28 Julia Who prepares and signs the letter of client representations? auditing fall 2015 29 Christina we must obtain certain representations from management in writing what kind of problem do we have if the client refuses? what kind of report will we issue ? auditing fall 2015 30 Gordon Do we modify the first paragraph? Do we modify the Management’s Responsibility paragraph? Do we modify the Auditor’s Responsibility paragraph? Do we modify the Opinion paragraph? Is there a Basis for Opinion paragraph? Before or after? auditing fall 2015 31 Iris what is a “waived” or “passed” adjustment? on page 360 “unadjusted misstatement audit schedule” “summary of possible misstatements” auditing fall 2015 32 auditing fall 2015 33 Materiality page 122 minimum percent dollar earnings from operations current assets total assets current liabilities auditing 7,370 51,027 61,367 13,216 0.03 0.03 0.01 0.03 fall 2015 221 1,531 614 396 maximum percent dollar 0.06 0.06 0.03 0.06 442 3,062 1,841 793 34 Xiaodan at what three stages of the audit MAY we perform Analytical Procedures ? at what stages of the audit are we required to perform Analytical Procedures? auditing fall 2015 35 req’d planning phase substantive tests req’d at conclusion as an overall review auditing fall 2015 36 AU-C Section 520* Analytical Procedures Source: SAS No. 122. Effective for audits of financial statements for periods ending on or after December 15, 2012. Introduction Scope of This Section .01 This section addresses the auditor's use of analytical procedures as substantive procedures (substantive analytical procedures). It also addresses the auditor's responsibility to perform analytical procedures near the end of the audit that assist the auditor when forming an overall conclusion on the financial statements. Section 315, Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement, addresses the use of analytical procedures as risk assessment procedures (which may be referred to as analytical procedures used to plan the audit).1 Section 330, Performing Audit Procedures in Response to Assessed Risks and Evaluating the Audit Evidence Obtained, addresses the nature, timing, and extent of audit procedures in response to assessed risks; these audit procedures may include substantive analytical procedures auditing fall 2015 37 interim A auditing B fall 2015 date report issued end of field work report date 12/31/15 C D 38 Contingent Liabilities / Attorney’s Letter Subsequent Events Management Representations analytical procedures Final assessment of audit risk - opinion communications to audit comm or mgmt • AU-c 260 Communication with Those Charged with Governance • AU-c 265 Communicating Internal Control Related Matters Identified in an Audit subsequent discovery of facts auditing fall 2015 39 Jake M what is the definition of audit risk? auditing fall 2015 40 auditing fall 2015 41 material .05 0 known misstatement from samples auditing projected uncorrected misstatements fall 2015 42 final review of workpapers • all accounting and auditing questions have been resolved • support the auditor’s opinion • provide evidence the audit complied with GAAS • means of coordinating and supervising the audit auditing fall 2015 43 Dillon who is an “independent reviewer?” auditing fall 2015 44 dual dating events that occur between the end of field work (the report date) and the date the report is issued extend field work or dual date page 353 auditing fall 2015 45 dual dating p. 353 Hewlett-Packard has an October 31 year end Ernst & Young completed field work on November 13th On Dec. 6, 2001, Hewlett-Packard made a $1 billion dollar debt offering, which it disclosed in Note 19 in its financial statements. This is how Ernst & Young dated its auditor’s report November 13, 2001, except for Note 19, as to which the date is December 6, 2001. auditing fall 2015 46 interim A auditing B fall 2015 date report issued end of field work report date 12/31/15 C D 47 auditing fall 2015 48 auditing fall 2015 49 communication with audit committees • The auditor’s responsibilities • An overview of the scope of the audit – Approach to address significant risks • Corrected misstatements • Accounting practices & estimates • Difficulties & disagreements with management auditing fall 2015 page 36250 management letter auditing fall 2015 51 auditing fall 2015 52 auditing fall 2015 53 Deficiency in internal control. A deficiency in internal control exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent, or detect and correct, misstatements on a timely basis. A deficiency in design exists when (a) a control necessary to meet the control objective is missing, or (b) an existing control is not properly designed so that, even if the control operates as designed, the control objective would not be met. A deficiency in operation exists when a properly designed control does not operate as designed or when the person performing the control does not possess the necessary authority or competence to perform the control effectively. Material weakness. A deficiency, or a combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity's financial statements will not be prevented, or detected and corrected, on a timely basis. Significant deficiency. A deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness yet important enough to merit attention by those charged with governance. auditing fall 2015 54 Aleksandr what is the definition of control risk? auditing fall 2015 55 control risk the risk that a misstatement in an assertion about a class of transaction, account balance, or disclosure and that could be material, either individually or when aggregated with other misstatements, will not be prevented, or detected and corrected, on a timely basis by the entity’s internal control. auditing fall 2015 56 Tim what is a material weakness? auditing fall 2015 57 material weakness (page 177 ) a significant deficiency in internal control such that there is a reasonable possibility that a material misstatement would not be prevented, or detected and corrected on a timely basis auditing fall 2015 58 Ian what two types of control deficiencies do we report ? auditing fall 2015 59 Janet to whom do we report deficiencies in the internal controls ? auditing fall 2015 60 communication of internal control matters • communicate what – significant deficiency – material weaknesses • communicate to who – the audit committee – board of directors – owners or senior management auditing fall 2015 61 interim A auditing B fall 2015 date report issued end of field work report date 12/31/14 C D 62 Contingent Liabilities / Attorney’s Letter Subsequent Events Management Representations analytical procedures Final assessment of audit risk - opinion communications to audit comm or mgmt • AU-c 260 Communication with Those Charged with Governance • AU-c 265Communicating Internal Control Related Matters Identified in an Audit subsequent discovery of facts auditing fall 2015 63 auditing fall 2015 64 auditing fall 2015 65 Fischer vs. Kletz, 266 F. Supp. 180 (SDNY 1967), the auditor did not disclose errors in a previously issued audit report when (s)he discovered the errors three months later during a consulting engagement an auditor has a duty to anyone still relying on his report to disclose subsequently discovered errors in the report auditing fall 2015 66 subsequent discovery of facts existing at the date of the audit report the auditor should a. discuss the matter with management and, when appropriate, those charged with governance. b. determine whether the financial statements need revision and, if so, inquire how management intends to address the matter in the financial statements. auditing fall 2015 67 subsequent discovery of facts existing at the date of the audit report .16 If management revises the financial statements, the auditor should a. apply the requirements of paragraph . b. if the audited financial statements have been made available to third parties, assess whether the steps taken …. ensure that anyone in receipt of those financial statements is informed of the situation, auditing fall 2015 68 subsequent discovery of facts existing at the date of the audit report .17 If management does not revise the financial statements in circumstances when the auditor believes they need to be revised, then a. if the audited financial statements have not been made available to third parties, the auditor should notify management and those charged with governance—unless all of those charged with governance are involved in managing the entity4—not to make the audited financial statements available to third parties before the necessary revisions have been made and a new auditor's report on the revised financial statements has been provided. If the audited financial statements are, nevertheless, subsequently made available to third parties without the necessary revisions, the auditor should apply the requirements of paragraph .17b. b. if the audited financial statements have been made available to third parties, the auditor should assess whether the steps taken by management are timely and appropriate to ensure that anyone in receipt of the audited financial statements is informed of the situation, including that the audited financial statements are not to be relied upon. .18 If management does not take the necessary steps to ensure that anyone in receipt of the audited financial statements is informed of the situation, as provided by paragraphs .16b or .17b, the auditor should notify management and those charged with governance—unless all of those charged with governance are involved in managing the entity5—that the auditor will seek to prevent future reliance on the auditor's report. If, despite such notification, management or those charged with governance do not take the necessary steps, the auditor should take appropriate action to seek to prevent reliance on the auditor's report. (Ref: par. .A23–.A26) auditing fall 2015 69 subsequent discovery of facts existing at the date of the audit report auditing fall 2015 70 end of audit party auditing fall 2015 71 great quarter Because of You I enjoyed coming to “work” every day auditing fall 2015 72 congratulations to our December 2015 grads auditing fall 2015 73 auditing fall 2015 74 auditing fall 2015 75 auditing fall 2015 76 auditing fall 2015 77 auditing fall 2015 78 auditing fall 2015 79