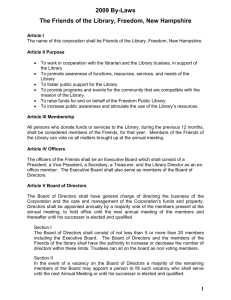

Common Law

advertisement