PPT - EisnerAmper

advertisement

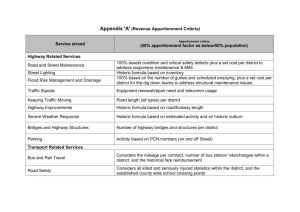

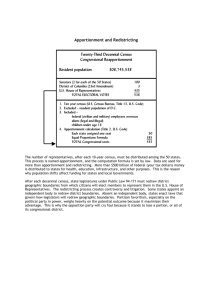

Tax Executives Institute – NJ Chapter Current Issues in Apportionment Gary C. Bingel bingel@amper.com Stephen J. Bercovitch bercovitch@amper.com Contents: Constitutional Background Issues with Apportioning Sales Other Than Those from the Sale of Tangible Personal Property Alternative Apportionment Relief Apportionment Issues with Flow-through Entities Constitutional Background Due Process Clause – concerned with fundamental fairness and notice: Must be some minimal connection (“slightest presence”) between the state and activities the state is seeking to tax (including the taxpayer itself); and Must be a rational relationship between the income attributed to the interstate and intrastate values of the entity. Constitutional Background Commerce Clause Must be “substantial nexus” with the state Tax must be fairly apportioned • Internal consistency test Tax must not discriminate against interstate commerce Tax must be fairly related to the services provided by the state and how income is earned. • External consistency test Overriding Constitutional Questions When evaluating apportionment formulas, the following should always be included in the thought process: Is the income being taxed rationally related to the value connected with the state and the benefits received? Are material income-producing factors excluded or disproportionately weighted? Discrimination? Apportioning Receipts Other than from the Sale of TPP Alternative Apportionment Relief UDITPA Section 18: If the allocation and apportionment provisions of this Act do not fairly represent the extent of the taxpayer’s business activity in this state, the taxpayer may petition for or the tax administrator may require, in respect to all or any part of the taxpayer’s business activity, if reasonable: • Separate accounting • The exclusion of any one or more of the factors • The inclusion of one or more additional factors which will fairly represent the taxpayer’s business activity in this state, or • The employment of any other method to effectuate an equitable allocation and apportionment of the taxpayer’s income. Alternative Apportionment Relief Contrast UDITPA’s “business activity” language (CA, NJ, NY, PA) with other states (CT, DE, MD) that reference a taxpayer’s “income.” Language often interchanged – E.g. MD’s statute references a taxpayer’s income, while the regulation references business activity. Some states use “or” language (business activity or income). E.g., NJ & NY Differences between locations of a company’s “business activity” and where “income is earned.” Some states provide for only the state to seek an alternative method and not the taxpayer (MD). Alternative Apportionment Relief Current Application: Single Factor Constitutionality? • Moorman Mfg. Co. v. Blair, 437 U.S. 267 (1978) • This case was NOT decided under current internal / external consistency framework, which didn’t come into place until five years later in Container Corp. of America v. FTB, 463 U.S. 159 (1983). • Case was also decided primarily on the failure to establish a base against which single-factor could be measured. Alternative Apportionment Relief Current Application Single Factor / Heavily Weighted Receipts / Throw-back / Throw-out • Do these formulas reasonably reflect how income is earned? External consistency? • Are a company’s property and payroll irrelevant to how a company earns its income? Aren’t they a significant measure of a company’s “business activities?” • Why do the laws of another state effect how your income is earned in another state? • Are these formula’s discriminatory? • Look to statements of legislators! Alternative Apportionment Relief Recent Case: In the Matter of Infosys Technologies, Ltd, NY tax App Tribunal (2/21/08): • India-based software firm was not allowed to utilize a separate accounting method to calculate its income for NY purposes, and was required to use worldwide income as its tax base. • The use of an alternative receipts factor was also denied. • Taxpayer was allowed to adjust its payroll factor based on the ratio of NY billable employees to total billable employees, due to disparate pay rates between NYC and India. Alternative Apportionment Relief Sword Cuts Both Ways: Even if you follow a state’s statutory guidance, the state may use these same arguments to alter your apportionment calculation. • Microsoft Corp. v. FTB, CA Supreme Ct. No S133343. 39 Cal.4th 750) (8/17/06) and other treasury function receipts cases. • In Microsoft, even though gross receipts marketable securities transactions may be properly included in the receipts factor, such inclusion would be distortive. Therefore, the apportionment formula was modified to include only the net proceeds in the receipts factor. Alternative Apportionment Relief How do you Obtain Relief? Some states have defined methods of seeking relief: • NY & NJ – Require pre-approval from the Dept of Rev. Taxpayer must file report using statutory formula. A request to vary the formula must be attached, along with the related computation and reasons for the variance. • MD – separate accounting permitted “if practicable.” • PA requires a taxpayer to “petition” the department for use of an alternative formula. However, no further guidance is given. For other states it is often not clear how relief is sought. • File, file and disclose, disclose through amended return? Alternative Apportionment Relief Timing? Is pre-approval required before utilizing alternative formula? • CA / NY / NJ all require taxpayer to receive approval before the filing date of the return. Alternative Apportionment Relief Other Issues for Obtaining Relief: Establishment of Baseline • Most cases are decided based on the inability to establish a proper baseline (See, e.g., Unisys v. PA, 812 A.2d 448 (10/25/02)), but how is such a baseline determined? • Use of economists? • Separate Accounting? Burden of Proof? • Clear and Convincing? • Other? Flow Through Entity Issues Many more states are taxing flow-through entities directly: OH MI TX NH TN Phila NYC Flow Through Entity Issues Threshold question – is there jurisdiction to tax the owners of flow-through entities under the Due Process Clause? The owners of flow-through entities are legal entities separate and apart from the pass-through entities themselves. Thus, a question exists as to whether under the Due Process Clause a state can require an owner to treat income from a flow-through entity as apportionable income absent a unitary relationship. • One factor to consider is whether flow-through treatment was elective (eg, S corps). • Is there limited liability? • Does the flow-through serve a purely investment function? • Is ownership less than 50% Flow Through Entity Issues Assuming the jurisdiction has the right to tax the owners, how are apportionment factors calculated? Flow-through of all factors? (Typical treatment) • Unitary relationship? Some states (e.g., CA) require a flow-through of factors when a unitary relationship exists. • Other special rules; e.g., previously IL did not deem second tier partnerships unitary and thus did not flow-up factors more than one level. • Elimination of intercompany transactions with partnership? IL DOR Ruling IT 08-0001-PLR (5/19/08) Distributive share as gross receipt? Specific allocation of pass-through income • LA / MS / OK all require partnership income to be specifically allocated based on where earned. Flow Through Entity Issues Determination of Business / Non-business Income At the partnership level – IL At the partner’s level – PA Most states don’t address Flow Through Entity Issues Calculation of Throw-back / Throw-out and Joyce / Finnigan issues: Is the determination made at the partnership level or the partner level when determining sales to be thrown back / out? • Joyce states – each entity’s apportionment factors are calculated independent of the others, and then combined. Thus, a partnership’s sales to a state where it doesn’t have nexus may be subject to throwback despite the fact that the corporate partner has nexus in such state.