UPPA - State Law Resources

advertisement

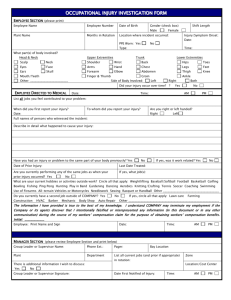

UPPA: A Persistent Problem for Policyholders, Regulators and Insurers A Presentation to the Market Actions (D) Working Group of the National Association of Insurance Commissioners Tuesday, December 17, 2013 Washington, DC 2 UPPA—Unauthorized Practice of Public Adjusting UPPA—What is It? UPPA is the Unauthorized Practice of Public Adjusting UPPA is usually perpetrated by contractors including roofers, plumbers and electricians, and sometimes even accountants and other professionals, including public adjusters operating in areas for which they are not licensed UPPA perpetrators prey upon unsuspecting insureds with promises of big paydays, deductible reimbursements, no hassle claims settlements, etc., without any protection of law or regulation NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 3 UPPA From the Headlines… “Contractors Acting as Public Insurance Adjusters Irk States,” Insurance Journal, July 29, 2011: “[S]tates are cracking down on roofing and other contractors who pass themselves off as claims adjusters for customers.” “Contractor Ordered to Cease and Desist from Unlicensed Public Adjusting,” Property Insurance Coverage Blog, February 2, 2013: “It is important for policyholders to understand they should ask those who attempt to do any [public adjuster-specific activities] whether they are a licensed and bonded public insurance adjuster before they sign any agreements or allow work to be performed.” NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 4 UPPA From the Headlines… “Indiana bars unlicensed Illinois insurance adjusters from Lake County,” Northwest Indiana Business via NWI.com. June 12, 2013: Three public adjusters licensed in another state were not allowed to practice in Indiana because they did not hold valid Indiana licenses. “Roofers acting as Unlicensed Public Adjusters…busted!” Claimconcepts.com, May 11, 2013: “Public Adjusters do NOT do property repairs and a Contractor should never attempt to advise a client and negotiate on their behalf in times of an insurance claim.” NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 5 UPPA Case Study # 1 Large insurance brokerage (not agency) acquires a small accounting agency to help the brokerage assist clients with “forensic accounting, property insurance, property insurance, exposure quantification, forensic analysis and risk consultancy” in such complex claims areas as business interruption and property damage, including “megaloss disaster response.” Blurring the lines between broker assisting clients with a claim and doing the business of public adjusting, without the benefit of a license to perform such activities NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 6 UPPA Case Study # 2 Company holding itself out as a roofing and siding contractor also promises to “assist you with contacting your insurance company to report the loss…prepare a detailed report of all the damage…[and] meet with your insurance company to discuss the necessary storm, wind or hail damage repairs.” Company emphasizes hail damage which is a particular favorite of contractors engaged in adjusting No mention of being licensed as a public adjuster; relies on “Angie’s List” and BBB logos to show legitimacy. NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 7 UPPA UPPA—Why It Is A Problem For policyholders: they are dealing with largely unregulated entities, with no protections in the law, and are oftentimes left having to chase contractor to perform services which have been paid for through insurance proceeds For insurers: while some insurers and independent adjusters may be complicit in negotiating with known UPPA predators as opposed to licensed PAs, many insurers now understand they fall victim to the haphazard negotiations and false promises made by UPPAs to their insureds For PAs: UPPAs are responsible for many of the problem situations that are being characterized as public adjuster frauds, they unfairly compete for business in a largely unsophisticated and unregulated manner, and they create an overall atmosphere of distrust in the claims environment NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 8 UPPA UPPA—Why It Is A Problem For regulators: with no direct oversight of UPPAs, their practices have gone largely unchallenged by insurance regulators, who are primarily focused on enforcing laws pertaining to regulated/licensed entities. Other enforcement bodies, such as local and state prosecutors, look at this as an “insurance issue” and default back to insurance regulators, while the regulatory stakeholders, e.g. policyholders, insurers and public adjusters, all continue to suffer from an issue that has fallen between the proverbial cracks NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 9 UPPA NAPIA’S UPPA Initiative Outreach to individual insurance departments to educate on UPPA, discuss challenges to effective enforcement, promote those states incentivized to enforce, take direct legal action and support legal actions where necessary and appropriate NAPIA leadership has determined this to be top priority issue for 2014, and must be addressed regardless of perpetrator of unauthorized practices NAPIA coordinating with departments and other emergency management resources to also monitor adjuster activities in catastrophes, improve temporary licensure of PAs and move PAs into operating areas to expedite claims settlement NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 10 UPPA NAPIA’s UPPA Initiative While recognizing that some states allow adjusters to also serve as contractors, NAPIA has been supportive of initiatives to prohibit PAs from also serving as contractors, such as is the law in Texas NAPIA has also assiduously worked to protect against the inflation of damage claims, inflate the scope of damage, or do other things that are unlawful, unethical or contrary to the consumer’s interest and integrity of the insurance marketplace NAPIA has also promoted and supported licensing of all public adjusters, continuing education of PAs and other initiatives to improve professionalism of those licensed as PAs NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 11 UPPA Enforcement Actions In The States Some states have taken aggressive action against UPPA, and that action is greatly appreciated by NAPIA; however, the action has been limited to a few states, and they acknowledge the shortage of internal resources, natural nexus to the perpetrators, and challenges in coordinating with other enforcement agencies to effectively combat UPPA Enforcement by insurance regulators is generally limited to cease-and-desist orders for an unauthorized practice of insurance, and perhaps insurance fraud violations in certain instances Most states surveyed, though, find the C&D to be an ineffective deterrent and too little an outcome for too much work in tracking UPPA cases NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 12 UPPA Enforcement Actions in the States The Problem with C&Ds Limited civil impact, and no criminal penalties No central repository of C&Ds issued Transient and “multiple identity” contractors evade most implications of C&Ds or multiple offenders NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 13 UPPA Enforcement Actions in the States Enforcement usually falls to the attorneys general or district attorneys (rarely to the US attorneys, though they would have standing to sue/prosecute under theories of interstate commerce) AGs limited in many instances to civil cases rather than criminal prosecutions Civil fines and even practice prohibitions generally do not prevent perpetrators from moving to another state as there is no database tracking contractors NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 14 UPPA Enforcement Actions In The States--Colorado In response to an inquiry as to whether a roofer can “handle” an insurance claim, the Division opined: The Division does not regulate the roofing contractors, nor do we enforce the provisions of SB 38, which fall under Title 6 of the Colorado Revised Statutes. However, if the contractor were to transact the unauthorized business of insurance, the Division would investigate the roofers actions. Roofers, or any other contractor, cannot negotiate the settlement of a claim without a public adjuster license; the roofer cannot negotiate the amount of claim settlement and cannot take the claim out of the consumer’s hands. NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 15 UPPA Enforcement Actions in the States — North Carolina In describing protocols for adjuster activities in post-disaster environment, Commissioner Goodwin made clear that “there is no provision in Article 33A allowing public adjusters to adjust claims in NC without a public adjuster license in times of catastrophic emergencies.” (Bulletin 13-B-02) North Carolina’s focus on the licensing status of those holding themselves out as public adjusters, whether contractors or PAs from other states, is appreciated NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 16 UPPA Enforcement Actions in the States--Texas Commissioner’s bulletin focused on problem of unlicensed parties and how they “prey on unknowing consumers by promising to ‘work’ insurance claims to achieve a higher settlement.” Department’s advisory went to all licensed entities, including insurers, to be on alert for these perpetrators: “The department takes seriously the harm unlicensed individuals and entities can cause on the marketplace when they prey on unsuspecting consumers and the industry. I urge insurers, agents, adjusters and consumers to help call attention to and halt attempts by unlicensed persons to negotiate insurance claims, and I encourage everyone to report these practices to the department and the TDI Fraud Unit.” NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 17 UPPA Enforcement Actions in the States—Texas Texas is to be commended for having the most progressive platform of public adjuster regulation and enforcement Law prohibiting PAs from having financial interest in contractors Model act implementation Advisory council including PAs, independent adjusters and insurers—”huge advantage having PAs on the council”—TDI official NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 18 UPPA Enforcement Action in the States--Ohio Special mention is needed also for Ohio’s aggressive pursuit of contractors generally and when they serve as insurance claims adjusters An important part of the contractor scam is to maintain control of the insurance relationship, from beginning to end, which means a consumer must not seek out the services of a licensed and authorized public adjuster Ohio’s Insurance Department has worked to coordinate efforts among the numerous local prosecutors, state prosecutors and licensed insurance entities to improve the understanding of the UPPA problem NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 19 UPPA Enforcement Actions in the States — Ohio “Despite state laws, contractors have been found to be acting in the capacity of public insurance adjusters Contractors are advertising and/or including language in their contracts indicating they will assist the homeowner in the filing, negotiation and/or settlement of their claim Contractors are charging consumers a set fee to file, negotiate and/or settle their claim” -- Ohio Insurance Department NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 20 UPPA Enforcement Actions in the States — Ohio Contractors are requiring consumers to sign a power of attorney relative to their insurance claim Contractors are filing claims on the consumer’s behalf Contractors “representing” and/or speaking for the insured. Contractors are intercepting insurance proceeds. Excerpted from Ohio Insurance Department publication on UPPA NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 21 UPPA Enforcement Actions in the States — Kansas Attorney General brought civil action against roofing contractor under the Kansas Consumer Protection Act for alleged fraud arising from hail damage Insurer advised insured to contact roofer, independent adjuster negotiated with roofer, and consumer signed over proceeds of insurance claim settlement to the roofer Roof repairs were never completed Petition only included typical consumer-related claims, such as forgery and fraud, rather than insurance-related claims as well including UPPA, insurance fraud or other insurance law violations as it predated a new roofers law implemented in July, 2013 NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 22 UPPA Enforcement Actions in the States — Illinois Classic “storm-chaser” scenario where contractor serves to expedite insurance claims settlement with insurer, requires up front payment for services and then either doesn’t do work or does so in inferior manner UPPA is a critical part of the fraud: it is the pathway to the money that turns out to be the key to the consumer fraud Challenge is that insurers are pressed to settle claims quickly, especially in event of catastrophes, which drives independent adjusters to expedite settlement discussions with any representative of the homeowner, and most times it turns out to be a contractor NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 23 UPPA Enforcement Opportunities Enforcement Bulletins: As in Texas, Oklahoma, Minnesota, North Carolina, and Arizona, states can issue enforcement bulletins to all licensees—sharing with other law enforcement as well—that raises awareness to the problem of UPPA and provides specific recitation of the laws pertaining to public adjusting. Market Monitoring: Especially websites and advertising both during regular periods and during catastrophes, is essential Cat Response Emergency PA Licenses: States, by including public adjuster licensing in emergency licensing and PAs in disaster area access protocols, can reduce the incidence of contractor UPPA perpetration in post-disaster recovery period NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 24 UPPA Enforcement Opportunities Development of independent adjuster licensing laws and continuing education programs would help address issue of UPPA if only to alert IA community of prevalence of the problem Sometimes unlicensed also means untrained or uninformed, especially about UPPA, so improved regulatory oversight of IAs could improve the situation NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 25 UPPA Enforcement Opportunities Expansion of use and publicizing of cease and desist letters: while of limited value as compared to more assertive law enforcement, C&Ds can be “early warning signs” to UPPA community that regulators are aware and monitoring marketplace and publication/tracking of C&Ds take use of these tools to a new level Interagency Task Force: given limitations of authority of insurance regulators to enforce laws against non-licensed entities, commissioners can join forces with attorneys general, federal prosecutors (on an interstate commerce theory) to bring more serious general business practice fraud and other charges for major perpetrators NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 26 UPPA Enforcement Opportunities Model Legislation/Amendments to Model Act #228 Require that all PAs identify that they are licensed to manage claims, and require all non-PAs to acknowledge that they are not licensed as PAs. Require insurance companies and independent adjusters to request identification of any party purporting to represent insured consumer Inclusion of UPPA in definition of insurance fraud Create public adjuster councils in each state, such as that in Texas, to educate and inform regulators on the incidence of UPPA, and discuss other issues of interest to PAs. NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 27 UPPA Enforcement Opportunities 2014 Charge to Market Regulation and Consumer Affairs (D) Committee: NAPIA requests (D) Committee to focus on improved monitoring and enforcement of independent and public adjusters in the marketplace, and discussion of improved surveillance opportunities or methodologies for rooting out and preventing UPPA TF of NAIC focused on UPPA and other enforcement-related issues: Anti-fraud WG, MAWG, Producer Licensing, Cat WG, including Roundtable presentation or public hearing on the problem of UPPA, can be the execution on this charge NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 28 UPPA Summary of Enforcement Opportunities Model Act revisions designating UPPA as insurance fraud, requiring confirmation of party’s authority to settle claims Issuance of departmental bulletins advising of perils of UPPA and need for market surveillance Development of CD tracking database Creation of public adjuster advisory councils Include public adjusters in emergency licensing protocols during disasters Interagency task forces with insurance regulators, AGs and other prosecutors Greater enforcement focus in various working groups of NAIC through development of TF and inclusion in D committee 2014 charge NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 29 UPPA QUESTIONS NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 30 UPPA Contacts David Barrack, Executive Director Brian Goodman, General Counsel NAPIA Pessin Katz 21165 Whitfield Place 901 Dulaney Valley Road Suite 105 Suite 400 Potomac Falls, VA 20165 Towson, MD 21204 david@napia.com bgoodman@pklaw.com NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 31 UPPA Contacts Gregory V. Serio Art Jansen, Jr., Texas, President NAPIA/NAIC Liaison Karl Denison, Maryland, President-elect Park Strategies, LLC Ron Reitz, California, Imm. Past President 101 Park Avenue Scott DeLuise, Colorado, First Vice President New York, NY 10178 gserio@parkstrategies.com NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS 32 UPPA About NAPIA The National Association of Public Insurance Adjusters is the oldest and largest association of its kind in the United States serving the public adjuster profession and striving for excellence in the practice of public adjusting. Its members are experts in public adjusting who have joined together for the express purpose of professional education, obtaining certification and promoting a rigid code of professional conduct and ethics. NATIONAL ASSOCIATION OF PUBLIC INSURANCE ADJUSTERS