The Federal 340B Program

advertisement

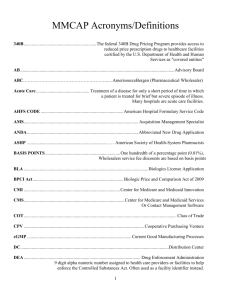

The Federal 340B Program Facts, Figures, Opportunities, and Pitfalls Presented By: Shrujal Patel M.S. RPh. MBA Introduction to 340B and Relevant Trends SECTION 1 2 340B Timeline 3 Intent of 340B • What 340B Is….. – Program designed to provide savings on outpatient drugs to entities that serve a proportion of vulnerable patient populations – Savings are realized by increasing the margin between reimbursement from commercial payers and actual acquisition cost • What 340B Isn’t….. – A program that provides low cost drugs directly to indigent patients (although in some instances, this does occur) 4 Relative Pricing (Brand Name) 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 100% Private Sector Pricing 79% 66% “Best Price” 63% 64% 58% 53% 51% Adapted from a slide by Safety Net Hospitals for Pharmaceutical Access Source: Data derived from Prices for Brand-Name Drugs Under Selected Federal Programs, Congressional Budget Office (June 2005) 49% 42% 5 340B Statistics • 17,162 OPA Registered Entity Sites • 12,225 Participants in the 340B Prime Vendor (73%) • Over 11,000 OPA Registered Contract Pharmacies • $6 Billion/year in 340B drug purchases * 2012 Statistics 6 Entity Types Hospital Types Federal Grantees • Disproportionate Share Hospital • Federally Qualified Health Center • Children’s Hospital • Federally Qualified Health Center Look-Alikes • Critical Access Hospital • Title X Family Planning Grantees • Free-Standing Cancer Hospital • State Aids Drugs Assistance Programs • Rural Referral Center • Ryan White Care Act Grantees (A,B,C,D,F) • Sole Community Hospital • Black Lung Clinics • Hemophilia Treatment Centers • Native Hawaiian Health Centers • Urban Indian Organizations • Sexually Transmitted Disease Grantees • Tuberculosis Grantees 7 Hospitals; What’s the Difference? Non Profit or Government Contract DSH % GPO Exclusion Orphan Drug Exclusion DSH Hospital Yes >11.75% Yes No Children's Hospitals Yes >11.75% Yes No Free-Standing Cancer Hospital Yes >11.75% Yes Yes Rural Referral Center Yes ≥8% No Yes Sole Community Hospital Yes ≥8% No Yes Critical Access Hospitals Yes N/A No Yes Covered Entity Type 8 340B Compliance SECTION 2 9 Compliance Covered Entity is Responsible for Ensuring: 1. Entity Eligibility 2. Patient Eligibility – see “patient definition” 3. Against duplicate discounts a) Medicaid “carve-in” vs. “carve-out” 4. Adherence to (if applicable): a) GPO Prohibition b) Orphan Drug Exclusion 10 Patient Definition An individual is a patient of a 340B covered entity only if: • the covered entity has established a relationship with the individual, such that the covered entity maintains records of the individual's health care; and • the individual receives health care services from a health care professional who is either employed by the covered entity or provides health care under contractual or other arrangements (e.g. referral for consultation) such that responsibility for the care provided remains with the covered entity; and • the individual receives a health care service or range of services from the covered entity which is consistent with the service or range of services for which grant funding or Federally-qualified health center look-alike status has been provided to the entity. Disproportionate share hospitals are exempt from this requirement. An individual will not be considered a patient of the covered entity if the only health care service received by the individual from the covered entity is the dispensing of a drug or drugs for subsequent self-administration or administration in the home setting. Exception: Individuals registered in a State-operated or funded AIDS Drug Assistance Program (ADAP) that receives Federal Ryan White funding ARE considered patients of the participant ADAP if so registered as eligible by the State program. 11 340B Qualified Drug Utilization • Drug must be administered to a qualified patient (per patient definition on previous slide) • 340B is for outpatient use only • Drugs must be administered in a hospital point of service that would qualify as a “reimbursable cost center” on a Medicare cost report • 100% hospital owned (i.e. joint ventures are not eligible) • Non-profit (i.e. for profit subsidiaries are not eligible) • Same tax ID number as the hospital • Outpatient facilities (Physician clinics, surgery centers, etc.) • Ownership of inventory • Proximate relationship • Employed Physicians 12 340B Virtual Inventory Process Patient received a drug as part of an outpatient service at covered entity 340B drugs are placed into inventory and can be used on any patient Patient billing system is queried for outpatient drug charges Wholesaler ships drugs to covered entity CDM to NDC Crosswalk is used to convert CDM quantities to packages Pharmacist uses “available package list” to reorder drugs on the 340B account 13 Prohibitions GPO • Relevant for DSH, Children’s, and Cancer Hospitals • Requires that outpatient meds for 340B eligible outpatients be purchased at 340B, inpatients at GPO, and 340B ineligible outpatients at a non-GPO price; typically WAC ORPHAN DRUG • Relevant for Cancer, RRC, SCH, and CAH • (PREVIOUSLY) For these entities, any drug that has a Orphan Drug indication (primary, secondary, or otherwise); the 340B price cannot be leveraged • As of 7/24/13 – Only if the drug is used for the orphan indication 14 340B Covered Drugs As defined by SSA 1927(k) – definition of “Covered Outpatient Drugs” Covered Drugs Not Covered Outpatient drugs Inpatient drugs OTC’s with a prescription Vaccines Drugs that are bundled with a procedure (not charged/reimbursed as a line item) Biologics Insulin Clinic administered drugs 15 Tracking and Reporting All participating hospitals MUST maintain an audit trail for ALL 340B purchases. Data required for the audit trail includes: • • • • 340B purchase history GPO purchase history Patient billing records including patient classification (IP/OP) List of eligible points of service and DSH Adjustment factor calculation • Specifications used to define outpatient utilization query • CDM to NDC Crosswalk • Policies and Procedures 16 Tracking Requirements • Hospital must be able to prove that the drugs purchased on the 340B account were administered to an outpatient in an eligible point of service • Patient level detail • Identify qualified patients • Patient Type, Status, and/or Point of Service • The 340B program must be implemented in all qualified outpatient points of service • Both “Mixed” & “Clean” areas • Two options: • Separate 340B Inventory • Retrospective Purchasing 17 Audits • All 340B enrolled entities agreed to be subject to audits at the time that they joined the program. Audits can be requested by the Office of Pharmacy Affairs AND by pharmaceutical manufacturers. • 340B has been added to the OIG work plan and the OIG has issued several memos discussing the need for additional regulation of the 340B program. • As a result of ballooning 340B enrollment, pharmaceutical manufacturers have seen revenue erosion on many drugs. 18 340B Multiple Contract Pharmacy SECTION 3 19 What is Contract Pharmacy? • Any relationship between a pharmacy services provider and another entity whereby the pharmacy provider is conducting said pharmacy business on behalf of the other entity in exchange for an agreed upon contracted rate. Revenues, patient data, and cost of goods belong to the contracting entity and fees belong to the pharmacy. Contract Rx Fees Patient Traffic Revenue Cost of Goods Sold Patient Rx Data 20 How Does it Work? 21 Benefits of 340B Contract Pharmacy • For the Covered Entity – Expands the reach of the 340B program, thus directing more “savings” to the entity to support care • For the Pharmacy – Potential up-tick in profitability (if dispense fee is calculated correctly – Profit without drug carrying costs – better cash flow 22 Contract Rx Growth 23 Contract Pharmacy Relationships Type Positives Negatives Chain • High volume • Large revenues • High fees • Arduous terms Independent • Better MTM • Lower fees • Smaller volumes • Lower revenues Mail order • Potentially high volume • Not limited geographically • Lack of compliance control • No visibility of operations Joint venture/Subsidiary* • Financial Transparency • Operational control • Potentially low volume • Potentially low revenue Third Party Administrator • Limited necessity for internal controls • High fees • Lack of program control * Not above the line or on the covered entity cost report 24 Third-Party Administrators • What are they? – Typically a software or management company Software Company Examples Mgmnt. Company Examples Macro Helix SunRx Sentry Wellpartner • What do they do? – Use data and/or analytics to determine eligible claims – Reconcile finances between pharmacy and CE – Provide audit reporting • Risks and Benefits? 25 Due Diligence - Examples Example Issue Risk Dispense Fee • Dispense fees that are too low can result in losses to pharmacy; too high can raise kick-back concerns for the covered entity Payment Cycle • Potential for negative cash flow Slow-movers • Carrying cost burden to the pharmacy without the benefit of revenue Indemnification • Liability may arise as a result of negligence on the part of either party Reconciliation • Adequate data not provided on a regular basis 26 Financial Due Diligence • Pro forma – Parallel pro-formas are suggested to determine current and future state earnings • Margin analysis – Estimate counterparty margin based on available data (e.g. 10K for publically traded chain pharmacy) – Model entity margins using frequency bands (see next section) • Cash flow analysis – Use payment terms from supplier and vendor agreement to model cash flow • Fee structure optimization – Functional aspect of financial model; utility for bi-lateral due diligence – Situation where 340B entity owns both operations or is contracting with a “friendly” vendor 27 “Dispense Fees” • Contract Pharmacy Dispense Fee: – What does the dispense fee represent? • Represents a “hurdle rate” • Does not represent operating costs (dispense fees from third party payers represent operating costs; this is not the same thing RETAIL PHARMACY PBM PHARMACY Revenue = Reimbursement Rate + Dispense Fee 340B CONTRACT PHARMACY PBM PHARMACY 340B ENTITY Revenue = Reimbursement Rate + Dispense Fee 340B Dispense Fee Profit Profit = Revenue – = 340B Dispense Fee (COGS + OPS Cost) Ops Cost - Profit = Revenue (COGS + 340B Dispense fee) 28 Analyses – Pro-Forma COVERED ENTITY NAME HERE "CHAIN PHARMACY" 340B CONTRACT PHARMACY INITIATIVE: Pro forma (Current State) QUARTER 2011 ANNUALIZED YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 TOTAL REVENUE Gross Receipts (by "Chain Pharmacy" on behalf of CE) $ 6,641,344.48 $ 26,565,377.92 $ 27,893,646.82 $ 29,288,329.16 $ 30,752,745.62 $ 32,290,382.90 $ 33,904,902.04 $154,130,006.53 Fees $ (1,469,091.67) $ (5,876,366.69) $ (6,170,185.02) $ (6,478,694.27) $ (6,802,628.99) $ (7,142,760.44) $ (7,499,898.46) $ (34,094,167.18) Net Revenue $ 5,172,252.81 $ 20,689,011.23 $ 21,723,461.79 $ 22,809,634.88 $ 23,950,116.63 $ 25,147,622.46 $ 26,405,003.58 $120,035,839.35 OPERATING EXPENSES Cost of Goods Sold $ (2,111,211.62) $ (8,444,846.50) $ (8,867,088.82) $ (9,310,443.26) $ (9,775,965.43) $ (10,264,763.70) $ (10,778,001.88) $ (48,996,263.09) Labor $ Technology $ - $ - $ - $ - $ - $ - $ - $ - Additional Internal Audit $ - $ - $ - $ - $ - $ - $ - $ - Total Expenses $ (2,143,711.62) $ (8,574,846.50) $ (8,999,688.82) $ (9,445,695.26) $ (9,913,922.47) $ (10,405,479.88) $ (10,921,532.39) $ (49,686,318.81) (32,500.00) $ (130,000.00) $ (132,600.00) $ (135,252.00) $ (137,957.04) $ (140,716.18) $ (143,530.50) $ (690,055.73) OPERATING PROFIT $ 3,028,541.18 $ 12,114,164.74 $ 12,723,772.97 $ 13,363,939.62 $ 14,036,194.16 $ 14,742,142.58 $ 15,483,471.20 $ 70,349,520.54 Net Proceeds to "Chain Pharmacy" % of CE True Net $ 1,469,091.67 $ 5,876,366.69 $ 6,170,185.02 $ 6,478,694.27 $ 6,802,628.99 $ 32% 32% 32% 32% 32% 7,142,760.44 $ 32% 7,499,898.46 $ 34,094,167.18 32% 32% 29 Analyses – Assumption Tables Rx Volume Annually 32976 131904 31526 126104 Auto-populates from raw data Used for “fee-modeling” Quarterly Total # of Rx in Data Set Total # of Eligible 340B Prescriptions Fees Administration Fee $ 15.00 Coordination of Benefit Fee ($) $ - Coordination of Benefit Fee (%) 15% Additional Expenses Additional FTE (Annually) Technology Costs Additional Internal Audit Costs $ 130,000.00 $ $ - Growth Rates Gross Receipts 5% Cost of goods sold 5% Labor Technology Internal Audit 2% 0% 0% Estimated "Chain Pharmacy" BATNA Method 1 Revenue $ 26,565,377.92 COGS (est. by adding back 65% COGS) $ (24,128,132.85) Net $ 2,437,245.07 Method 2 Revenue $ 26,565,377.92 Estimated Margin 21% Net $ 5,578,729.36 BATNA AVG: $ 4,007,987.22 Auto-populates from pro forma 30 Analyses – Distribution & Margin Primary Analytics # of Rx 7639 6278 15258 1434 917 % of Rx 24.23% 19.91% 48.40% 4.55% 2.91% Avg. Revenue $ 34.08 $ 73.62 $ 194.62 $ 661.97 $ 2,181.07 Revenue Total Revenue $ 260,324.81 $ 462,203.27 $ 2,969,510.50 $ 949,267.29 $ 2,000,038.61 Avg. COGS $ 6.01 $ 17.72 $ 59.45 $ 208.49 $ 815.65 Total COGS Avg. Margin Before Fees $ 45,917.69 82.36% $ 111,268.33 75.93% $ 907,098.38 69.45% $ 298,971.61 68.51% $ 747,955.62 62.60% Frequency Distribution (Revenue) Revenue ($) Distribution $0.01-50.00 $50.01-100.00 $100.01-500.00 $500.01-1000.00 $1000.01-28000.00 917 1434 $1000.01-28000.00 $500.01-1000.00 $100.01-500.00 $50.01-100.00 $0.01-50.00 15258 6278 7639 0 5000 10000 # of Rx 15000 20000 # of Rx Distribution $0.01-50.00 $50.01-100.00 $100.01-500.00 $500.01-1000.00 $1000.01-28000.00 # of Rx 22015 5308 3558 366 279 % of Rx 69.83% 16.84% 11.29% 1.16% 0.88% Avg. COGS $ 15.96 $ 69.41 $ 189.54 $ 708.96 $ 1,640.16 COGS Total COGS $ 351,319.35 $ 368,416.63 $ 674,393.19 $ 259,478.08 $ 457,604.38 Avg. Revenue $ 102.89 $ 199.31 $ 509.04 $ 1,483.12 $ 3,456.25 Total Revenue Avg. Margin Before Fees $ 2,265,114.78 84.49% $ 1,057,946.45 65.18% $ 1,811,168.09 62.76% $ 542,822.34 52.20% $ 964,292.82 52.55% COGS ($) Frequency Distribution (COGS) 279 366 $1000.01-28000.00 $500.01-1000.00 $100.01-500.00 $50.01-100.00 $0.01-50.00 3558 5308 # of Rx 22015 0 5000 10000 15000 20000 25000 # of Rx 31 Analyses – Cash Flow Cumulitive Cash Flow $10,000,000.00 $8M $8,000,000.00 $6,000,000.00 $4,000,000.00 $2,000,000.00 INFLOWS $$(2,000,000.00) $(4,000,000.00) OUTFLOWS 32 Hot Topics SECTION 4 33 Hot Topics • GPO Prohibition • Definition of “Covered Outpatient Drug” • Critical Access Hospitals and the Orphan Drug Exclusion • Specialty Pharmacy 34 35 Contact Information: Shrujal V. Patel | Managing Consultant | Healthcare | Navigant Consulting, Inc. 30 S Wacker Drive | Suite 3100 | Chicago, IL 60606 Cell: 516.220.8859|Fax: 312.583.5701|Email: Shrujal.Patel@navigant.com www.navigant.com DISPUTES & INVESTIGATIONS • ECONOMICS • FINANCIAL ADVISORY • MANAGEMENT CONSULTING 36