Financial Projections 2011 - HU - MGMT533

advertisement

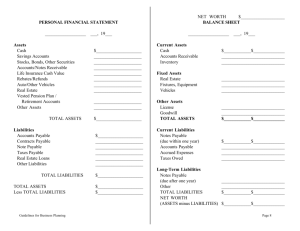

Financial Projections HACC Institute for Entrepreneurial Studies David McNaughton 221-1213 dwmcnaug@hacc.edu The Ambiguous Financial World How do you handle it? Dealing with Bankers and Accountants •Learn some of the terminology •What does the bank look for? •Sources of funding •Investors Expectations from this class Understand what your own personal financial obligations are for the next 12 months Use that information to prepare your business forecast Understand the basic accounting terms What records are required by law to be kept Use of the three basic financial sheets Reason to Keep Records Law Must be separate, complete, permanent, and accurate Management To properly evaluate your business Assist in decision making Outside Help If you will be using an accountant for taxes, meet with him prior to the start of your business so that he can help you define exactly what records should be kept Then evaluate how you will create these records – computerized or handwritten ledgers Doing this correctly from the beginning is essential Personal Budgeting What income do you need to survive? Completing the personal budgeting statement The importance of this information How is this related to my business development? Personal Budget Preparation Start with all your income Then list actual expenses or calculate an average Plan for savings Adjustments Determine minimum living expenses Handout Minimum Living expenses Worksheet What does this tell us? How does this relate to my business? Vocabulary (The Basics) Account payable – A liability backed by the general reputation and credit standing of the deptor Account receivable – A promise to receive cash from a customer for whom goods and/or services have been provided by the activity Accrual Basis Accounting – Accounting that records the impact of a business event as it occurs, regardless of whether the transaction affected cash. 10 Vocabulary (The Basics) Accrued Expense – An expense the business has incurred but not yet paid Accrued Revenue – A revenue that has been earned but not yet collected in cash Adjusting Entry – Entry made at the end of the period to assign revenues to the period in which they are earned; and expenses to the period in which they are incurred. Asset – An economic resource that is expected to be of benefit in the future. 11 Vocabulary (The Basics) Book Value of an Asset – The assets cost minus accumulated depreciation Cash Basis Accounting – Accounting that records transactions only when cash is received or paid. This methodology excludes receivables, payables, and depreciation in its computations. Chart of Accounts – List of all accounts and their account numbers in the ledger Current Assets – An asset that is expected to be converted to cash, sold, or consumed during the next 12 months, or within the business’s normal operating cycle 12 Vocabulary (The Basics) Current Liabilities – A debt due to be paid with cash or with goods and services within one year or within the entity’s operating cycle Current Ratio – Measures the ability to pay current liabilities with the current assets. (Current Assets/Current Liabilities) Debt Ratio – This ratio measures the ability to pay for both current and long term debts (total liabilities) (Total Liabilities/Total assets) Lower debt ratio is preferred (.60 is safe, .80 is risky) 13 Vocabulary (The Basics) GAAP – Accounting guidelines formulated by the Financial Accounting Standards Board (FASB) that govern how accountants measure, process and communicate financial information Journal – The chronological accounting record of an entity’s transactions Liability – An economic obligation such as a debt payable Liquidity – Measure of how quickly an item can be converted to cash 14 Vocabulary (The Basics) Matching principle – The basis for recording expenses (Identify all expenses, measure expenses and match them against the revenues earned in the same span of time) Net Income – Excess of total revenues over total expenses. (Net Earnings or Net Profit) Net Loss – Excess of total expenses over total revenues Note Payable – A written promise of future payment 15 Vocabulary (The Basics) Note Receivable – A written promise for future collection of cash Posting – Copying amounts from the journal to the ledger Revenue – Amounts earned by delivering goods or services to a customer Transaction – An event that affects the financial position of a particular entity and can be recorded later Trial Balance – A list of all accounts with their balances taken from the ledger used to ensure that total debits equal total credits 16 Vocabulary (The Basics) Unearned Revenue – A liability created when a business collects cash from customers in advance of doing work (deferred income) 17 NUMBER OF BUSINESSES BY BUSINESS STRUCTURE Sole Proprietor Corporations Partnerships LLC 18 REVENUE BY BUSINESS STRUCTURE Sole Proprietor Corporations Partnerships LLC 19 Forms of Business Ownership (continued) A sole proprietorship is operated by an individual for profit. A partnership is an association of two or more persons who carry out a business as co-owners for a profit. General partnership Limited partnership Limited liability company Forms of Business Ownership(continued) The corporation is a legal entity according to U.S. law. Incorporated in one of the fifty states or territories of the United States. Public Corporation: stock is sold to the public. Private Corporation: Stock is not sold to the public. All corporations are formed as C corporations unless they meet the requirements of and request Subchapter S tax status. Subchapter S corporation: Private corporation with special tax status granted by Internal Revenue Service (IRS) Maximum of 100 shareholders No double taxation Forms of Business Ownership (continued) A Limited Liability Company (LLC) is a hybrid business entity having features of both partnerships and corporations. Taxed as a partnership Has limited liability for its owners Flows through income and losses to individual owner’s tax returns http://en.wikipedia.org/wiki/Limited_liability_com pany Business Records Sales records Cash Receipts Cash Disbursements Accounts Receivable Capital Equipment Insurance Payroll Sales Record All income derived from the sale of your product or service One category or many as total sales Or many by different products or service Cash Receipts Money generated through cash sales Money collected from accounts receivable not your sales numbers A cash & carry business only accepts cash at point of sale so all receipts are considered cash Cash Disbursements Operating expenses or accounts payable Pay by check Problems with petty cash accounts Records kept together Check, invoice, receipt, and record Accounts Receivable Sales from credit ( not credit cards) Managed monthly and aged Be prudent with extensions of credit beyond 60 days Capital Equipment Detailed Records on major purchases What is major? Only items you would depreciate Not leased equipment Record should include Date purchased Vendor Description How paid for Check number Insurance Records of all insurance Include carriers List of filed claims Payroll All payroll tax information for at least four years There are 20 different kinds of employee records that must be kept Ways to keep track of records Bookkeeping Computerized List of records to keep Amount and sources of gross receipts Cash register tapes Bank deposit slips Receipt Books Invoices Credit card charge slips Any 1099-MISC forms List of records to keep Purchases Cancelled Checks Cash register receipts Credit card sales slips Invoices List of records to keep Expenses Cancelled checks Cash register tapes Account statements Credit card sales slips Invoices Petty cash Slips and records Expenses that are subject to special rules List of records to keep Assets When and how acquired Purchased price Cost of improvements Deductions taken How asset was used How and when asset was disposed of Selling price Expenses of sale How records are kept Journals and ledgers Business checkbook and reconciliation Single verse double entry system Computerized Microfilm Electronic storage Cash Accounting vs Accrual When do I have to use Accural Inventory Accepting credit Not credit cards Structure of business Financial Statements Balance Sheet Income Statement (or Profit Statement) Statement of Cash Flow Order of Importance Cash Flow Statement Balance Sheet Income Statement Balance Statement Review Uses (Assets = Liabilities + Worth) Represents a snapshot at a specific time Shows what you own and what you owe Balance Sheet Format Assets Cash Accounts receivable Inventory Prepaid Expenses Current Assets Liabilities Accounts payable Accrued Expenses Current Portion of debt Income Taxes payable Current Liabilities Other assets Fixed Asset at cost Accumulated Depreciation Long Term Debt Capital Stock Retained Earnings Net Fixed Assets Total Assets Shareholders’ Equity Total Liabilities & Equity Balance Sheet - Terminology Total assets Current assets Cash, accounts receivable, inventory Fixed assets Land Building & equipment (less accumulated depreciation) Net building & equipment Balance Sheet - Terminology Total liabilities Current liabilities Accounts payable, notes payable, taxes payable Long-term liabilities (debt) Total equity Preferred stock Common stock par value Paid-in capital in excess of par (common) Retained earnings Balance Sheet Income Statement Review Sales – Costs – Expenses = Income For a Period of Time Usually a Quarter or Year Income Statement Format (Traditional) Net Sales Cost of Goods Gross Margin Sales & Marketing Research & Development General & Administration Operating Expense Income From Operations Interest Income Income Taxes Net Income Income Statement Cash Flow Statement Think of as a Check Register Summary Shows cash in, cash out, and balance. Cash Flow Statement Format Ratios Current Ratio = current assets current liabilities Gross Margin = net sales – CGS Gross Margin % = gross margin net sales Debt/ Worth = total liabilities net worth at least 1 Highest Climbing Low as possible More Ratios Review of other ratios Quick Ratio Debt Ratio Inventory Turnover Days Sales Outstanding Investment Turn-over ratio Operating Margin Gross Margin Net Margin ROI, ROA, ROE Financial Projection Tool www.entr-203.wikispaces.com http://www.slideshare.net/dwmcnaughton/fina ncial-projections-2011-hu