What is Technology Transfer?

advertisement

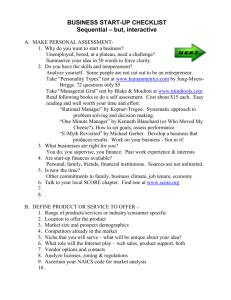

An Overview of University Technology Transfer Marjorie Hunter, JD Associate Vice President OTT, URMC Title Slide Class of '62 Auditorium December 8, 2011 1 Technology Transfer in Academia Translation of Research into New Products and Services to Benefit the Public in fulfillment of the Academic Mission: • • • • 22 Education Research Public Benefit/ Patient Care Economic Development/ Community Paradigms Academia • Academic Freedom • Broad Access to Information Business • Control of Dissemination • Control of Access 3 Why do Technology Transfer? • Bayh-Dole Act of 1980 • Potential for significant long term revenue streams • Faculty recruitment and retention 44 Bayh-Dole Act of 1980 • Allows universities to retain rights in inventions resulting from federally-funded research – Requires sharing of these revenues with inventors • Encourages licensing to industry – Requires licensing of inventions in a manner to bring them to practical application 55 University Technology Transfer Activity (AUTM 2005 Annual Report) • 228 Universities and Academic Institutions reporting • $42.3 billion in research expenditures • 17,382 invention disclosures • 15,115 US patent applications • 4,932 new licenses and options 66 What is Technology Transfer? • Mission: – To facilitate the transfer of technology arising from URMC research to industry for the benefit of the public good by creating new and useful products and promoting economic development. Successful transfers generate unrestricted funds to support future research, motivate inventors, attract and retain high quality faculty and industrial support for research. 77 Goals • Increase technologies transferred to industry • Increase effective participation of faculty • Promote and facilitate URMC start-ups • Optimize intellectual property portfolio • Expand and advance external relationships 88 Function of OTT • Manage the University’s intellectual property • Advise on intellectual property issues in research contracts • Negotiate, execute, monitor and enforce University licenses, confidentiality agreements and material transfer agreements • Assist in formation of start-up companies 99 Invention Disclosure Process • • • • 10 10 Evaluation Patenting Decision Marketing Strategy License or Start-up Company Evaluation • • • • 11 11 Discussions with Inventors Prior Art Searches Market Research Industry and Legal Experts Patenting Decision • • • • 12 12 Is it patentable? Is it enforceable? License as Biological Material? Potential for Generating Future Revenues? Marketing Strategy • • • • • 13 13 When to start Widespread vs. focused Bundling Passive vs. Active Inventor contacts Licensing Strategy • • • • 14 14 Exclusive vs. Nonexclusive Fields of Use Geographic Large company vs. Small/Start-up Company Parameters of a License • Revenues – License Issue Fee – Annual Minimum Royalties/ License Maintenance Fee – Earned Royalty – Milestone Payments – Equity • Reimbursement of Patent Costs 15 15 Parameters of a License (cont’d) • Due Diligence Provisions – Development Milestones – Commercial Milestones • Intellectual Property – Patent Prosecution – Infringement and Litigation • Reports and Records – Audit 16 16 Parameters of a License (cont’d) • Dispute Resolution – Arbitration • Indemnification, Warranties and Product Liability • Regulatory Filing • Confidentiality • Termination 17 17 Why do a University Start-Up? • • • • 18 18 Public Benefit and Academic Mission Economic Development Faculty Recruitment and Retention Financial Incentives When to do a University Start-Up There is no easy or best answer 19 Factors arguing for a start-up • Investable CEO – successful start-up track record – understand, accept and manage risk – comprehend science and developmental process – capable in academic and business environments – realistic expectations – entrepreneurial attitude 20 20 Factors arguing for a start-up • Intellectual Property Assessment: – Are there blocking patents or technologies? – Can the university’s technologies dominate and prevent others from entering the market? • Market Opportunity Analysis: – Market applications – Needs assessment – Potential customers – Competition – Obstacles • Financial Projections 21 21 Invention Disclosures Received 160 140 120 100 80 60 139 141 FY '04 136 142 150 148 148 FY '05 FY '06 FY '07 FY '08 FY '09 123 117 89 40 20 0 FY '01 FY '02 FY '03 FY '10 22 All Patent Applications Filed by Fiscal Year 90 80 70 60 50 84 84 40 30 87 82 73 60 56 59 52 54 20 62 53 41 42 24 10 0 FY '06 FY '07 U.S. Provisional 23 23 FY '08 FY '09 U.S. Non-provisional PCT FY '10 Issued Patents 7 3 17 17 8 17 3 2 5 20 20 FY '01 FY '02 24 26 25 FY '07 FY '08 28 22 16 FY '03 FY '04 FY '05 US Patents 24 24 23 25 FY '06 Foreign Patents FY '09 FY '10 Active License and Option Agreements 140 120 21 100 19 80 17 18 60 40 20 16 18 7 18 11 11 28 108 38 38 44 FY '02 FY '03 FY '04 48 FY '05 58 84 87 FY '08 FY '09 70 0 FY '01 Existing Agreements 25 FY '06 FY '07 New Agreements FY '10 Royalty Revenue (in millions) 72.25 53.34 46.02 42.1 29.59 FY '01 26 26 26.73 FY '02 FY '03 33.76 FY '04 38.06 40.55 29.98 FY '05 FY '06 FY '07 FY '08 FY ' 09 FY '10 URMCLicensed Products • Over 150 products and services including: 6 vaccines: HIBTiter, Meningtec, Prevnar, Tetraimune, Gardasil, Cervarix Periopertive Checklist COMPAS Analytics 100+ reagents, antibodies and research tools Copyrights Software 27 27 URMC Licensees • • • • • • • • • • • • • • 28 28 • Abbott • Acambis, Inc. • Alios BioPharma • AndroScience • AstraZeneca • Auckland UniServices • Bayer • Becton, Dickinson • BloodCenter of Wisconsin • Boehringer • Ingelheim • Boston Scientific • Bridgekey Corp • Cardinal Health • Davis International DiaCarta Eli Lilly Enzo Life Sciences ESA Fate Therapeutics Genaissance Pharma Genentech, Inc. GlaxoSmithKline Green Mountain Antibodies Harvard University HomMed ImmuQuest Ltd IntegraGen SA ISIS Pharma Johnson & Johnson • • • • • • • • • • • • • Laxdale, Ltd. • Medimmune • MEDSYS • Technologies • Merck Millipore • Molecular Express• Novadaq Technologies, Inc • Novartis Oxford • BioTherapeutics • Ltd • Pfizer Inc • Pharmanova • Polysciences, Inc. Proctor and Gamble Roche Diagnositcs Sanofi-Aventis Sanofi Pasteur Shanghai EnPei Biotech Siena Biotech StemCell Technologies Technolas Perfect Vision Teva Unither UMDNJ Warner- Lambert Xcellerex, Inc. URMC Start-Ups • • • • • • • • 29 29 AAIT CAS Envision iCardiac Koning Lumetrics My Health Oyagen • • • • • • • • Oyagen PharmAdva PhysioComm RT&I Socratech Science Take-Out Vaccinex ZZ Alztech Start-Up Formation 8 7 6 4 3 2 1 1 3 2 1 FY '99 FY '00 FY '01 FY '02 FY '03 FY '04 FY '05 FY '06 FY '07 FY '08 FY '09 30 30