IFTA/IRP Project Implementation PCC Request

advertisement

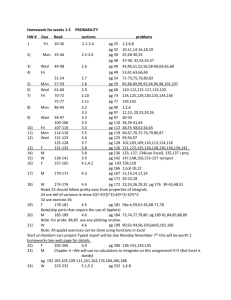

IFTA/IRP Project Implementation PCC Request November 6, 2012 Motor Vehicle Division Taxation and Revenue Department MVD Need • MVD is required to perform the functions for IFTA\IRP. • The Agency’s current IRP/IFTA systems were acquired from, and are currently maintained by ACS/Xerox on a fully hosted, sole-source contract basis. The current ACS/Xerox contract, with all available contract extensions, will expire on June 30, 2013. • Because there are a number of vendors in what is now a competitive marketplace for Motor Carrier systems, including IRP and IFTA, the Agency has pursued a competitive bid RFP procurement process (RFP#20-333-00-11763) to identify and contract for an IRP/IFTA system solution that meets the Agency’s needs and offers the best value for the Agency. What is IRP? • The International Registration Plan (Plan) is a registration reciprocity agreement among states of the United States, the District of Columbia and provinces of Canada providing for payment of apportionable fees on the basis of total distance operated in all jurisdictions. • IRP's fundamental principle is to promote and encourage the fullest possible use of the highway system. What is IFTA? • The International Fuel Tax Agreement (or IFTA) is an agreement between the lower 48 states of the United States and the Canadian provinces, to simplify the reporting of fuel use by motor carriers that operate in more than one jurisdiction. An operating carrier with IFTA receives an IFTA license and one decal for each qualifying vehicle it operates. The carrier files a quarterly fuel tax report. This report is used to determine the net tax or refund due and to redistribute taxes from collecting states to states that it is due. • This tax is required for motor vehicles used, designed, or maintained for transportation of persons or property and: – – – Having two axles and a gross vehicle weight rating or registered gross vehicle weight in excess of 26,000 pounds, and/or Having three or more axles regardless of weight, and/or Is used in combination, when the weight of such combination exceeds 26,000 pounds gross vehicle or registered gross vehicle weight. Note: Alaska, Hawaii, and the Canadian territories do not participate in IFTA. Note: Exceptions exist for Recreational Vehicles (such as motor homes, pickup trucks with attached campers, and buses when used exclusively for personal pleasure by an individual). Some states have their own exemptions that often apply to farm vehicles or government vehicles. Features of the selected IFTA\IRP Package • The proposed system must allow for the base jurisdiction or authorized third parties to license, calculate, bill, and record payment of fees for all member IRP and IFTA jurisdictions in which the applicant’s fleet operates. • The electronic, Web-based interface will conduct IRP registration, IFTA registration and IFTA quarterly tax filing, including associated electronic funds transfer capabilities and interfaces required for payment tracking. Budget Identifier Budget Category Cost IMPLEMENTATION PHASE (Year 1) Implementation Implementation Services, including licensing fee IV&V IV&V Services (Professional Services) TOTAL $420,000.00 $50,000.00 $470,000.00 MAINTENANCE AND SUPPORT (Post Implementation) Annual Licensing Fee, Maintenance and Support Contract for four (4) years with an option for an additional four (4) years. $420,000/year TOTAL (4) Yrs $1,680,000.00 Funding Sources SOURCE 66-2-7.2. Royalties 66-6-23.5H AMOUNT ASSOCIATED APPROVERS RESTRICTIONS $470,000 Used for DRIVE Mark Williams MVD purposes. Schedule Task Name Duration Start Project Initiation Contracts Finalized Project Staff Co-Located IFTA | IRP Modules Preparation Definition Base Configuration Development Testing System Integration Test End To End (User Acceptance) Training Train-The-Trainer Train the Users Conversion Rollout Desk Side Support 18 days 0 days 3 days 185 days 3 wks 1.5 mons 2.5 mons 2.5 mons 40 days 1 mon 4 wks 35 days 4 wks 3 wks 6.3 mons 1 day 30 days Wed 11/07/12 Wed 11/28/12 Mon 11/07/12 Wed 11/28/12 Mon 11/26/12 Wed 11/28/12 Mon 11/28/12 Fri 7/19/13 Mon 11/28/12 Fri 12/14/12 2 Mon 11/28/12 Fri 12/28/12 5FS-1 wk Mon 12/10/12 Fri 2/15/13 6FS-3 wks Mon 1/28/13 Fri 4/5/13 7FS-3 wks Mon 3/25/13 Fri 5/17/13 Mon 3/25/13 Fri 4/19/13 8FS-2 wks Mon 4/22/13 Fri 5/17/13 10 Mon 4/22/13 Fri 6/7/13 Mon 4/22/13 Fri 5/17/13 11SS Mon 5/20/13 Fri 6/7/13 13 Mon 12/17/12 Mon 6/10/13 6SS+4 wks Mon 6/10/13 Mon 6/10/13 14 Mon 6/10/13 Fri 7/19/13 16SS Finish Predecessors Architecture The IFTA/IRP application/module will be installed in the existing GenTax hardware and network infrastructure. No additions to the infrastructure are necessary to add this application/module. A separate team, from the GenTax Upgrade team, will implement IFTA\IRP. Therefore, the impact on the previously approved GenTax Upgrade project will be minimal. Architecture Diagram Software for the IFTA\IRP application will be added to the existing GenTax Infrastructure. The IFTA\IRP application will only be used by internal MVD personnel, and will therefore not utilize the TAP architecture provided to other Tax programs for Users external to TRD. Questions ?