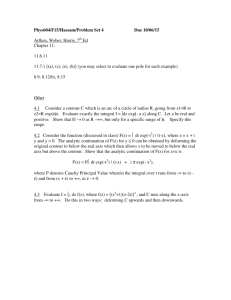

Chapter

Seven

Accounting

for

Receivables

McGraw-Hill/Irwin

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

Accounts and Notes Receivable

• A/R are the expected future

cash receipts of a company.

They are typically small and are

expected to be received within

30 days.

• N/R are used when longer

credit terms are necessary.

The promissory note specifies

the maturity date, the rate of

interest, and other credit terms.

2

Value of Receivables

• Receivables are reported at

their face value less an

allowance for accounts

which are likely to be

uncollectible.

• The amount which is actually

expected to be collected is

called the net realizable value

(NRV).

3

Allowance Method vs. Direct

Write-Off Method

• GAAP requires that A/R be reported at

NRV. (A/R minus Allowance)

• This is done using a valuation allowance:

An ALLOWANCE METHOD.

– % of Sales (or “Income Statement”) approach.

– Aging (or “Balance Sheet”) approach.

• With the ALLOWANCE METHOD, an

estimate of the amount that will NOT be

collected is recorded in the same period

that the sales revenue is recorded. Thus,

the MATCHING PRINCIPLE is being followed.

4

Allowance Method vs. Direct

Write-Off Method (continued)

• The DIRECT WRITE-OFF method violates

GAAP because it does NOT follow the

MATCHING principle.

• With the Direct Write-off method, no estimate

of bad debts is recorded at the time of the

sale. Rather, only after a specific account is deemed

“uncollectible” is a Bad Debt Expense recorded.

• Since GAAP is only required if the amounts are

MATERIAL (significant), if the amount of uncollectible

A/R is immaterial the Direct Write-off method may be

used.

5

Transaction Analysis:

• Assume the following selected events

occurred at Cell-It. For each event:

– Determine how the accounting equation

was affected and fill in the horizontal

model. (Assume GAAP must be followed.)

– Determine the effect on the financial

statements.

– Record the event in t-accounts.

6

1. Provided services to customers for

$10,000 on account.

Balance Sheet

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

Inc. Statement

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

10000

n.a.

2

3

4

5A

5B

Bal.

10

2. Collected $7,000 from account

receivable.

Balance Sheet

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

2 7000

(7000)

Inc. Statement

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

10000

n.a.

7000 OA

3

4

5A

5B

Bal.

11

3. At year-end it was estimated that $200 of the

current accounts receivable balance will not be

collected.

Balance Sheet

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

2 7000

(7000)

3

Inc. Statement

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

10000

n.a.

7000 OA

200

(200)

200

(200)

n.a.

4

5A

5B

Bal.

12

3. At year-end

it wasfor

estimated

that 2%

Allowance

Doubtful Accounts

is

a CONTRAASSET will

account.

of the year’s

credit sales

not This

be

account balance is INCREASING by

collected.

$200 causing TOTAL assets to

Balance Sheet

decrease.

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

2 7000

(7000)

3

Inc. Statement

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

10000

n.a.

7000 OA

200

(200)

200

(200)

n.a.

4

5A

5B

Bal.

13

4. Jane Doe’s $50 account was written-off

as uncollectible.

Balance Sheet

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

2 7000

(7000)

3

4

(50)

Inc. Statement

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

10000

n.a.

7000 OA

200

(50)

(200)

200 (200)

NO EXPENSE!

n.a.

5A

5B

Bal.

Note: This is NOT the Direct Write-off method. Rather, it is a

write-off under the ALLOWANCE Method.

14

Effect of Transaction 4 on

Acct. Rec. Net Realizable

Value

Before Event 4

A/R

$3,000

Allow.

(200)

N.R.V.

$2,800

The check is

in the mail.

After Event 4

Acme Collection

Agency

15

Effect of Transaction 4 on

Acct. Rec. Net Realizable

Value

Before Event 4

A/R

$3,000

Allow.

(200)

N.R.V.

$2,800

After Event 4

A/R

$2,950

(150)

Allow.

N.R.V. $2,800

16

Effect of Transaction 4 on

Acct. Rec. Net Realizable

Value

Before Event 4

A/R

$3,000

Allow.

(200)

N.R.V.

$2,800

After Event 4

A/R

$2,950

Allow.

(150)

N.R.V. $2,800

When using an ALLOWANCE method, the

Net Realizable Value of accounts receivable

does not change as a result of the write-off.

17

Before recording Transaction #5:

What happens when an account that has been

written off later pays off his/her account?

Reinstate the account by recording an

entry that undoes (reverses) the write-off:

– increase (debit) Accounts Receivable

– increase (credit) Allowance for

Doubtful Accounts (a contra-asset)

- Record the entry to show the cash

collection and A/Rec. reduction:

– increase (debit) Cash

– decrease (credit) Accounts

Receivable

18

5. $50 cash was unexpectedly received

from Jane Doe. (5A=Reinstate,

5B=Collect)

Balance Sheet

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

2 7000

(7000)

4

5A

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

10000

n.a.

7000 OA

(50)

200

(50)

50

50

3

Inc. Statement

(200)

200 (200)

NO EXPENSE!

n.a.

5B

Bal.

19

5. $50 cash was unexpectedly received

from Jane Doe. (5A=Reinstate,

5B=Collect)

Balance Sheet

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

2 7000

(7000)

4

5A

5B

50

10000

n.a.

7000 OA

(50)

50

50

(50)

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

200

(50)

3

Inc. Statement

(200)

200 (200)

NO EXPENSE!

n.a.

50 OA

Bal.

20

Calculate all ending balances.

Balance Sheet

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

2 7000

(7000)

4

5A

5B

50

Bal. 7050

10000

n.a.

7000 OA

(50)

50

50

(200)

200 (200)

NO EXPENSE!

(50)

2950

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

200

(50)

3

Inc. Statement

n.a.

50 OA

200

9800 10000

200

9800 7050 bal.

21

What’s the result?

After completing the horizontal model fill in

below.

How did the previous transactions affect the financial statements?

20X1

How much Bad Debt Expense should

appear on the income statement?….

What is the A/R: NRV at year end?……

How much A/R should be added to the

other current assets on the year-end

balance sheet?………………………….

22

Final Account Balances

Remember, the Bad Debt EXPENSE is accrued in the

year of sale, NOT when the account is written off!

Balance Sheet

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

2 7000

(7000)

5A

5B

50

Bal. 7050

10000

n.a.

7000 OA

(50)

200

(50)

50

50

(200)

200 (200)

NO EXPENSE!

(50)

2950

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

3

4

Inc. Statement

n.a.

50 OA

200

9800 10000

MATCHING PRINCIPLE

200

9800 7050 bal.

23

What’s the result?

After completing the horizontal model fill in

below.

How did the previous transactions affect the financial statements?

20X1

How much Bad Debt Expense should

appear on the income statement?….

$

200

What is the A/R: NRV at year end?……

How much A/R should be added to the

other current assets on the year-end

balance sheet?………………………….

24

Final Account Balances

Net Realizable Value (NRV) = Acct.Rec. - Allowance

Balance Sheet

Assets

= Liab.+ Stk. Equity

Cash+ A/Rec .- Allow. = A/P + C.Stk.+ R.E.

1

10000

2 7000

(7000)

4

5A

5B

50

Bal. 7050

10000

n.a.

7000 OA

(50)

50

50

(200)

200 (200)

NO EXPENSE!

(50)

2950

Cashflow

Rev. - Exp. = N. I. OA,IA,FA

10000 10000

200

(50)

3

Inc. Statement

n.a.

50 OA

200

9800 10000

200

9800 7050 bal.

25

What’s the result?

After completing the horizontal model fill in

below.

How did the previous transactions affect the financial statements?

20X1

How much Bad Debt Expense should

appear on the income statement?….

$

What is the A/R: NRV at year end?……

$ 2,750

How much A/R should be added to the

other current assets on the year-end

balance sheet?………………………….

$ 2,750

200

26

Transaction Posted to T-accounts

1. Provided services to customers for $10,000

which will be collected at a later date.

Cash

Acct. Rec.

Service Revenue Bad Debt Exp.

Allow. for D.A.

Retain. Earn.

27

Transaction Posted to T-accounts

1. Provided services to customers for $10,000

which will be collected at a later date.

Cash

Acct. Rec.

Allow. for D.A.

(1) 10,000

Service Revenue Bad Debt Exp.

10,000 (1)

Retain. Earn.

28

Transaction Posted to T-accounts

2. Collected $7,000 of the Accounts Receivables.

Cash

Acct. Rec.

Allow. for D.A.

(1) 10,000

Service Revenue Bad Debt Exp.

10,000 (1)

Retain. Earn.

29

Transaction Posted to T-accounts

2. Collected $7,000 of the Accounts Receivables.

Cash

(2) 7,000

Acct. Rec.

Allow. for D.A.

(1) 10,000 7,000 (2)

Service Revenue Bad Debt Exp.

10,000 (1)

Retain. Earn.

30

Transaction Posted to T-accounts

3. At Yr. end it was estimated that 2% of the year’s

credit sales will never be collected.

Cash

(2) 7,000

Acct. Rec.

Allow. for D.A.

(1) 10,000 7,000 (2)

Service Revenue Bad Debt Exp.

10,000 (1)

Retain. Earn.

31

Transaction Posted to T-accounts

3. At Yr. end it was estimated that 2% of the year’s

credit sales will never be collected.

Cash

(2) 7,000

Acct. Rec.

(1) 10,000 7,000 (2)

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

Allow. for D.A.

200 (3)

Retain. Earn.

32

Transaction Posted to T-accounts

4. Jane Doe’s $50 account was written-off as

uncollectible.

Cash

(2) 7,000

Acct. Rec.

(1) 10,000 7,000 (2)

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

Allow. for D.A.

200 (3)

Retain. Earn.

33

Transaction Posted to T-accounts

4. Jane Doe’s $50 account was written-off as

uncollectible.

Cash

(2) 7,000

Acct. Rec.

(1) 10,000 7,000 (2)

50 (4)

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

Allow. for D.A.

(4) 50

200 (3)

Retain. Earn.

34

Transaction Posted to T-accounts

5a. Jane Doe’s account is reinstated.

Cash

(2) 7,000

Acct. Rec.

(1) 10,000 7,000 (2)

50 (4)

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

Allow. for D.A.

(4) 50

200 (3)

Retain. Earn.

35

Transaction Posted to T-accounts

5a. Jane Doe’s account is reinstated.

Cash

(2) 7,000

Acct. Rec.

(1) 10,000 7,000 (2)

50 (4)

5a

50

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

Allow. for D.A.

(4) 50

200 (3)

50 (5a)

Retain. Earn.

36

Transaction Posted to T-accounts

5b. Jane Doe’s account is collected.

Cash

(2) 7,000

Acct. Rec.

(1) 10,000 7,000 (2)

50 (4)

5a

50

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

Allow. for D.A.

(4) 50

200 (3)

50 (5a)

Retain. Earn.

37

Transaction Posted to T-accounts

5b. Jane Doe’s account is collected.

Cash

(2) 7,000

5b

50

Acct. Rec.

Allow. for D.A.

(1) 10,000 7,000 (2) (4) 50

50 (4)

5a

50

50 (5b)

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

200 (3)

50 (5a)

Retain. Earn.

38

Transaction Posted to T-accounts

Closing entries at the end of Year 1.

Cash

(2) 7,000

5b

50

Acct. Rec.

Allow. for D.A.

(1) 10,000 7,000 (2) (4) 50

50 (4)

5a

50

50 (5b)

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

200 (3)

50 (5a)

Retain. Earn.

39

Transaction Posted to T-accounts

Closing entries at the end of Year 1.

Cash

(2) 7,000

5b

50

Acct. Rec.

(1) 10,000 7,000 (2) (4) 50

50 (4)

5a

50

50 (5b)

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

(c) 10,000

Allow. for D.A.

200 (c)

200 (3)

50 (5a)

Retain. Earn.

(c) 200 10,000 (c)

40

Transaction Posted to T-accounts

Balances of all accounts after Year 1 closings.

Cash

Acct. Rec.

Allow. for D.A.

(1) 10,000 7,000 (2) (4) 50

50 (4)

5a

50

50 (5b)

bal 2,950

(2) 7,000

5b

50

bal. 7,050

Service Revenue Bad Debt Exp.

10,000 (1) (3) 200

(c) 10,000

0 bal

bal. 0

200 (c)

200 (3)

50 (5a)

200 bal.

Retain. Earn.

(c) 200 10,000 (c)

9,800 bal.

41

Summary:

Accounting for Bad Debts

• Allowance method

– GAAP

– Required if company has a

significant amount of bad

debts.

– Matches bad debt expense (on

the income statement) with the

sale.

– Requires an adjusting journal

entry before closing the books.

42

Summary:

Accounting for Bad Debts

• Direct Write-off method

– Violates GAAP (Matching)

– No estimates of bad debts are made,

so no allowance account is used.

– Used by small businesses with few

account receivables or large

business with few collection

problems.

– No entry until time specific account is

deemed “bad” (uncollectible).

43

Direct Write-off Method for

Accounting for Bad Debts

• Direct Write-off method

Entry to write off J. Jones’ $100

account:

Bad Debt Expense

100

Acct. Rec.-Jones

100

Cash+Acct.Rec. = A/P +C. Stk.+Ret.E. Rev.- Exp. = N.I. Cashflow

(100)

(100)

+100 (100)

n.a.

44

Notes Receivable

Event 1 Loan of Money

On November 1, 2013, ATS loans $15,000 cash to

Stanford Cummings. Cummings issues ATS a note

promising to repay the loan, with interest, in one

year.

Event No.

1

7-45

Assets

Cash

+ Notes Rec.

(15,000)

15,000

= Liab.

+ Equity

Rev.

– Exp.

= Net Inc.

= NA

+ NA

NA

– NA

= NA

Cash Flow

(15,000) IA

Calculating and recording

interest earned on the Note…

Let’s review how to calculate interest. The basic formula is:

BALANCE

SHEET (and Accounting

Principal

X RateEquation)

X Time

ASSETS

=

LIABILITIES

+

EQUITY

Accts

Int.

Accts

Int.

Note

Com.

Ret.

Cash + CD + Receiv. + Rec. + Land = Pay. + Pay. + Pay. + Stk. + Earn.

BB

$ borrowed or invested

1,650

1,500

1

ANNUAL1,000

rate

2,000

2,000

2

1,200

INCOME STATEMENT

STATEMENT

Net

Rev. - Exp. = Inc.

Time since interest

150

was2,000

last recorded.

2,000

2,000

(1,200)

CASHFLOW

1,200

OA,IA,FA

$ amt

1,650 bal.

(1,200)

On

Nov. 1, 2013

3 1,500

(1,500)ATS loans $15,000 cash to Cummings at 6% for 1 year.

1,500

4 (1,000)

(1,000)be accrued on December 31, 2013? (1,000)

How much interest should

5

(500)

500

Principal

6

7

$15,000

8

EB

+

+

+

+

X

Rate

X

Time

=

Interest

OA

OA

(500) IA

X .06 X 2/12 = $150.00

rate =for 12+mo. +

+

November

through

+

= December

bal.

Interest Revenue

Event 2 Recognition of Interest Revenue

At the end of 2011, ATS must accrue interest on its

note receivable.

$15,000 × 6% × 2/12 = $150 interest revenue

Event No.

2

Assets = Liab. + Equity

150

= NA

Interest Receivable

7-47

+

150

Rev.

150

– Exp. = Net Inc.

– NA

=

150

Cash Flow

NA

Collection of a Note Receivable

Event 3 Collection of Principal and Interest

On November 1, 2012, ATS collects the principal

and interest due on the note receivable. ATS first

recognizes interest revenue for the 10 months of

2012.

$15,000 × 6% × 10/12 = $750 interest revenue

Event No.

3a

Assets = Liab. + Equity

750

= NA

Interest Receivable

7-48

+

750

Rev.

750

– Exp. = Net Inc.

– NA

=

750

Cash Flow

NA

Collection of a Note Receivable

Event 3 Collection of Principal and Interest

Now that the entire $900 of interest receivable has

been accrued, ATS records the collection of $15,900

in principal and interest on the note.

Account Title

Cash

Notes receivable

Interest receivable

Event No.

3b

Credit

15,000

900

Assets = Liab. + Equity

Rev.

– Exp. = Net Inc.

Cash Flow

NA

NA

– NA

15,000 IA

900 OA

= NA

+ NA

Asset Exchange Transaction

7-49

Debit

15,900

= NA

Credit Card Sales

Rather than maintaining a credit granting

department, many companies find it cost beneficial

to accept credit cards. The credit card company

deducts a fee, usually between 2% and 8%, from

the gross amount of the sales, and pays the

merchant the net balance (gross sales less credit

card fee).

50

Credit Card Sales

Event 1 Recording a Credit Card Sale

Matrix, Inc. accepts a credit card in payment for services

of $10,000. The credit card company charges a fee of 2%

of the gross sale.

Event No.

1

Assets

= Liab.

9,800 = NA

+ Equity

+

9,800

Account Title

Accounts Receivable

Credit Card Expense

Service Revenue

Rev.

– Exp.

10,000 –

Debit

9,800

200

= Net Inc.

200 =

9,800

Cash Flow

NA

Credit

10,000

51

Credit Card Sales

Event 2 Collection of a Credit Card Receivable

Matrix, Inc. collects the full amount due from the

credit card company.

Event No.

2

Assets

= Liab.

Cash

+ Acct. Rec.

9,800

(9,800) = NA

+ Equity

Rev.

– Exp.

= Net Inc.

+ NA

NA

– NA

= NA

Account Title

Cash

Accounts Receivable

Debit

9,800

Cash Flow

9,800 OA

Credit

9,800

52

Financial Statement Analysis

• Accounts Receivable Turnover

Sales

Accts/Rec. =

Turnover

$ Accounts Receivable*

Often the AVERAGE Accts. Rec. is used as the denominator.

Ave. A/R =

Beginning Accts/Rec. + Ending Accts/Rec.

2

This ratio is a measure of how

quickly receivables are collected.

53

Accounts Receivable Ratios

Accts. Rec. Turnover: (A measure of how fast

receivables are collected. Higher is better.)

Sales

$50,000

=

= 10.0 times

Accounts. Receiv.

$ 5,000

Average Days to collect A/R: (How many days

go by between a credit sale and the time it is collected?)

365

365

Accts. Rec. Turnover = 10.0 = 36.5 days

Generally, lower means better.

54

Length of Operating Cycle

Remember from Chapter 6 that a

company’s operating cycle is the time it

takes to convert inventory to cash by

selling it plus the time it takes to convert

accounts receivable back into cash.

So, the Operating Cycle is:

Ave. days to sell inventory

+ Ave. days to collect receivables

Length of Operating Cycle

60.8 days

36.5 days

97.3 days

55

Chapter 7

The End

56

Notes Payable: Transaction

Analysis - Appendix

nAssume

the following selected

events occurred at Cell-It. For

each event:

pDetermine

how the financial statements

are affected and fill in the horizontal

statements model.

pRecord

the event in the Journal and

Post to the Ledger.

57

Notes Payable: Transaction

Analysis

Assume the following events occurred at Cell-It.

1. On Oct. 1, 2004 Cell-It borrowed $8,000 cash by issuing a note

payable with a one-year term and an 8% stated interest rate. All

interest will be paid at maturity. This is an “interest bearing” note.

2. On Oct. 1, 2004 Cell-It issued an $8,000 face value, discounted note

payable with a one-year term and an 8% stated discount rate. This

is called a “Discounted” or “Non-interest bearing” note.

3. On Dec. 31, 2004 recorded interest related to the 8% interestbearing note issued on Oct. 1st (see #1).

4. On Dec. 31, 2004 recorded interest related to the 8% discounted

(non-interest bearing) note issued on Oct. 1st (see #2).

5. On Sept. 30, 2005 repaid the 8% non-discounted note payable (#1),

plus all interest.

6. On Sept. 30, 2005 repaid the 8% discounted note payable (#2).

58

Horizontal Model Transaction Analysis

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1

59

T1: On Oct. 1, 2004 Cell-it borrowed $8,000

at 8% for 1 year on an interest bearing

note. All interest to be paid at maturity.

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1 8000

8000

8000 FA

60

T2: On Oct. 1, 2004 Cell-it issued an $8,000 face

value, one year note payable discounted at

8%. (A noninterest bearing note.)

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1 8000

2 7360

8000

8000

640

8000 FA

7360 FA

The interest is INCLUDED in the Note Payable. The

interest must be subtracted to calculate the amount of

cash the borrower receives on the issue date.

Note Payable (Face Value)

$8000

Interest ($8000 x .08 x 12/12)

(640)

Cash to borrower

$7360 (Carrying value)

61

T2: On Oct. 1, 2004 Cell-it issued an $8,000 face

value, one year note payable discounted at

8%. (A noninterest bearing note.)

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1 8000

2 7360

8000

8000

640

8000 FA

7360 FA

The interest is INCLUDED in the Note Payable. The

interest must be subtracted to calculate the amount of

Since no time

cash the borrower receives on the issue date.

has past, the

Note Payable (Face Value)

$8000

$640 is NOT an

12

Interest ($8000 x .08 x /12)

(640)

EXPENSE yet.

Cash to borrower

$7360 (Carrying value)

62

T2: On Oct. 1, 2004 Cell-it issued an $8,000 face

value, one year note payable discounted at

8%. (A noninterest bearing note.)

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1 8000

2 7360

8000

8000

640

8000 FA

7360 FA

Discount on Note Payable is a contra liability account.

Its balance is SUBTRACTED from the Note Payable

account to obtain the total liability for the Note.

Note Payable

8000

Less: Discount on N/P

(640)

Total Note Liability

7360

63

T3: On Dec. 31, 2004 recorded interest

related to the note in #1.

Oct. 1-Dec. 31 = 3 mo. (8000 x .08 x 3/12=160)

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1 8000

2 7360

3

160

8000

8000

640

(160)

8000 FA

7360 FA

160 (160) n.a.

64

T4: On Dec. 31, 2004 recorded interest related to

the discounted (noninterest bearing) note in #2.

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1 8000

2 7360

3

160

4

8000

8000

640

(160)

(160)

(160)

8000 FA

7360 FA

160 (160) n.a.

160 (160) n.a.

65

T4: On Dec. 31, 2004 recorded interest related to

the discounted (noninterest bearing) note in #2.

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1 8000

2 7360

3

160

4

8000

8000

640

(160)

(160)

(160)

8000 FA

7360 FA

160 (160) n.a.

160 (160) n.a.

Discount on Note Payable is a contra liability account.

Its balance is SUBTRACTED from the Note Payable

account to calculate the current liability for the Note.

Note Payable

8000

Less: Discount on N/P

(480) (640 – 160)

Current Note Liability 7520

66

T5: On Sept. 30, 2005 repaid the 8% note from

Transaction #1 and all its interest.

a= accrue the remaining interest. b= payment.

(Jan. 1-Sept. 30 = 9 mo. (8000 x .08 x 9/12= $480)

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1 8000

8000

2 7360

3

160

4

5a

480

b (8640) (640) (8000)

8000

640

(160)

(160)

(160)

(480)

8000 FA

7360 FA

160 (160) n.a.

160 (160) n.a.

480 (480)

n.a

(8000) FA

(640) OA

67

T6: On Sept. 30, 2005 repaid the 8%

discounted note payable from Trans. #2. a=

accrue the remaining interest. b= payment.

Balance Sheet

Assets =

Liabilities

+ Equity

Inc. State.

Cashflow

Cash = I/P + N/P(1) + N/P(2) - Disc.+C.Stk+R.E. Rev.- Exp.= N. I. OA,IA,FA

1 8000

8000

2 7360

3

160

4

5a

480

b (8640) (640) (8000)

8000

6a

b (8000)

(8000)

640

(160)

(160)

(160)

(480)

160

160

480

(480)

(480)

480

8000 FA

7360 FA

(160) n.a.

(160) n.a.

(480)

n.a

(8000) FA

(640) OA

(480)

n.a.

(7360) FA

(640) OA

68

Comparison of Journal Entries for

Interest Bearing and Discounted Notes

Contra-liabilities are increased by debiting.

Date

2004

Oct. 1

NOTE PAYABLE (Interest bearing)

Accounts

Debit Credit

Cash

Note Payable

8000

8000

Borrowed $8000 at 8% for one year

Date

2004

Oct. 1

DISCOUNTED NOTE PAYABLE

Accounts

Debit Credit

Cash

Discount on Note Payable

Note Payable

7360

640

8000

Borrowed $8000 discounted at 8% for one year

Dec. 31 Interest Expense

Interest Payable

160

160

Accrued 3 mo. interest (8000x.08x3/12)

2005

Sept. 30 Interest Expense

Interest Payable

Paid note and all interest

160

160

Amortized 3 mo. interest from Discount to Int. Exp.

480

480

Accrued 9 mo. interest (8000x.08x9/12)

Sept. 30 Interest Payable

Note Payable

Cash

Dec. 31 Interest Expense

Discount on Note Payable

2005

Sept. 30 Interest Expense

Discount on Note Payable

480

480

Amortized 9 mo. interest from Discount to Int. Exp.

640

8000

Sept. 30 Note Payable

Cash

8640

8000

8000

Paid note (which already includes iall nterest)

69

Comparison of Ledger Accounts for

Interest Bearing and Discounted Notes

INTEREST BEARING NOTE PAYABLE

Cash

Beg. Bal.

X

10/01/04 8000

8640 9/30/05

Note Payable

10/01/04 8000

9/30/05 8000

2004 Exp.

Interest Expense

12/31/04

160

09/30/05

480

0

2005 Exp.

Interest Payable

160 12/31/04

480 09/30/05

9/30/05

640

0

NON-INTEREST BEARING (DISCOUNTED) NOTE PAYABLE

Cash

Beg. Bal.

X

10/01/04 7360

8000 9/30/05

Note Payable

10/01/04 8000

9/30/05 8000

2004 Exp.

Interest Expense

12/31/04

160

09/30/05

480

0

2005 Exp.

Discount on Note Pay.

160 12/31/04

480 09/30/05

9/30/05

640

0

70

Which loan was the better deal for Cell-It?

Transaction Analysis:

Calculate the EFFECTIVE INTEREST % of each.

Interest bearing note:

Effect on Financial Statements

Eff. Int.

%State.

= $ Annual

Interest

÷ Cash

Inc.

State.

of Ch.

in Eq Rec’d.

CashFlow

1.

No effect

No effect

= $640

÷ $8,000+8,000 FA

2.

No effect

No effect

+7,360 FA

= 8.0%

3. +Int. Exp, so - N.I. Decr. R/E, so Dec. Eq,

n.a.

Non-Interest

note

(Discounted

4.

+Int. Exp, sobearing

- N.I. Decr.

R/E,

so Dec. Eq. note):

n.a.

5. +Int. Exp, so - N.I. Decr. R/E, so Dec. Eq. -8000FA,-640 OA

Eff. Int. % = $ Annual Interest ÷ Cash Rec’d.

=

$640

=

8.7%

÷

$7,360

71

Which loan was the better deal for Cell-It?

Transaction Analysis:

Calculate the EFFECTIVE INTEREST % of each.

Interest bearing note:

Effect on Financial

Statements

With note

#2 Cell-It only

Eff. Int.

%State.

= $ Annual

Interest

÷ $7,360

Cash

received

from

the

Inc.

State.

of Ch.

in Eq Rec’d.

CashFlow

lender,

but

had+8,000

to payFA

1.

No effect

No effect

= $640

÷ still

$8,000

$640

interest for the

year.FA

2.

No effect

No effect

+7,360

= 8.0%

That’s

why

the

effective

3. +Int. Exp, so - N.I. Decr.

R/E, so

Dec.

Eq,

n.a.

interest

higher

for

Non-Interest

note

(Discounted

note):

4.

+Int. Exp, sobearing

- N.I. Decr.

R/E,

sorate

Dec.isEq.

n.a.

Note

5. +Int. Exp, so - N.I. Decr.

R/E,#2.

so Dec. Eq. -8000FA,-640 OA

Eff. Int. % = $ Annual Interest ÷ Cash Rec’d.

Note #1 (Interest bearing) is

= $640

$7,360

a “better÷deal”

in this case.

72

= 8.7%