FISCAL RESPONSIBILITIES Principals' Leadership Academy

advertisement

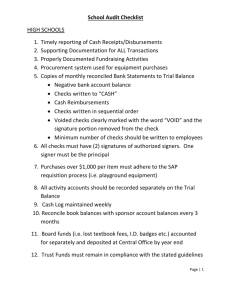

ACCOUNTING PROCEDURES MANUAL presented by: Office of School Finance WV Department of Education WVDE-OSF Presenter Susan Smith, CPA, Coordinator susmith@access.k12.wv.us 304-558-6300 ext 3 The manual can be found online at http://wvde.state.wv.us/finance/ WVDE-OSF Accounting Records Pre-numbered receipt forms Transaction journal (receipts and disbursements) Requisitions and pre-numbered purchase orders Bank checkbook Bank deposit slips Monthly bank reconciliations and financial statements Annual financial statements WVDE-OSF Principal’s Review The principal must review the monthly financial statement and sign it By reviewing it, he/she can assess the financial situation at the school quickly – Journals are up-to-date and balanced – Cash has been reconciled – The school isWVDE-OSF not in a deficit Receipts Pre-numbered receipts MUST be issued for all collections at the time moneys are collected with original provided to individual from whom moneys are received and a copy retained – Original recording of transaction – Protects both individuals – A single receipt with a supporting list may be used when collecting moneys from a group – Voided receipts – mark void and retain both copies – Receipts must be posted at least weekly WVDE-OSF WVDE-OSF Vending Machines Recommendation – let the vendor stock If not, collections are to be receipted and deposited into school account Prepare a profit/loss statement periodically (p. 81 & p. 83) Remit consumer sales tax 75% of soft drink sales go to faculty senate WVDE-OSF Gate Receipts Pre-numbered tickets must be used if an admission fee is charged Two individuals should be used (sell/take up tickets) Tickets are to be torn in half and one half given back to the patron Ticket reconciliation reports must be completed for each event WVDE-OSF Fund-Raisers Receipt and disbursement procedures apply Profit/Loss Statement must be completed for each fund-raiser WVDE-OSF WVDE-OSF WVDE-OSF Child Nutrition Collections Receipt written to each teacher collecting money at the time money is remitted – one for breakfast collections and one for lunch collections If moneys are collected from parents, write receipt or use cash collection form Ensure Summary Meal Report matches the collection amounts for each meal Recommendation - centralized billing WVDE-OSF Deposits Prepare in duplicate & retain a copy No cash disbursements or personal checks cashed from collections Must deposit at $500 or weekly Checks must be listed separately Beginning and ending receipt numbers must be shown WVDE-OSF Purchase Orders Purchase order must be completed PRIOR to obligation of the funds Pre-numbered, duplicate Retain a copy No purchases may be made from a fund or account in excess of funds currently available Signed by the Principal or designee Does not need to be the exact amount of the purchase WVDE-OSF Disbursements All disbursements must be made by check All disbursements must be supported by an invoice or travel expense report All checks require two signatures Never pre-sign a blank check WVDE-OSF Personal Services All payments to individuals must be made through payroll process UNLESS clearly shown an independent contractor ONLY exception is athletic officials Report all payments for personal services to central board office each year for 1099 reporting WVDE-OSF Other Cash Petty Cash – Maximum is $50 – Don’t cash personal checks – Receipts + cash must always equal the total amount authorized – Replenish by a check made out to the principal Starting Cash – Maximum is $500 – Don’t cash personal checks – Amount of cash must always equal the total authorized – Deposit back into bank when not used WVDE-OSF Authorized Expenditures All moneys are considered to be quasi-public funds and are to be expended for the benefit of the students at the school WVDE-OSF Unauthorized Expenditures Contributions to charitable organizations are prohibited unless a fund-raiser is conducted specifically for that purpose Purchase of food and drink for meetings Purchase of service awards for employees WVDE-OSF Authorized/Unauthorized Appendix C provides a list of expenditures specifically authorized or unauthorized by the State Attorney General opinions or State Superintendent of Schools interpretations WVDE-OSF Bank Statements Principal review the unopened bank statement for irregularities Reconciliation must be performed as soon as possible Reconciliation must be signed by preparer and principal WVDE-OSF SSAC Tournaments Deposit all proceeds into the school account Establish a sub-account to track receipts and disbursements All payments made for personal services must be through payroll process WVDE-OSF School Support Organizations Procedures are to be established by each county board. At a minimum each one: – That collects funds in the name of the school must be approved by the board in advance – Must have the approval of the principal for each fund-raiser that is conducted WVDE-OSF – Must provide an annual financial School Support Organizations Each is to have its own business registration certificate and FEIN – Be officially organized with a set of published by-laws – Prepare and make available written minutes of each meeting – Maintain a transaction journal of all receipts and disbursements – Establish proper accounting procedures WVDE-OSF School Support Organizations If an organization does not wish to obtain it’s own FEIN, funds may be deposited into the school’s bank account Follow all school purchasing procedures Including unallowed expenditures WVDE-OSF School Support Organizations Boards have the authority to examine the financial records of all disbursements of all funds, including the operation of concession stands, fund raisers and gate collections WVDE-OSF Faculty Senate Each teacher is entitled to a $50 allotment – Check or allocation – Sales tax is allowed – No purchase orders required Additional monies up to a total of $200 could be allotted to each teacher. Amounts above the $50: – Allocation method only – No sales tax can be paid – Approved purchase order prior to obligating the funds is required – Monies not expended by year end go back into faculty senate pool WVDE-OSF Faculty Senate (continued) A budget must be adopted (see sample form) Individual balances could be restored from end of prior year with majority vote Faculty senate checks must be signed by faculty senate designee and principal (or his designee) Allotments for teachers who transfer stay with the original faculty senate Monthly bank reconciliations and financial statements are required WVDE-OSF County Policies BOE must include in local policy: – Number of funds to be maintained at the schools – Whether high schools may sell soft drinks during school hours (except at meal service times) – Whether schools may obtain a purchasing card – Whether schools may have petty cash, and the maximum amount (up to $50) WVDE-OSF County Policies (continued) – Maximum amount of starting cash authorized for gate collections (up to $500) – Procedures by which school support organizations are to operate County or school may establish procedures for: – Concession sales – Vending machines WVDE-OSF Recommendations Use a computerized accounting system – More efficient – Reduces chance for error – Standardizes the accounting function at all schools Vending machines stocked by vendor Disallow the payment for merchandise at time of delivery Centralized billing for Child Nutrition Program WVDE-OSF Questions WVDE-OSF