Impact of WTO accession for Tajikistan's textile sector

advertisement

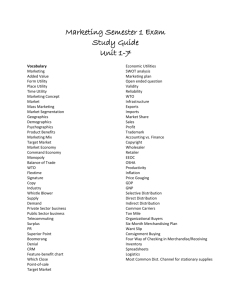

“WTO Accession with a Particular Emphasis on the Textile Sector” Presentation by Paolo R. Vergano Partner, FratiniVergano – European Lawyers 16 May 2014 Dushanbe, Tajikistan 1 Table of Contents 1. Introduction to the WTO 2. Textiles under the WTO 3. Impact of WTO accession for Tajikistan’s textile sector 4. Implications for businesses 5. Conclusions and recommendations 2 Introduction to the WTO 3 Introduction to the WTO What is the WTO? International organisation; Established in 1995; As a result of the Uruguay Round negotiations; Located in Geneva (Switzerland); and With 159 Members (123 original and 36 acceded, the last one, Tajikistan) Dealing with the rules of trade between countries at a global level. 4 Introduction to the WTO What are its functions? Administration and facilitation of the implementation of the WTO Agreements; Forum for negotiations; Forum for the settlement of disputes; Periodic reviews of WTO Members’ trade policies; Cooperation with other international organisations; and Technical assistance for developing countries. 5 Introduction to the WTO What are its principles? Non discrimination; Most-Favoured Nation (MFN); National Treatment; Further trade liberalisation; Transparency and predictability; Promotion of fair competition; and Development and economic reform. 6 Introduction to the WTO Benefits for businesses Stable multilateral trade environment, based on a set of rules; Enhanced market access opportunities business opportunities; and Certain rights conferred to the private sector to ensure: enhanced Secure access; Stable access; and Protection against unfair trade. 7 Introduction to the WTO Historical background The GATT (1947) as the primary WTO predecessor: Due to the lack of entry into force of the ITO; Provisional instrument; Focussed on tariff reduction. Several trade rounds (1947 – 1986). The Uruguay Round (1986 – 1994). Results signed in the Marrakesh Agreement Establishing the WTO. 8 Introduction to the WTO Historical background (cont.) Single undertaking approach. Expanded scope of the negotiations the resulting Agreements: expanded scope of Trade in goods; Trade in services; and Trade-related intellectual property rights. Institutional mechanism: Dispute settlement mechanism; Trade Policy Review Mechanism (TPRM). 9 Introduction to the WTO Scope of the WTO Agreements The Annexes to the Marrakesh Agreement are: Annex 1A – Multilateral trade in goods; Annex 1B – Trade in services; Annex 1C – Trade-related aspects of intellectual property rights; Annex 2 – Dispute Settlement Understanding; Annex 3 – Trade Policy Review Mechanism; and Annex 4 – Plurilateral Trade Agreements. 10 Introduction to the WTO Dispute settlement Compulsory, exclusive and adjudicatory system to solve disputes between WTO Members concerning their respective rights and obligations under WTO law. Phases of the proceedings. Timeframes. 11 Introduction to the WTO Trade Policy Review Mechanism Transparency mechanism. Periodic review. Publicity of the outcome. 12 Textiles under the WTO 13 Textiles under the WTO The pre-WTO days Short-term Arrangement Regarding International Trade in Cotton Textiles (1961). Long-term Arrangement Regarding International Trade in Textiles (1962). Scope limited to cotton-based textiles. Resulted in strong market fragmentation. 14 Textiles under the WTO The pre-WTO days (cont.) The Multi-Fibre Arrangement (1974): Product coverage extended to wool and man-made fibres. Targets for increased trade through minimum growth rates and progressive liberalisation of textile trade. Basis for the adoption of quantitative restrictions on a bilateral basis, thus departing from the GATT nondiscrimination principles. Renewed and extended several times. 15 Textiles under the WTO The WTO Agreement on Textiles and Clothing (ATC) Transitional instrument (1995 – 2004) to bring textile and clothing goods under the general rules of the multilateral trading system. Product coverage: yarns, fabrics, made-up textile products and clothing. Four-stage quota liberalisation schedule to progressively integrate covered products into the GATT rules. Enlargement of existing quotas by increasing annual growth rates. 16 Textiles under the WTO The WTO Agreement on Textiles and Clothing (cont.) Special transitional safeguard mechanism to protect WTO Members from damaging surges in imports. Supervised by the Textiles Monitoring Body. Other rules addressing, inter alia, quota circumvention and the administration of restrictions. 17 Textiles under the WTO The aftermath of the WTO ATC Article 9 of the ATC: “This Agreement and all restrictions thereunder shall stand terminated on the first day of the 121st month that the WTO Agreement is in effect, on which date the textiles and clothing sector shall be fully integrated into GATT 1994. There shall be no extension of this Agreement”. 18 Impact of WTO accession for Tajikistan’s textile sector 19 Impact of WTO accession for Tajikistan’s textile sector Relevant WTO Agreements The most relevant Agreements for trade in textiles are: General Agreement on Tariffs and Trade; Agreement on Customs Valuation; Agreement on Technical Barriers to Trade; Agreement on Rules of Origin; Anti-Dumping Agreement; Agreement on Subsidies and Countervailing Measures; and Agreement on Safeguards. 20 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework The GATT lays down a number of basic rules and principles, notably: MFN and National Treatment (Articles I and III); Prohibition of treatment less favourable than provided for in the Schedule of Concessions (Article II); Prohibition of quantitative restrictions (Article XI); and General Exceptions (Article XX). 21 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Tariff “bindings”: According to Article II of the GATT, Tajikistan may not apply duties and charges higher than those it committed to in its “Schedule of Concessions and Commitments on Goods”. Increased predictability for importers and improved competition to the benefit of consumers. 22 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Similarly, other WTO Members cannot raise their tariff “bindings” (without granting compensation to their most affected trading partners). Enhanced security and predictability for Tajikistan’s exporters. 23 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Tajikistan’s import tariff rates: Product group Average bound rate Average MFN applied rate Total 8.1 % 7.8 % Textiles 11.2 % 10.2 % Clothing 19.3 % 10.2 % Source: WTO (2013). 24 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Import tariff rates of relevant trading partners: Trading partner Average bound rate Average MFN applied rate Armenia Textiles (T) - 9.4 % Clothing (C) - 15 % Textiles (T) - 1.6 % Clothing (C) - 10 % China T - 9.7 % C - 16.2 % T - 9.5 % C - 16 % European Union T - 6.5 % C - 11.5 % T - 6.6 % C -11.5 % Kazakhstan n.a. T - 11.1 % C - 12.6 % Kyrgyz Republic T - 8.7 % C - 11.9 % T - 6.5 % C - 11.5 % 25 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Trading partner Average bound rate Average MFN applied rate Russia Textiles (T) - 7.8 % Clothing (C) - 11.8 % Textiles (T) - 10.9 % Clothing (C) - 19.6 % Turkey T - 24.5 % C - 27.3 % T - 6.5 % C - 11.5 % United States T - 7.9 % C - 11.4 % T - 7.9 % C - 11.6 % Uzbekistan n.a. T - 24.5% C - 31.4 % Viet Nam T - 10.5 % C - 19.9 % T - 9.6 % C - 19.8 % Source: WTO (2014). 26 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Export duties: Tajikistan undertook a general commitment not to introduce any export duties. However, 300 tariff lines may be subject to export duties in Tajikistan. These include certain types of raw silk, cotton and cotton products. 27 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Internal taxes: WTO Members cannot use them as an instrument to discriminate against imported goods. Tajikistan’s 2012 Tax Code subjects imported and domestic goods to excise taxes and value added tax (VAT, applied at a single 20% rate). Imported and domestic cotton fibre, cotton yarn and cotton are VAT-exempt. 28 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Prohibition of quantitative restrictions: According to Article XI of the GATT, restrictions on imports and exports other than duties or taxes are prohibited. Tajikistan and its trading partners may not impose quotas, import or export licensing requirements or any other measure restricting or prohibiting imports or exports of goods. There are specific rules to ensure that import licensing procedures be transparent, neutral and administered in a fair and equitable manner. 29 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) General Exceptions: Article XX of the GATT allows for WTO-inconsistent measures to be maintained, provided that they: Are provisionally justified under one of the listed policy objectives (inter alia, public morals; human, animal or plant life or health; and the environment); and Are in accordance with the chapeau (i.e., that they are “not applied in a manner which would constitute a means of arbitrary or unjustifiable discrimination between countries where the same conditions prevail, or a disguised restriction on international trade”). 30 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Customs valuation and fees: The Agreement on Customs Valuation requires that, for the determination of the dutiable value, customs authorities accept the price actually paid by importers in their transactions and not base their calculation on other unreasonable methods, which would bring uncertainty and unpredictability to private operators. Fees must be commensurate to the services rendered. Right of administrative appeal against decisions of Customs bodies. 31 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Rules on technical barriers to trade: The Agreement on Technical Barriers to Trade applies to technical regulations, including mandatory standards on, e.g., labelling requirements, packaging and marking. Tajikistan and other WTO Members cannot use technical regulations to discriminate between imported and domestic goods or between imported goods. In addition, technical regulations must be proportionate (i.e., not more trade-restrictive than necessary to achieve the legitimate policy objective pursued). 32 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) For example, the EU’s REACH Regulation (concerning the Registration, Evaluation, Authorisation and Restriction of Chemicals) applies to textile products. In relevant part, the REACH Regulation requires that information on chemicals used during products’ supply chain be provided upon importation, as well as that such chemicals not be used in a manner that poses risks for human health or the environment. It also restricts the use of certain substances, such as organic pollutants. 33 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Rules of origin: Tajikistan applies identical rules of origin for preferential and non-preferential purposes. These are based on the “wholly obtained” and “substantial transformation” criteria (i.e., change of tariff heading). A document stating the origin of goods is only required in Tajikistan where the application of preferential duty rates is sought. 34 Impact of WTO accession for Tajikistan’s textile sector Textiles under the general WTO framework (cont.) Rules of origin are also relevant for exports from Tajikistan, whether subject to: Non-preferential tariff treatment (MFN); or Preferential tariff treatment (for example, under FTAs or GSP). 35 Implications for businesses 36 Implications for businesses Relevant trade data World trade in textiles and clothing: (In billion USD) Source: UN Comtrade (2011) Tajikistan’s exports of textiles and clothing: (In million USD) Source: ITC (2010) 37 Implications for businesses Relevant trade data (cont.) Tajikistan’s main export markets for textiles are WTO Members. 38 Implications for businesses Advantages and challenges of WTO accession Tajikistan will benefit from MFN treatment and have access to WTO remedies. Tajik companies will operate within a rules-based system and transparent framework. Tajikistan will be able to take part in trade negotiations and partake in developing future global trade rules. Tajikistan will not be able to raise its level of tariff protection without granting compensation. 39 Implications for businesses Tajikistan’s textile sector has concrete instruments at its disposal Multilateral instruments and remedies; and Unilateral remedies. 40 Implications for businesses Multilateral instruments and remedies Participation in the WTO technical committees: Various technical committees oversee the implementation of the WTO Agreements and provide a forum for Tajikistan to consult with other WTO Members on related issues. WTO Members may raise specific trade concerns. Governmental engagement largely results from inputs from the domestic industry. 41 Implications for businesses Multilateral instruments and remedies (cont.) Trade Policy Review Mechanism: Open process of review of WTO Members’ domestic policies. Although it does not seek to trigger disputes, this mechanism often has the effect of “shaming” WTO Members with WTO-inconsistent policies in place. Tajikistan’s first trade policy review (2019). Trade negotiations: Tajikistan has a stand in discussions and negotiations to further advance in the process of trade liberalisation. Tajikistan may modify its tariff “bindings” by negotiating with the most affected WTO Members. 42 Implications for businesses Multilateral instruments and remedies (cont.) WTO Dispute settlement: Disputes are brought by Governments on the basis of inputs and support from their industrial sector. Some statistics: Consultations are requested by developed countries (57%) and developing countries (43%); Controversial measures are maintained by developed countries (58%) and developing countries (42%); 70% of panel reports are appealed. 43 Implications for businesses Unilateral remedies Anti-dumping and countervailing measures: May be adopted in cases of dumped or illegally subsidised imports hurting Tajikistan’s domestic industry. Dumping occurs where imports of a product are sold at less than its “normal value”. Subsidies may be incompatible with WTO rules if they are particularly harmful. Export subsidies and local-content subsidies are prohibited. “Specific” subsidies are illegal if they cause adverse effects to the interests of another WTO Member. 44 Implications for businesses Unilateral remedies (cont.) Anti-dumping and countervailing investigations must be conducted according to a set of rules and fixed timeframes. Provisional duties may be imposed. Definitive duties will be in place for as long as necessary during a maximum of 5 years, unless a review determines that the termination would lead to a continuation of the injury. 45 Implications for businesses Unilateral remedies (cont.) Safeguard measures: May be imposed if Tajikistan’s industry is injured as a result of a sharp and unexpected increase of imports. Safeguard measures may adopt the form of tariff raises, import restrictions or licensing requirements, and may be in place for up to 8 years. Requirements for the imposition of safeguard measures are stricter than for anti-dumping or countervailing duties, and their adoption may require that compensation be granted. 46 Implications for businesses Unilateral remedies (cont.) However, Tajikistan’s textile products may also be targeted by unilateral remedies adopted by other WTO Members. Anti-dumping measures imposed on textiles (1995 – 2013) by: India Turkey European Union 61 35 23 Source: WTO (2013). Should an investigation be triggered against goods from Tajikistan, participation in the proceedings is essential. WTO dispute settlement remains available to Tajikistan in case its rights are not respected in the course of the proceedings. 47 Conclusions and recommendations 48 Conclusions and recommendations Conclusions As the engine of Tajikistan’s economy, Tajikistan’s private operators will be directly affected by a more transparent, secure and predictable trading framework; The positive effects of WTO accession will likely be felt in the medium or long term, while certain negative impacts may be observed in the short run. 49 Conclusions and recommendations Recommendations Tajikistan’s textile sector has access to the relevant WTO fora and mechanisms through Tajikistan’s Government; Transparent and continuous engagement with the Government is essential to secure that the interests of Tajikistan’s industry are taken into account in trade negotiations and technical discussions; Need for business to familiarise and take advantage of WTO available WTO instruments and resources. 50 THANK YOU! FratiniVergano – European Lawyers Rue de Haerne 42, B-1040 Brussels, Belgium Tel. +32 2 648 21 61 – Fax +32 2 646 02 70 E-mail : p.vergano@fratinivergano.eu Website : www.fratinivergano.eu 51